マンション購入の頭金はいくら必要か:総合ガイド

Are you dreaming of owning your very own condo but feeling daunted by the down payment? You’re not alone.

Many people find themselves asking, “How much down payment do I really need for a condo? ” The answer isn’t always straightforward, and it can vary depending on several factors. But don’t worry, we’ve got you covered. We’ll break down everything you need to know about condo down payments.

We’ll uncover the strategies that can make your dream of condo ownership a reality, sooner than you think. Imagine the relief of opening the door to your own place, knowing exactly how you got there. Stick around, and let’s turn your condo dreams into a plan with clear, actionable steps.

What Is A Down Payment?

あ 頭金 is the money you pay first. You pay it when you buy a condo. It shows you are serious about buying. It is a part of the total price. The rest you pay later. Many people pay 20% of the condo price upfront. Sometimes it can be less, like 10%. It depends on the rules where you live. Also, your bank can have its own rules. Paying more can help you in the long run. It can lower your monthly bills. It can also make getting a loan easier.

Typical Down Payment Amounts

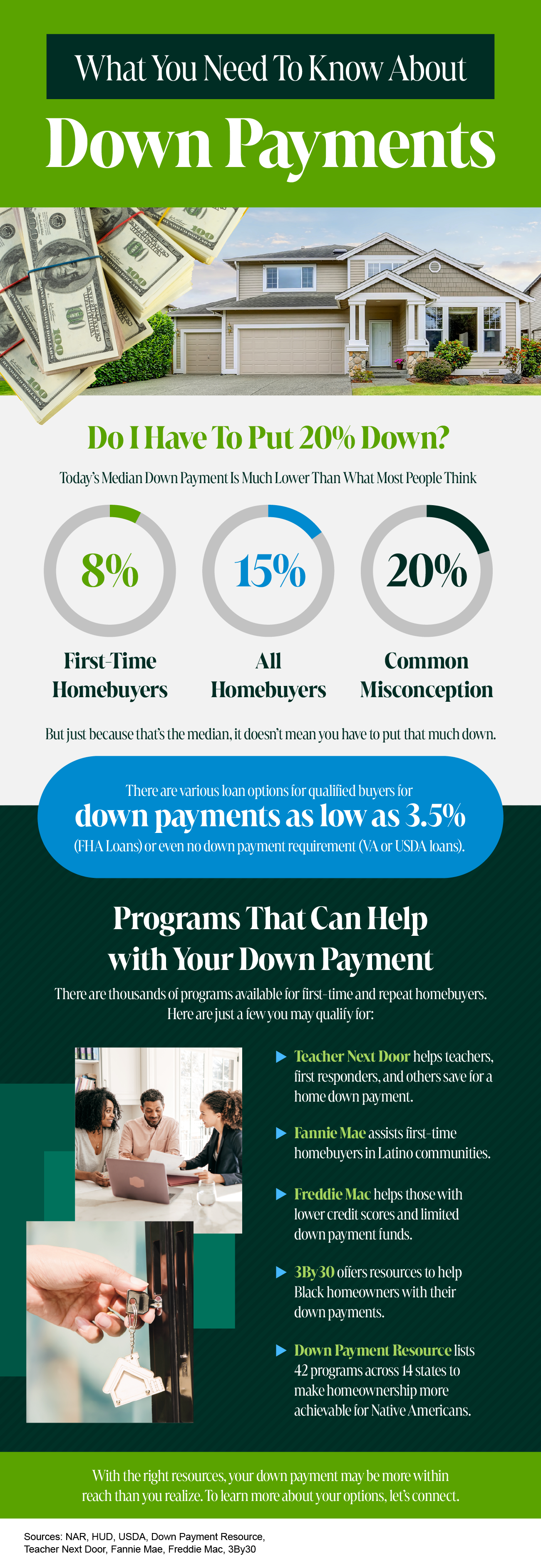

その standard down payment for a condo is usually 20%. Some lenders may allow 10%. A larger down payment can reduce monthly payments. It can also build equity faster.

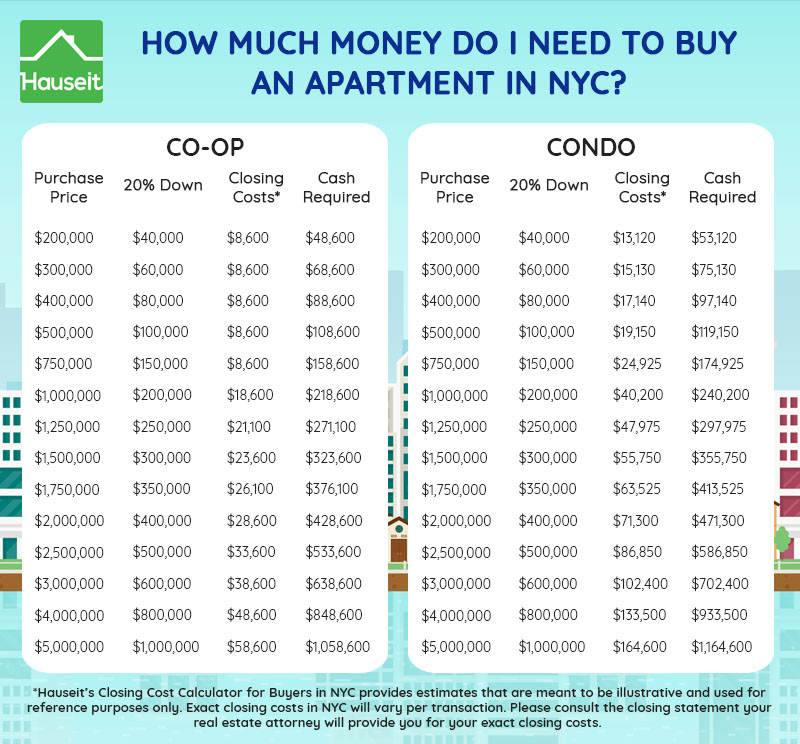

Down payments can vary by location. In big cities, prices are often higher. This means higher down payments. In small towns, it might be lower. Always check local market trends.

