サンタンデールには自動車ローンの支払い猶予期間がありますか?

You’re juggling bills, and suddenly, your car payment is due. You’re not alone; many people find themselves in the same situation.

If your car loan is with Santander, you might be wondering, “Does Santander have a grace period for car payments? ” Understanding this can make a big difference in how you manage your finances and avoid late fees. In this post, we’ll break down everything you need to know about Santander’s policies and how they can impact you.

By the end, you’ll have the clarity and confidence to handle your car payments with ease. So, let’s dive into the details that could potentially save you stress and money.

Santander’s Car Payment Policies

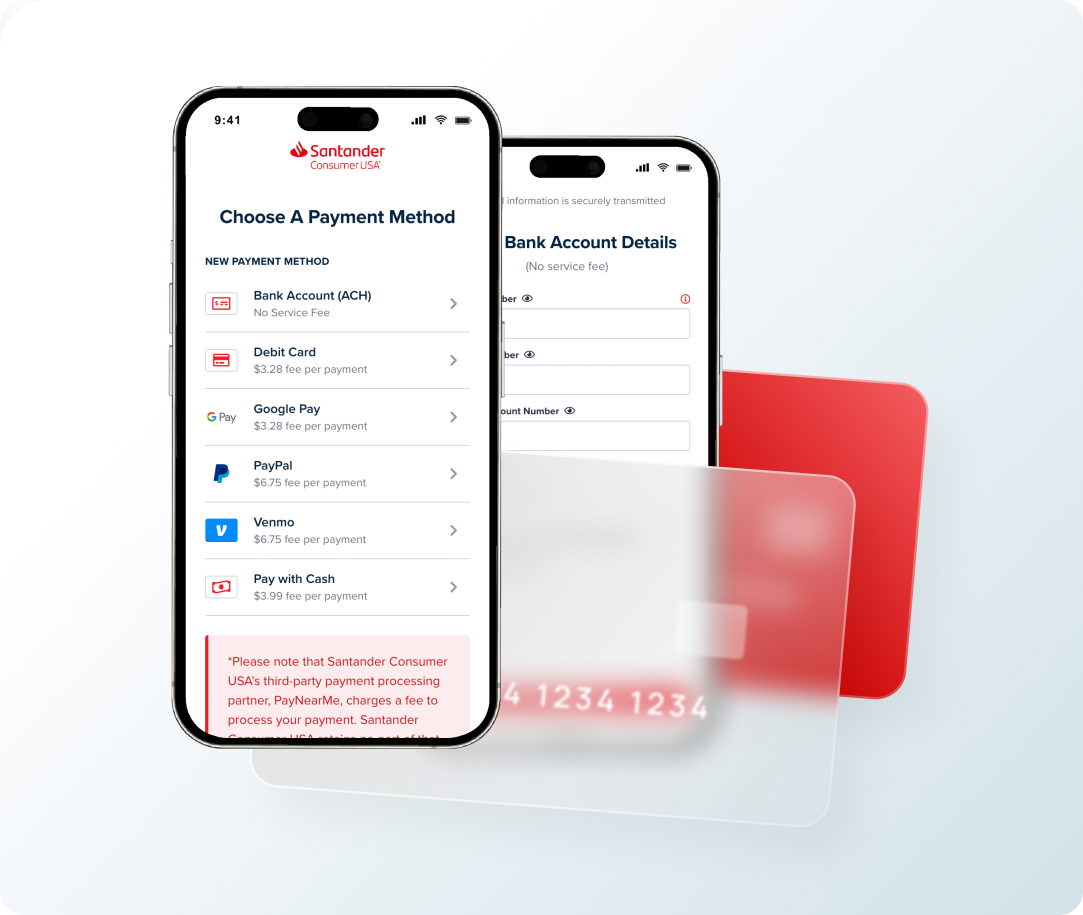

Santander offers flexible payment options. They understand money problems happen. Grace periods allow extra time to pay. Santander’s grace period varies. It depends on your loan agreement. Not all loans have this option. It’s important to check your contract. Contact Santander for more details. Late fees might apply. These fees can add up quickly. Always try to pay on time. Your credit score can be affected. Payment history matters. Responsible payments build good credit. Good credit helps with future loans.

Understanding Grace Periods

Grace periods are extra days to pay your bill. These days help avoid late fees. Santander offers grace periods for car payments. Extra time makes managing money easier. It’s important to know how many days you have. Santander might offer a few days or more. Knowing your grace period helps avoid stress.

