債券割引により半年ごとの支払いで利回りが上昇

Have you ever wondered how a bond discount impacts your investments? You’re not alone.

Understanding the financial nuances of bonds can feel like decoding a complex puzzle, but it doesn’t have to be. When a bond is sold at a discount, it does more than just alter its price; it can significantly affect your financial outlook with each semi-annual interest payment.

This seemingly small detail can lead to considerable differences in your investment returns over time. Imagine unlocking the potential to maximize your earnings by grasping this concept. Let’s dive into how a bond discount increases blank______ at each semi-annual interest payment, and why it matters for your financial future. Get ready to uncover the insights that could empower your investment decisions and boost your portfolio’s performance.

Bond Discount Basics

Bonds can sell for less than their face value. This is a bond discount. Investors pay less but get the full amount later. The difference is the discount. It happens when market rates are higher than the bond’s rate. Bonds become less attractive at lower rates. Investors want more for their money. So, they buy at a discount.

Several factors can cause a bond discount. Interest rate changes are a main reason. If rates go up, bonds with lower rates lose value. Inflation can also affect bond prices. Higher inflation makes future money less valuable. Poor company performance might lead to discounts too. Investors worry about risk and want a better deal.

Yield And Its Importance

Yield is a key part of investments. It shows the return on money invested. Bonds have fixed interest payments. These payments affect the yield. An increase in bond discount can change the yield. The yield helps you know how well your investment is doing. Investors watch yield carefully. It helps them make smart choices.

Many things change the yield. 金利 play a big role. High rates can mean lower bond prices. Low rates may raise bond prices. Inflation affects yield too. If prices go up, yield might go down. Bond duration can change yield. Longer bonds might have different yields. It’s important to know these factors. They help in understanding bond yields better.

Impact Of Bond Discount On Yield

あ bond discount means the bond is priced less than its face value. A lower price increases the yield for investors. The yield is like the reward for buying the bond. When the price is low, the reward seems bigger. Bondholders enjoy better returns.

Yield to Maturity (YTM) is the total return on a bond if held until it matures. A bond bought at a discount has a higher YTM. Higher YTM makes bonds more attractive. Investors might prefer bonds with a higher YTM. This is because they get more money in the end.

Semi-annual Payments Explained

Bonds often offer semi-annual payments. These payments occur twice a year. Investors receive interest every six months. This regular schedule helps in planning. It ensures a steady cash flow. Each payment includes interest earned on the bond. The amount can vary based on the bond’s terms. This structure is common in bond markets.

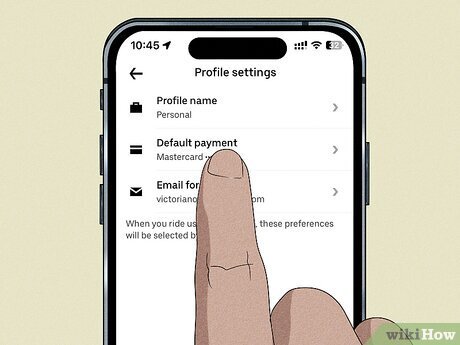

Semi-annual payments affect bond pricing. Bond discounts can change at each payment. This happens due to interest rate changes. Payments increase financial predictability. They provide regular income. Investors enjoy frequent returns. The bond’s yield may alter with each payment. Frequent payments can attract more investors. These payments impact overall bond value. Regular updates on bond status are essential.

