決済オーケストレーションとは:取引の効率化

Have you ever wondered why some online payments feel seamless, while others are frustratingly complex? The secret often lies in a behind-the-scenes process called payment orchestration.

As a savvy consumer or business owner, understanding this concept can transform the way you handle transactions. Imagine streamlining your payments, reducing costs, and improving customer satisfaction, all while maintaining robust security. Intrigued? You’ll discover what payment orchestration is and how it can revolutionize your financial dealings.

Let’s dive into the details and unlock the potential to elevate your payment experience.

Payment Orchestration Basics

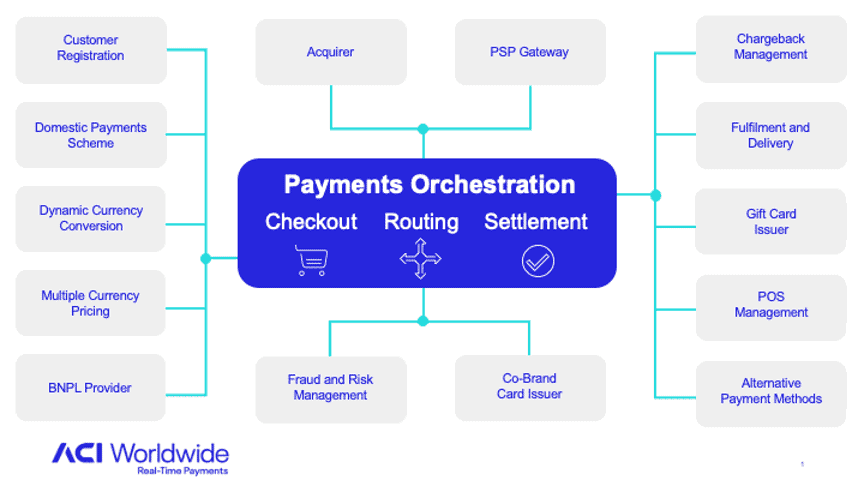

Payment orchestration helps businesses manage their payments. It connects many payment methods. This makes it easier to accept money from customers. Payment orchestration also improves speed and safety. It is like a conductor for payments. It helps make sure everything works together. Businesses use it to keep things simple. Customers can pay however they want. This makes customers happy.