Paying on time is important. Late payments can lead to extra charges. Planning your payment helps avoid trouble. Checking your account is wise. It shows if you have a grace period. Understanding your agreement helps stay informed. This knowledge keeps you ready. Always ask Santander if unsure about your grace period.

| Benefits of Grace Period | 考慮事項 |

|---|---|

| No late fees during grace period | Grace period length varies |

| Extra time to pay | Check agreement for details |

Terms And Conditions

To qualify for a grace period, you must meet certain criteria. Santander checks your payment history. They also review your account status. Your account should be in good standing. No past due amounts or penalties. Regular on-time payments boost eligibility. Consistency is key.

Santander offers a short grace period. This usually lasts for 10 days. The grace period allows you extra time. Pay within this period to avoid late fees. After 10 days, fees may apply. It’s important to stay informed. Check your loan agreement for details. Knowing the terms helps you manage your payments better.

How Grace Periods Affect Payments

A grace period can help with paying interest. During this time, you don’t pay extra money. The interest does not grow. This can make payments easier. 金利 stay the same. You have more time to gather funds. It helps with managing your budget better.

Grace periods also stop late fees. No penalties are added during this time. This can save money. You avoid paying extra charges. Late fees can be big. So, a grace period is helpful. It keeps your payment history clean. You won’t have bad marks on your credit.

顧客体験

Many customers face issues with car payment schedules. Some miss payment dates due to unexpected events. Others struggle with understanding the payment terms clearly. Late fees can become a big problem if payments are delayed. Customers sometimes feel stressed when they don’t have a clear communication from the bank. It’s crucial for customers to stay informed about their payment plans. Proper planning can help avoid these challenges.

Some customers manage their payments well with Santander. They find it easy to follow the 支払いスケジュール. Clear communication from the bank helps them stay on track. These customers feel secure knowing their car payments are in order. They appreciate Santander’s support in managing their finances. Success often comes with good planning and understanding bank terms. Happy customers often share their positive experiences with others.

Alternatives To Grace Periods

Santander does not offer a traditional grace period for car payments. Options like payment extensions or deferrals may be available. Contacting their customer service can provide more details on what is offered.

Payment Deferrals

Payment deferrals allow you to delay your car payments. This option gives you time to manage your finances. You might pay later but still keep your car. Deferrals can be a short-term solution. It helps avoid late fees and penalties. Check if your lender offers this option. Some lenders may charge a fee for deferrals. コミュニケーション with your lender is key. Always ask for clear terms and conditions. Understand any changes to your loan schedule.

Loan Modifications

Loan modifications change the terms of your loan. They can lower monthly payments. 金利 might change, too. This helps if you struggle with payments. Discuss options with your lender. They might offer different solutions. Modification can be long-term help. Always review the new loan terms. Make sure the new plan works for you. Get all changes in writing. This ensures clarity and prevents misunderstandings.

Steps To Take If Struggling With Payments

First, reach out to Santander. Explain your situation clearly. They might offer solutions. Ask about grace periods or any 柔軟なオプション. It helps to 落ち着いて. Keep all 文書 ready. This way, you can provide 情報 quickly.

確認 financial help. Some programs can assist with payments. Look into government aid または local charities. These might 容易に your burden. Knowing what’s 利用可能 is crucial. Explore options that fit your needs. Many people find relief through these programs.

よくある質問

What Is Santander’s Car Payment Grace Period?

Santander typically offers a 10-day grace period for car payments. This means you have an extra 10 days after your due date to make a payment without incurring a late fee. It’s essential to check your loan agreement as terms may vary.

Can I Extend My Santander Car Payment Grace Period?

Generally, extending the grace period is not an option. However, if you’re facing financial difficulties, contacting Santander’s customer service might provide alternative solutions. They may offer temporary assistance or suggest refinancing options, depending on your situation.

What Happens If I Miss A Santander Car Payment?

Missing a payment beyond the grace period can result in late fees and negative credit reporting. Persistent missed payments might lead to repossession. It’s crucial to communicate with Santander if you’re unable to make a payment to explore possible solutions.

How Do Late Fees Work For Santander Car Payments?

If you pay after the grace period, Santander may charge a late fee. The fee amount is specified in your loan agreement. Late payments can also affect your credit score, so it’s important to stay informed about payment deadlines.

結論

Understanding Santander’s car payment grace period is crucial for planning. It helps manage finances better. This knowledge prevents late fees. Always check with Santander for current policies. Policies can change over time. Stay informed to avoid surprises. Knowing your payment options empowers you.

It gives peace of mind. Make timely payments a priority. It maintains good credit. A good credit score benefits your future. Remember, staying proactive is key. Always communicate with your lender. They can offer solutions if you face difficulties. Being informed ensures financial stability.

Plan ahead and stay on top of payments.