サウスウェストクレジットカードの解約方法

もし検討中なら サウスウェストクレジットカードのキャンセルプロセスを段階的に進めることが重要です。まずは、アカウントの詳細を確認し、交換したい特典などを確認しましょう。 カスタマーサービスに連絡する 正式に解約手続きを開始するには、いくつかの重要な手順と考慮事項があり、それらは決定に影響を与える可能性があります。これらのニュアンスを理解することで、潜在的な落とし穴を避けることができますが、解約手続きのその後に何が起こるかは、予想外の事態になるかもしれません。

カードを解約する理由

多くの人がよく考えるのは サウスウエストのクレジットカードをキャンセルする 様々な理由があります。よくある理由の一つは 高額な年会費 支出習慣に合わないかもしれません。サウスウエスト航空を頻繁に利用しないのであれば、これらの手数料は割に合わないかもしれません。また、サウスウエスト航空への不満も理由の一つかもしれません。 顧客サービス あるいは、期待に応えられない報酬プログラム。さらに、 信用スコアを向上させる使用していないクレジットカード口座を閉鎖すると、場合によっては効果があるかもしれません。不正請求やデータ漏洩などのセキュリティ上の懸念から、解約を検討する場合もあります。最後に、 より有利なクレジットカードオプション より良い特典やより低い金利を提供しているカードがある場合は、経済的な安全のために切り替える時期かもしれません。

アカウントの詳細を確認する

続行する前に サウスウェストクレジットカードのキャンセル、アカウントの詳細を確認して、 未払い残高, 報酬ポイント、 または 潜在的な手数料明細書で未払い料金がないかご確認ください。未払い残高がある場合は、利息が発生しないように、解約前に全額お支払いいただくことをご検討ください。

次に、貯まったリワードポイントをメモしておきましょう。ポイント数を把握しておくことで、ポイント交換の判断材料となり、潜在的な特典を逃さずに済みます。最後に、 キャンセル料 適用される場合があります。これらの詳細を理解しておくことで、予期せぬ事態を避け、よりスムーズに解約手続きを進めることができます。

キャンセル前に特典を利用する

重要なのは リワードポイントを利用する 前に サウスウェストクレジットカードのキャンセルアカウントを閉鎖すると、これらの情報が失われる可能性があります。アカウントにログインしてご確認ください。 現在のポイント残高フライトの予約、座席のアップグレード、あるいはホテル宿泊にポイントを使うことを検討してみてください。近いうちに旅行の予定がない場合は、ポイントをギフトカードや商品に交換することも検討してみてください。 有効期限特典には有効期限があるため、キャンセル前にポイントを利用することで、特典を確実に受け取ることができます。 報酬を最大限に活用する結局のところ、ポイントを獲得したのですから、先に進む前にポイントを賢く使うようにしましょう。

カスタマーサービスにお問い合わせください

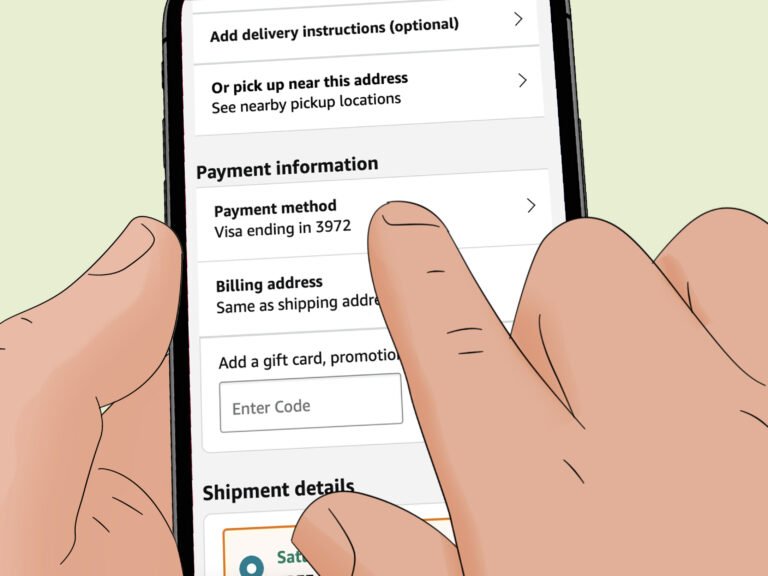

特典を受け取ったら、次のステップは カスタマーサービスにお問い合わせください を開始する キャンセル手続き サウスウエストクレジットカードの担当者に連絡を取るには、カード裏面の電話番号に電話するか、ウェブサイトのチャットサポートをご利用ください。担当者が確認する際には、アカウント情報が必要になりますので、事前に準備しておいてください。 本人確認キャンセルの意思を明確に伝え、クレジットスコアへの影響について確認することが重要です。通話中は、担当者の名前や確認番号など、必ずメモを取ってください。これらの記録は、リクエストの記録を確実に残すのに役立ちます。機密情報は安全なチャネルを使用して安全に保管してください。

キャンセル手続きの確認

サウスウエストクレジットカードのキャンセルを確実に行うには、カスタマーサービスへのお電話の際に確認番号をお伝えください。この番号はキャンセルの証明となり、後々問題が発生した場合に備えて書類として保管しておくことができます。

キャンセル手続きの追跡に役立つ簡単な表を以下に示します。

| ステップ | アクション |

|---|---|

| 1. カスタマーサービスに電話する | 指定された番号にダイヤルする |

| 2. キャンセルをリクエストする | キャンセルしたい旨を明記してください |

| 3. 確認を得る | 確認番号を尋ねる |

| 4. 記録の詳細 | 日付と担当者名を記入してください |

信用レポートを監視する

サウスウェストのクレジットカードを解約した後は、定期的に信用情報レポートをチェックし、解約内容が正確に反映されているかを確認し、信用情報全体の健全性を維持することが重要です。レポートを確認することで、不一致を早期に発見し、信用スコアを維持することができます。

警戒を怠らないためのヒントをいくつか紹介します。

- 正確な情報を確認する: キャンセルされたカードが閉鎖済みとしてマークされており、予期しない取引がないことを確認します。

- 個人情報の盗難に注意: 個人情報の盗難の兆候となる可能性のある不正なアカウントや問い合わせには注意してください。

積極的に行動することで信用の健全性を守ることができます。