ChimeからVenmoに送金できますか?

Chimeのデジタルバンキングプラットフォームは他の金融アプリと互換性がないと思わないでください。 送金する ChimeからVenmoへ。ChimeとVenmoは用途が異なりますが、簡単に 2つのアカウントをリンクする接続が完了したら、自由に送金を開始できます。ただし、送金のタイミング、手数料、制限などの詳細は、 転送オプション 選択する。今、最も気になるのは「どうやって?」でしょう。こうしたニュアンスを理解することは成功に不可欠です。正確な手順と期待される効果を知ることで、時間を節約し、確実な結果を得ることができます。 完璧な取引.

ChimeからVenmoへの送金オプション

ChimeからVenmoに送金する場合、ニーズや連携している口座の種類に応じて、いくつかのオプションから選択できます。 インスタント転送機能、これにより資金をすぐに移動できますが、これには 少額の手数料または、 標準転送通常は無料ですが、処理に少し時間がかかります。送金を開始する前に、 Chimeアカウントを確認してください スムーズな取引のために、Venmoアカウントにリンクされています。また、 送金制限 予期せぬ請求を避けるため、適用される手数料についてもご確認ください。適切な送金方法をお選びいただくことで、安全で便利な取引を保証いたします。

ChimeとVenmoの設定

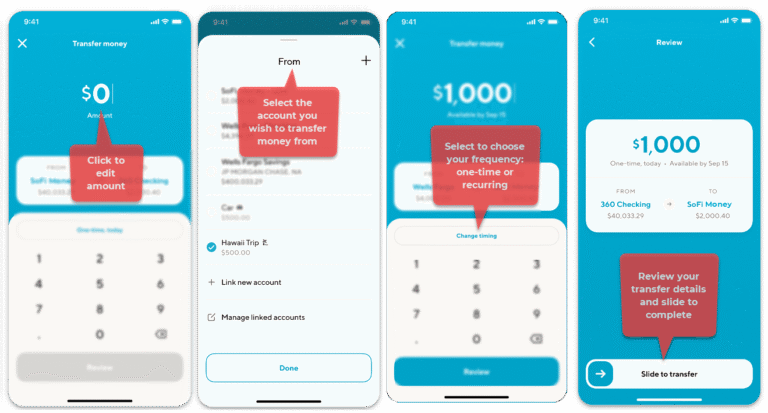

間の送金を開始するには チャイム そして ベンモ両方のアカウントを設定してリンクする必要があります。これには、それぞれのダウンロードとインストールが含まれます。 モバイルアプリ まだお持ちでない場合は、まずApp Store(iOSデバイスの場合)またはGoogle Play Store(Androidデバイスの場合)からChimeとVenmoをダウンロードしてください。インストール後、アプリ内の指示に従ってアカウントを作成するか、既にアカウントをお持ちの場合はログインしてください。 二要素認証 セキュリティを強化するために、各アプリの設定またはプロフィールセクションに移動して、 外部アカウントをリンクするリンクプロセスを完了するには、アカウントの詳細を入力する必要があります。スムーズなセットアップを実現するために、各アプリの最新バージョンをご使用ください。

オンラインで利用可能な送金方法

何 転送オプション ChimeからVenmoへオンラインで送金する場合、どのような方法がありますか?また、どの方法があなたのニーズに最も適していますか?考慮すべきオプションがいくつかあります。例えば、 Chimeアプリ Venmoアカウントへの送金を開始するには、Venmoアカウントにログインして「資金を追加'機能を使ってChimeアカウントから直接資金を引き出すことができます。もう一つの選択肢は オンライン送金プラットフォーム PlaidやFinicityのような、複数の口座間でシームレスな送金を可能にするサービスもあります。送金を行う前に、それぞれの方法の利用規約や手数料を必ず確認してください。自分に合った方法を選ぶことで、確実な送金が可能になります。 安全でスムーズな取引.

