法人口座から個人口座への送金:専門家のヒント

Managing finances between your business and personal life can feel like navigating a maze. You want to make sure everything is above board, yet streamlined and simple.

Transferring money from your business account to your personal account is a common task, but it’s one that comes with its own set of rules and implications. Are you confident you’re doing it right? We’ll break down the process in straightforward steps, ensuring you handle your finances smartly and legally.

Discover how to make these transactions not only smooth but also beneficial for your overall financial health. Stay with us and learn how to handle your money transfers with ease and confidence.

法的考慮事項

Transferring money from a business account to a personal account requires careful attention to legal considerations. Understanding the legal framework ensures compliance and avoids potential pitfalls. This section highlights key factors to consider for a seamless transfer process.

Legal Documentation

Maintain accurate records of all transactions between accounts. These records include the amount, date, and purpose of transfer. Proper documentation ensures transparency and compliance with legal requirements.

Transferring money might have tax consequences. Consult with a tax professional to understand the potential impact. This ensures you meet your tax obligations and avoid penalties.

Business Structure

Your business structure affects how transfers are treated legally. Sole proprietorships might have different rules compared to corporations or LLCs. Knowing your business type helps in adhering to legal guidelines.

規制コンプライアンス

Ensure compliance with local and national regulations. Different regions have specific laws governing money transfers. Familiarize yourself with these laws to avoid legal issues.

If your business has shareholders, get their approval for transfers. This is particularly important for large amounts. Involving shareholders prevents disputes and maintains harmony.

Consult Legal Experts

Legal experts provide valuable insights and guidance. They help navigate complex legal landscapes and offer tailored advice. Consulting them ensures your transfers are legally sound.

税金の影響

Transferring money from a business to a personal account has tax implications. It’s important to track these transactions carefully. Consult a tax professional to understand the impact on your finances.

Understanding The Nature Of The Transfer

Transfers must be categorized correctly. Is it a salary or a dividend? This categorization affects tax rates. Salaries are subject to income tax. Dividends might incur different taxes. The nature of the transfer influences how much tax you pay.Impact On Business Taxes

Money transferred affects business tax filings. It may reduce taxable business income. This can lower the overall tax burden. Accurate records are essential. They help in ensuring correct tax calculations.Personal Tax Considerations

Transferring funds impacts personal taxes. The money might be taxed as income. This can increase personal tax obligations. Knowing personal tax brackets helps. It aids in estimating tax impacts.Documenting The Transfer

Record every transfer meticulously. Proper documentation is key. It supports tax compliance. It also helps avoid audits. Keeping clear records is a safeguard.Consulting A Tax Professional

Tax professionals offer valuable insights. They help in navigating tax complexities. Consulting them ensures compliance. They provide guidance tailored to individual needs. Their advice can prevent costly mistakes. “`ベストプラクティス

Transferring money from a business to a personal account needs careful attention. Keep records clear to avoid confusion. Follow legal guidelines to ensure compliance and maintain financial integrity.

Documenting Transfers

Proper documentation is key to maintaining clear financial records. Each time you transfer money, record the amount, date, and purpose of the transfer. Use accounting software or a simple spreadsheet to track these transactions. Having a detailed log helps you during tax season and if any financial disputes arise. Imagine explaining to an auditor why certain amounts were moved without proper records. Not fun, right? Clear documentation also assists in maintaining transparency with stakeholders. It helps them understand that the transfers are legitimate and business-related.Setting Clear Policies

Establish clear policies for money transfers to maintain consistency and avoid confusion. Define what constitutes a legitimate reason for transferring funds from business to personal accounts. Set limits on transfer amounts to prevent excessive withdrawals that could impact business cash flow. For instance, you might decide that only a certain percentage of the monthly profit can be transferred. Communicate these policies with your team or partners to ensure everyone is on the same page. If you’re a solo entrepreneur, this might seem unnecessary, but having guidelines keeps you accountable. Have you ever experienced a situation where unclear policies caused financial chaos? Adopting clear policies can prevent such scenarios and promote financial health for your business.転送方法

Transferring money from a business to a personal account can be simple. Choosing the right method is crucial. It ensures a smooth transaction. Let’s explore two popular methods: direct bank transfers and payment apps.

Direct Bank Transfers

Direct bank transfers are a traditional method. They involve moving money between accounts in the same or different banks. This method is reliable and secure. Most banks offer online banking services. This makes transfers convenient and fast.

Transferring funds directly can be done via online platforms. Business owners log in to their accounts. Then, they initiate the transfer to a personal account. It’s straightforward. Ensure both accounts are linked. This saves time during the transfer process.

Some banks might charge fees. Check with your bank first. Knowing the cost helps avoid surprises. Direct transfers are often used for regular transactions. They are trusted by businesses worldwide.

決済アプリの利用

Payment apps are gaining popularity. They are user-friendly and accessible. Apps like PayPal and Venmo simplify transfers. They offer quick solutions for moving funds.

Setting up payment apps is easy. Download the app and create an account. Link your business and personal accounts. Once linked, transferring money is a breeze. Payment apps often have lower fees. This makes them attractive to many users.

Security is a priority for payment apps. They use encryption to protect transactions. This ensures your money is safe. Payment apps also provide instant notifications. You can track every transfer easily.

Payment apps are perfect for small businesses. They offer flexibility. Transfers can be done anytime, anywhere. This convenience is unmatched.

