バーチャルVISAカードの仕組み:完全ガイド

Are you looking for a convenient and secure way to shop online? A virtual Visa card might be just what you need.

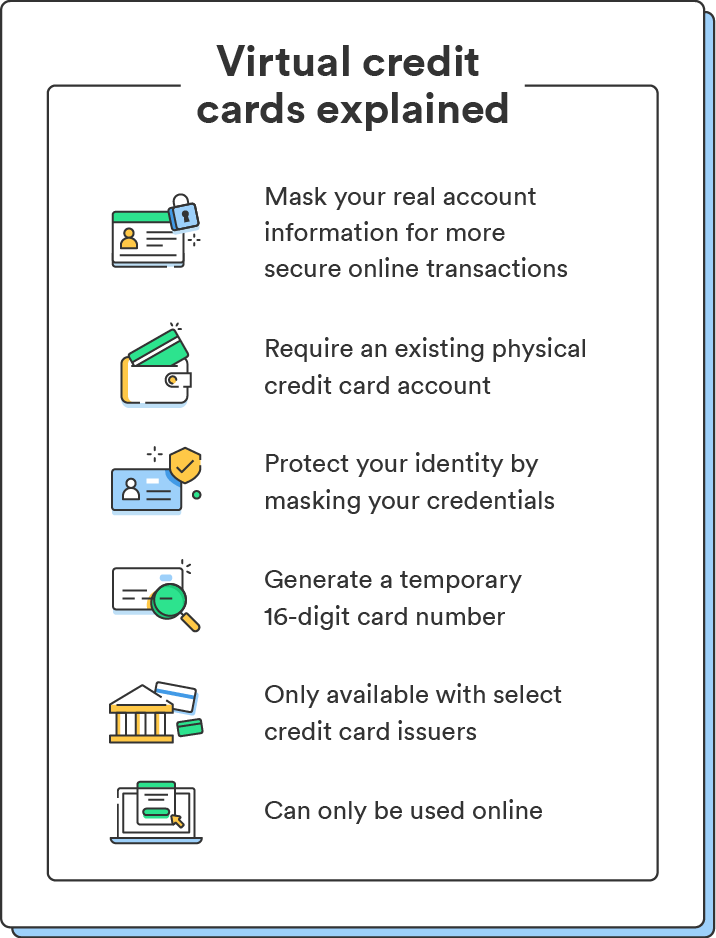

Unlike traditional cards, these digital cards offer added layers of security and flexibility. You can use them for everything from online purchases to subscriptions, all while keeping your personal information safe. But how does a virtual Visa card actually work?

We’ll break it down step-by-step, so you can make informed decisions about your online spending. By the end, you’ll have a clear understanding of how to utilize this innovative payment method to enhance your shopping experience. Let’s dive in!

What Is A Virtual Visa Card

A Virtual Visa Card is a digital payment card. It works like a regular Visa card but exists only online. You cannot hold it in your hand. This card allows you to make purchases on the internet safely.

When you get a Virtual Visa Card, you receive a card number. This number is unique. It is linked to your bank account or a prepaid account. You can use it for online shopping.

How Does It Work?

Using a Virtual Visa Card is simple. First, you need to sign up with a provider. Many banks and financial apps offer this service. Once you sign up, you will receive your card number.

Next, enter the card number when buying online. You will also need the expiration date and security code. This information helps verify your identity. It keeps your transactions safe.

A Virtual Visa Card has many benefits. It provides extra security. Your real card details stay private. If someone steals your card number, they cannot access your bank account.

You can also control your spending. Many cards have limits. This feature helps prevent overspending. It is especially helpful for budgeting.

どこで使えますか?

You can use a Virtual Visa Card at any online store that accepts Visa. This includes major retailers and subscription services. You can shop without worries.

Some services allow you to use the card for in-app purchases. This makes it easy to pay for apps and games. Just enter your card details at checkout.

Credit: www.chime.com

How To Get A Virtual Visa Card

Getting a virtual Visa card is simple and quick. You can use it for online shopping and subscriptions. It offers security and convenience. Follow these steps to obtain your card.

Choosing A Provider

Select a provider that offers virtual Visa cards. Look for trusted financial institutions or online services. Check their fees and card limits. Ensure they have a good reputation. Reading reviews can help with this choice.

Application Process

Visit the provider’s website to start your application. Fill out the necessary information. This usually includes your name, email, and phone number. Some providers may ask for more details like your address.

After submitting, you may receive an email confirmation. This confirms your application has been received. Keep an eye on your inbox for updates.

Verification And Activation

Most providers require you to verify your identity. This may involve uploading a photo ID. Follow the instructions provided carefully. Once verified, you will receive your virtual card details.

Activate your card according to the provider’s instructions. This usually involves logging into your account. Your card will be ready for use after activation.