直接入金による送金

ChimeからVenmoに資金を送金する便利な方法の一つは、直接入金を設定することです。これにより、ChimeアカウントをVenmoにリンクして直接送金できます。これを行うには、Chimeアカウントとルーティング番号を取得する必要があります。これらはChimeアプリで確認できます。次に、Venmoにアクセスし、支払い方法としてChimeアカウントを追加し、「直接入金」を選択します。アカウントをリンクしたら、ChimeからVenmoへの送金を開始できます。資金は数営業日以内にVenmoアカウントに入金されます。この方法は安全です。 安全な, 使いやすい2 つのサービス間で資金を移動するための優れたオプションになります。

デビットカードによる送金

リンク チャイムデビットカード Venmoを使用すると 資金を送金する 2つのサービス間での送金が簡単かつ迅速に行える便利なオプションが加わりました。これを行うには、Chimeデビットカードを Venmoアカウントこれを行うには、Venmoアプリにアクセスし、「支払い方法「お支払い方法を追加」セクションに移動して、「お支払い方法を追加」を選択します。そこからChimeデビットカードの情報を入力し、Venmoアカウントにリンクできます。リンクが完了すると、Chimeデビットカードを使ってVenmoに送金できるようになります。このプロセスは通常、 瞬時の、Venmoアカウントに送金された資金はすぐに確認できます。Chimeデビットカードが有効になっており、十分な残高があることを確認してください。

送金にかかる手数料

通常、 送金 ChimeからVenmoまで、 手数料が発生する Chimeのデビットカードまたは銀行口座をご利用の場合、これらの送金は追加料金で資金が減る心配なく行えます。ただし、Chimeのデビットカードまたは銀行口座をご利用の場合、少額の手数料がかかる場合がありますのでご注意ください。 ネットワーク外ATM Venmoアカウントに間接的に現金を追加する。さらに、 移転を早める少額の手数料がかかる場合があります。ChimeとVenmoの利用規約をよく読んで、最新情報を入手することをお勧めします。 潜在的な手数料手数料体系を理解することで、送金についてより情報に基づいた判断を下すことができます。不要な手数料を避け、安全かつ費用対効果の高い取引を維持できるようになります。

転送期間とタイミング

さて、あなたは 潜在的な手数料 ChimeからVenmoへの送金について、送金処理にどれくらいの時間がかかり、資金がVenmoアカウントにいつ反映されるのか気になる方もいるかもしれません。ChimeとVenmo間の送金は、ほとんどの場合、 即座に取引の確認後、資金はすぐにVenmoアカウントに反映されます。ただし、状況によっては送金が遅れる場合があります。 セキュリティチェック または技術的な問題が発生した場合、通常は数時間以内に資金が利用可能になります。スムーズな取引を保証するために 移転プロセス、 いつも 受信者の情報を確認する 送金を完了する前に取引の詳細を確認してください。

取引の制限と制約

ChimeからVenmoに送金する場合、両方のサービスで一定の制限が課せられることに注意する必要があります。 取引の制限と制約 安全で責任ある取引を保証するために、これらの制限と制約を設けています。これらの制限と制約は、お客様とお客様の資金を保護するために設けられています。以下に留意すべき制限と制約をいくつか示します。

- * 1日あたりの送金限度額Chime の 1 日の送金限度額は $2,000 ですが、Venmo の限度額はアカウントの種類に応じて $2,000 ~ $5,000 です。

- 週ごとの送金制限Chime の週当たりの送金限度額は $10,000 ですが、Venmo の場合は $10,000 ~ $20,000 です。

- 月間送金限度額Chime の月間送金限度額は $20,000 ですが、Venmo は $20,000 ~ $40,000 です。

- 取引ごとの制限Chime の取引あたりの制限は $1,000 ですが、Venmo の場合は $1,000 ~ $5,000 です。

送金状況の追跡方法

ステータスを追跡できます ChimeからVenmoへの送金 さまざまな方法を通じて、 モバイルアプリの通知, メールによる最新情報、アプリ内 転送追跡機能送金を開始すると、通常はモバイル端末に通知が届き、ChimeまたはVenmoアカウントに登録されているメールアドレスにメールが送信されます。Venmoアプリ内で送金状況を確認するには、「入金」または「取引履歴」セクションにアクセスしてください。Chimeアプリでは送金状況の最新情報も確認できます。送金の安全性についてご不安な場合は、ChimeまたはVenmoの担当者までお問い合わせください。 カスタマーサポート サポートが必要な場合は、お問い合わせください。複数の追跡方法により、送金のステータスを監視し、送金が正常に完了したことを確認できます。

転送に関する問題の解決策

送金に関する問題は、誤った送金など、さまざまな理由で発生する可能性があります。 受取人情報, 資金不足、 または 技術的な不具合遅延や損失を避けるためには、これらの問題を迅速に解決することが不可欠です。ChimeからVenmoへの送金がスムーズに行われるように、いくつかの予防策を講じることができます。

- * 送金を開始する前に、受取人の情報を再確認してください。

- * Chime アカウントに十分な資金があることを確認してください。

- * 技術的な問題を回避するために、アプリを定期的に更新してください。

- * 転送ステータスを監視して、問題を迅速に特定し、対処します。