トランスユニオンを利用するクレジットカード会社

Imagine you're applying for a credit card from American Express, and you wonder how your 信用力 is determined. Many card issuers, including Visa and Discover, rely on TransUnion for essential credit data that influences their decisions. Understanding which companies use TransUnion can shed light on the approval process and what factors might affect your chances. But how does this relationship between credit card companies and credit bureaus really shape your financial opportunities?

Overview of TransUnion

TransUnion is one of the three major credit reporting agencies in the United States, providing essential data and insights that help lenders assess the 信用力 of potential borrowers. By gathering information from various financial institutions, TransUnion compiles detailed 信用報告書 that reflect your credit history, payment behavior, and outstanding debts. These reports are vital for lenders when determining loan approvals, interest rates, and credit limits.

Moreover, TransUnion offers consumers access to their credit reports, enabling you to monitor your credit standing and identify any inaccuracies that could affect your financial safety. Their services include credit monitoring そして identity theft protection, which help safeguard your personal information. Understanding TransUnion's role can empower you to make informed financial decisions and enhance your credit health.

Major Credit Card Issuers

検討する際に credit options, it is crucial to recognize the major credit card issuers that dominate the market, as they greatly influence access to credit and terms offered to consumers. These issuers include well-known names like Visa, Mastercard, American Express, and Discover. Each of these companies has unique offerings and risk assessment criteria. Visa and Mastercard primarily operate as networks, partnering with various banks to issue cards, while American Express and Discover often act as both issuer and network. Understanding the differences in 報酬プログラム, fees, and customer service can help you make informed decisions. Additionally, these issuers often report to 信用調査機関 like TransUnion, impacting your credit score and overall financial health, so choose wisely.

Companies Using TransUnion

Many companies across various industries rely on TransUnion for credit reporting そして risk assessment to make informed lending decisions. Major credit card issuers, banks, and financial institutions frequently use TransUnion's data to evaluate potential borrowers' 信用力. This helps guarantee that the lending practices are responsible and aligned with risk management protocols. Additionally, companies in retail and auto financing sectors also utilize TransUnion reports to assess consumer behavior and manage credit risk effectively. By leveraging accurate credit information, these organizations can minimize default rates and enhance their 金融の安定. Understanding which companies use TransUnion can guide you in choosing a credit card or loan provider that prioritizes thorough risk assessment and your financial safety.

Benefits of TransUnion Reports

活用 トランスユニオンの報告 provides consumers and businesses with essential insights into 信用力, helping them make informed financial decisions. These reports offer a detailed overview of your 信用履歴, including payment patterns, outstanding debts, and credit utilization rates. By analyzing this data, you can identify areas for improvement, potentially boosting your 信用スコア over time. Additionally, lenders use these reports to assess risk, enabling them to offer more tailored financial products. Access to your TransUnion report also empowers you to catch and dispute any inaccuracies, protecting your financial reputation. Overall, leveraging TransUnion reports enhances your understanding of your financial standing, allowing you to take proactive steps toward achieving your 財務目標 with confidence.

How Approval Processes Work

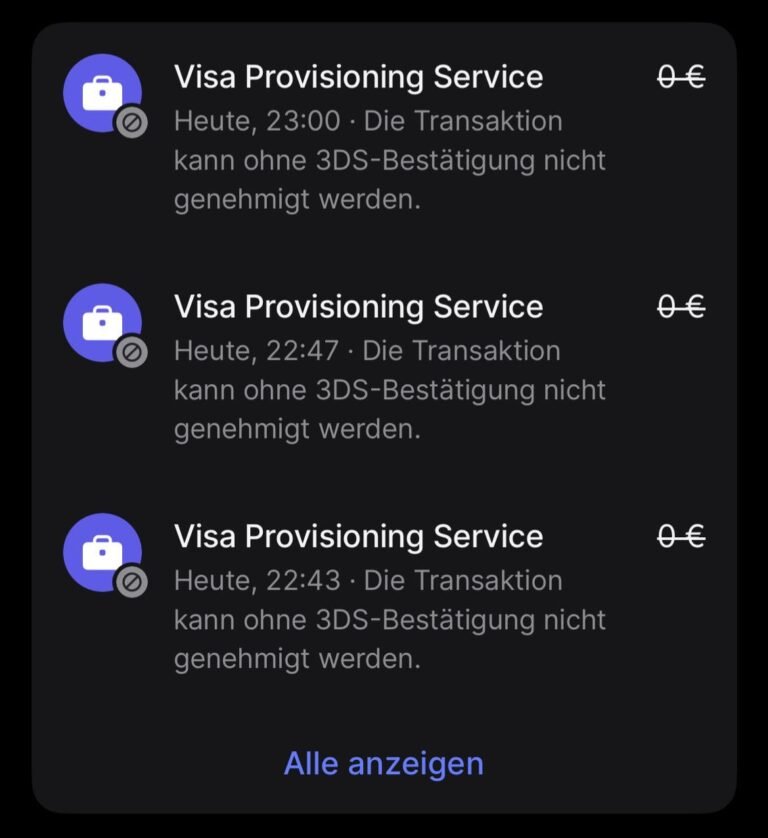

その approval process for credit cards typically involves a thorough evaluation of your 信用報告書, including data from agencies like TransUnion, to determine your eligibility and risk level as a borrower. Lenders assess various factors, including your 信用スコア, payment history, and existing debts. They want to guarantee you can manage additional credit responsibly. If your score meets the lender's criteria, you may receive an approval offer. Conversely, a lower score or negative marks can lead to denial. It's crucial to understand that each application can affect your credit profile, so consider checking your report beforehand. By being informed, you can make strategic decisions about applying for credit, enhancing your chances of approval while safeguarding your 財務健全性.

信用スコアへの影響

Understanding how credit card companies leverage data from TransUnion can greatly impact your 信用スコア, especially during the approval process. When you apply for a credit card, the issuer retrieves your credit report and score from TransUnion, evaluating your 信用力. Factors like your payment history, credit utilization, and length of credit history play a vital role in this evaluation. If you have a strong credit profile, you're more likely to secure favorable terms; however, a poor score can lead to higher interest rates or outright denial. Additionally, hard inquiries from applications can temporarily lower your score. As a result, maintaining a healthy credit profile is essential for securing the best credit options available, ultimately influencing your 金融の安全性と安定性.

Tips for Consumers

To improve your chances of getting approved for a credit card through companies that use TransUnion, you should regularly check and maintain your 信用報告書 のために 正確さ. This involves reviewing your report for errors that could negatively impact your score. If you find discrepancies, dispute them promptly to rectify your credit standing. Additionally, consider paying down existing debts to lower your 信用利用率, which is a key factor in credit scoring. Establishing a consistent 支払い履歴 can also enhance your creditworthiness. Finally, limit new credit inquiries, as multiple applications within a short period can signal risk to lenders. By following these steps, you can present yourself as a responsible borrower and increase your approval odds with credit card companies.