Features Of A Virtual Visa Card

A Virtual Visa Card offers many features that make online shopping easy and safe. It is a digital version of a traditional credit or debit card. You can use it for online purchases without needing a physical card. Let’s explore its key features.

Single-use Vs Multi-use

Virtual Visa Cards come in two main types: single-use and multi-use. Single-use cards are valid for one transaction only. They help prevent fraud by ensuring the card cannot be reused. This is great for one-time purchases.

Multi-use cards can be used for multiple transactions. They allow you to shop at various online stores. You can set a limit on how much you spend. This helps you control your budget.

Customizable Spending Limits

Another great feature is customizable spending limits. You can choose how much money is available on the card. This helps you manage your expenses. Set a limit that fits your budget. If you reach that limit, the card will not work until you add more funds.

This feature is helpful for parents who want to control their children’s spending. It gives peace of mind while still allowing for online shopping.

強化されたセキュリティ機能

Security is a top concern for online shoppers. Virtual Visa Cards offer enhanced security features. They often come with fraud protection. This means you are covered if unauthorized purchases happen.

Many virtual cards have features like temporary numbers. These numbers change with each use. This makes it harder for hackers to steal your information. You can shop with confidence, knowing your data is safer.

Benefits Of Using A Virtual Visa Card

A Virtual Visa Card offers many advantages. It is designed for online use. Users enjoy added security and convenience. Here are some of the key benefits.

Improved Online Security

Security is a top concern for online shoppers. A Virtual Visa Card protects your financial information. It generates a unique number for each transaction. This means your actual card number stays safe.

Fraudsters find it hard to misuse a virtual card. If someone steals your number, it won’t work for other purchases. You can easily cancel it without affecting your main account.

Ease Of Use For Online Shopping

Using a Virtual Visa Card is simple. You can shop from any website that accepts Visa. Just enter your virtual card number at checkout. No need to wait for a physical card.

This convenience speeds up the buying process. You can make purchases anytime and anywhere. It makes shopping easier and faster.

No Physical Card Required

With a Virtual Visa Card, you don’t need a physical card. This means no lost or stolen cards. You can access your card details online, anytime.

This feature is great for those who travel. You can create a virtual card from your phone. It helps you stay safe while enjoying your trip.

How To Use A Virtual Visa Card

A Virtual Visa Card is simple to use. It works like a regular card but is digital. You can use it for many online activities. This section covers how to use it for different purposes.

Making Online Purchases

Using a Virtual Visa Card for online shopping is easy. First, find a store that accepts Visa. Add items to your cart and proceed to checkout.

Enter your Virtual Visa Card number in the payment section. This number is unique to you. Fill in the expiration date and security code. Then, click to complete your purchase.

Your transaction will process as usual. You get a confirmation email once it is done. This method keeps your real card information safe.

サブスクリプションサービス

Many people use Virtual Visa Cards for subscriptions. Services like streaming and magazines accept them. Choose the subscription you want.

During sign-up, enter your Virtual Visa Card details. This includes the card number, expiration date, and security code. You will be billed monthly or annually based on your choice.

It is a great way to manage payments. If you need to cancel, just stop the subscription. No worries about unwanted charges.

Travel And International Payments

Travelers find Virtual Visa Cards helpful. Use them for booking flights and hotels. Most travel sites accept Visa cards.

For international payments, this card works well. It allows you to pay in different currencies. You avoid high foreign transaction fees.

Simply enter your card details at checkout. Your payment is secure and fast. Enjoy your trip without payment stress.

Credit: www.airwallex.com

セキュリティと詐欺防止

A virtual Visa card offers security and fraud protection for online purchases. It works like a regular card but exists only digitally. Users receive a unique card number, which reduces the risk of fraud during transactions. This makes online shopping safer and more convenient.

Security and fraud protection are critical when it comes to using a virtual Visa card. These cards offer a convenient way to shop online, but with convenience comes the need for robust security measures. Understanding how these protective features work can give you peace of mind while making purchases.Encryption And Data Safety

Virtual Visa cards utilize advanced encryption technology to secure your transactions. This means your sensitive information, like card numbers and personal details, is scrambled and unreadable to anyone trying to intercept it. Many providers employ secure servers and follow strict security protocols. This layered approach helps safeguard your data during every transaction. You can shop online without the fear of compromising your financial information.One of the standout features of virtual Visa cards is their ability to prevent unauthorized transactions. These cards can be generated for one-time use or set to expire after a short period. You can also set spending limits, which adds an extra layer of security. If someone gains access to your card details, they won’t be able to make large purchases or use the card for long. Have you ever worried about unauthorized charges on your account? With a virtual Visa card, you can shop with confidence knowing you have control.

