賠償金は税控除の対象になりますか?今すぐご確認ください!

Are you wondering if restitution payments can ease your tax burden? You’re not alone.

Many people find themselves in situations where they need to make restitution payments, and the tax implications can seem daunting. Understanding whether these payments are tax deductible could potentially save you money and simplify your financial planning. Picture this: You’re already dealing with the stress of making these payments, and the last thing you want is added confusion about your taxes.

By diving into this topic, you might uncover a way to ease some of that financial pressure. This article will guide you through the maze of IRS rules and regulations, providing clear and simple answers. So, are restitution payments tax deductible? Let’s unravel this question together and see how it might impact your wallet. Stay with us to gain insights that could bring clarity and potentially save you money.

What Are Restitution Payments?

Restitution payments are money paid to correct a wrong. They aim to make things right for someone harmed. Courts often order these payments when someone breaks a law. The goal is to repair damage done to a victim. This can include paying for things stolen or damaged. Restitution tries to restore fairness.

People pay restitution in many situations. Shoplifters might pay for stolen goods. Vandalism could lead to paying for repairs. 詐欺 can mean returning stolen money. Accidents might result in paying for damages. Each situation seeks to fix harm done to others.

Tax Deductibility Basics

Tax deductions can lower your taxable income. This means you pay less tax. Deductions are amounts you subtract from your income. Not all expenses are deductible. Only certain costs qualify.

To be deductible, an expense must meet some criteria. It should be necessary for your work or business. It must also be ordinary in your field. Ordinary means common and accepted. The expense should be reasonable. Not too high or too low.

| 基準 | 説明 |

|---|---|

| Necessary | Needed for work or business |

| Ordinary | Common and accepted in your field |

| Reasonable | Not too high or too low |

Restitution Payments And Tax Law

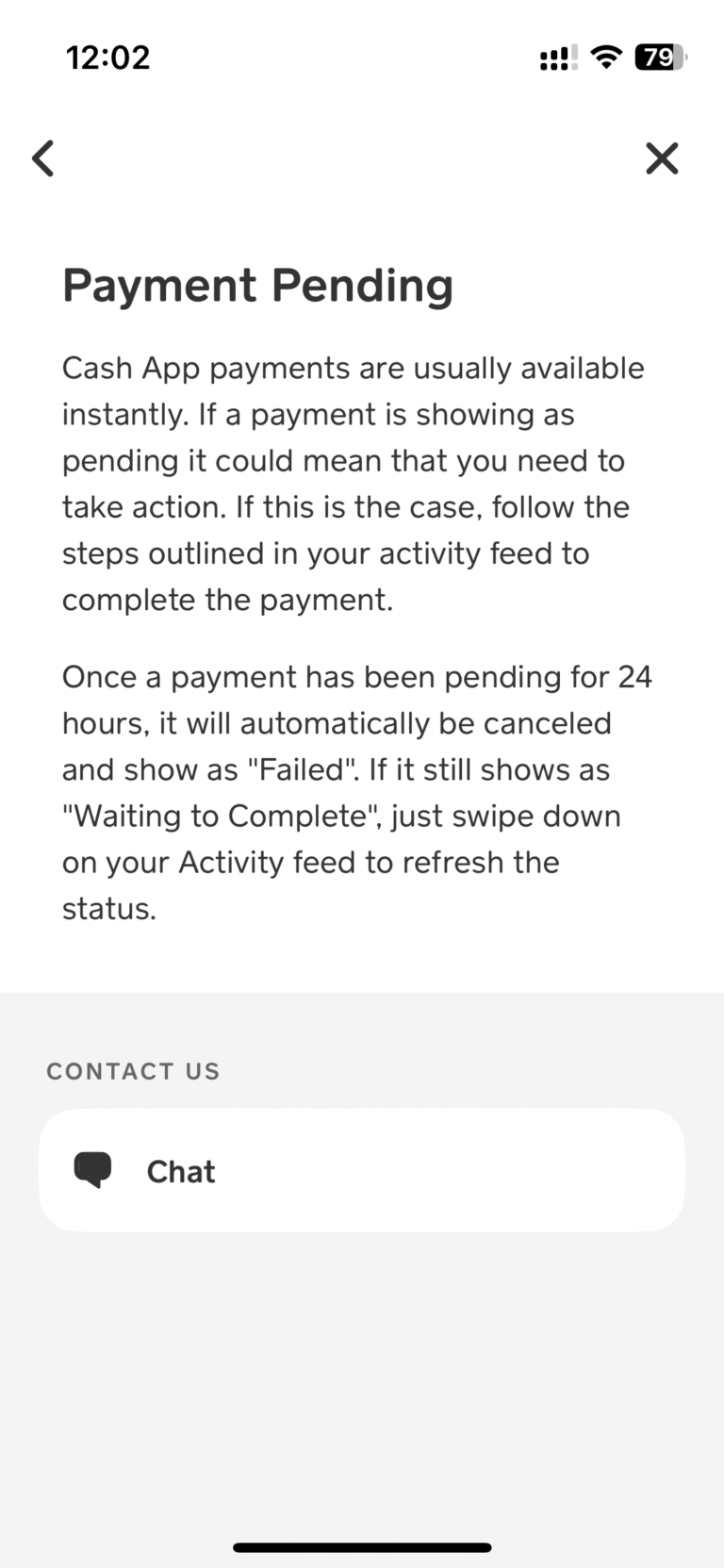

その IRS has clear rules. Not all payments are tax deductible. Restitution payments often fall into this category. They are payments for harm or loss. The IRS treats them as 個人的な経費. Personal expenses are usually not deductible. Understanding these rules is important.

