Afterpayで毎月の支払いをする方法:簡易ガイド

Imagine having the freedom to buy what you want today and spread the cost over time. Sounds great, right?

That’s exactly what Afterpay offers—a way to shop without the immediate financial burden. But how do you manage those monthly payments effectively? If you’ve ever felt a bit overwhelmed about keeping track of your Afterpay installments, you’re not alone. In this guide, we’ll unravel the secrets to making your Afterpay payments smoothly and stress-free.

By the end, you’ll not only be a savvy Afterpay user but also a master at managing your finances with ease. Ready to take control of your spending? Let’s dive in!

Understanding Afterpay Basics

アフターペイ is a payment tool. It lets you buy things now. You pay later. You pay in small parts, over time. This is called installments. You don’t need to pay the full amount upfront. 追加料金なし if you pay on time. It’s easy to use. Many stores accept Afterpay. You can shop online or in stores.

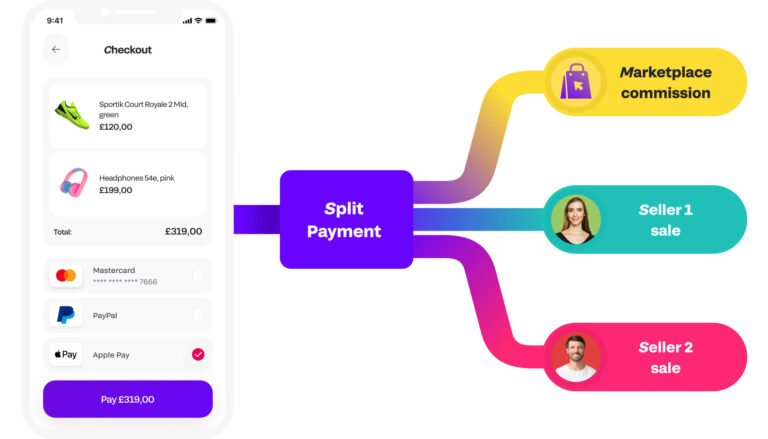

You choose Afterpay at checkout. You pay the first part then. The rest is paid in four parts. Every two weeks, you pay one part. They send a reminder to you. You must have a debit or credit card. Your card is charged automatically. It’s simple. It’s convenient. You can track payments in the app. It helps you manage spending. You know exactly what you owe. No surprises.

Setting Up Your Afterpay Account

Start by visiting the Afterpay website. Click on the sign-up button. Fill in your email and create a password. Make sure your password is strong. This keeps your account safe. After this, check your email. You will find a link to confirm your account. Click it to complete the sign-up process.

Go to your account settings. Click on “Payment Methods”. You can add a debit or credit card. Enter your card details carefully. Double-check the card number and expiration date. Make sure they are correct. This helps in smooth payments. Your card must have enough funds for purchases.

Making A Purchase With Afterpay

Select your items and add them to your cart. Go to checkout and pick アフターペイ as your payment option. You will need to log in or create an Afterpay account. It’s quick and easy. Enter your details carefully. This includes your address and email.

Review your order to make sure everything is correct. Then click 確認する to complete the purchase. Your items will ship after the order is confirmed. You will pay in four equal installments. Every two weeks, a payment will be due. Keep track of your payment dates. This helps avoid late fees. Enjoy your new purchase!

Managing Monthly Payments

Afterpay helps you buy things now and pay later. You pay in four parts. The first part is due right away. The next three are due every two weeks. This makes it easy to buy without paying all at once. Four parts mean smaller amounts each time. Easy to manage for everyone.

