iPhoneでバーチャルVisaカードを使う方法:簡単なガイド

Are you looking for a secure and convenient way to make online purchases on your iPhone? A Virtual Visa Card could be the solution you need.

With this digital payment option, you can shop online without sharing your personal credit card information, keeping your financial details safe from fraud. In this guide, you’ll discover how to set up and use a Virtual Visa Card on your iPhone easily.

Whether you’re buying apps, music, or anything else, you’ll learn tips that make the process seamless. Stay with us, and unlock the benefits of hassle-free online shopping today!

Setting Up A Virtual Visa Card

Setting up a Virtual Visa Card on your iPhone is simple. First, choose a reliable app that offers virtual cards. Then, follow the app’s instructions to create your card. Use it for online shopping or subscriptions securely. Enjoy the convenience of managing your finances easily.

Setting up a Virtual Visa Card can streamline your online shopping experience, making it both secure and convenient. With a virtual card, you can shop without exposing your main bank details. Let’s break down the steps to help you get started.Choosing A Provider

Selecting the right provider is crucial for your virtual Visa card. Many options are available, so consider what features matter most to you. Look for providers that offer strong security features, user-friendly apps, and good customer service. Some popular providers include: – Revolut – Wise – NetSpend Check reviews and compare fees before making a decision. Your choice impacts your overall experience, so take your time to choose wisely.Creating Your Virtual Card

Once you’ve chosen a provider, it’s time to create your virtual card. This process is usually straightforward. 1. Download the app of your chosen provider. 2. サインアップ for an account using your email and a secure password. 3. Follow the prompts to create your virtual card. You might need to verify your identity by providing a photo ID or other documentation. Remember, the more secure your setup, the safer your transactions.Linking To Your Bank Account

Linking your virtual card to your bank account is an essential step. This allows you to fund your virtual card easily and use it for purchases. – Open your provider’s app. – Navigate to the settings or funding section. – Select “Link Bank Account” and follow the instructions. Some providers may require your bank account number and routing number. Ensure you double-check your details to avoid any issues. Have you ever faced trouble during an online transaction? Linking your virtual Visa card correctly can help prevent such headaches in the future.Credit: www.joinporte.com

Adding The Card To Your Iphone

Adding a Virtual Visa Card to your iPhone is simple. It lets you shop easily and securely. Follow the steps below to get started.

Accessing Wallet App

First, open the Wallet app on your iPhone. This app is usually on the home screen. Tap the “+” icon in the top right corner. This will help you add a new card.

Manually Entering Card Details

Next, choose the option to add a card manually. You will see a form to fill out. Enter your card number, expiration date, and security code. Make sure all details are correct. This step is important for successful setup.

Using The Card Issuer’s App

You can also add your card using the card issuer’s app. Download the app from the App Store. Open the app and log in to your account. Look for the option to add the card to Wallet. Follow the prompts to complete the process.

Making Payments With The Virtual Card

Using a Virtual Visa Card on your iPhone is simple and secure. First, add the card to your Apple Wallet. Then, use it for online purchases or in-store payments. Enjoy the convenience of shopping without sharing your actual card details.

Making Payments with the Virtual Card Using a Virtual Visa Card on your iPhone opens up a world of convenience, especially when it comes to making payments. You can easily manage your expenses while enjoying added security. Let’s dive into how you can utilize this digital asset effectively.Using Apple Pay

Adding your Virtual Visa Card to Apple Pay is a seamless process. Open your Wallet app and tap the plus sign to add a new card. 1. Choose “Add Credit or Debit Card.” 2. Follow the prompts to enter your card details. 3. Verify your card using the instructions sent to your email or phone. Once your card is added, you can pay with just a tap. Apple Pay is accepted at numerous retailers, making transactions quick and efficient. Just double-click the side button and hold your iPhone near the contactless reader.Shopping Online

Shopping online with your Virtual Visa Card is straightforward. When checking out, select the option to enter your card details. – Input your card number, expiration date, and CVV. – Make sure the billing address matches the one linked to your card. This step ensures your transaction goes through without issues. Many online retailers also accept Apple Pay, adding another layer of convenience. Ever faced that moment of panic when your card gets declined? Using a Virtual Visa Card can reduce this anxiety, as your funds are preloaded, ensuring you only spend what you have.In-store Transactions

Using your Virtual Visa Card in stores is just as easy as online shopping. If you’ve added it to Apple Pay, you can pay without pulling out a physical card. – Simply approach the checkout, double-click your side button, and hold your phone near the reader. – Watch as your payment is processed with just one touch. If you prefer not to use Apple Pay, you can still enter your card details directly at the register. Just hand over the card information, and you’re good to go. Isn’t it great to have the flexibility of choosing how you want to pay? The Virtual Visa Card makes transactions smooth and hassle-free, whether online or in-store.

