請求書と支払いを追跡する方法:究極のガイド

Are you struggling to keep track of your invoices and payments? You’re not alone.

Managing finances can be overwhelming, especially when there’s so much at stake. But imagine this: a world where your invoices are organized, payments are tracked seamlessly, and your stress is minimized. Sounds like a dream, right? This guide is your ticket to transforming that dream into reality.

By the end of this article, you’ll have the tools and strategies you need to streamline your financial processes and take control of your business’s cash flow. Don’t let confusion and missed payments hold you back any longer. Dive in and discover how you can master the art of keeping track of invoices and payments with ease and efficiency.

Importance Of Tracking Invoices

Tracking invoices is very important for any business. It helps in managing money. It shows what is paid and what is due. Organizing invoices prevents money problems. It avoids late fees. It also helps in planning future expenses. Knowing where money goes is key. It keeps business running smoothly. It helps in making smart choices. Tracking payments gives peace of mind. It builds trust with customers. It ensures a business is healthy. This process makes work easier. It saves time and effort. Every business should track invoices carefully. It is a simple step to avoid big problems.

Choosing The Right Tools

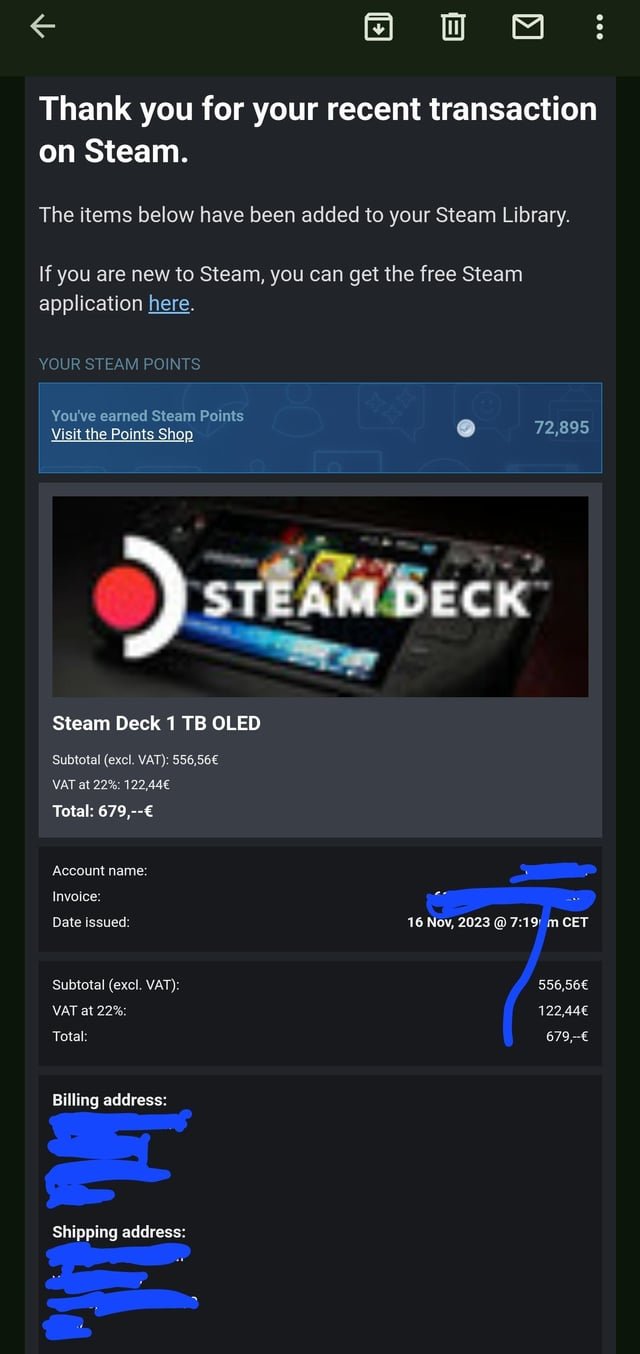

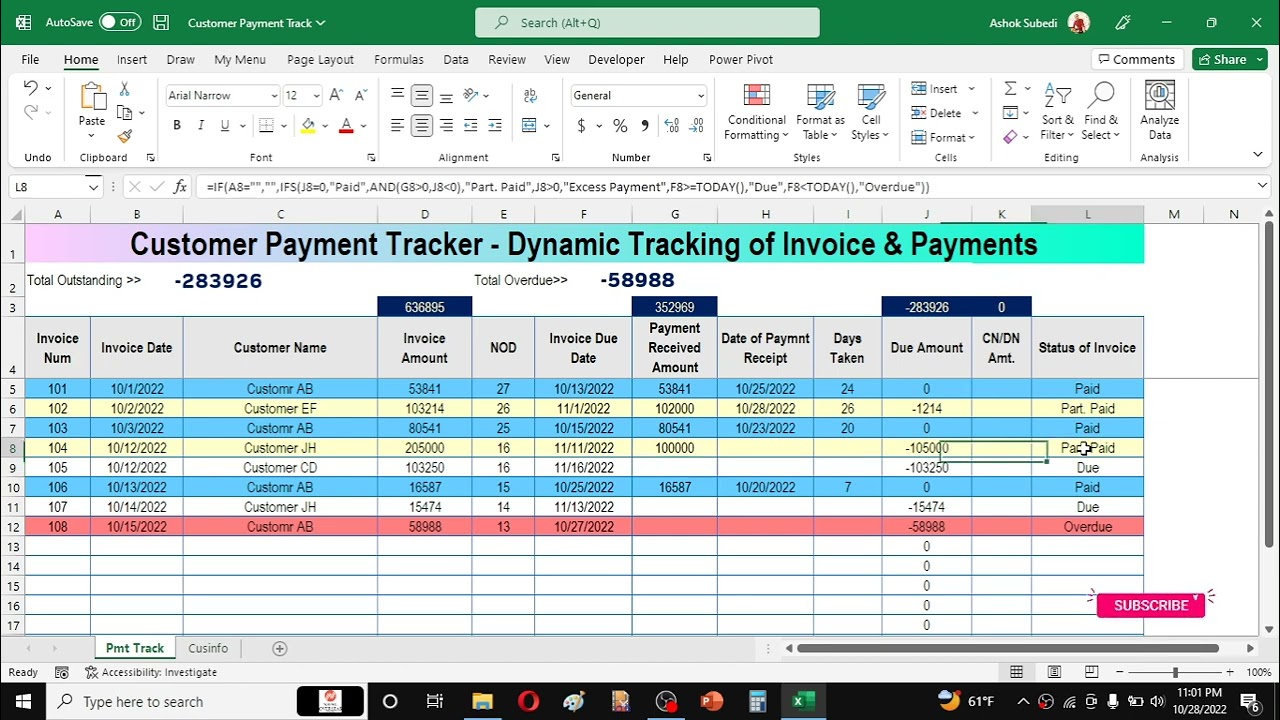

Many businesses use software to track invoices そして 支払い. These tools help in organizing and managing all financial records. Some popular software solutions are QuickBooks and FreshBooks. They offer easy-to-use interfaces for users. With these tools, you can create invoices