送金支払いとは何か:金融に関する洞察を明らかにする

Have you ever wondered what happens when money is transferred from one place to another? Whether it’s paying a bill, sending a gift, or settling a debt, money moves around the world every second.

But when you dive into the details, you might come across a term that sounds a bit mysterious: remitted payment. What exactly does that mean, and how does it affect your financial transactions? Understanding remitted payments can not only demystify your financial dealings but also empower you to manage your money more effectively.

When you grasp the concept, you gain insight into a crucial aspect of the financial world that could streamline your transactions and potentially save you time and money. Curious to learn more? Let’s unravel the mystery of remitted payments and explore how this knowledge can benefit you in your everyday financial life. Read on to discover how understanding this simple concept can lead to smarter financial decisions.

Definition Of Remitted Payment

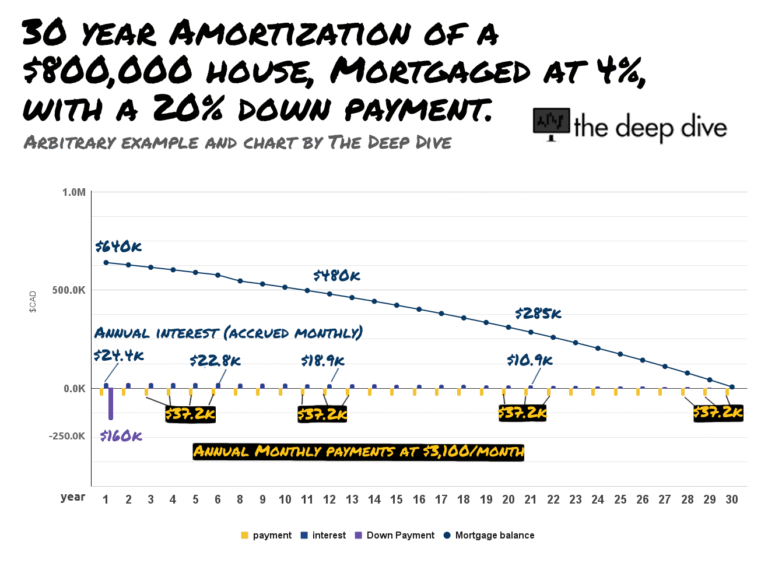

あ remitted payment is money sent from one person to another. The sender could be an individual or a company. This money is usually sent to pay for goods or services. It can also be a gift or support to family members. Payments are often sent through banks or online services. These services help send money quickly and safely. They also provide confirmation that the money was sent. Remitted payments can be sent locally or internationally. Sending money internationally might cost more. This extra cost is called a 取引手数料. The fee depends on the amount sent and the service used. Some services offer lower fees for larger amounts. Always check the fee before sending money.

Mechanics Of Remitted Payments

Remitted payments travel through various pathways. These include banks and money transfer services. Each pathway has its own rules and steps. Some pathways are faster, while others may take longer. Choosing the right pathway depends on speed そして 料金.

Processing timeframes vary greatly. Some payments are instant. Others may take several days. The time depends on the method そして location. Faster services might cost more. Always check the timeframe before sending money.

Sending money often includes 手数料と料金. These can be a flat fee or a percentage. Knowing the fee structure is crucial. Hidden fees can add up quickly. Always review the total cost before confirming a remittance.

Types Of Remitted Payments

Domestic transfers are payments made within the same country. They are often used for paying bills or sending money to friends and family. These transfers are usually quick and can be done online. Banks or mobile apps are common ways to send domestic transfers. The fees for these transfers are generally low. They are a 便利 way to handle payments.

International remittances involve sending money across borders. This type of payment is often used by people working abroad. They send money back to their home country. It can be done through banks or money transfer services. Fees are higher compared to domestic transfers. The process can take a few days. It’s important to ensure the correct details for a smooth transfer.

:max_bytes(150000):strip_icc()/remittance.asp-v1-final-15009dcc008b44c3ab240f0dfbef02ad.png)

Role In Global Economy

Remitted payments are crucial for many developing countries. They help families buy food, pay bills, and go to school. These funds can create jobs and improve healthcare too. Many people depend on them for a better life. Without these payments, poverty can increase. They are a lifeline for millions. Economies can grow faster with remitted payments.

Remitted payments affect 為替レート in many ways. When people send money home, currencies can change. More remitted payments can make local currency stronger. This helps the economy grow. Stable exchange rates are good for business. They make trading easier between countries. Remitted payments play a key role in this process.

Technological Advancements

Digital payment platforms are changing how we send money. ペイパル そして ベンモ are popular choices. They make sending money easy and fast. You can send money to friends or family. Businesses use these platforms too. They accept payments from customers. It’s simple and secure. モバイルアプリ help you track your transactions. This makes managing money easier. People enjoy the convenience of digital payments. They don’t need cash or checks anymore. Everything is online now.

