ステップバイステップで銀行口座に送金する方法:簡単ガイド

Have you ever felt stuck trying to figure out how to transfer money from your Step account to your bank account? You’re not alone.

Navigating financial apps can sometimes feel like decoding a secret language. But it doesn’t have to be this way. Imagine a world where transferring your funds is as simple as a few taps on your phone. This blog post is here to make that world a reality for you.

We understand that your time is precious, and dealing with complicated financial processes is the last thing you want to do. That’s why we’ve crafted an easy-to-follow guide that will show you exactly how to move your money seamlessly. No more frustrating delays or confusing steps. Just clear, straightforward instructions that put you in control of your finances. Are you ready to unlock the power of hassle-free money transfers? Let’s dive in and simplify your financial life.

Step App Basics

Understanding the basics of Step App can make transferring money to your bank account a breeze. Whether you’re new to digital banking or just exploring different options, Step App offers a seamless way to manage your finances. It’s crucial to get familiar with its fundamentals to ensure you navigate it effectively. So, let’s dive into the essentials and make your financial journey smoother.

What Is Step App?

Step App is a modern financial tool designed for ease and efficiency. It’s not just another app; it’s a gateway to smart banking. Imagine having a virtual wallet that keeps your finances in check. With Step App, you can manage your money, track spending, and transfer funds effortlessly. It’s like having a bank in your pocket but without the complex jargon.

Why choose Step App over traditional banking? It’s simple. You get real-time updates, no hidden fees, and the convenience of handling everything from your smartphone. Plus, it’s designed with young adults in mind, making financial management accessible for everyone. So, do you want to simplify your banking experience?

Setting Up Your Step Account

Getting started with Step is straightforward. First, download the Step App from your app store. Open the app and follow the on-screen instructions to create your account. You’ll need to provide basic details like your name, email, and phone number. It’s as simple as setting up an email account.

Once you’ve signed up, the app will guide you through linking your bank account. This step is crucial for transferring money. Ensure you have your bank account details ready. The app uses encryption to keep your data safe. Isn’t it comforting to know your money is secure?

After linking your bank account, explore the app’s features. Check out how you can track your spending or set savings goals. The app’s intuitive design makes it easy to manage your finances. The setup takes just a few minutes, but the benefits are long-lasting. Are you ready to take control of your financial future?

銀行口座のリンク

Easily transfer money from Step to your bank account by linking them. Follow clear instructions for a smooth process. Enjoy effortless transactions and manage your finances better.

Linking your bank account to the Step app is a pivotal step in managing your finances smoothly. It’s the bridge that connects your digital wallet to your real-world bank account, allowing seamless money transfers. But how do you ensure this connection is both secure and effective? Let’s walk through the process together, ensuring you’re equipped with the know-how to get it right the first time. ###Checking Bank Compatibility

First things first, not every bank might be compatible with the Step app. Before diving into the linking process, it’s crucial to verify if your bank is supported. Most major banks are, but it’s always good to double-check. You can find a list of compatible banks directly within the Step app under the bank linking section. Imagine trying to fit a square peg into a round hole. Ensuring compatibility saves you time and frustration, making the process smooth and straightforward. ###Secure Bank Account Connection

Security is paramount when it comes to linking your financial accounts. The Step app uses encryption to protect your sensitive information during the connection process. When you add your bank account, you’ll typically be prompted to enter your online banking credentials. Don’t worry, this step is secure. The app doesn’t store these credentials; instead, it uses them to establish a secure link. Consider using two-factor authentication if your bank offers it. This adds an extra layer of security, ensuring that even if someone tries to access your account, they’ll face a significant hurdle. Doesn’t it feel reassuring to know your money is safe? By taking these steps, you can ensure your bank account connection is as secure as it can be. Once your account is linked securely, you can effortlessly transfer funds between your Step app and bank account, making financial management a breeze. Have you ever linked a bank account before? What steps did you take to ensure it was secure? Share your thoughts in the comments below!送金を開始する

Transferring money from Step to a bank account is simple. First, link your bank account in the Step app. Then, follow on-screen instructions to complete the transfer.

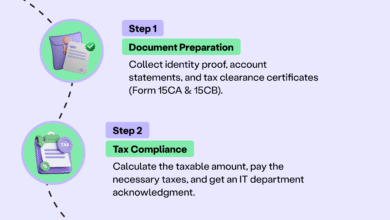

Accessing The Transfer Feature

To begin, open your Step app and navigate to the home screen. You’ll find a menu or icon labeled “Transfer” or “Move Money.” Tap on it. This is your gateway to managing your funds and transferring money to your bank account. Have you ever wondered why accessing this feature is so seamless? Step designed it with user-friendliness in mind, ensuring that even first-time users can navigate it without hassle. Don’t forget to check for updates regularly to keep the app running smoothly. ###Inputting Transfer Details

Once you’ve accessed the transfer feature, it’s time to input your transfer details. Enter the amount you wish to transfer. It’s important to double-check this figure to avoid any errors. Next, select the bank account you want to transfer money to. If it’s your first time, you’ll need to add your bank account details. This might include your account number and the bank’s routing number. But why is accuracy crucial here? Because even a small typo can lead to delays or failed transactions. Consider using the ‘notes’ section to label your transfer. This can help you track your financial activities later, especially if you’re managing multiple accounts. Have you ever transferred money and forgotten what it was for? Adding a note can help jog your memory. By following these steps, you can initiate a seamless money transfer from your Step account to your bank account. This process not only helps you manage your finances but also empowers you to make informed decisions. What will you do with your newfound financial flexibility?

Confirming The Transfer

Once you’ve initiated a money transfer from Step to a bank account, confirming the transfer is crucial. This process ensures your funds reach the right destination without any issues. Knowing how to confirm the transfer can save you from potential errors or delays.