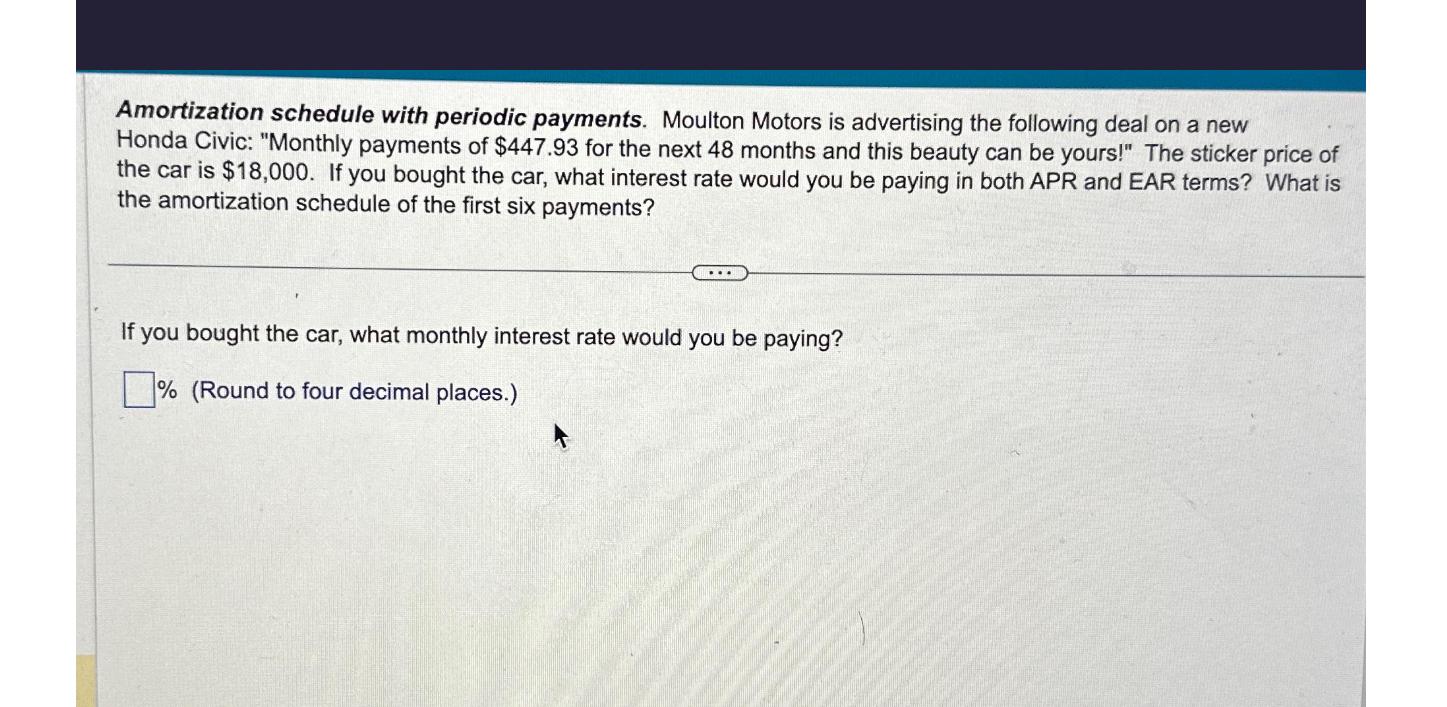

Calculating Increased Yield

Bonds sold at a discount can be tricky. The bond’s value grows over time. Each semi-annual interest payment helps the yield increase. It is important to know how these payments work. The bond’s initial price is lower than its face value. As you get interest payments, the bond’s value rises. This is good for those who hold the bond.

Compounding makes your money grow faster. Interest adds to the bond’s value. The next interest payment is larger. Each payment builds on the last. This process repeats every time. This is how compounding works. It makes the bond more valuable over time.

Real-world Examples

Bonds are like loans. People buy them to earn money. Sometimes, bonds sell for less than their face value. This is called a bond discount. When interest payments are made, the bond’s value goes up. This is because part of the discount is added to the interest. Over time, the bond’s value gets closer to its face value.

In the past, many bonds were sold at a discount. This was common during times of high inflation. Investors wanted to protect their money. They chose bonds as a safe option. As the interest was paid, the bond’s value increased. This trend can help us understand bond markets today.

Investor Considerations

Investors face risks when bonds trade at a discount. The bond issuer might struggle financially. This can affect the bond’s value. Interest rates also play a big role. Rising rates can make bond prices drop. Lower bond prices can lead to losses. Inflation is another risk. It can reduce bond returns. Investors must watch the market closely. Understanding these risks is key.

Buying discounted bonds can be smart. It offers potential value. Investors should diversify their portfolio. This reduces risk. Holding bonds till maturity ensures full face value. Regularly review bond performance. Stay informed about market changes. Investing in different bonds can help. Look for bonds with strong issuers. This increases chances of good returns. Consider bonds with higher interest rates. It might offer more income. Assess risk versus reward carefully.

よくある質問

What Happens When A Bond Is Sold At A Discount?

When a bond is sold at a discount, its market price is lower than its face value. This often occurs when interest rates rise above the bond’s coupon rate. The discount compensates investors for the lower yield. Over time, the bond discount decreases, and the book value of the bond increases.

How Does Bond Discount Affect Interest Payments?

A bond discount increases the book value at each semi-annual interest payment. This process is called amortization. As the bond’s book value rises, the effective interest expense also increases. This affects the issuer’s financial statements, reflecting the gradual elimination of the discount.

Why Do Bonds Sell At A Discount?

Bonds sell at a discount primarily due to higher market interest rates. When interest rates exceed the bond’s coupon rate, the bond becomes less attractive. To compensate, the bond is sold below face value. This discount ensures competitive yields for investors.

Can Bond Discounts Impact Investor Returns?

Yes, bond discounts can significantly impact investor returns. Buying a bond at a discount can enhance yield. As the bond matures, the discount diminishes, increasing the bond’s value. This process, combined with coupon payments, can boost overall returns.

結論

Understanding bond discounts helps with financial planning. It highlights potential savings. Each semi-annual interest payment reduces overall costs. This knowledge aids in better investment choices. Investors can benefit from strategic decisions. Knowing bond behavior is crucial. It impacts future financial outcomes.

Simple insights can lead to greater financial stability. Make informed choices today. Reap benefits tomorrow. Use this understanding for your financial advantage.