バーチャル口座番号への送金方法:簡単ガイド

Are you tired of the hassle of traditional banking methods when transferring money? Do you wish there was a simpler, more efficient way to send funds?

You’re not alone. Many people like you are discovering the ease and convenience of using virtual account numbers for money transfers. It’s a game-changer in the world of finance. Imagine having the ability to manage your transactions seamlessly, without the stress of dealing with physical bank branches or long wait times.

This guide will walk you through the process step-by-step, ensuring you can confidently and securely transfer money to a virtual account number. Stick with us, and you’ll unlock a new level of financial freedom and efficiency. Ready to transform your money transfer experience? Let’s dive in!

What Is A Virtual Account Number?

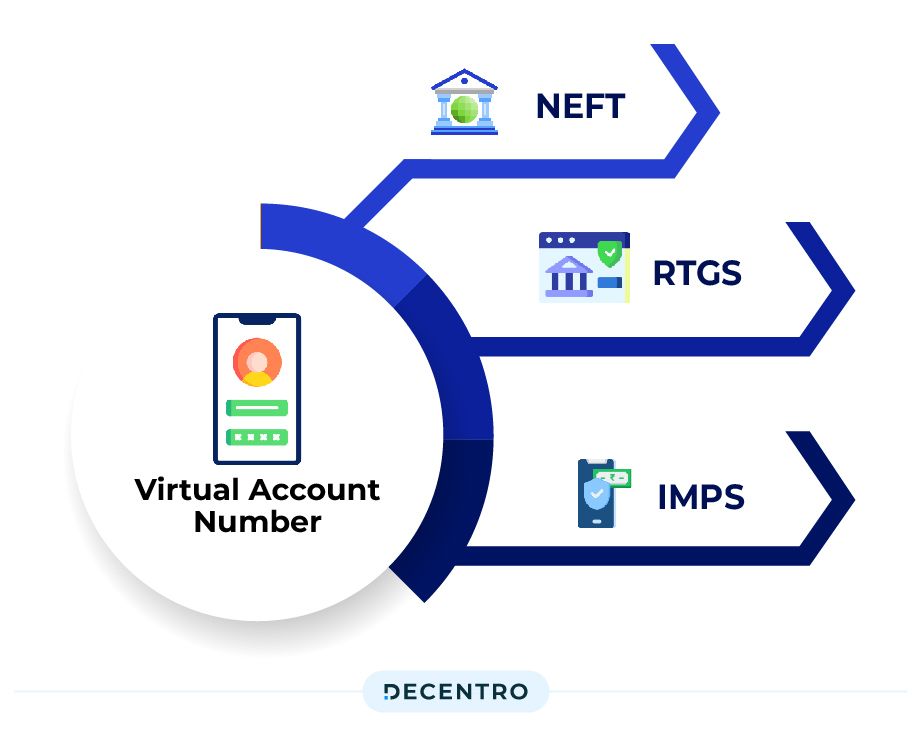

A Virtual Account Number is a unique number for secure online transactions. To transfer money, simply enter the virtual account number, specify the amount, and confirm the transaction. This process keeps your actual account details private and safe.

