ビジネスアカウントから個人アカウントに送金する方法

As the old adage 'don't mix business with pleasure' goes, separating your business and personal finances is essential. Yet, there are times when you need to 送金する あなたの ビジネスアカウント to your personal account, and that's where things can get tricky. You'll want to guarantee you're doing it correctly to avoid any 税金の影響 or accounting headaches. But before you initiate the transfer, you'll need to take into account a few things, such as the best method for the transfer and any 潜在的な手数料 involved. So, where do you start?

Understand Business Account Types

Before you can transfer money between accounts, you'll need to understand the different types of ビジネスアカウント involved, including their specific features, restrictions, and requirements. You'll encounter various account types, such as checking, savings, and money market accounts, each with its own set of rules and limitations. For instance, some accounts may have 最低残高要件, while others may restrict the frequency of transactions. Understanding these nuances is essential to guarantee that your transfers are executed smoothly and securely. Take the time to review your account agreements and familiarize yourself with the specific 利用規約 governing your business accounts. This knowledge will help you navigate the transfer process with confidence and avoid potential pitfalls.

送金方法を選択

When transferring money between accounts, you'll need to decide which 転送方法 is most suitable for your business needs, considering factors such as 転送速度, 手数料、 そして 安全. You'll want to weigh the trade-offs between methods, like 電信送金, ACH transfers, or online transfers. Wire transfers are typically the fastest, but often come with higher fees. ACH transfers are more affordable, but can take a few days to process. Online transfers through your bank's platform may offer a balance between speed and cost. Consider the urgency of the transfer, the amount being transferred, and your business's budget to determine the best approach. Be sure to also evaluate the security measures in place for each method to protect your business's financial information.

Review Accounting Implications

As you finalize the 転送方法, you'll also need to contemplate the accounting implications of moving funds between accounts, including how the transaction will be recorded and reflected in your 財務諸表. The transfer will likely be categorized as a distribution, and you'll need to track it accordingly. This entails confirming the transaction is dated and labeled correctly, making it easier to distinguish and reconcile in your ledgers. Additionally, this detailed accounting helps prevent discrepancies. You'll also need to verify that the accounts can handle the transfer and your financial records are accurate post-transfer. Confirm the relevant accounting software and financial sheets are updated to avoid difficulties during future audits. Organized accounting helps avoid unforeseen consequences.

Consider Tax Liabilities

Your transfer of funds between accounts may trigger tax liabilities, including potential capital gains taxes, income taxes, or other tax implications that you'll need to reflect on. It's crucial to evaluate these liabilities to avoid unexpected tax bills. The following table highlights some potential tax implications:

| Tax Type | 考慮事項 |

|---|---|

| Capital Gains Tax | Profits from the sale of assets, such as investments or property, may be subject to capital gains tax. |

| Income Tax | Transferring funds from a business account to a personal account may be considered taxable income. |

| Self-Assessment Tax | You may need to report the transferred funds on your self-assessment tax return. |

| Value-Added Tax (VAT) | VAT implications may arise if you're transferring funds related to business activities.

Consult a tax professional to guarantee compliance with tax laws and regulations.