and send them to clients. They also help in reminding clients about pending payments. This way, you never miss tracking any payment. Software solutions save time and reduce errors. They also provide detailed reports and insights. This helps in understanding the business finances better. Always choose a tool that fits your needs.

Some people still prefer manual tracking of invoices そして 支払い. This can be done using spreadsheets or notebooks. Spreadsheets like Excel are helpful. You can create tables and list all invoices. It is important to update them regularly. Write down every payment received. Keep a record of unpaid invoices too. Manual tracking requires more time and effort. It is also prone to errors. But it can be a good choice for small businesses. Always ensure accuracy when tracking manually.

Setting Up A System

Start with a simple folder for each client. Label each folder with the client’s name. Place each invoice in the right folder. This helps find invoices fast. Use colors to sort by date or type. Keep folders in a safe place.

Set up a digital filing system on your computer. Name each file with a date and client name. This makes searching easy. Use folders for different months. Backup your files often. Use cloud storage for extra safety.

Automating Invoice Processes

Automation saves time by speeding up tasks. It reduces mistakes. People make mistakes. But machines follow rules. You can trust them. Automation also helps in keeping records. Records stay safe and easy to find. Businesses save money. Less time means less cost. Workers can focus on other tasks. Their jobs become better. They can be more creative. Customers are happy too. They get invoices faster. They pay on time. Everyone wins with automation.

