Square Moneyを銀行口座に送金する方法:クイックガイド

Are you struggling to figure out how to transfer your hard-earned money from Square to your bank account? You’re not alone.

Many users find themselves puzzled when it comes to moving their funds securely and efficiently. But worry not! This guide is here to make the process smooth and stress-free for you. Imagine the relief of seeing your Square balance safely nestled in your bank account, ready to use for whatever you need.

By the end of this article, you’ll feel confident and empowered, with all the knowledge you need at your fingertips. So, let’s dive in and ensure your money gets exactly where it needs to go!

Setting Up Your Square Account

Setting up your Square account is a crucial step in ensuring your money transfers smoothly to your bank. Whether you’re a small business owner or an individual looking to streamline your transactions, Square offers a user-friendly experience. Let’s dive into how you can get started with Square and effortlessly link your bank account for hassle-free transfers.

Creating A Square Account

To begin, visit the Square website and hit the sign-up button. You’ll need to enter your email address and create a secure password. Consider using a combination of letters, numbers, and symbols to keep it strong.

After signing up, Square will guide you through a quick setup process. You’ll be asked to verify your email address. Check your inbox for a confirmation message and click the provided link. It’s like the digital handshake that confirms you’re ready to start.

Once verified, you’ll be prompted to fill in some basic information about yourself or your business. This includes your name, business name, and contact details. Make sure you have these handy to avoid any delays.

銀行口座のリンク

Linking your bank account is straightforward. Head to the ‘Account & Settings’ section and locate the ‘Bank Accounts’ option. Click on it to begin the linking process.

You’ll need your bank routing number and account number. These can usually be found on your bank’s website or your checkbook. Input these numbers carefully to avoid any errors.

Square might ask for a small verification deposit. This ensures everything is working correctly. Once you see the deposit in your bank account, confirm it within Square. This step is like the final puzzle piece falling into place.

Have you ever felt anxious about making financial transactions online? Square’s security features are designed to put those worries to rest. They employ encryption to protect your data. How do you feel knowing your financial information is safeguarded?

Remember, setting up your Square account and linking your bank account isn’t just about getting started; it’s about ensuring a seamless flow of funds. Are you ready to take control of your financial transactions with confidence?

Understanding Transfer Types

Transfer Square money to your bank account easily. Open your Square app, select “Transfer to Bank. ” Confirm details and submit. Money moves securely, reaching your bank in one to two business days. Simple steps ensure a smooth transfer process for everyone.

即時送金

Instant transfers are ideal when you need your money right away. Imagine you’ve had a great sales day and need to pay a supplier quickly. With instant transfers, you can move your funds from Square to your bank account in minutes. However, there’s a catch: this convenience comes at a cost. Square charges a small fee for instant transfers. Weighing this fee against your immediate need for funds will help you decide if it’s worth it. Have you ever faced a cash crunch where instant transfers saved the day?標準転送

Standard transfers are the routine way to move money from Square to your bank account. This method is free of charge, but patience is required. Typically, funds will take one to two business days to appear in your account. Standard transfers are perfect for regular transactions where urgency isn’t a factor. Planning ahead can help you avoid any rush fees associated with instant transfers. Do you plan your transfers to maintain a steady cash flow without extra costs? Understanding these transfer types allows you to make informed decisions that align with your financial strategy. Whether it’s the speed of instant transfers or the cost-efficiency of standard transfers, knowing your options ensures you’re never caught off guard.送金の開始

Transferring money from Square to your bank is simple. Follow these steps to start. Ensure your bank details are correct. Mistakes can cause delays.