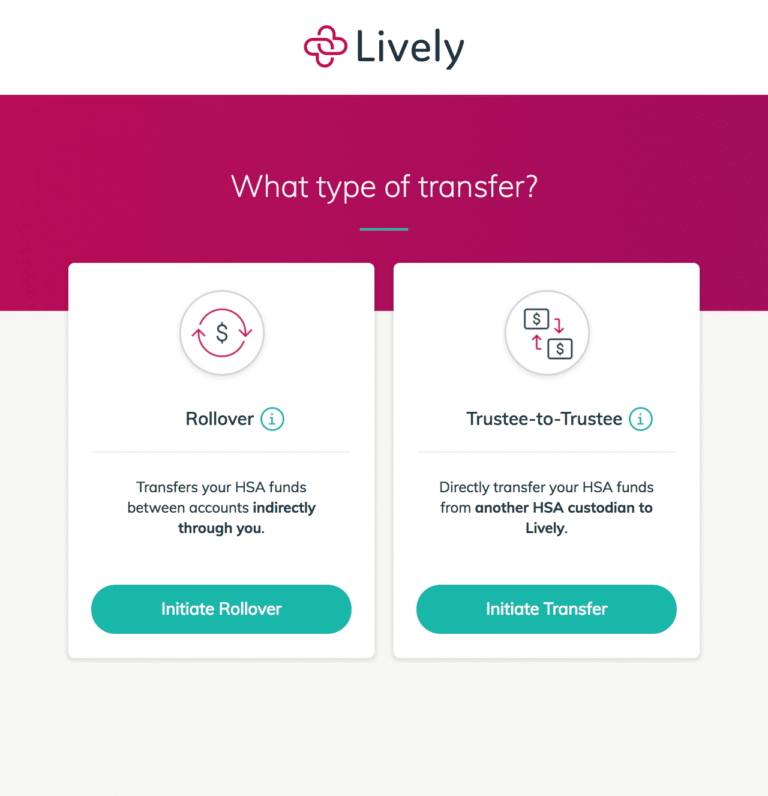

Check With Financial Institution

Prior to initiating a transfer, it is essential to verify with your financial institution whether there are any specific requirements or restrictions on transferring funds between accounts. You'll want to confirm their policies and procedures for inter-account transfers, as these may vary. Your financial institution may have specific rules or limitations on the amount of money you can transfer, the frequency of transfers, or the types of accounts involved. They may also require advance notice or have specific documentation requirements. Additionally, you should inquire about any potential fees or charges associated with the transfer. By verifying this information, you can guarantee a smooth and compliant transfer process that meets your financial institution's requirements.

Prepare Transfer Documentation

Having confirmed your financial institution's policies and procedures for inter-account transfers, you'll now need to gather and prepare the 必要な書類 to initiate the transfer process. This typically includes the account numbers and routing numbers for both the business and personal accounts, as well as identification verifying your authority to initiate the transfer. Make sure you have accurate and up-to-date information to avoid any delays or errors. You may also need to provide a transfer justification or explanation, especially for large or frequent transfers. It is crucial to maintain a record of all transfer documentation for auditing and compliance purposes. Make certain all documentation is secure and compliant with financial regulations to protect your accounts and sensitive information.

Execute the Transfer

To execute the transfer, you'll typically need to access your financial institution's オンラインバンキングプラットフォーム, visit a branch in person, or use a モバイルバンキングアプリ, depending on the institution's available transfer methods. You'll need to initiate the transfer by specifying the amount, source account (business), and 宛先アカウント (personal). Verify that the account numbers and routing numbers are accurate to avoid any errors. If you're using online banking, you may be required to enter a one-time password or confirm the transfer via a security token. If you're using a mobile banking app, you may need to authorize the transfer using biometric authentication or a secure login. Once you've confirmed the transfer, it will be processed in real-time or according to the institution's transfer schedule.

Record the Transaction

Now that you've successfully executed the transfer, you'll need to secure accurate bookkeeping by recording the transaction in your financial records. To do this, log in to your accounting software or spreadsheet and create a new transaction entry. In the table below, we outline the necessary information to record:

| 分野 | 説明 |

|---|---|

| 日付 | The date the transfer was executed |

| 額 | The amount transferred from the business account to the personal account |

| 説明 | A brief description of the transfer (e.g. 'Transfer to personal account for business expenses') |

Make sure to save the transaction and reconcile your accounts to guarantee accuracy and prevent potential issues. By properly recording the transaction, you'll maintain a clear and transparent financial trail.

Monitor for Potential Issues

After recording the transaction, you'll need to periodically review your accounts to identify and address any 潜在的な問題 that may arise from the transfer, such as discrepancies or overdrafts. Keep an eye out for 異常な活動, like unexpected fees or transfers. Confirm that the recipient account received the correct amount, and that your business account has 十分な資金 to cover any future transactions. Set up account alerts to notify you of any suspicious activity or low account balances. 定期的な監視 can help you quickly detect and resolve issues, minimizing potential financial losses and protecting your business and personal accounts. By staying vigilant, you'll confirm a smooth and secure transfer process.