支払い前に先取特権放棄書に署名すべきか?その理由とは?

Imagine this: you’re about to receive a much-anticipated payment for your hard work, but there’s a catch—you’re asked to sign a lien waiver first. Should you do it?

This seemingly simple decision can have significant implications for your financial security and peace of mind. Navigating the intricacies of lien waivers can be daunting, but understanding them is crucial for protecting your interests. This article will delve into what lien waivers are, why they’re important, and whether you should sign one before receiving payment.

By the end, you’ll have the confidence to make an informed decision that safeguards your hard-earned money. Ready to unravel the mystery of lien waivers? Let’s get started.

Understanding Lien Waivers

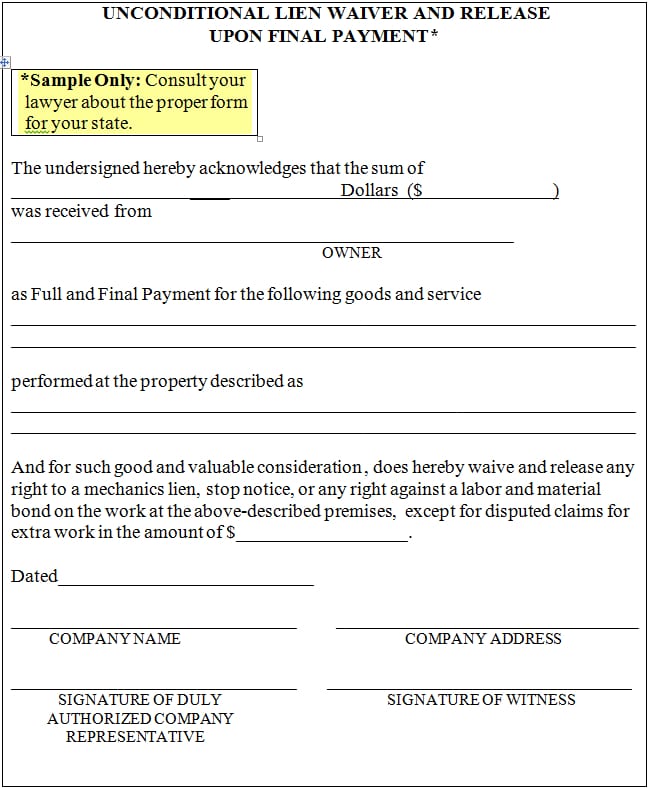

Lien waivers help avoid payment disputes. They are legal documents. People use them in construction projects. Contractors and suppliers sign them. These waivers ensure payment protection. They prevent future claims. Signing means giving up the right to file a lien. It shows work is paid for. It is important to read them carefully. Always check the waiver terms. They must be clear and fair. Understanding their purpose is crucial.

Purpose Of Lien Waivers

Lien waivers protect owners from unpaid claims. They ensure contractors get paid. These waivers show work is complete. They guarantee payment release. Contractors feel safe signing them. Owners feel secure too. They prevent double payment. Lien waivers help keep projects smooth. They build trust between parties. Signing shows agreement and payment received. They help in avoiding legal troubles.

Types Of Lien Waivers

| タイプ | 説明 |

|---|---|

| Conditional Waiver | Given after payment is verified. |

| Unconditional Waiver | Given without verifying payment. |

| Progress Waiver | Signed during project phases. |

| Final Waiver | Signed when project ends. |

Risks Of Signing Before Payment

Signing a lien waiver can be risky. You might lose your 法的権利 to claim payment. This waiver acts like a promise. You say you have been paid. If you sign too early, you may face trouble. You cannot ask for money later. It is very important to be careful before signing. Once signed, it is hard to change. Always check if payment is clear first. This can save your rights and your money.

Payment security can be affected by early signing. Without payment, you risk losing money. Signing means you trust the payer. If they fail to pay, you can be stuck. Payment security is very important. It protects your work and effort. Never sign without being sure of payment. This keeps your work safe. Always ensure payment is received before signing any waiver.

Benefits Of Signing Lien Waivers

Signing a lien waiver can make payments easier. It shows you agree the work is done. This helps in getting your money faster. No need for long talks or delays. Everyone knows what to expect. This makes the process smooth. It can save time and reduce stress. The payment is quick and simple.

A lien waiver shows trust. It says you believe in your work. Clients feel safe and secure. They see you as honest. This builds a good relationship. Trust is important for future work. It leads to more jobs and happy clients. Clients like working with people they trust.

Negotiating Lien Waivers

Lien waivers are important for both parties. They ensure everyone gets paid. Before signing, look at the key clauses. These clauses protect your rights. Make sure the waiver is fair. Check if it covers all work done. See if it mentions any disputes. Always read it carefully.

A lawyer can explain complex terms. They help you understand your risks. Ask questions if unsure. It’s okay to seek help. Lawyers know the laws well. They ensure you don’t lose your rights. It’s wise to consult them. They provide peace of mind.

Alternatives To Early Signing

Conditional waivers offer a smart way to protect your rights. You sign them only after receiving payment. This means you keep your rights until you get paid. It’s like a promise that works both ways. The payer is happy to pay. You stay safe with your rights intact. This method builds trust between parties. Everyone knows their duties and rewards. It’s a simple way to avoid trouble.

Joint check agreements can be helpful too. In this setup, a check is made out to two parties. This includes you and another party. Both must sign to cash it. It’s safe because it ensures payment. You get paid directly. No waiting and no worries. This method helps everyone feel secure. It ensures fairness in payments.

Best Practices For Contractors

Keep every document safe. Store them in a secure place. Use folders to sort papers. Digital copies are helpful. Backup files regularly. Update records often. Accurate records prevent mistakes. Clear documents build trust. They show professionalism. They help in audits. They protect from disputes. Organized records save time.

Talk clearly with clients. Listen to their needs. Ask questions if unsure. Use simple words to explain. Email is a good tool. Keep messages short. Reply quickly to concerns. Share updates regularly. Be polite and respectful. Good communication avoids confusion. It builds strong relationships. Happy clients mean more business.

よくある質問

What Is A Lien Waiver?

A lien waiver is a legal document. It relinquishes the right to claim a lien on a property. It’s commonly used in construction. Signing it may affect your payment rights. Always review it carefully before signing.

Why Should I Sign A Lien Waiver?

Signing a lien waiver can facilitate payment. It shows trust and cooperation with the payer. However, ensure payment terms are clear. Understand your rights before signing. Consulting a legal expert is advisable.

Can I Refuse To Sign A Lien Waiver?

Yes, you can refuse to sign a lien waiver. However, it might delay payment. It’s crucial to communicate your concerns. Seek legal advice if unsure. Understanding your rights and obligations is essential.

When Should I Sign A Lien Waiver?

Sign a lien waiver after receiving payment. Ensure all terms are met before signing. Verify that the document aligns with your agreement. Consulting a legal professional can provide clarity. Always protect your rights.

結論

Signing a lien waiver before payment requires careful thought. It impacts your rights and future claims. Always read and understand the document thoroughly. Seek legal advice if unsure about any terms. Protect your interests by knowing the risks involved. Clear communication with involved parties is key.

Assess your trust in the payer’s reliability. Only proceed if you feel confident about the transaction. Remember, once signed, reversing a lien waiver can be challenging. Stay informed and make wise decisions to safeguard your financial interests.