Court-ordered payments can be confusing. Not all are the same. Some might seem deductible but are not. Restitution is a common 裁判所命令. The IRS does not see these as business expenses. Business expenses are deductible. Restitution is not. Knowing this helps in tax planning. It prevents errors and saves time. Keep informed about these rules.

Business Vs. Personal Restitution

Business restitution payments can sometimes be tax deductible. These payments are made to correct mistakes or wrongdoings in business. The IRS may allow deductions for these, but rules are strict.

Personal restitution payments are different. These payments usually come from personal wrongs or damages. Tax deductions for personal restitution are often not allowed.

- Paying back money for overcharging customers.

- Refunds for faulty products sold.

- Compensation to settle employee disputes.

Business restitution can protect reputation. It also fixes errors and builds trust. Yet, tax benefits depend on the situation.

Exceptions And Special Cases

Some payments might qualify for deductions. Restitution linked to business operations could be deductible. If payments restore lost income, a deduction may apply. Seek advice from a tax expert. Every case can be different. Always keep proper documentation. This helps in tax filing.

Most restitution payments are not tax-deductible. Personal damages or fines fall in this category. Payments for personal injuries are usually non-deductible. In some situations, legal fees are non-deductible too. Understanding these rules is important. Always verify with a professional.

Impact Of Recent Tax Reforms

Recent tax reforms raise questions about the tax deductibility of restitution payments. Changes may affect how individuals report these payments. Understanding new rules is crucial to ensure compliance and avoid unexpected tax liabilities.

Changes In Tax Legislation

Recent tax reforms have altered the landscape of tax deductions. Restitution payments are now under scrutiny. Many people wonder if these payments are tax deductible. Laws have changed in the past years. These changes affect what you can deduct. Restitution payments might not be eligible anymore. Tax laws can be confusing. It’s important to understand the new rules.

Implications For Restitution Payments

Restitution payments are made to compensate for harm or loss. Tax reforms can affect their deductibility. If laws change, so do tax deductions. Paying restitution might not reduce your taxes. Understanding these changes is crucial. Consult a tax expert if unsure. They can guide you with tax rules. Being informed helps avoid mistakes.

Consulting A Tax Professional

Understanding taxes is hard. Tax rules change often. Getting the right advice matters. A professional knows the latest tax laws. They help avoid mistakes. Mistakes can cost money. Professionals answer tough questions. They make tax filing less stressful. Their advice can save money. Paying for help is smart.

Choosing a tax advisor is important. Look for experience in tax. Check their reviews online. Ask friends for recommendations. A good advisor listens. They explain complex terms clearly. They help with tax deductions. They know about restitution payments. Always ask about their fees first. Make sure they are certified.

Real-life Examples

John paid restitution after a court case. He wondered if it was tax deductible. He learned that if restitution is part of a business expense, it may be deductible. Court fees そして fines are usually not deductible. But, if the restitution repairs business damage, it might be.

Tax court cases show that each situation is unique. One man paid restitution for fraud. The court ruled it was not deductible. The key point was intent. If the payment is to fix a business error, it might be deductible. Always check with a tax expert.

Future Of Restitution And Tax Deductions

Restitution payments often raise questions about tax deductions. These payments are typically not deductible. Their primary purpose is to compensate victims, not offer tax benefits. Always consult a tax advisor for personalized advice.

Potential Changes In Tax Policy

Tax laws might change in the future. Lawmakers discuss new rules often. These rules could affect restitution payments. Some people hope for deductions. Others worry about higher taxes. Different countries have different rules. Always check local laws. This helps in understanding potential changes.

Advocacy And Legal Developments

Many groups advocate for better tax laws. They want fair rules for everyone. Lawyers often lead these efforts. They work with government to change laws. Some changes may help people. Others might be more strict. Watching these developments is important. They can impact your tax responsibilities. Stay informed to know your rights.

よくある質問

Are Restitution Payments Tax Deductible?

Restitution payments are generally not tax deductible. They are considered personal expenses, not business expenses. Tax laws classify them as penalties or fines. Always consult a tax professional for advice. They can provide guidance based on your specific situation and the applicable tax laws.

Do Restitution Payments Affect Taxable Income?

Restitution payments do not typically affect taxable income. They are not considered a deductible expense. These payments are treated as personal obligations. Consult a tax advisor for personalized guidance. They can help navigate your specific financial circumstances and tax responsibilities.

Can Businesses Deduct Restitution Payments?

Businesses usually cannot deduct restitution payments. These payments are seen as penalties or fines. Such expenses are not tax deductible. It’s crucial for businesses to consult with tax professionals. They can provide advice tailored to the business’s specific needs and circumstances.

Are There Exceptions For Restitution Tax Deductions?

Exceptions for restitution tax deductions are rare. Generally, these payments are non-deductible. Tax laws treat them as penalties or fines. Consulting with a tax professional is advisable. They can offer insights based on current laws and your unique situation.

結論

Understanding restitution payments and taxes is important. These payments often aren’t tax deductible. Always check current tax laws. They change often. Consider consulting a tax professional. They can provide up-to-date advice. This ensures you make informed decisions. Keep records of all payments.

It helps during tax time. Stay informed. This knowledge empowers you financially. Be proactive in managing taxes. It can save you money and stress. Remember, every financial situation is unique. So, it’s wise to seek personalized advice. Make smart financial choices with the right information.