Blockchain technology is special. It keeps records safe and clear. People use it with cryptocurrencies like Bitcoin. Cryptocurrencies are digital money. They are not controlled by any bank. This makes them different. Transactions are fast and secure. Many people find them interesting. They use them for online shopping. Others invest in them. The world of blockchain is growing. More people learn about it every day. Its future is exciting and full of potential.

Regulatory Considerations

Understanding remitted payments involves knowing the compliance requirements. Businesses must follow rules for safe transactions. These rules protect both senders and receivers. Every transaction should be recorded properly. Records help in audits and checks. Missing records can cause trouble. So, keeping clear records is key.

Anti-money laundering measures are important for remitted payments. They stop illegal money flow. Systems are in place to track transactions. Transactions that look suspicious are flagged. This helps find any wrong activities. Regular checks keep the system clean. It’s crucial to follow these measures. They ensure trust and safety.

Common Challenges

Understanding remitted payment involves recognizing its common challenges. Transferring money across borders can face delays and high fees. Currency fluctuations also impact the final amount received, complicating financial planning.

Currency Fluctuations

Currency changes can be tricky. Money value goes up and down. This can make payments hard. Some countries have strong money. Others have weak money. Businesses must watch these changes. They must plan for changes. They can lose money if they don’t plan. It is important to keep track of rates. It helps to avoid big losses.

Fraud And Security Risks

Security is very important for payments. Bad people can steal money. They use tricks to fool people. Businesses must stay safe. They use strong locks and checks. They make sure payments are safe. They watch for strange actions. Protecting money is a big job. Trust is important for everyone.

Future Of Remitted Payments

The world of remitted payments is changing fast. デジタルウォレット are becoming more common. People can send money with a few taps. This makes sending money quick and easy. More people are using cryptocurrencies for payments. They like the idea of secure and fast transactions.

Blockchain technology is growing in importance. It offers transparency and security. This is very important for trust in payments. Many companies are looking at AI to improve payment systems. AI can help make payments smarter and faster.

New ideas are always being tested. Biometric payments might become popular. Using your fingerprint or face to pay is easy. Voice-activated payments could be next. Imagine paying just by speaking.

Some people think virtual reality might play a role. You could buy things in a virtual store. These innovations could make payments more exciting and interactive.

よくある質問

What Does Remitted Payment Mean?

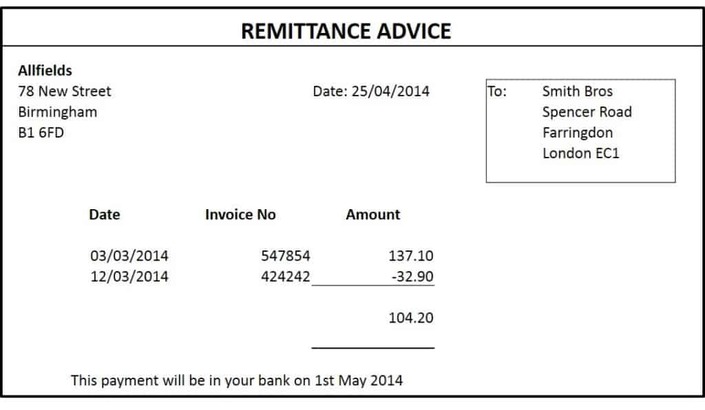

A remitted payment refers to money that is transferred from one entity to another. This process is often used in financial transactions, where funds are sent to settle a debt or invoice. The payment can be made through various methods, including bank transfers, checks, or digital payment platforms.

How Do Remitted Payments Work?

Remitted payments work by transferring funds from a payer to a recipient. The payer initiates the payment through a financial institution or payment platform. Once processed, the funds are deducted from the payer’s account and credited to the recipient’s account.

This process ensures timely and accurate payment delivery.

Why Is Remitted Payment Important?

Remitted payments are crucial for ensuring financial obligations are met on time. They facilitate the smooth operation of business transactions by enabling prompt settlement of debts. Additionally, remitted payments help maintain healthy cash flow and financial stability for both individuals and organizations.

What Are Common Methods For Remitting Payments?

Common methods for remitting payments include bank transfers, checks, and online payment platforms. Bank transfers are secure and widely used for large transactions. Checks offer a traditional method, though slower. Online payment platforms provide convenience and speed, making them popular for personal and small business payments.

結論

Understanding remitted payments is crucial for managing finances effectively. These payments often involve transferring money across borders. This process can seem complex at first. Yet, grasping the basics helps simplify it. Businesses and individuals benefit from knowing how it works.

Secure transactions ensure funds reach the intended recipient. Awareness of fees and exchange rates is also important. This knowledge aids in budgeting and financial planning. Staying informed leads to smoother transactions. Thus, learning about remitted payments can enhance your financial acumen.

It’s always wise to stay updated on payment methods and regulations.