Market conditions affect down payments. In a booming market, prices go up. Down payments might rise too. In a slow market, they might be lower. Keep an eye on economic changes.

Factors Influencing Down Payment Size

あなたの 信用スコア affects how much you pay. A high score means you pay less. A low score means you pay more. Lenders trust people with good scores. They offer better deals to them.

Different loans need different down payments. Some loans need only 3% down. Others need 20% or more. FHA loans are good for low down payments. Conventional loans may need more money.

How much money you have matters too. A big savings can help you pay more. A small savings might limit your options. It’s good to have a budget plan. This helps in deciding what you can afford.

Benefits Of A Larger Down Payment

Lower monthly payments make life easier. A larger down payment reduces your loan amount. With a smaller loan, monthly payments are lower. This means more money for other needs. It’s a smart choice for long-term savings.

Avoiding Private Mortgage Insurance is possible with a big down payment. PMI adds extra costs each month. It protects the lender if you can’t pay. Paying more upfront can save you from this. Keep your money for your family, not insurance.

Improved loan terms often come with a larger down payment. Lenders may offer better interest rates. This saves money over time. A larger down payment shows you are serious. It makes lenders feel secure. You get better deals and save more money.

Challenges Of A Smaller Down Payment

Paying a small down payment can lead to 金利上昇. Banks charge more because the risk is higher. You pay more money over time. This can make your monthly payments bigger.

Another issue is increased loan costs. You may have to pay extra fees. These fees add up and cost a lot. It makes buying a condo more expensive.

その potential for negative equity is a big risk. Your condo’s value might drop. You could owe more than the condo is worth. Selling the condo would then become difficult. This can lead to financial stress.

Saving Strategies For Your Down Payment

Set a clear goal for your down payment amount. Create a 月間予算. Track your spending. Cut unnecessary expenses. Save the extra money. Automate savings. This helps you save without thinking. Use apps to remind you of savings goals.

Choose safe investments like bonds. They grow your money slowly but safely. Look into mutual funds. They spread risk over many stocks. Consider a high-yield savings account. It offers more interest than regular accounts. Diversify your investments to protect your money.

Research local programs. They offer help for first-time buyers. Some programs give grants または low-interest loans. Check eligibility before applying. Some require specific income levels. Others focus on certain locations. Contact local housing agencies for more information.

Alternatives To Traditional Down Payments

Government programs can help with down payments. They offer 財政支援 to buyers. Some programs give grants. Others provide loans. These programs make buying easier. They aim to help low-income families. Research your local options. You might qualify for help. Start early to secure funds.

Gift funds come from family or friends. They help with buying a condo. The money is a gift, not a loan. Check your lender’s rules. Some lenders have 厳格なポリシー. You may need a gift letter. The letter proves the money is a gift. Gift funds can lower your costs.

Co-borrowing means two people buy together. They share the down payment. This option reduces individual costs. Both names are on the loan. Each person has equal responsibility. Co-borrowing is ideal for friends. It is also good for family members. Discuss 財務計画 before starting.

よくある質問

What Is The Typical Down Payment For A Condo?

The typical down payment for a condo is usually 20% of the purchase price. This percentage can vary based on factors like the lender’s requirements and the buyer’s financial situation. Some programs may offer lower down payment options, but this often involves additional costs like private mortgage insurance.

Are There Low Down Payment Options For Condos?

Yes, there are low down payment options available for condos. Some government-backed loans allow down payments as low as 3%. However, these options may come with stricter qualification requirements and additional fees. It’s important to compare different loan programs to find the best fit for your financial situation.

How Does Credit Score Affect Condo Down Payment?

A higher credit score can result in a lower down payment requirement. Lenders view higher scores as less risky, potentially offering better loan terms. Conversely, a lower credit score might mean a higher down payment or more restrictive loan conditions.

Always check your credit score before applying for a mortgage.

Can First-time Buyers Get Lower Condo Down Payments?

First-time buyers often qualify for programs offering lower down payments. Government-backed loans and special first-time buyer programs can reduce the required down payment. These options help make homeownership more accessible. However, lower down payments might come with additional costs, so it’s essential to understand the terms thoroughly.

結論

Buying a condo is an exciting step. The down payment plays a crucial role. It affects your mortgage and monthly payments. A 20% down payment is often ideal. It reduces your loan amount and interest. Some loans require less. Always check your finances first.

Compare different loan options. Understand all costs involved. Consult with a financial advisor if unsure. Make informed decisions for your future. Planning well ensures a smoother buying process. Enjoy your new home with peace of mind.