建設ローンの頭金はいくら?:必須ガイド

Are you considering building your dream home from the ground up? If so, navigating the financial aspects of a construction loan is likely at the top of your mind.

One of the biggest questions you might have is: “How much down payment do I need for a construction loan? ” This is a crucial piece of the puzzle that can make your dream a reality—or put it on hold.

We’ll demystify the down payment process for construction loans, providing you with clear insights and actionable advice. Understanding these financial requirements could be the key to unlocking the door to your new home. Stay with us as we delve into the specifics and help you feel confident in your financial planning.

Construction Loan Basics

A construction loan helps you build a house. It’s different from a regular loan. Construction loans cover the costs of building. They pay for materials and workers. You get money in stages. This happens as the work is done. You must finish building by a certain time. The loan is short-term. Once the house is built, you switch to a regular loan.

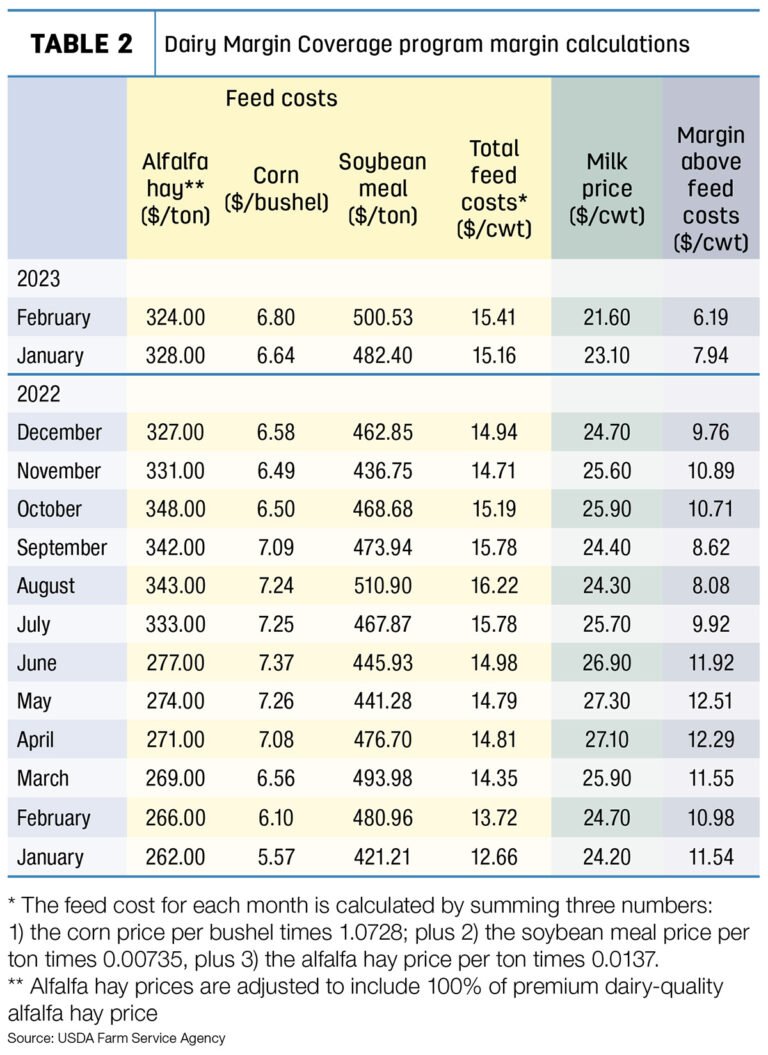

There are different types of construction loans. Construction-only loans cover building costs. You pay them back quickly. Construction-to-permanent loans start as building loans. Then they become regular home loans. These loans have longer terms. You pay them back over many years. Each type fits different needs. Talk to your 銀行 about which is best for you.

Importance Of Down Payment

Down payments are crucial for construction loans. They show lenders you are serious. Lenders look at down payments first. A big down payment means less risk for lenders. It can help in getting loan approval faster. People often need at least 20% down.

Role In Loan Approval

Loan approval depends on your down payment. A higher payment can make approval easy. Lenders feel safe with large down payments. They trust you more. This trust leads to faster approvals. Small payments might delay your loan approval.

Impact On Interest Rates

金利 change with your down payment size. Large payments mean lower rates. This saves money over time. Small payments might cause higher rates. Higher rates mean paying more later. Choose a good down payment for better rates.