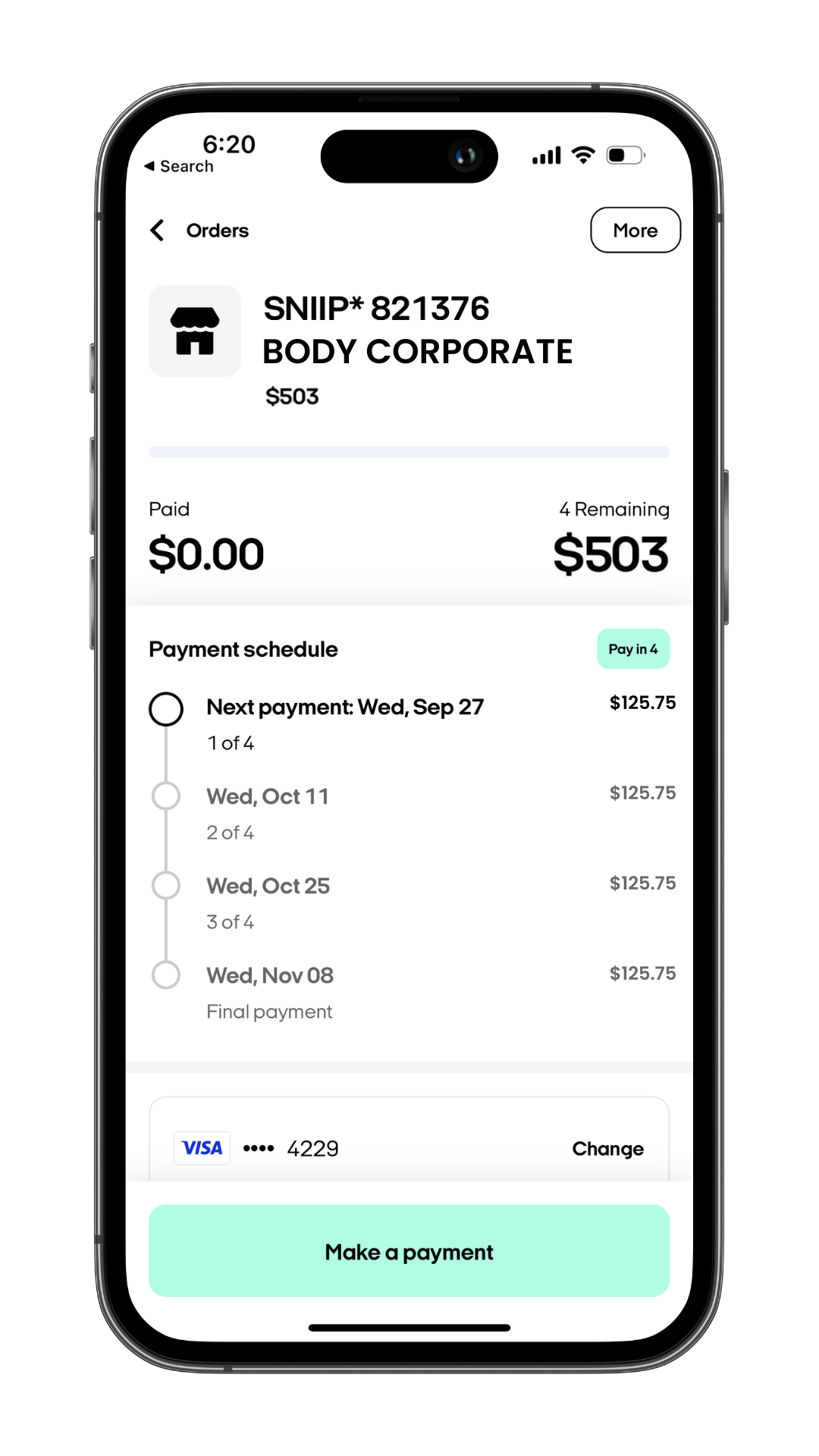

Keep track of your payments easily. Use the Afterpay app on your phone. The app shows when each payment is due. It also shows how much you owe. Staying on track は重要です。 Avoid late fees by knowing your dates.

Adjusting Payment Details

You can change your payment method on Afterpay. Login to your account. Find the 支払い方法 section. Click on it. Choose a new payment method. Enter the new card details. Save the changes. Ensure the card is 有効. This helps avoid missed payments. Always double-check the card numbers.

Sometimes you need to change payment dates. Go to your account. Find the Payment Schedule. Click to view it. You can see your due dates. Click on the date you want to change. Select a new date. Confirm the change. Remember, not all payments can be changed. Check with Afterpay first.