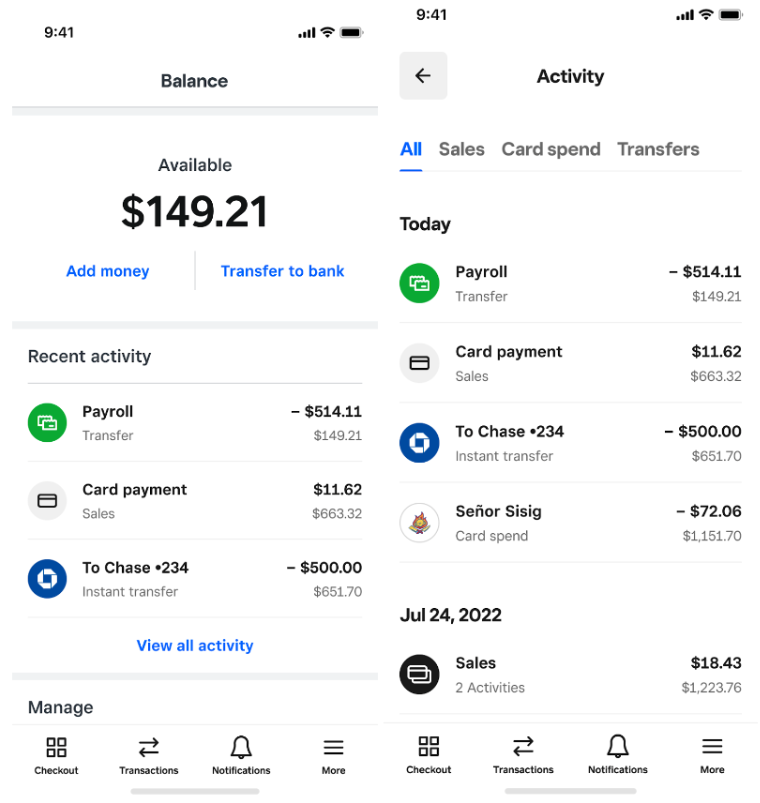

ダッシュボードへのアクセス

First, log in to your Square account. Find the dashboard option. Click on it to open. This section shows your transactions and balances.

Choosing Transfer Type

Decide how you want to transfer. Immediate or scheduled? Immediate transfers are fast but may cost more. Scheduled transfers can take a few days.

送金詳細の入力

Input your bank account number. Double-check for errors. Enter the amount you wish to transfer. Confirm the details before proceeding.

Managing Transfer Fees

Managing transfer fees can be a crucial aspect of moving your money from Square to your bank account. Understanding these fees helps you save money and keeps your transactions smooth. Whether you’re a small business owner or just using Square for personal transactions, knowing how to handle these fees effectively is vital.

Fee Structures

Square charges a standard fee for transferring money to your bank account. This fee is usually a small percentage of the transaction. However, it can add up if you’re transferring large sums or frequent transactions. Understanding the exact percentage can help you plan your finances better. You might be wondering, is it worth paying these fees, or should you look for alternatives? Knowing the fee structure gives you a clear picture to make informed decisions.

Avoiding Extra Costs

One effective way to minimize fees is by timing your transfers. Square offers the option of instant transfers, but they come with a higher fee. If you can wait, opting for the standard one to two business days transfer might save you money. Another tip is to consolidate smaller transactions into one larger transfer. This way, you reduce the frequency of fees, saving more in the long run. Have you ever thought about how these small changes could impact your overall finances?

Managing transfer fees is not just about understanding the fees but also about strategically planning your transfers. By being aware and proactive, you can keep more of your hard-earned money in your pocket.

一般的な問題のトラブルシューティング

Transferring money from Square to your bank account is usually easy. Yet, sometimes issues arise. These can cause stress and confusion. This section explores common problems users face. It also provides solutions. This ensures a smoother transfer process. Let’s dive into common issues like failed transfers and delayed transactions.

失敗した転送

Failed transfers can happen for many reasons. First, check your bank account details. Are they correct? A single error can stop a transfer. Next, ensure your bank account is verified with Square. Unverified accounts may lead to transfer failures. Also, check if you have enough funds in your Square account. Insufficient funds can block the transfer. Another reason could be technical glitches. Try logging out and back into your Square account. Often, this simple step resolves many issues.

遅延取引

Delayed transactions can be frustrating. First, check if there are any Square system updates. Updates can slow down the transfer process. Next, look at your bank’s processing times. Some banks take longer to process transfers. This can cause delays. Also, ensure you have a stable internet connection. A weak connection can slow down transaction processing. Lastly, check for any holidays. Transfers may get delayed during public holidays. Keeping these factors in mind can help minimize delays.

セキュリティの確保

Transferring Square money to a bank account involves simple, secure steps. First, ensure your Square account is linked to your bank. Then, select the transfer option, input the amount, and confirm the transaction. Security measures protect your funds during the transfer process.