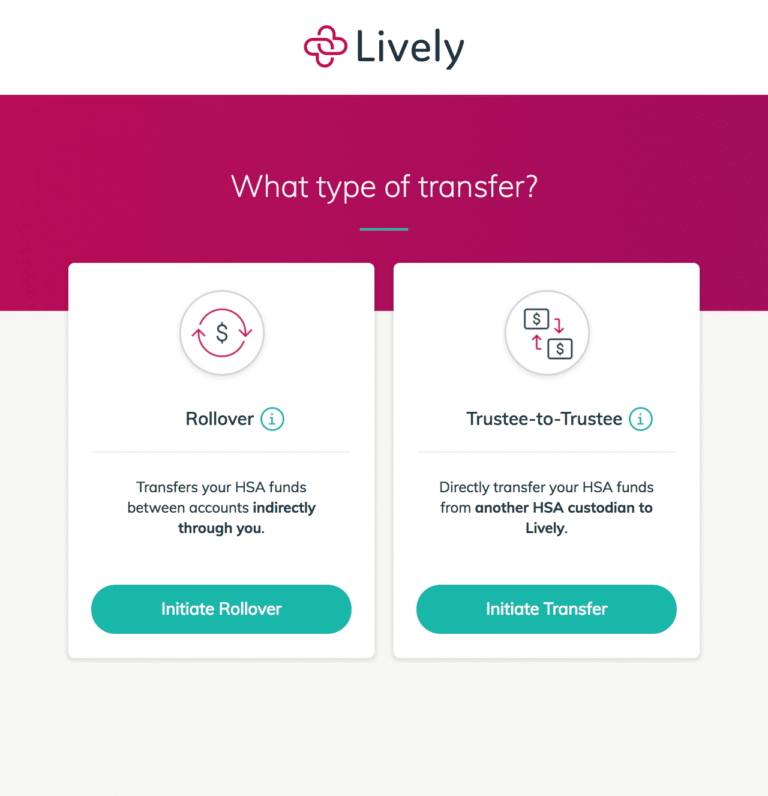

Understanding how to transfer money to a virtual account number can simplify your financial transactions significantly. But before diving into the process, it’s essential to know what a virtual account number actually is. Imagine a temporary, unique bank account number created for a specific purpose. This number is linked to your main bank account but offers an extra layer of security and flexibility. ### A virtual account number is like having a secure alias for your real bank account. It’s a temporary, unique number assigned to you for online transactions. This way, your actual bank account details remain private and secure. These numbers are particularly useful for businesses that need to track payments from multiple clients. They help in identifying transactions easily without the hassle of reconciling each payment manually. ###How Do Virtual Account Numbers Work?

Virtual account numbers are generated by banks or financial service providers. They are linked to your main bank account but act as a placeholder during transactions. When money is transferred to the virtual account number, it automatically redirects to your actual bank account. ### Using virtual account numbers can significantly enhance your financial security. They reduce the risk of fraud by keeping your real bank details hidden during transactions. Additionally, they simplify the tracking of payments, especially for businesses dealing with multiple clients. ###Are Virtual Account Numbers Safe?

Yes, virtual account numbers are considered safe. They provide an added layer of security by masking your real bank account details. However, it’s crucial to use them responsibly and ensure they are provided by a trusted financial institution. ###Can You Use Virtual Account Numbers For Personal Transactions?

Absolutely, virtual account numbers aren’t limited to business use. You can use them for personal transactions to enhance your privacy and security online. Think of them as a protective shield, keeping your financial information safe from prying eyes. ###Final Thoughts

Have you ever felt uneasy sharing your bank details online? Virtual account numbers offer a solution by providing a secure, temporary alternative. Consider using them for your next online transaction and experience the peace of mind that comes with added security.Benefits Of Using Virtual Account Numbers

Virtual account numbers provide a safe way to manage money transfers. They offer numerous benefits that enhance financial security and efficiency. These digital solutions simplify the transfer process while ensuring privacy.

Security And Privacy

Virtual account numbers protect your real account details. This reduces the risk of fraud. Only temporary numbers are shared during transactions. This keeps your primary account safe. You maintain control over who sees your real information.

Ease Of Use

Using virtual account numbers is straightforward. They simplify the process of sending and receiving money. You don’t need to remember complex account numbers. This makes transactions quick and easy.

強化された予算編成

Virtual accounts help track spending. They act as separate accounts for specific purposes. This aids in managing budgets effectively. You can allocate funds for different needs without confusion.

柔軟性

Virtual accounts offer flexibility in financial transactions. You can create multiple accounts for various purposes. This is useful for businesses managing different projects. It allows easy organization and tracking.

Cost-effective

Virtual account numbers often come with lower fees. They are generally cheaper than traditional banking services. This makes them a cost-effective solution for managing money. You save on transaction costs over time.

Setting Up A Virtual Account

Transferring money to a virtual account number is straightforward. Simply access your online banking platform and choose the transfer option. Enter the virtual account number and confirm the transaction for secure and quick money transfer.