Standard Down Payment Requirements

Many banks ask for a 頭金 of 20% of the loan. Some banks may ask for more. Others might ask for less. It depends on the lender. 20% is a common number to expect. It is a safe starting point. This means if the loan is $200,000, the down payment is $40,000. This money shows you can pay your part.

A few factors can change the down payment amount. Your 信用スコア matters a lot. A high credit score can help. A low score might mean more money down. The location of the property also plays a role. Some places are more expensive. The loan type can also make a difference. Fixed loans might need more money upfront. Adjustable loans might not. Talk to your lender for clear guidance.

Strategies To Lower Down Payment

Some programs help you with 頭金. These programs can 減らす what you pay. They give loans または grants. You might qualify for these if you meet certain needs. Check if your state offers these programs. Many families find these helpful. Always read program rules. Rules tell you what to do. They help you know if you can get help.

Talk to lenders to lower your down payment. Ask if they have special deals. Some lenders may オファー better terms. Show them your good credit. Good credit can help you. Lenders might trust you more. Always ask questions. Questions help you understand better. Write down what lenders say. This helps you remember.

Saving Tips For Down Payment

Save money by using smart budgeting techniques. Start by listing all your expenses. Write down everything you spend. This helps you know where your money goes. Cut down on things you don’t need. Save that money instead.

Make a goal for saving. It can be weekly or monthly. Stick to your goal no matter what. Keep your savings in a separate account. This keeps it safe and away from spending.

Invest your savings to grow them. Look for safe investment options. Bank savings accounts are a good start. They are easy and safe. You can also try fixed deposits. They give better interest rates than savings accounts.

Consider low-risk mutual funds. They can give you better returns. Always check with a financial advisor before investing. This helps you choose the best option. Investing wisely helps you save more.

避けるべきよくある間違い

Many people don’t plan for hidden costs. Materials can cost more than expected. Labor costs might rise. Weather delays can happen. These factors can surprise you. Always have a backup fund. Save extra money for emergencies. It will help in tough times. Planning is key.

Credit score affects loan approval. Banks check it first. Low scores can lead to higher interest rates. Paying bills on time helps improve scores. Old debts can lower your score. Always check your score before applying. Fix errors quickly. A good score saves money. It opens better loan options.

Faqs On Construction Loan Down Payments

Many people wonder about the 頭金 for a construction loan. It’s often a big question. A typical 頭金 might be around 20%. Sometimes, it could be higher. It depends on the lender そしてあなたの 信用スコア. Smaller down payments mean higher 毎月の支払い.

People also ask about loan terms. They worry about 金利. Shorter terms might have lower rates. But they increase monthly payments. Longer terms can be easier. Yet, you pay more in 興味.

Expert advice is always helpful. They suggest checking with multiple lenders. This helps find the best loan deals. Comparing loans can save money. It’s smart to ask questions before signing anything. Always read loan documents carefully. Understanding terms is important.

よくある質問

What Is The Typical Down Payment For A Construction Loan?

The typical down payment for a construction loan ranges from 20% to 30%. This varies based on lender policies, borrower creditworthiness, and loan terms. A higher down payment might result in better interest rates. Always compare different lenders to find favorable terms.

Can I Get A Construction Loan With 10% Down?

Getting a construction loan with 10% down is challenging but possible. Some lenders offer low down payment options for borrowers with excellent credit. Government-backed loans like FHA or VA might offer lower down payments. It’s essential to shop around and discuss options with lenders.

Are There Zero Down Construction Loan Options?

Zero down construction loans are rare and typically require excellent credit and specific conditions. Some government programs may offer zero down options for eligible borrowers. It’s crucial to research thoroughly and consult with financial advisors to explore all available options.

How Does Credit Score Affect Down Payment?

Credit score significantly affects the down payment required for a construction loan. Higher credit scores often result in lower down payments and better loan terms. Conversely, lower scores may necessitate a larger down payment to mitigate lender risk. Improving your credit score can lead to better loan conditions.

結論

Understanding down payments for construction loans is essential. It impacts your budget. Typically, lenders ask for 20% to 25% down. This amount shows your commitment. Saving for this can be challenging. But it’s necessary. Start early to prepare financially. Explore different lenders.

They offer various terms. Ask questions. Clarify doubts. Being informed helps you decide. Remember, each situation is unique. Seek advice from financial experts. They can guide you. With the right plan, you can manage your construction loan successfully. Stay focused on your goals.

Your dream home is within reach.