Reviewing Transfer Information

Double-check the transfer details. Ensure the bank account number is correct. Verify the amount you wish to transfer. Look for any hidden fees or charges that may apply. Confirm the bank’s name and branch details. Reviewing this information prevents mistakes and ensures a smooth transfer.

Finalizing The Transaction

Once you’re sure everything is correct, proceed to finalize the transaction. Click the confirm button to complete the transfer. You might receive a confirmation email or notification. Save this confirmation for your records. It serves as proof of your transaction.

一般的な問題のトラブルシューティング

Transferring money from Step to a bank account can have issues. Check your account details for accuracy. Ensure your bank is linked correctly and verify if transaction limits are exceeded.

送金遅延

Experiencing delays can be frustrating, especially when you need funds urgently. The first thing to check is whether there are any bank holidays or weekends that might affect the processing time. Banks typically don’t process transfers outside of business days, which could delay your transaction. Ensure your Step account is linked correctly to your bank account. An incorrect setup might require additional verification, causing delays. Check if you’ve received any notifications from Step regarding the status of your transfer, as they might provide insights on the delay. If the delay persists, consider reaching out to Step’s customer support. They can offer assistance and help resolve any technical issues that might be causing the delay. Have your transaction details handy to speed up the support process. ###アカウントの詳細が正しくありません

Entering incorrect account details is a common mistake that can prevent successful transfers. Double-check the account number and routing number you’ve entered in your Step app. A single digit error can send your money to the wrong place or fail the transaction entirely. Before initiating a transfer, review your bank account details in the app. Verify them against your bank statement or online banking portal to ensure accuracy. This simple step can prevent a lot of hassle down the line. If you realize you’ve entered incorrect details after starting the transfer, contact both your bank and Step’s support immediately. They may be able to halt the transfer or help recover funds if they were sent to the wrong account. Acting quickly is crucial in these situations. Have you ever faced similar issues while transferring money? How did you resolve them? Sharing your experience might help others navigate through their challenges too.

セキュリティ対策

Transferring money from a Step account to a bank involves trust. It’s crucial to ensure that your information stays safe during this process. Understanding the security measures helps protect your financial details. Below are key security practices to consider.

Protecting Personal Information

Keep your personal information private. Never share your account details with anyone. Use strong, unique passwords for your Step account. Change your passwords regularly. Enable two-factor authentication for added security. This adds an extra layer of protection. Always log out after completing a transaction.

Check the URL before entering personal details. Ensure the website begins with “https”. This indicates a secure connection. Avoid using public Wi-Fi when transferring money. Public networks are less secure. Use a trusted, private network instead.

Recognizing Fraudulent Activities

Stay alert to signs of fraud. Be cautious of unexpected emails or messages. Scammers often disguise themselves as bank officials. Check for spelling mistakes or unfamiliar email addresses. These can be red flags. Always verify the source before clicking on links.

Monitor your account regularly. Look for unusual activity or transactions. Report any suspicious activity immediately. Contact Step support if you notice anything strange. Quick action helps prevent further issues. Stay informed about common scams. Awareness helps you stay secure.

Benefits Of Using Step App

Step App simplifies transferring money to a bank account. Enjoy quick and straightforward transactions with minimal fees. The user-friendly interface ensures a seamless experience for everyone.

Convenience And Speed

One of the greatest advantages of using the Step app is its convenience. Imagine you’re at a café, and you realize you need to transfer money to your bank account right away. With Step, you can do this in just a few taps on your phone. There’s no need to visit a bank or fill out complicated forms. The speed is impressive too. Transactions are processed quickly, allowing you to access your funds almost instantly. This means you can handle unexpected expenses or seize opportunities as they arise without any delay.Budget Management Features

Step isn’t just about transferring money; it’s a powerful tool for managing your budget. Have you ever wondered where your money goes each month? With Step, you can track your spending and see exactly how much you’re saving. The app offers features that help you set spending goals and monitor your progress. You can categorize your expenses, making it easier to identify areas where you can cut back. This can be especially useful if you’re saving for something special, like a trip or a new gadget. How do these features impact your financial habits? They encourage mindful spending and help you make informed financial decisions. You gain a clearer picture of your financial health, which can lead to better money management in the long run. Utilizing Step’s convenience and budget management features not only simplifies financial transactions but also empowers you to take control of your finances. Have you tried it yet?よくある質問

How Do I Link Step To My Bank Account?

To link Step to your bank account, visit the Step app’s settings. Select ‘Link Bank Account’ and follow the prompts. You’ll need your bank account details and may need to verify via email or text. Once linked, you can seamlessly transfer funds between Step and your bank.

Can I Transfer Money Instantly From Step?

Yes, transferring money from Step to your bank account is typically instant. However, it may take up to 1-3 business days depending on your bank’s processing times. Always check both Step and your bank’s policies for any delays or specific requirements.

Are There Fees For Transferring Money From Step?

Transferring money from Step to your bank account is usually free. However, some banks might charge fees for receiving transfers. Check with your bank for any applicable fees. It’s always good to review Step’s terms for updates on any potential charges.

What Is The Maximum Transfer Limit On Step?

Step has a maximum transfer limit, which can vary based on account verification status. Generally, you can transfer up to $5000 per day. For larger amounts, contact Step’s customer support for assistance. Always check the app for any updates on transfer limits.

結論

Transferring money from Step to a bank account is simple. Follow the steps carefully. Ensure your bank details are correct. Double-check the transfer amount. Use the Step app’s secure features. Keep your app updated for smooth transactions. Always monitor your balance.

This helps in avoiding any mistakes. Remember, online banking can make life easier. Stay informed about any app updates. These can improve your experience. Safe and quick transfers mean less stress. Enjoy managing your money with ease.