Choosing A Financial Institution

Start by selecting a reputable financial institution. Look for one with a strong track record in digital banking. Pay attention to customer reviews and ratings. Consider the range of services they offer. Do they provide 24/7 customer support? Is their app user-friendly? Make sure their features align with your needs. Think about any fees they might charge. Some institutions have hidden fees for transactions. Always read the fine print to avoid surprises later. ###Registration Process

Once you’ve chosen your financial institution, proceed to the registration process. You’ll usually start by downloading their app or visiting their website. Have your personal information ready, such as your ID and proof of address. The process typically involves filling out forms and agreeing to terms and conditions. Don’t rush through this step—double-check your entries. Incorrect information can delay your account setup. Many institutions offer a guided registration process. Make use of online tutorials or customer service if you get stuck. They’re there to help you. ###Verification Steps

Verification is crucial for the security of your virtual account. Expect to provide identification documents. This may include a government-issued ID or a utility bill. Some institutions use digital methods like facial recognition or a one-time password sent to your phone. These steps ensure that only you can access your account. Once your documents are verified, you’ll receive a confirmation. Keep an eye on your email or app notifications. This is the final step before you can start using your virtual account. Have you ever considered how convenient a virtual account could be for your daily transactions? With these steps, you’re just a few clicks away from a seamless banking experience.Transferring Money To A Virtual Account

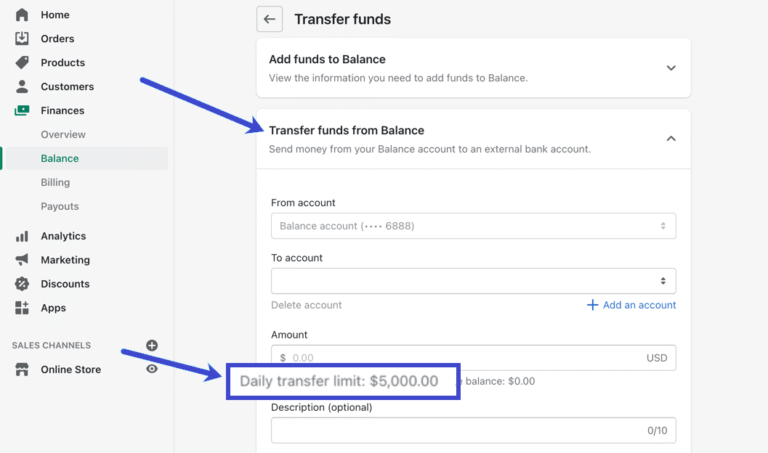

Transferring money to a virtual account is simple. Enter the unique virtual account number in your bank app. Confirm the amount and initiate the transfer. Funds will reflect instantly, ensuring a quick transaction.

オンラインバンキングの利用

Online banking is a common method. It allows for easy transfers. Log into your online banking platform. Find the transfer option. Enter the virtual account number. Input the amount you want to send. Confirm the transaction details. Submit the transfer. The bank processes the transaction. Funds are usually transferred quickly.モバイルバンキングアプリ

Mobile banking apps are convenient. They offer transfers on-the-go. Download the bank’s app on your phone. Log in using your credentials. Navigate to the transfer section. Enter the virtual account number. Specify the transfer amount. Review and confirm the transaction. Touch the submit button. The app sends your money instantly.サードパーティ決済サービス

Third-party services are versatile. They include platforms like PayPal or Venmo. Sign up for an account on these services. Link your bank account or card. Select the transfer option. Input the virtual account number. Set the amount to transfer. Confirm the transaction. These services offer fast transfers. They often provide additional security features.Security Measures And Tips

Transferring money safely to a virtual account requires careful verification of account details. Ensure the virtual account number is correct before proceeding. Use secure networks and trusted platforms to protect your financial information during transactions.

Recognizing Fraudulent Activity

Watch for signs of fraud. Unusual account activity is a red flag. Unexpected emails requesting personal details are suspicious. Always confirm with your bank before acting.個人情報の保護

Keep your personal information private. Never share your account number with strangers. Use strong, unique passwords for online banking. Change them regularly to stay safe.Using Secure Connections

Always use secure connections for online transactions. Avoid public Wi-Fi when accessing your bank account. Ensure your device has updated antivirus software. This helps to block hackers and malicious activities.よくある問題と解決策

Transferring money to a virtual account number often presents challenges like incorrect details or transaction delays. Verify account information before proceeding and use secure platforms to ensure smooth transfers. Regularly check transaction status to avoid unexpected issues and ensure funds reach the right destination efficiently.

