Chime から銀行口座に簡単に送金できますか?

Have you ever wondered if you can transfer money from your Chime account to your bank account? You’re not alone.

Navigating the world of digital banking can sometimes feel like piecing together a puzzle. You’ve got the app, the features, the benefits, but how do you make it all work seamlessly with your existing accounts? Imagine the ease of moving your money exactly where you need it, without the hassle.

Understanding these steps not only saves you time but also gives you peace of mind. Stay with us, and by the end of this article, you’ll know exactly how to effortlessly transfer money from Chime to your bank account, making your financial life a little bit easier.

Chime Basics

Understanding Chime is essential for managing your finances effectively. Chime offers modern banking solutions tailored for today’s digital age. It’s a popular choice for those seeking convenience and flexibility. But what exactly is Chime, and what features does it offer? Let’s explore these questions.

What Is Chime?

Chime is an online financial technology company. It provides banking services through a mobile app. Unlike traditional banks, Chime doesn’t have physical branches. Its operations are entirely digital, offering easy access to your money.

The app helps you manage your funds seamlessly. It caters to tech-savvy individuals who prefer online banking. Chime partners with banks to provide secure services. This ensures your money is protected and easily accessible.

Features Of Chime Accounts

Chime accounts come with many features. A key benefit is no monthly fees. This makes Chime an affordable choice for many users. Automatic savings is another valuable feature. You can set it to save a percentage of your deposits.

Chime also offers early direct deposit. You can receive your paycheck up to two days early. The app provides instant transaction alerts. This helps you track your spending in real-time. Chime’s user-friendly interface ensures smooth navigation. Managing your finances has never been easier.

銀行口座のリンク

Linking your bank account to Chime is an important step. It allows you to transfer money seamlessly. This process is simple and user-friendly. You’ll have access to your funds anytime you need them. Let’s explore the steps to connect your accounts and resolve any issues.

