NRO口座からNRE口座に送金できますか?:簡単なガイド

Are you wondering if you can transfer money from your NRO (Non-Resident Ordinary) account to your NRE (Non-Resident External) account? You’re not alone.

Many non-resident Indians face this question, especially when managing finances back home. Understanding these accounts and the rules governing them can be tricky. But don’t worry, you’re in the right place. This article will guide you through the process, offering clear, straightforward answers.

By the end, you’ll know exactly what to do and how to do it. Ready to take control of your finances? Let’s dive in.

Nro And Nre Accounts

Navigating through the intricacies of NRO and NRE accounts can feel like decoding a financial puzzle. If you’re an Indian expatriate or Non-Resident Indian (NRI), understanding these accounts is crucial for managing your finances effectively. Imagine you’re an NRI looking to streamline your funds or plan your investments. How do NRO and NRE accounts fit into this picture? Let’s dive into the specifics.

Key Differences

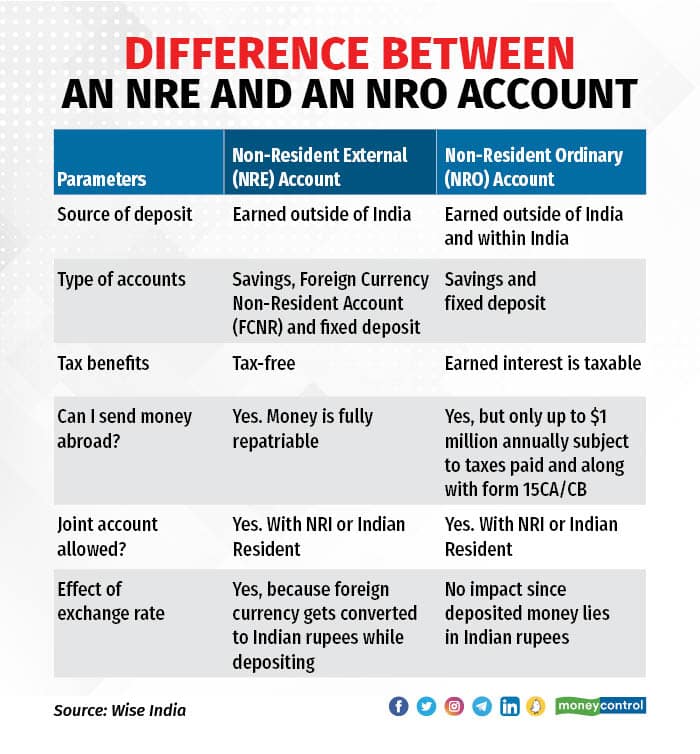

Both NRO (Non-Resident Ordinary) and NRE (Non-Resident External) accounts serve NRIs but have distinct features. NRO accounts are primarily for managing income earned in India, like rent or dividends. On the other hand, NRE accounts handle foreign income, offering full repatriation. The interest earned in NRE accounts is tax-free, unlike NRO accounts, which are subject to Indian taxation.

Consider this: you receive rental income from a property in India. An NRO account would be your go-to for depositing this money. For earnings abroad, such as salary from a foreign job, the NRE account ensures easy repatriation and tax benefits. Do these differences influence your financial strategies?

Purpose And Benefits

Why might you choose one over the other? NRO accounts are ideal for handling Indian-based income. They help you manage finances without converting foreign currency to INR every time. Meanwhile, NRE accounts provide the benefit of holding foreign income in Indian banks with tax-free interest. This is perfect for NRIs planning to return to India or invest there.

Think about your future plans: are you looking to invest in India or return home eventually? NRE accounts offer the flexibility of repatriation, making it easier to access funds globally. NRO accounts ensure seamless handling of Indian earnings. What suits your goals better?

Understanding these accounts can transform your financial management. Your choices in using NRO and NRE accounts can impact your tax liabilities and investment returns. So, what’s your strategy for leveraging these accounts to maximize benefits?

Eligibility For Transfers

Transferring money from an NRO (Non-Resident Ordinary) account to an NRE (Non-Resident External) account is a common need for many Non-Resident Indians (NRIs). Understanding the eligibility for such transfers is crucial. You might wonder: Am I eligible to transfer funds between these accounts? Let’s break it down in simple terms.