Transferring money from your Square account to your bank is a straightforward process, but ensuring the security of your funds is crucial. Security is not just about having a strong password; it’s about understanding potential threats and taking proactive steps to protect your hard-earned money. Let’s dive into how you can keep your Square transactions secure.Protecting Your Account

Keeping your Square account secure starts with a strong password. Choose a combination of letters, numbers, and symbols that is not easily guessed. Avoid using obvious information like birthdays or common words. Enable two-factor authentication (2FA) for an extra layer of security. This requires a second verification step, such as a text message or authentication app code, before accessing your account. It adds a crucial barrier against unauthorized access. Regularly update your account information and security settings. Make it a habit to review your security settings every few months. Are your contact details up-to-date? Is 2FA still enabled? These small checks can make a big difference.不正行為の認識

Stay vigilant for signs of fraudulent activities. Unfamiliar transactions or changes in your account settings could be red flags. Monitor your account regularly to catch anything suspicious early. Educate yourself on common scams targeting Square users. Scammers often use phishing emails or fake customer service calls to trick you into giving away your information. Be cautious of unsolicited messages asking for your account details. Report any suspicious activity immediately. If you notice anything strange, contact Square’s support right away. Quick reporting can prevent further unauthorized access and protect your funds. Security is about vigilance and proactive measures. Have you taken all the necessary steps to protect your Square account? Being aware and prepared can save you from potential headaches down the road. Stay informed, stay secure.Monitoring Transfer History

Transferring Square money to a bank account is simple. First, link your bank account in Square settings. Next, choose the amount to transfer and initiate the transfer. Regular monitoring of your transfer history ensures accuracy and helps track your finances effectively.

Monitoring your transfer history is crucial when you want to ensure your funds are moving smoothly from Square to your bank account. It’s not just about keeping track of your money; it’s about understanding your business’s financial flow. Having a clear picture of your transactions can help you manage your finances better and avoid any hiccups.Accessing Transaction Records

To begin, log into your Square dashboard. You’ll find the transaction history section easily, as Square prioritizes user-friendly navigation. It’s like having a detailed bank statement at your fingertips. This is where you can see all your transactions, including those transferred to your bank. How often do you check this feature? If not regularly, it’s time to start! The dashboard displays your transactions in an organized manner. You can sort them by date or transaction type. This makes it easy to find specific transfers you’re interested in. Think about how much time this saves compared to sifting through paper records.Reviewing Past Transfers

Now, onto reviewing those transfers. Click on each transaction to view details. You can see the date, amount, and status of each transfer. This level of detail helps you verify that each transaction was processed correctly and on time. Have you ever noticed any discrepancies? If so, this is the first place you should check. You might also find trends in your transfer history. Are certain days more profitable? Do transfers take longer during certain periods? By noticing these patterns, you can optimize your business strategy. Imagine the insights you could gain just by keeping a closer eye on your transfer history. Regularly reviewing your past transfers can prevent financial mishaps. It’s a proactive step to ensure your funds are where they should be. What’s your strategy for keeping track? Developing a habit of checking your transfer history can make a significant difference in managing your business finances efficiently.よくある質問

How Do I Link My Bank To Square?

To link your bank, go to your Square dashboard. Select ‘Account & Settings’, then ‘Bank Accounts’. Follow prompts to add your bank details. Ensure your bank information is correct to avoid transfer delays. Square may verify your account with micro-deposits before enabling transfers.

How Long Does Square Transfer Take?

Square transfers typically take 1-2 business days. Transfers initiated before 5 PM PST usually process faster. Weekend and holiday transfers may experience delays. Instant transfers are available for a fee. Ensure your bank account details are correct for timely processing.

Can I Transfer Square Money Instantly?

Yes, Square offers instant transfers for a fee. Enable instant transfers in your Square dashboard. Ensure your bank supports instant transfers. Funds are available within minutes. Instant transfers are subject to limits and fees. Verify your account information for seamless transactions.

Are Square Transfers Secure?

Square uses advanced encryption to protect your transactions. Your bank details are securely stored. Regular security audits ensure data safety. Monitor your account for unusual activity. Contact Square support for any security concerns. Always use strong passwords for your Square account.

結論

Transferring money from Square to your bank is easy. Follow the steps shared. Ensure your bank details are correct. Mistakes can delay transfers. Keep track of your transactions. This helps in managing your finances. Remember, regular transfers build trust. Your business can benefit from this trust.

Stay informed about any Square updates. This helps in smooth operations. Always check for any fees involved. Understand the process completely. It makes things simpler. With these insights, you can manage your funds efficiently. Enjoy the ease of transferring money.

Your business deserves it.