Steps To Connect Accounts

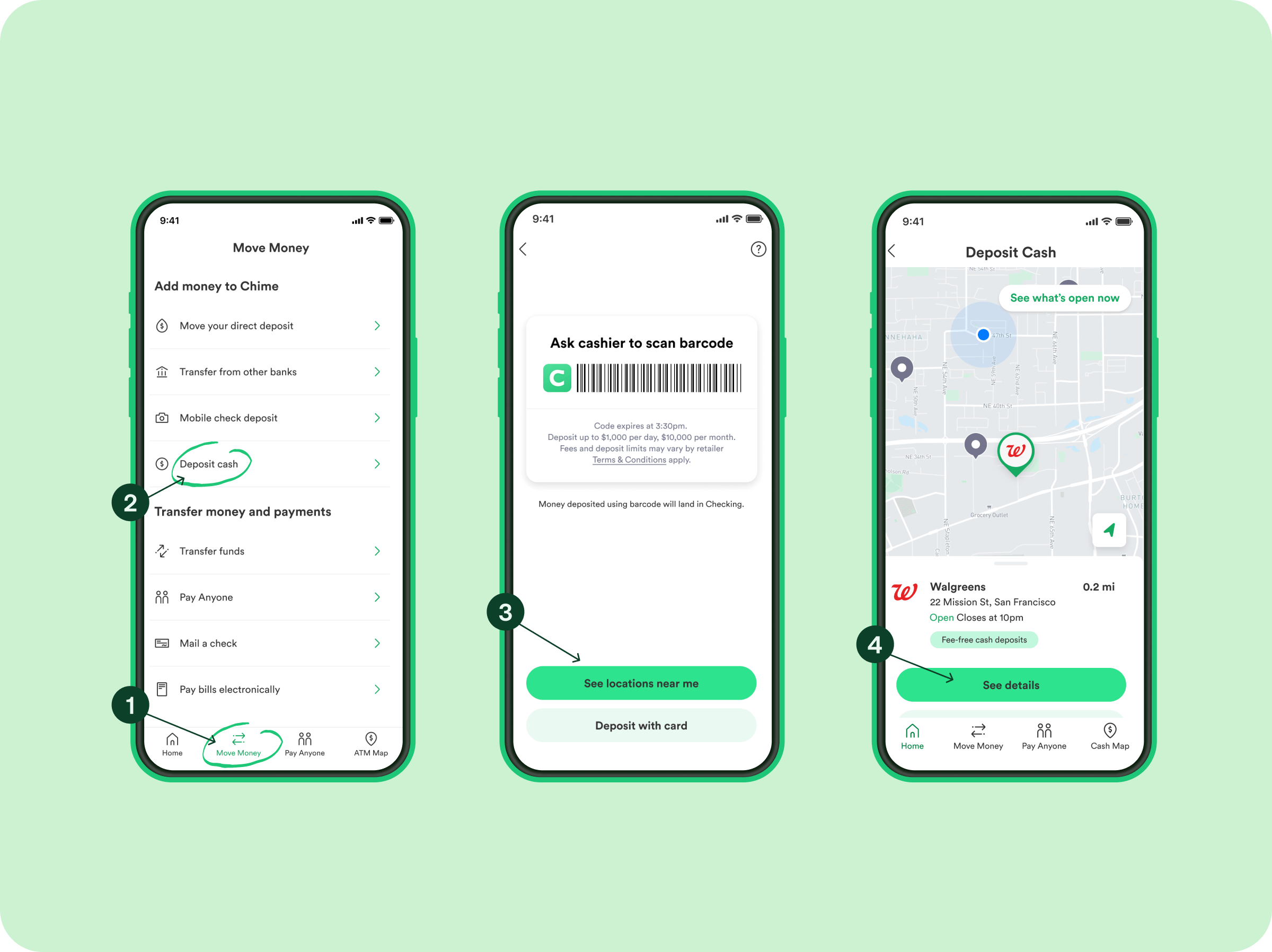

First, open the Chime app on your phone. Tap on the ‘Move Money’ option. Next, select ‘Transfers’ from the menu. Tap on ‘Add Bank Account’ to begin. You will see a list of banks. Choose your bank from the list. If not listed, search for it. Enter your online banking credentials. Follow the prompts to verify your account. Once verified, your bank account is linked.

Troubleshooting Connection Issues

Sometimes, linking issues can occur. Check your internet connection first. Ensure your banking details are correct. If problems persist, contact Chime support. They offer guidance to resolve issues. Re-check your bank’s online settings. Ensure your bank allows third-party connections. Clear your app cache and restart your device. These steps often fix connection issues.

Transferring Funds From Chime

Transferring money from Chime to a bank account is simple. Log into your Chime app, select ‘Transfer Funds’, and follow the prompts. Your money will reach your bank within a few business days.

送金の開始

Starting a transfer from your Chime account is as easy as pie. First, make sure your Chime account is linked to your external bank account. You can do this by logging into your Chime app, navigating to “Settings,” and selecting “Link a Bank Account.” Once linked, go to the “Move Money” section. Here, choose “Transfer Funds” and enter the amount you wish to transfer. Confirm the details, and you’re set! The process is user-friendly and designed to be as intuitive as possible.Transfer Limits And Fees

Understanding transfer limits is crucial to avoid any hiccups in your transactions. Chime imposes certain limits to ensure security and manage flow. For instance, there might be a cap on the amount you can transfer in a single transaction or within a certain period, like a week. Fees can often be a hidden nuisance, but Chime is known for its transparency. Typically, Chime does not charge fees for standard transfers. However, it’s wise to check if your receiving bank imposes any charges. By staying informed, you can avoid unpleasant surprises and make sure your hard-earned money stays with you. How do you usually handle transferring funds between accounts? Understanding the process can help you streamline your financial management and perhaps even save on unnecessary fees.セキュリティ対策

Transferring money from Chime to a bank account involves secure processes to protect users. Encryption safeguards personal data during transactions. Notifications alert users of any unusual activity, ensuring peace of mind.

お客様の情報の保護

Chime uses advanced encryption technologies to safeguard your data. This means your personal information is scrambled during transmission, making it nearly impossible for hackers to access. Think about it—how often do you worry about sharing sensitive information online? With Chime, you can rest assured that your details are treated with the highest level of security. Moreover, Chime employs multi-factor authentication to verify your identity. This adds an extra layer of security, requiring not just a password but also a code sent to your phone.Secure Transfer Practices

When transferring money, Chime ensures the process is secure from start to finish. Transactions are monitored for unusual activity, so if anything looks suspicious, it’s flagged immediately. Do you ever wonder if your money is safe while it’s being transferred? Chime’s security systems work in real-time, keeping your transactions under constant surveillance. Additionally, Chime collaborates with reputable banks and financial institutions. This partnership ensures that your money moves smoothly and securely between accounts, reducing the risk of errors or delays. Security in financial transactions is critical. How do you feel knowing Chime is looking out for your best interests with these robust measures?Common Challenges

Transferring money from Chime to a bank account can face hurdles like account compatibility and transfer limits. Understanding the process and verifying details ensure smoother transactions. Always check for fees or delays that might affect the transfer timeline.