Transferring money to a virtual account number can be a convenient way to manage transactions. However, it’s not always smooth sailing. You might encounter hiccups that can be frustrating if not handled properly. Understanding common issues and their solutions can save you time and stress. Let’s dive into some frequent challenges and how you can tackle them effectively.失敗したトランザクション

Nothing is more frustrating than a failed transaction. It’s like hitting a roadblock when you’re in a hurry. Failed transactions often occur due to insufficient funds or technical glitches. Before initiating a transfer, ensure your account has enough balance. Check your app or website for any scheduled maintenance that might affect processing. If a transaction fails, review your bank statement or transaction history. Sometimes, a pending status can mean a temporary hold. Contact customer support if the issue persists.Delay In Processing

A delay can be nerve-wracking, especially when you need the money transferred urgently. This can result from network congestion or bank processing times. Consider making transfers during off-peak hours. Early mornings or late evenings often see less traffic. Ask yourself if the delay is due to a holiday or weekend. Banks typically process slower during these times. Plan your transfers accordingly to avoid surprises.アカウントの詳細が正しくありません

Entering wrong account details can lead to failed transfers or money landing in the wrong place. It’s a simple mistake with potentially serious consequences. Double-check the account number and other details before hitting send. A tiny error can make a big difference. Use the copy-paste feature with caution. Sometimes formatting issues arise. Verify each entry meticulously. By being proactive and attentive, you can navigate these common issues seamlessly. What steps will you take next time to ensure a hassle-free transfer?Future Of Virtual Account Numbers

The future of virtual account numbers is promising and evolving. As technology advances, these numbers become crucial in digital transactions. They offer a flexible and efficient way to manage finances. This trend is reshaping the financial landscape, making transactions easier for users.

Virtual account numbers provide a unique and secure way to handle money. They allow for seamless transactions without revealing personal details. This reduces the risk of fraud and enhances security. As more people embrace digital banking, virtual account numbers will likely become more popular.

What Are Virtual Account Numbers?

Virtual account numbers are unique identifiers for financial transactions. They act like a temporary credit card number. You use them for online purchases or transfers. This keeps your real account information safe and private.

Benefits Of Virtual Account Numbers

Virtual account numbers offer several benefits. They improve transaction security by concealing personal data. They also simplify account management. Users can create multiple virtual accounts for different purposes. This makes tracking expenses easier and more organized.

Technology Enhancing Virtual Account Numbers

Technological advancements boost the efficiency of virtual account numbers. Artificial intelligence and machine learning enhance their security features. These technologies detect suspicious activities and prevent fraud. They also streamline the transaction process, making it faster and more reliable.

Integration With Digital Platforms

Virtual account numbers are integrating with various digital platforms. This includes online banking apps and e-commerce sites. Such integration simplifies the user experience. It allows for quick and secure transactions without leaving the platform.

Impact On Traditional Banking

Virtual account numbers are impacting traditional banking methods. They offer more convenience and security than physical accounts. Banks are adapting by offering more digital services. This change is leading to a shift in how people manage their finances.

よくある質問

How Do I Transfer Money To A Virtual Account?

To transfer money to a virtual account, use your banking app or online portal. Enter the virtual account number as the recipient. Ensure the account details are accurate. Confirm the transfer amount and initiate the transaction. Review the transaction summary for any fees.

Your funds should transfer promptly.

Is Transferring To A Virtual Account Safe?

Yes, transferring to a virtual account is safe. Banks and financial institutions secure these transactions with encryption. Always verify the account details before transferring. Monitor your transaction history for any discrepancies. Use trusted and secure networks to avoid fraud. Regularly update your banking app for enhanced security.

Can I Use Any Bank For Transfers?

Most banks support transfers to virtual accounts. Check with your bank for compatibility and any fees. Online banking platforms generally facilitate such transfers easily. Ensure your bank’s app is up-to-date for smooth transactions. Contact customer service for assistance if needed.

Always confirm the virtual account details before proceeding.

What Fees Are Associated With Transfers?

Transfer fees vary by bank and transaction type. Some banks offer free transfers to virtual accounts. Check your bank’s fee structure for details. Fees may apply for international transfers or large amounts. Always verify potential fees before initiating a transfer.

Contact your bank for more information on specific fee policies.

結論

Transferring money to a virtual account number is simple and secure. Follow the steps outlined, and you’ll complete the transfer smoothly. Always double-check the details before sending money. This ensures you avoid errors and delays. Remember, keeping your account information safe is vital.

Stay updated with your bank’s latest security features. This adds an extra layer of protection. With these tips, you can confidently manage your transactions. Start today and experience the convenience of virtual account numbers. Make your financial activities more efficient and stress-free.