Many tools help with invoices. QuickBooks is well-known. It is easy to use. FreshBooks is another tool. It is great for small businesses. Zoho Invoice offers many features. It is good for different needs. Tools like these make work easy. Choose what fits best for you. Try them and see the difference.

Monitoring Payments

Keeping track of 支払い helps in managing money well. Use a simple spreadsheet to list all payments. Include the date, amount, and payer. This makes it easy to see who paid. Another way is using payment apps. They send alerts for every payment. This helps in real-time tracking. Also, keep all receipts in one place. This way, you can check them anytime.

Late payments can be a problem. First, send a reminder to those who owe you. Be polite but clear. If they still do not pay, call them. Talk about why the payment is late. Set a new deadline for payment. If needed, add a late fee to encourage faster payment. Always keep a record of these conversations. This helps in case of future issues.

財務データの分析

Reports show details about your money. Dashboards display clear visuals. They help you understand numbers fast. You see how much money comes in. You see what goes out. It’s easy to spot problems.

Trends show patterns in your data. Watch them closely. Trends help you make smart choices. You can improve business decisions. You notice if sales are going up or down. You can find ways to save money.

コンプライアンスの確保

Businesses must follow legal rules to keep their records right. This keeps them safe from penalties. Every invoice should have the 正しい情報. This includes names, dates, and amounts. The law also asks for clear payment details. This helps in audits and checks.

Keeping good records is important for businesses. It helps in tracking money. Use デジタルツール to store invoices. They make searching easy. Always check for mistakes. Even small errors can cause big problems. Organize files by date or client name. It saves time and effort. Review records often to catch issues early.

Improving Cash Flow Management

Keep a close eye on your キャッシュフロー. It helps your business. Use simple tools to track money coming in. Also, watch money going out. Organize invoices by date. It makes payment tracking easier. Send reminders to clients for due payments. This helps you get paid on time. Plan for 予期せぬ出費. Always have some money saved. This keeps your business safe.

Balance is key. Match your income with your expenses. This keeps your business strong. Use a budget plan. It helps you see all costs. Adjust spending if needed. Keep a record of all 取引. This shows you where your money goes. Review your finances every month. It helps you stay on track. Make sure you have enough money for future needs. This ensures smooth business operation.

Tips For Small Businesses

Simple tools can help track invoices. Use free apps or software. These tools are easy to set up. They help keep records organized. Many are available online. They save time and money.

Use spreadsheets for tracking. They are affordable. You can customize them. They help keep data neat. They are easy to update. You can share with others.

Choose systems that grow with your business. Start with basic features. As you grow, add more options. Look for systems with flexible plans. This helps avoid big costs later.

Consider cloud-based solutions. They are easy to access. You can update from anywhere. These systems are reliable. They keep data safe. They make sharing simple.

Use automated reminders. They help track due dates. They ensure timely payments. They reduce missed invoices. These reminders save effort.

よくある質問

What Is The Best Way To Track Invoices?

Using accounting software is the best way to track invoices. It automates the process, reduces errors, and provides real-time updates. Many platforms offer features like reminders, templates, and integrations with other financial tools. This ensures efficient management of invoices and payments.

How Can I Automate Payment Tracking?

Automate payment tracking by using financial software with automation features. These tools sync transactions, send reminders, and update payment statuses. Automation reduces manual tasks, minimizes errors, and ensures timely payment tracking. Many software options are available, catering to different business needs and sizes.

Why Is Tracking Invoices Important?

Tracking invoices is crucial for maintaining cash flow and financial health. It ensures timely payments, reduces the risk of missed payments, and aids in financial planning. Proper tracking also helps in maintaining accurate financial records and can improve customer relationships by ensuring transparency and accountability.

What Tools Help Manage Invoices Effectively?

Tools like QuickBooks, Xero, and FreshBooks help manage invoices effectively. They offer features like automated invoicing, payment reminders, and integration with banking systems. These tools streamline the invoicing process, improve accuracy, and save time, making them essential for efficient financial management.

結論

Managing invoices and payments can be simple. Use clear steps to stay organized. Choose a reliable system that fits your needs. Keep records updated regularly. This helps avoid missed payments and confusion. Digital tools make tracking easier and faster. Always back up your data for safety.

Regularly review financial reports to spot any issues. Good invoice management saves time and reduces stress. It helps your business run smoothly. Stay consistent and keep learning for improvement. With these practices, managing finances becomes a breeze.