Transferring money from Chime to a bank account can be a breeze, but sometimes, unexpected challenges pop up. These hiccups can be frustrating, especially when you’re relying on that money for something important. Let’s dive into some common challenges you might face and how to tackle them.Delayed Transfers

One of the most common challenges is delayed transfers. You might expect your money to show up in your bank account almost instantly, but sometimes it takes a little longer. This delay can be due to various reasons, such as processing times on weekends or holidays. It can feel like you’re stuck in a waiting game. Have you ever needed to pay a bill only to find your transfer is taking its sweet time? It’s a situation many can relate to, but don’t worry—there’s usually a way around it.Resolving Transfer Issues

When you encounter an issue with your transfer, it’s crucial to act swiftly. Start by checking if your account details are correct. Errors in account numbers or routing numbers are common culprits. Always double-check before hitting that send button. If the transfer is still delayed, reach out to Chime’s customer support. They can offer insights or solutions to get your money moving again. Have you tried contacting them and found the wait time unbearable? Try reaching out via their online chat or social media for faster responses. By staying proactive, you can minimize the hassle of transfer issues. Have you faced any of these challenges before? How did you handle it? Your experiences might help someone else in a similar situation.Alternatives To Chime Transfers

Transferring money from Chime to a bank account is straightforward. Explore alternatives like direct deposits or using third-party apps. These methods offer flexibility and convenience for moving your funds efficiently.

Using Other Financial Apps

Many people find success with other financial apps like Venmo, PayPal, or Cash App. These platforms often offer quick transfers and sometimes even lower fees. You might find that using these apps can be more convenient, especially if you’re already using them for other transactions. Imagine a scenario where you need to send money to a friend. Using an app you’re already familiar with can save you time and hassle. It’s like having a multipurpose tool in your financial toolkit. Do you have any other apps on your phone that could simplify your money transfers?Direct Bank Transfers

Direct bank transfers might seem old-school, but they can still be a reliable option. Most banks offer online services that allow you to transfer money without needing an intermediary like Chime. Consider the ease of logging into your bank’s app and making a transfer directly. It’s straightforward and cuts out the middleman, giving you one less app to worry about. Have you checked if your bank offers this service? It could be the simplest solution you’ve overlooked. By exploring these alternatives, you open up new possibilities for managing your finances. What might seem like a simple change could lead to more control and ease in your financial life. So, why not give it a try?Tips For Seamless Transfers

Transferring money from Chime to a bank account is straightforward. Ensure your bank account is linked to Chime. Initiate the transfer by selecting the bank account as the destination, following the steps provided in the app.

Transferring money from Chime to your bank account should be stress-free. Using these tips, you can ensure a smooth transfer process. Understand the key steps to avoid common pitfalls. Follow these guidelines for a hassle-free experience.Ensuring Account Compatibility

Check if your bank account is compatible with Chime. This prevents transfer issues. Verify your bank’s transfer policies. Some banks have specific requirements. Ensure your bank account is active. Inactive accounts can cause transfer delays. Double-check your account details. Mistakes can lead to unsuccessful transfers.転送ステータスの監視

Keep an eye on your transfer status. This helps track the process. Use Chime’s app for real-time updates. You’ll know when the money arrives. Set up notifications for peace of mind. Alerts notify you of any changes. Contact customer support for delays. They provide guidance and solutions. Stay informed to ensure a smooth transfer.

よくある質問

How To Transfer Money From Chime To Bank Account?

Transferring money from Chime to a bank account is simple. Log into your Chime app, go to “Move Money,” select “Transfer to Bank,” and follow the prompts. Ensure your bank account is linked. The process usually takes 1-3 business days to complete.

Is There A Fee For Transferring From Chime?

No, Chime does not charge any fees for transferring money to a bank account. This makes it an affordable option for users. However, always check with your receiving bank for any potential incoming transfer fees.

How Long Does Chime Transfer Take?

Chime transfers to a bank account typically take 1-3 business days. The exact timing depends on the receiving bank’s processing times. Always plan ahead to accommodate for any potential delays.

Can I Transfer Money Instantly From Chime?

Chime does not currently offer instant transfers to external bank accounts. Transfers usually take 1-3 business days. For faster access to funds, consider using Chime’s direct deposit feature or Chime’s SpotMe service.

結論

Transferring money from Chime to a bank account is simple. Follow the steps outlined above. Ensure your bank details are accurate. This prevents any delays or errors. Remember, Chime makes online transactions easy. Stay updated with any app changes. This ensures smooth transfers.

With these tips, managing your finances becomes straightforward. Enjoy hassle-free banking with Chime. You’re now ready for secure transfers. Keep exploring other features Chime offers. It’s all about convenience and security. Happy banking with Chime!