メディケイド加入中でもクレジットカードは持てますか?

If you're on Medicaid, you might wonder whether holding a credit card is feasible. While it's certainly possible, the nuances of 収入制限 and eligibility criteria can make it tricky. You'll need to take into account how rewards or interest could impact your benefits. Managing your credit wisely is essential, but what does that really entail? Understanding the balance between maintaining your メディケイドの受給資格 and building your credit can be complex, and the implications of your financial choices might surprise you. Let's explore this further to clarify your options and guarantee you're making informed decisions.

Understanding Medicaid Eligibility

理解 メディケイドの受給資格 is important, as it determines not only the benefits you can access but also how your financial choices, like obtaining a credit card, may be affected. To qualify for Medicaid, you'll need to meet specific income and asset limits, which can vary by state. This means evaluating your financial situation is essential. If your assets exceed the allowable limits, you risk losing eligibility for critical healthcare services. In addition, understanding how credit cards impact your financial standing can be complex. While having a credit card might seem beneficial, it can affect your overall financial profile and, as a result, your Medicaid eligibility. Thus, it's prudent to navigate these regulations carefully, ensuring your 経済的安定 while maintaining access to necessary healthcare.

Credit Cards and Income Limits

Many individuals on メディケイド may not realize that the income generated から クレジットカード特典 or interest can impact their eligibility for benefits. If you earn rewards through cash back or points, those can be considered income, potentially affecting your overall 財政状況. Additionally, if you carry a balance and accrue interest, that can also contribute to your income calculations. It's vital to understand your state's specific income limits for Medicaid eligibility, as exceeding these thresholds can lead to a loss of benefits. As a result, if you're using credit cards, keep track of any rewards or interest earned, and regularly assess how they fit into your financial landscape to guarantee you remain compliant with Medicaid requirements.

Impact on Medicaid Benefits

The way クレジットカード特典 and interest are treated can greatly affect your Medicaid benefits and eligibility. If you earn rewards or accrue interest that notably increases your income, this could push you over the 収入制限 set by Medicaid. Additionally, your available assets may be scrutinized; if rewards translate into cash or valuable points, they could count against the asset cap. It's vital to monitor your credit card usage closely and consider how these financial tools impact your overall financial picture. Understanding the nuances of how credit impacts Medicaid can help you make informed decisions while ensuring you maintain your eligibility for essential health services. Always consult a ファイナンシャルアドバイザー or Medicaid expert for tailored advice.

Building Credit With Medicaid

Building credit while on メディケイド is not only possible but can also be a strategic move to enhance your 金融の安定 without jeopardizing your benefits. You can build credit by responsibly using a secured credit card or becoming an authorized user on someone else's account. Make sure you pay your bills on time and keep your クレジット利用率 low, ideally below 30%. This approach allows you to establish a positive credit history, which can be beneficial for future loans or housing applications. Additionally, maintaining good credit can help you qualify for better financial products, bringing more security to your financial future. Always monitor your credit report for accuracy and address any discrepancies promptly to protect your financial interests.

Managing Debt While on Medicaid

Managing debt while on Medicaid requires a careful approach to make certain that your financial obligations don't interfere with your eligibility for benefits. Here are some strategies to bear in mind:

- 賢く予算を立てる: Track your income and expenses to make sure you live within your means.

- Prioritize Essential Bills: Always pay necessary expenses, like housing and utilities, before non-essential debts.

- 債権者とのコミュニケーション: If you're struggling, reach out to creditors to discuss potential payment plans or options.

- Monitor Your Credit: Regularly check your credit report for inaccuracies and understand how debt impacts your financial health.

Alternatives to Credit Cards

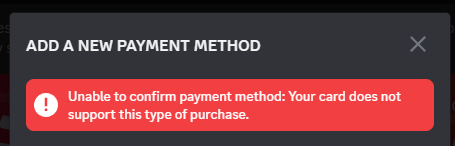

探検 クレジットカードの代替手段 can provide you with flexible financial solutions that align with your Medicaid benefits. One option is a デビットカード linked to your checking account, allowing you to manage your spending without incurring debt. プリペイドカード are another alternative; they offer similar features to credit cards but require you to load funds upfront, reducing the risk of overspending. Consider using a 個人ローン for larger expenses, as they often have lower interest rates and structured payment plans. Additionally, 予算管理アプリ can help you track your spending and savings. By choosing these alternatives, you can maintain financial stability while safeguarding your Medicaid eligibility and ensuring your healthcare needs are met.

Financial Planning Tips

When it comes to financial planning while on Medicaid, prioritizing your essential expenses and creating a realistic budget can help you navigate your financial landscape effectively. Here are some tips to contemplate:

- Identify Essential Expenses: Focus on necessities like housing, food, and healthcare.

- Set a Monthly Budget: Create a budget that tracks your income and expenditures to avoid overspending.

- 緊急基金: Aim to save a small amount each month for unexpected expenses, providing a safety net.

- 確認と調整: Regularly assess your budget and financial goals, making adjustments as needed to stay on track.

Resources for Assistance

Overcoming financial challenges on Medicaid can be intimidating, but several resources are available to provide assistance and support as you manage your budget and expenses. To begin with, consider reaching out to local non-profit organizations that specialize in financial counseling; they can offer personalized advice tailored to your situation. Additionally, your state's Medicaid office often provides information on financial aid programs that may be available to you. Online resources, such as 予算作成ツール and forums dedicated to Medicaid recipients, can also be invaluable. Finally, don't hesitate to consult with a ファイナンシャルアドバイザー who understands Medicaid regulations—they can help you navigate credit options safely while ensuring compliance with Medicaid guidelines. Utilizing these resources can empower you to make informed financial decisions.