Credit: onlinecheckwriter.com

Managing Your Virtual Card

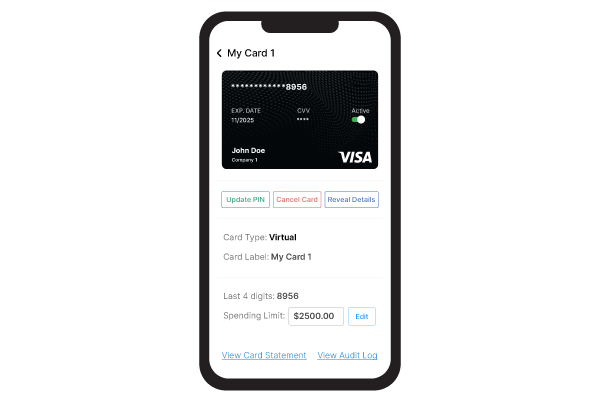

Using a Virtual Visa Card on your iPhone is simple. Start by adding the card to your Apple Wallet. Then, use it for online shopping or in-store payments. Enjoy the convenience and security it offers for your transactions.

Tracking Transactions

Keeping an eye on your transactions is crucial. You can easily track your virtual Visa card transactions through your banking app. Most apps provide real-time updates, so you’ll know exactly where your money is going. – Look for a section labeled “Transactions” or “Activity.” – Check for details like date, merchant, and amount spent. Regularly reviewing your transactions can help you spot unauthorized charges quickly. It’s a good habit to get into. How often do you check your spending?Freezing Or Deleting The Card

If you suspect that your card details have been compromised, act fast. Most banking apps allow you to freeze your card instantly. This feature prevents any new transactions while you sort things out. – Navigate to the card management section. – Select the option to freeze or temporarily disable your card. If you decide you no longer need the card, you can delete it. This process is usually straightforward. Just follow the prompts in the app to permanently remove the card from your account. Have you ever had to freeze a card? It’s a simple step that can save you from a lot of stress.Renewing Or Updating Card Details

Keeping your card information up-to-date is key to uninterrupted service. If you receive a new virtual Visa card, updating your details is necessary to avoid missed payments. – Go to the account settings in your banking app. – Select the option to update card information. Make sure to change your payment details wherever your card is saved online. This includes subscriptions, online stores, and any other services you regularly use. Have you ever faced issues because your card info was outdated? Keeping these details current can save you from a lot of hassle. Stay proactive with your virtual Visa card management for a smoother financial experience.Security Tips For Virtual Visa Cards

Using a virtual Visa card on an iPhone is safe and easy. Start by downloading your bank’s app to access your card details. Always enable two-factor authentication for extra security. Keep your card information private and monitor your transactions regularly for any suspicious activity.

Avoiding Fraudulent Websites

Staying vigilant while shopping online can save you from headaches. Always check the URL before entering your card details. Look for “https://” at the beginning of the web address, indicating a secure connection. Do some research on unfamiliar websites. Reading reviews and checking for contact information can provide insights into a site’s legitimacy. If something feels off, trust your instincts and avoid making a purchase. Remember that scammers often use fake sites that closely resemble legitimate ones. Compare the URL with the official site to spot any discrepancies. It’s better to miss a good deal than to risk your financial security.二要素認証の使用

Two-factor authentication (2FA) adds another layer of protection to your accounts. This means, in addition to your password, you’ll need to verify your identity through another method—like a text message or an authentication app. Setting up 2FA is often a simple process. Check your account settings and follow the prompts. Many online retailers and banking apps offer this feature, making it a smart choice for safeguarding your virtual card. Have you ever received a suspicious login alert? That’s a sign that 2FA is working for you. It can prevent unauthorized access, keeping your financial information secure.アカウントアクティビティの監視

Regularly checking your account activity can help you spot any unauthorized transactions early. Set aside time each week to review your statements. Look for any unfamiliar charges and report them immediately. Consider setting up alerts for transactions on your Virtual Visa Card. Many banks and financial apps allow you to receive notifications for purchases. This way, you’ll know right away if someone is using your card without your permission. Keeping track of your spending not only helps you budget but also keeps your finances secure. Have you ever caught a mistake on your statement? Catching fraud early can save you a lot of trouble down the line. Stay proactive about your financial security. By following these tips, you can enjoy the benefits of using a Virtual Visa Card while keeping your information safe.

クレジット: www.youtube.com

よくある質問

How Do I Get A Virtual Visa Card On Iphone?

To get a Virtual Visa Card on your iPhone, download a compatible app like PayPal or NetSpend. Create an account and follow the prompts to apply for a virtual card. Once approved, you can access your card details directly in the app for online purchases.

Can I Use A Virtual Visa Card For In-store Purchases?

Generally, Virtual Visa Cards are designed for online transactions. However, some retailers may accept them if you add the card to a mobile wallet, like Apple Pay. Always check with the retailer to confirm if they accept virtual cards for in-store purchases.

Is Using A Virtual Visa Card Safe?

Yes, using a Virtual Visa Card is safe. It provides an extra layer of security by masking your actual credit card number. Additionally, you can set spending limits and deactivate the card if necessary, reducing the risk of fraud during online transactions.

How Do I Add A Virtual Visa Card To Apple Wallet?

To add a Virtual Visa Card to Apple Wallet, open the Wallet app and tap the “+” icon. Enter your card details manually or use the camera feature to scan the card. Follow the prompts to complete the setup, and your card will be ready for use in your wallet.

結論

Using a Virtual Visa Card on your iPhone is simple and safe. Follow the steps outlined in this guide. You can enjoy online shopping without worries. This method keeps your personal information secure. Remember to check your card balance regularly.

Always keep your card details private. With a Virtual Visa Card, you have more control over your spending. Embrace this modern way to pay. It offers convenience and peace of mind. Start using your Virtual Visa Card today for a better shopping experience.