Deactivating A Compromised Card

If you suspect that your virtual Visa card has been compromised, you can deactivate it instantly. Most providers offer a simple process through their app or website to block the card. This quick action can prevent further unauthorized charges. You can generate a new card in just a few clicks. Taking immediate action is crucial in protecting your finances. Have you ever had to deal with a compromised card? The ability to deactivate your card quickly can save you from headaches later.Limitations Of Virtual Visa Cards

Virtual Visa cards are useful but come with limitations. Understanding these can help users make informed choices. Here are some key limitations to consider.

Restricted Offline Usage

Virtual Visa cards primarily work online. Many stores do not accept them in person. This can be a hassle for users who prefer shopping offline. Some services, like gas stations or restaurants, may not accept these cards. Always check before you go. This restriction can limit where you can spend your money.

Expiration And Renewal

Virtual Visa cards have expiration dates. Users must keep track of these dates. If a card expires, you may lose access to funds. Renewing a virtual card can be a hassle. Some providers automatically issue new cards. Others require you to request one. Make sure to check your card’s status regularly.

Compatibility With Certain Vendors

Not all vendors accept virtual Visa cards. Some websites and services may have restrictions. This can lead to unexpected payment issues. Always confirm if a vendor accepts virtual cards before shopping. Research can save time and frustration later.

クレジット: www.youtube.com

Tips For Maximizing Your Virtual Visa Card

A Virtual Visa Card works like a regular card but exists online. It generates a unique number for secure purchases. To get the most out of it, keep track of your spending and use it for online shopping. This helps protect your personal information and manage your budget better.

Maximizing your Virtual Visa Card involves understanding its features and using them to your advantage. This digital payment option offers convenience and security, but you need to know how to make the most of it. Here are some essential tips that can enhance your experience and ensure your transactions are smooth and effective.取引の監視

Keeping track of your transactions is vital. You should regularly check your account activity to identify any unauthorized charges quickly. Many providers offer mobile apps that allow you to monitor your spending in real time. Set up alerts for transactions. This feature can notify you instantly whenever your card is used. It adds an extra layer of security and helps you stay aware of your financial situation. Consider creating a budget. By categorizing your expenses, you can see where your money goes and adjust your spending habits. This proactive approach can lead to smarter financial decisions.Using In Combination With Physical Cards

Using your Virtual Visa Card alongside physical cards can provide flexibility. You can reserve your physical card for larger purchases while utilizing your virtual card for online transactions. This strategy can help you manage your finances better. You might also consider using your virtual card for subscriptions. Many services allow you to enter a virtual card number, making it easy to keep track of recurring payments. This way, you can easily cancel or change subscriptions without hassle. Blending both types of cards can enhance your overall spending strategy. It allows you to enjoy the convenience of online shopping while still having a tangible card for in-person purchases.Choosing The Right Provider

Selecting the right provider for your Virtual Visa Card is crucial. Look for one that offers competitive fees and excellent customer service. Research user reviews to gauge the reliability of the provider. Check if the provider has a user-friendly app. A good app can make monitoring your transactions and managing your funds much easier. You want a seamless experience, so don’t overlook this aspect. Consider the security features offered. Strong encryption and fraud protection are essential. You deserve peace of mind when using your virtual card for transactions. Taking these tips into account can significantly enhance your experience with a Virtual Visa Card. Start implementing them today and enjoy a more secure and organized way to manage your finances.よくある質問

How Can I Get A Virtual Visa Card?

You can obtain a Virtual Visa Card through various online financial service providers. Many banks and fintech companies offer this service. Simply sign up for an account, verify your identity, and request a virtual card. You’ll receive your card details instantly, ready for online transactions.

Is A Virtual Visa Card Safe To Use?

Yes, a Virtual Visa Card is generally safe to use for online transactions. It provides an added layer of security by using unique card details for each purchase. Since it’s not a physical card, the risk of theft is reduced.

Always ensure you use trusted websites to maximize security.

Can I Use A Virtual Visa Card Internationally?

Yes, you can use a Virtual Visa Card for international purchases. However, it depends on the card issuer’s policies and the merchant’s acceptance. Most Virtual Visa Cards work globally where Visa is accepted. Be aware of potential foreign transaction fees that may apply.

How Do I Add Funds To My Virtual Visa Card?

To add funds to your Virtual Visa Card, you typically link it to your bank account. Some providers allow direct deposits, while others may permit transfers from other cards. Check your issuer’s guidelines for specific methods to fund your card.

Always ensure the source is secure.

結論

A virtual Visa card is a simple tool for online shopping. It offers safety and convenience. Users can shop without sharing their real card details. This helps protect against fraud. Setting up a virtual card is easy and quick. Many banks and services provide this option.

It’s a smart choice for anyone who shops online. Understanding how it works makes it easier to use. Consider getting a virtual Visa card for your online purchases. It can make your shopping experience safer and smoother.