Common Pitfalls

Transferring money from your business to your personal account can be tricky. Many business owners face challenges during this process. These challenges often lead to financial confusion. Avoiding common pitfalls can save you time and stress. Understanding these mistakes is crucial for smooth financial management.

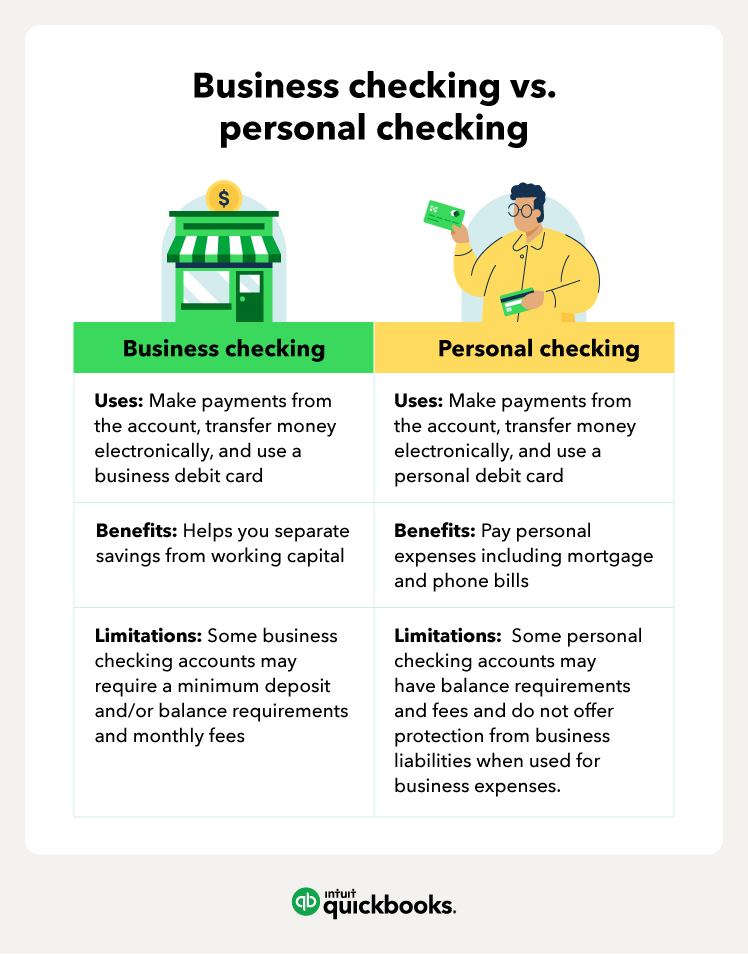

Commingling Funds

Commingling funds is a frequent issue. It means mixing personal and business money. This can create confusion and financial errors. Keep separate bank accounts to avoid this problem. It helps in tracking expenses accurately. Separate accounts also maintain clear financial boundaries.

Ignoring Record-keeping

Many overlook the importance of record-keeping. Proper records are essential for business health. They help in tracking income and expenses. Without records, you might miss important tax deductions. Maintaining detailed records ensures financial clarity. It also makes tax filing easier.

専門家のアドバイスを求める

Transferring money from a business account to a personal one may seem simple. Yet, many complexities can arise, making professional advice essential. Seeking guidance can ensure compliance with tax laws and financial regulations. This helps avoid penalties and ensures smooth transactions.

Consulting Accountants

An accountant can offer valuable insights into tax implications. They help navigate the rules about personal withdrawals. Their expertise ensures compliance with financial standards. This avoids potential tax issues. Accountants can explain the best practices for transferring funds. They ensure records are kept accurate.

Legal Expert Guidance

Legal experts provide advice on regulatory matters. They ensure transactions meet legal requirements. This guidance is crucial for avoiding legal pitfalls. Lawyers can explain contracts related to business finances. They help ensure everything is documented correctly. Their assistance can safeguard your business interests.

よくある質問

How Can I Transfer Money Legally?

To transfer money legally from a business to a personal account, document the transaction thoroughly. Ensure compliance with tax regulations, and maintain clear records. Consult with a financial advisor for guidance. Proper documentation helps avoid legal issues and maintains transparency in your financial transactions.

Are There Tax Implications When Transferring Money?

Yes, transferring money from business to personal accounts may have tax implications. It’s crucial to report such transactions accurately. Consult a tax professional to understand how these transfers affect your tax liability. Proper documentation ensures compliance with tax regulations and prevents potential penalties.

What Documentation Is Needed For Transfers?

Proper documentation for transfers includes transaction records, bank statements, and relevant invoices. Maintain detailed records to ensure transparency. This helps in tracking the flow of funds and provides necessary proof during audits. Accurate documentation is essential for legal compliance and financial management.

Can I Transfer Funds Anytime?

You can transfer funds anytime, but it’s essential to ensure compliance with banking and tax regulations. Consult with your bank and financial advisor for any restrictions or necessary approvals. Proper timing and documentation can help avoid legal issues and ensure smooth transactions.

結論

Transferring money from business to personal accounts needs careful planning. Understand the tax implications and legal requirements. This helps avoid penalties. Always keep clear records of transactions. Proper documentation ensures transparency. Consult with a financial advisor for guidance. They can provide specific advice tailored to your needs.

Regularly review your financial practices. This ensures compliance and efficiency. Stay informed about regulations. They can change and impact your transactions. By following these guidelines, you safeguard your finances. Remember, smart financial management benefits both business and personal stability.