Who Can Transfer

Not everyone can easily transfer money from an NRO account to an NRE account. You must be an NRI with both accounts in your name. This ensures that the funds are rightfully yours and can be transferred without legal hassles.

Additionally, you should verify that your bank allows such transfers. Some banks might have restrictions or specific procedures for transferring funds between these accounts. Check with your bank to ensure compliance.

Regulatory Requirements

The Reserve Bank of India (RBI) has specific rules regarding these transfers. You need to adhere to these regulations to avoid penalties or issues. Typically, the transferred amount should not exceed the total taxable income in India for that financial year.

Ensure that you have paid all applicable taxes on the funds before transferring them to your NRE account. This is crucial to stay within legal boundaries. Non-compliance might lead to unnecessary complications.

Have you ever wondered why these regulations exist? They help maintain a transparent financial system and prevent illegal fund transfers. Understanding and following these guidelines not only keeps you compliant but also safeguards your financial interests.

Consider using a CA or financial advisor to ensure all necessary paperwork is correctly filed. It’s a small step that can save you from future headaches. Do you think you’re eligible to transfer funds between these accounts? If yes, understanding these requirements can make the process smoother.

Steps For Money Transfer

Transferring money from an NRO to an NRE account is straightforward. First, ensure both accounts are active. Then, complete the necessary bank forms to initiate the transfer process. Lastly, check with your bank for any specific regulations or fees involved.

Preparing Necessary Documents

Before you start the transfer, ensure you have all necessary documents in place. Typically, you’ll need valid identification, such as a passport, and proof of your NRE and NRO account details. It’s wise to keep these documents organized and readily accessible. Don’t underestimate the importance of these papers. Missing documents can delay the process or even halt it altogether. A friend of mine once spent a week trying to gather missing documents simply because he was not prepared. ###Bank Procedures

Once your documents are ready, the next step is to understand the bank’s procedures. Every bank has its own set of rules and processes, so it’s important to check with your specific bank. You may need to fill out a form authorizing the transfer, either online or in person. Some banks offer online services that make the transfer process quick and easy. However, if your bank requires you to visit a branch, ensure you know the right person or department to contact. A quick phone call to customer service can clarify this. How familiar are you with your bank’s online portal? If you’re not, now might be the time to explore its features. Understanding the digital interface can significantly speed up your transaction. By preparing your documents and understanding bank procedures, you can efficiently transfer money from your NRO to NRE account. These steps are not just bureaucratic necessities but essential actions that ensure your financial transactions are secure and seamless.税金の影響

Transferring money from an NRO to an NRE account can impact your taxes. Such transfers are allowed under certain conditions. It’s crucial to understand possible tax implications and consult a financial expert to ensure compliance.

Tax Deduction Rules

NRO accounts are subject to specific tax deduction rules. Interest earned is taxed in India. The rate of tax can be high, often at 30%. This deduction occurs at the source. It’s crucial to factor in these deductions when transferring money. On the other hand, NRE accounts offer a tax-free advantage. Interest earned here is exempt from Indian taxes. This makes NRE accounts attractive for NRIs seeking tax-efficient options. Understanding these rules helps avoid unexpected tax liabilities.Double Taxation Avoidance Agreement

Many countries have Double Taxation Avoidance Agreements (DTAA) with India. DTAA prevents paying taxes twice on the same income. It ensures NRIs benefit from reduced tax rates. When transferring funds, these agreements can provide relief. DTAA provisions vary by country. They often require specific documentation. NRIs must understand their country’s agreement with India. This knowledge ensures compliance and maximizes tax benefits. Proper application of DTAA can significantly impact financial planning.Exchange Rates And Charges

Transferring money from NRO to NRE accounts involves various factors. Among them, exchange rates and charges are crucial. They can affect the total amount you transfer. Understanding these can help you make informed decisions.

Impact Of Currency Conversion

Currency conversion impacts how much money actually reaches the NRE account. Exchange rates can fluctuate daily. This means the amount you send could vary. A slight change in rates can make a big difference. Monitoring these rates can help you choose the best time for transfer.

Bank Fees And Charges

Banks often impose fees for transferring money. These charges can differ from bank to bank. Some banks may offer lower fees, while others might be higher. It’s essential to check the fee structure beforehand. This helps in avoiding surprises later.

