フリーランサーとしてクレジットカード決済を受け入れる方法:簡略化

Are you a freelancer looking to expand your payment options and make transactions smoother for your clients? Accepting credit card payments can be a game-changer for your freelance business.

Not only does it offer convenience to your clients, but it also speeds up the payment process, ensuring you get paid faster. Imagine the ease of mind knowing your payments are streamlined and secure. You might think setting this up is complicated, but it’s simpler than you might imagine.

In this guide, we’ll break down the steps you need to take to start accepting credit card payments seamlessly. So, if you’re ready to elevate your freelancing game and offer your clients a stress-free payment experience, keep reading to unlock the secrets of hassle-free transactions.

Choosing A Payment Processor

Freelancers can streamline credit card payments by selecting a reliable payment processor. Consider fees, security, and ease of use. Ensure compatibility with your existing systems for seamless transactions.

Factors To Consider

Choosing a payment processor is vital for freelancers. First, consider the 手数料. Some processors charge high fees. Others offer low-cost options. Next, check the セキュリティ機能. Your money must be safe. Also, look at the 使いやすさ. A simple interface saves time. Lastly, see if it supports your currency. Not all processors do. Think carefully before deciding.

Popular Options For Freelancers

Freelancers have many options for credit card payments. ペイパル is popular. It’s easy to set up. Many people use it. ストライプ is another choice. It’s good for online work. Offers great security. 四角 works well for in-person payments. Simple and reliable. Each option has pros and cons. Choose the one that fits your needs best.

Setting Up An Account

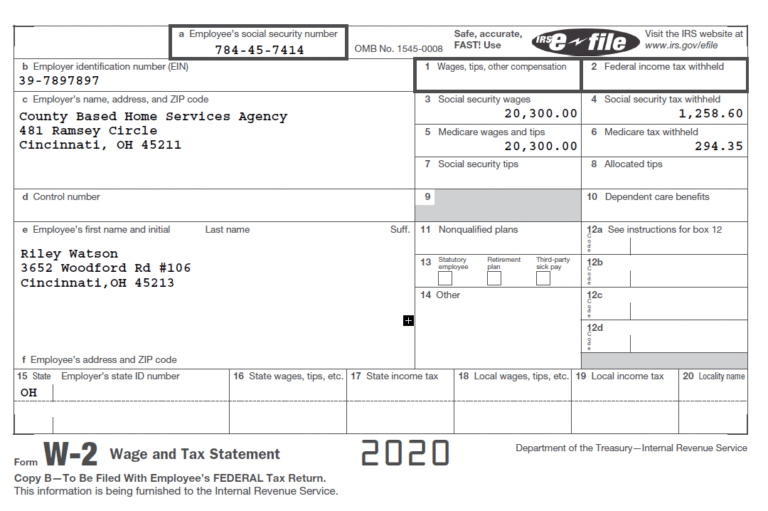

To accept credit card payments, you need an account. Gather important documents first. These include ID proof そして 銀行口座情報. Some may ask for a business license too. Keep copies ready.

After submitting documents, a verification process starts. They check your identity. This can take a few days. Be patient. Follow their instructions carefully. Sometimes, they may call or email you. Answer them quickly. This will help in speeding up the process.

Integrating Payment Methods

Freelancers can easily accept credit card payments by using online platforms like PayPal or Stripe. These platforms provide secure transactions and simplify the payment process. Offering multiple payment methods can enhance client satisfaction and help you grow your freelance business.

Using Invoicing Software

Freelancers need easy ways to get paid. Invoicing software helps with that. It allows you to send professional invoices quickly. You can add your payment details directly. Clients find it easy to pay. This software often comes with automatic reminders. These remind your clients to pay on time. Some tools even allow customizable templates. You can make invoices look just the way you want. Choose software that fits your needs and budget.

Adding Payment Links

Payment links make paying you simple. Share these links with clients. They click and pay online. You can add links to emails or websites. Many payment platforms offer these links. PayPal and Stripe are popular choices. Payment links are safe and fast. They help you avoid the hassle of checks. Try adding links for easy payments. It saves time for you and the client.

Ensuring Transaction Security

PCI compliance is very important for credit card payments. It helps keep payment data safe. Following PCI rules protects against fraud. Always check if your payment tools meet PCI standards. Secure systems build trust with clients. They feel safe sharing their card details.

Secure payment gateways protect client information. They encrypt data during transactions. Choose gateways that are popular and trusted. ペイパル そして ストライプ are good options. They offer strong security features. This keeps your client’s card data safe. Security matters when handling payments.