Handling Late Payments

Late payments can be a challenge. Afterpay charges fees for late payments. These fees add up quickly. Pay on time to avoid extra costs. Late fees are $10 initially. If still unpaid, an additional $7 fee is added. Fees can be stressful and hard to manage. Budget well to avoid them.

Strategies To Avoid Penalties

Plan payments carefully. リマインダーを設定する to pay on time. Use calendars or phone alerts. Always 残高を確認してください before shopping. Avoid buying beyond your budget. If short on money, contact Afterpay early. They might help with a payment plan. Stay informed about your payment dates. These steps can help you avoid fees.

Utilizing Afterpay Responsibly

予算編成 is key to using Afterpay smartly. Only buy things you can afford. Set aside money for monthly payments. Track all your spending. Know what you owe. Avoid buying more if you struggle with payments. Keep a list of all purchases. Make sure your bank account has funds. プラン ahead for big items. Save money for future payments. Don’t let debt grow. Use Afterpay like cash. Pay off bills every month. Watch your balance closely. This keeps spending under control.

Using Afterpay does not affect 信用スコア. It does not show on credit reports. But late payments can hurt you. 手数料 might increase if you miss payments. Keep a steady payment record. This shows you’re responsible. Pay bills on time every month. Stay alert to payment dates. Avoid late fees by setting reminders. This helps maintain a good profile. Remember, Afterpay is a tool. Use it wisely for a healthy financial future.

一般的な問題のトラブルシューティング

Learn to manage monthly payments on Afterpay easily. Log into your account, select the ‘Payment Schedule’ section, and follow the prompts. Ensure your linked card has enough funds to avoid issues.

失敗したトランザクション

Sometimes payments don’t go through. 再確認 your card details first. Make sure your card isn’t expired. Also, ensure you have enough funds. If the issue persists, try another card. Sometimes, a simple switch solves the problem. Clear your browser cache and try again. This can fix glitches. Stay patient and try these steps.

カスタマーサポートへのお問い合わせ

Still having trouble? Contact Afterpay’s support team. They are there to help. Visit the Afterpay website for contact details. Use the chat feature for quick help. You can also email them. Explain your issue clearly. Provide all necessary details. This helps in resolving your problem faster. Keep your order number handy. It speeds up the process.

よくある質問

What Is Afterpay’s Payment Schedule?

Afterpay splits your purchase into four equal payments. You make the first payment at checkout. The remaining payments are automatically deducted every two weeks. This allows you to budget your expenses over time. Always ensure sufficient funds in your account on payment days to avoid late fees.

How Do I Set Up Monthly Payments?

Afterpay does not offer a monthly payment plan. Payments are typically bi-weekly. To manage finances, create a personal budget to align with Afterpay’s schedule. Regularly review your spending and ensure funds are available for upcoming payments. This way, you stay organized and avoid unexpected fees.

Can I Change My Payment Date On Afterpay?

Currently, Afterpay does not allow changing payment dates. Payments are automatically scheduled every two weeks. Ensure you have sufficient funds in your account on these dates. If you anticipate any issues, contact Afterpay’s support for assistance. This helps maintain a positive account standing and avoid late fees.

What Happens If I Miss A Payment?

If you miss a payment, Afterpay may charge a late fee. Your account might also be temporarily suspended. To avoid this, ensure funds are available on payment dates. You can manage your account online to keep track of upcoming payments and update your payment method if necessary.

結論

Managing your Afterpay payments is simple and convenient. Stick to your budget. Plan your monthly payments with care. This helps avoid financial stress. Always check your payment dates. Set reminders to ensure timely payments. Timely payments maintain a good credit score.

Enjoy the flexibility Afterpay offers. Make smart buying decisions. Prioritize essential purchases over wants. This ensures financial stability. Be mindful of your spending habits. Use Afterpay responsibly to enjoy its benefits. Remember, financial discipline is key. Stay informed and make thoughtful choices.

This way, you can enjoy shopping without worry.