Understanding these fees ensures you get maximum value. Always compare charges before initiating a transfer. It can save you money in the long run.

Common Challenges

Transferring money between NRO and NRE accounts can be tricky. There are several common challenges that people face during this process. Understanding these obstacles can help plan better and avoid issues.

Regulatory Hurdles

Regulations can complicate money transfers between NRO and NRE accounts. Different rules apply to each account type. NRO accounts deal with income earned in India, like rent or dividends. NRE accounts handle income earned abroad. Banks follow strict guidelines for these transfers.

Documentation is crucial for smooth transactions. Proof of source and purpose of funds must be clear. Some regulations require detailed paperwork. This ensures compliance with tax laws and prevents fraud.

Banking Delays

Banking delays are common with NRO to NRE transfers. Processing times vary by bank. Some banks take longer to verify documents. This can cause frustration for those in a hurry.

Bank holidays and weekends can extend delays. It’s wise to plan transfers on weekdays. Staying informed about bank policies can minimize waiting times. Communication with bank officials can also help speed up the process.

Tips For Successful Transfers

Transferring money from an NRO to an NRE account can be complex. To ensure a smooth process, follow some essential tips. These tips can help avoid delays and ensure successful transfers. Let’s explore these tips for a hassle-free experience.

Choosing The Right Time

Timing plays a crucial role in currency conversion rates. Monitoring exchange rates can save you money. Choose a time when rates are favorable. Avoid transferring money during volatile market periods. This can lead to unfavorable exchange rates.

Consulting Financial Advisors

Financial advisors provide valuable insights for money transfers. They understand tax implications and regulations. Consulting them ensures compliance with legal requirements. They can guide you through complex paperwork. This makes the process smooth and stress-free.

Alternatives To Direct Transfer

Transferring money from an NRO to an NRE account isn’t always straightforward. Regulations often restrict direct transfers. Still, there are several alternatives. These options can help manage and optimize your funds efficiently.

投資オプション

Consider investing your NRO funds in secure avenues. Fixed deposits or mutual funds are popular choices. They offer stable returns and are easy to manage. You can later transfer profits to your NRE account. This way, your investments grow over time. Plus, it simplifies fund management.

Using Financial Instruments

Financial instruments can facilitate indirect transfers. Instruments like cheques or demand drafts are effective. They allow you to transfer money within regulatory limits. This method is straightforward and widely accepted. It also provides a paper trail for transactions. Ensuring compliance with financial regulations.

よくある質問

Can Nro Funds Be Transferred To Nre Accounts?

Yes, funds in an NRO account can be transferred to an NRE account. This is subject to certain conditions, such as adhering to the Reserve Bank of India’s guidelines. The transfer is typically allowed for genuine purposes, like repatriation of funds.

Consult with your bank for specific requirements and processes.

What Are The Tax Implications Of Nro To Nre Transfer?

Transferring funds from an NRO to an NRE account may involve tax implications. Funds in NRO accounts are subject to taxes in India. Before transferring, ensure that taxes on any income generated are settled. It’s advisable to consult a tax expert for accurate guidance on tax liabilities involved in such transfers.

How Much Money Can Be Transferred From Nro To Nre?

The transfer limit from an NRO to an NRE account is subject to regulations. As per RBI guidelines, up to $1 million can be transferred per financial year. This includes various charges and taxes applicable on the transaction. Confirm with your bank for detailed information on limits and documentation needed.

Is Rbi Permission Needed For Nro To Nre Transfer?

RBI permission is not needed for transferring funds from an NRO to an NRE account. However, banks require specific documentation to ensure compliance with regulations. You might need to provide Form 15CA and 15CB from a chartered accountant. Always check with your bank for updated requirements and procedures.

結論

Transferring money from an NRO to an NRE account is possible. It requires some steps and documentation. First, ensure compliance with the Reserve Bank of India rules. Then, consult with your bank for specific procedures. Remember, this transfer can help manage your funds better.

It also allows you to consolidate finances in one account. Always keep track of exchange rates and fees. This ensures you get the best value during the transfer. Proper planning makes this process smooth and hassle-free. Stay informed and make wise financial decisions.