Managing Fees And Costs

Choosing the right payment service is important. 取引手数料 can vary. Some providers charge a flat rate. Others charge a percentage. Always check these costs before choosing. PayPal and Stripe are popular options. They have clear fee structures. PayPal charges 2.9% plus 30 cents per transaction. Stripe has a similar fee. Keep these numbers in mind. They impact your earnings.

Hidden charges can surprise you. Always read the terms carefully. Look for words like 月額料金 または setup charges. These costs can add up. Some services charge for currency conversion. Others may charge for refunds. Avoid services with too many hidden fees. They reduce your profit. Choose a provider with transparent pricing. This helps keep your costs low.

Automating Payment Processes

Recurring payments make life easy for freelancers. Regular payments from clients keep your cash flow smooth. Set up recurring billing through payment platforms. This saves time and effort. Clients agree to pay you regularly. You can focus more on your work. 安心 comes with knowing payments are on schedule.

Automation tools help manage payments. Tools reduce manual work. They send invoices and track payments. Choose tools that fit your needs. Some tools offer カスタマイズ可能な機能. You can adjust settings for different clients. Automation ensures you never miss a payment. It keeps your work organized.

Handling International Payments

Freelancers can accept credit card payments easily by using online platforms like PayPal or Stripe. These tools simplify transactions and ensure secure payments globally. Setting up an account is quick and helps in managing international clients efficiently.

Dealing With Currency Conversion

Freelancers often face currency conversion issues. Clients pay in different currencies. Freelancers need to convert these payments. Using online platforms can help. PayPal and Stripe offer currency conversion services. These platforms simplify the process. Freelancers receive payments in their local currency. This reduces complexity.

Understanding International Fees

International payments come with fees. Banks charge for foreign transactions. Online platforms also have fees. It’s important to understand these costs. Compare different services. Choose one with lower fees. Always check transaction charges. These fees can add up quickly.

一般的な問題のトラブルシューティング

Freelancers often face hurdles in accepting credit card payments. Solutions include using reliable payment processors or invoicing software. Ensure a seamless transaction experience to keep clients satisfied.

Resolving Payment Disputes

Payment disputes can be very tricky. First, stay calm and listen. Understand the client’s concern clearly. Then, check the payment records and compare them. This helps find any errors or misunderstandings. Communicate openly with the client. Clear communication can resolve many issues. Offer solutions like partial refunds or extra work. Be fair but firm to protect your work’s value.

Addressing Technical Glitches

Technical glitches can cause stress. Always check your internet connection first. A bad connection can stop payments. Ensure your payment software is updated. Updates fix many common bugs. If the problem continues, contact support. They can help fix the issue quickly. Also, keep a backup payment method ready. This ensures you get paid on time.

よくある質問

How Can Freelancers Accept Credit Card Payments?

Freelancers can use payment gateways like PayPal, Stripe, or Square. These platforms offer secure transactions and are user-friendly. Setting up an account is straightforward, enabling freelancers to invoice clients easily. Most of these services provide integration options for websites, enhancing payment convenience for both freelancers and clients.

What Are The Benefits Of Accepting Credit Cards?

Accepting credit cards can boost your client base and cash flow. It offers clients convenience and flexibility in payments. Credit cards also enable quick transactions, reducing delays. Moreover, they often offer protection against fraud, ensuring secure transactions. This enhances trust between freelancers and their clients.

Are There Fees For Credit Card Transactions?

Yes, most payment gateways charge transaction fees. These typically range from 2. 5% to 3. 5% per transaction. Some platforms may also include additional fixed fees. It’s essential to review and compare fee structures of different providers. Understanding these costs can help freelancers manage their finances better.

Do Freelancers Need A Merchant Account?

Not necessarily, as many payment gateways offer merchant services. Platforms like PayPal and Stripe eliminate the need for separate merchant accounts. They streamline the process, making it easier for freelancers to accept payments. However, having a merchant account can provide more control and lower fees for high-volume transactions.

結論

Accepting credit card payments boosts your freelance business. It offers convenience for clients and ensures faster payments. Choose a secure payment processor. Consider transaction fees and ease of use. Set up your system seamlessly. Test the process to ensure smooth transactions.

Keep communication clear with clients about payment options. Protect your financial data with secure methods. With these steps, accepting credit card payments becomes straightforward. Your clients enjoy easier transactions. You enjoy steady cash flow. It’s a win-win situation for everyone involved.

Start today and enhance your freelance operations.