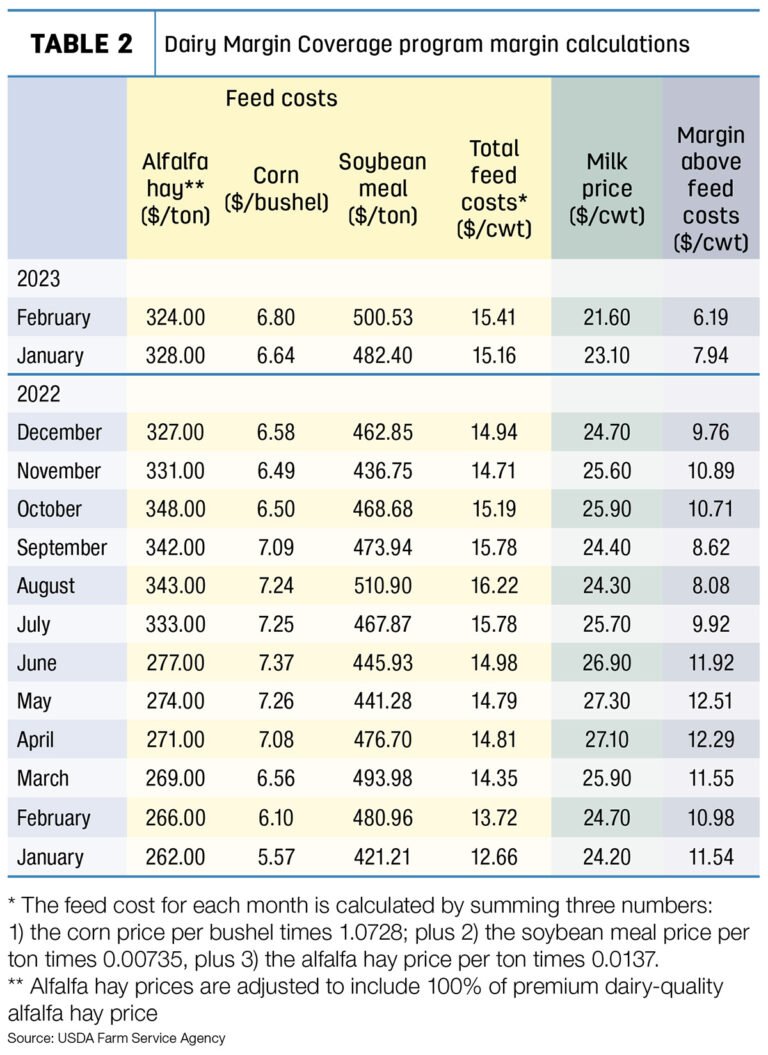

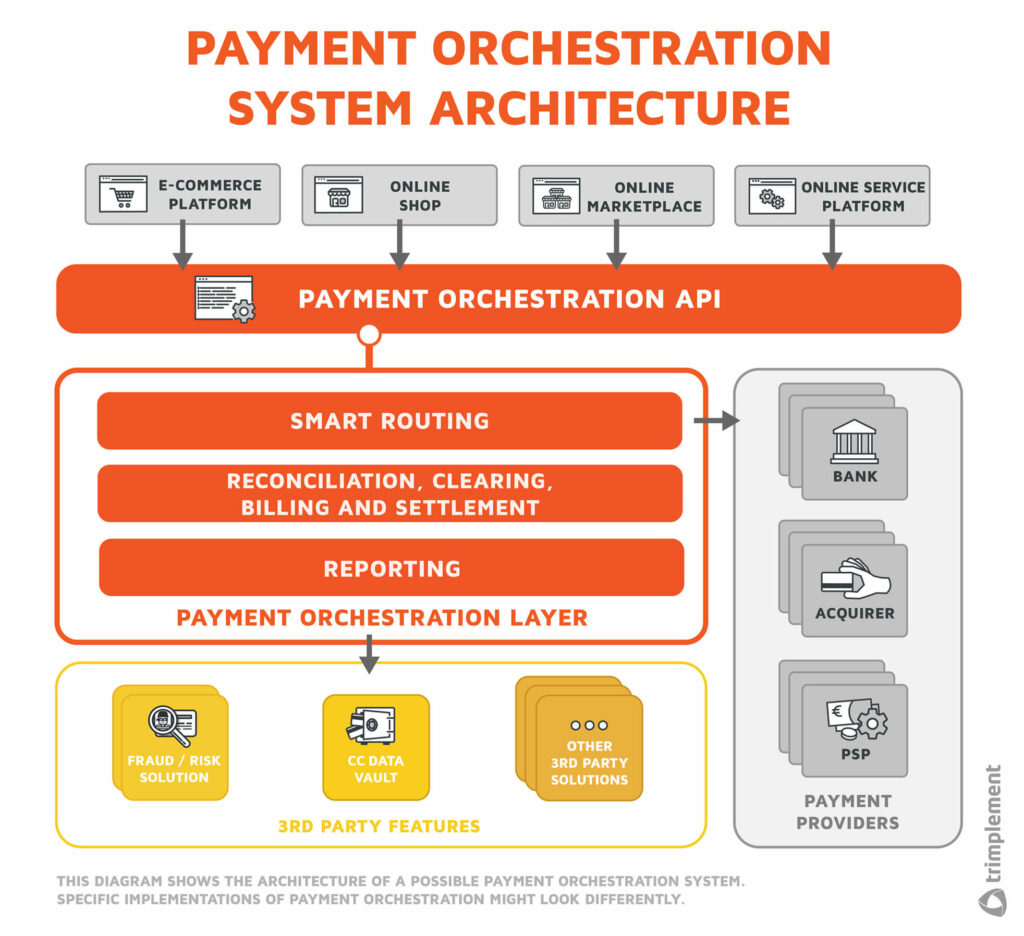

Several parts make up payment orchestration. First is the 決済ゲートウェイ. It processes payments. Second is the 決済処理業者. It sends money to banks. Third is the 詐欺防止 tool. It keeps payments safe. Fourth is the 支払方法. It includes cards and mobile payments. Fifth is the analytics. It helps track payments. All parts work together. Businesses use them to handle payments.

Benefits Of Payment Orchestration

Payment orchestration brings faster transaction times. This means less waiting for payments. Businesses can handle more payments at once. This boosts productivity. Systems work smoothly together. Errors are reduced, making operations more reliable.

Customers enjoy a simple checkout process. They have many payment options. This makes them happy. Happy customers come back. Payment orchestration allows businesses to offer local payment methods. This helps in different countries. Everyone gets a パーソナライズされた体験.

Businesses save money with payment orchestration. Lower 取引手数料 are possible. Systems are centralized, reducing the need for extra tools. Fewer resources are needed, which cuts costs. This is good for the business bottom line.

How Payment Orchestration Works

Payment orchestration helps manage different payment steps. It starts when a customer pays online. The system sends the payment details to the bank. Then, it checks if there is enough money. If yes, the payment goes through. Each step is smooth and fast. This makes paying easy for everyone.

Many businesses use payment gateways. These gateways help process payments. Payment orchestration connects with many gateways. This allows more options for customers. They can choose how to pay. Credit cards, e-wallets, or bank transfers. All options work well together.

Security is very important in payments. Payment orchestration includes fraud detection. It watches for bad activity. If something looks wrong, it stops the payment. This keeps money safe. Customers trust businesses more with strong security.

Challenges And Considerations

Navigating payment orchestration involves managing multiple payment gateways and methods efficiently. Security, integration, and cost are key challenges. Ensuring smooth transactions requires careful consideration of technology and compliance.

Technical Complexity

その complexity of payment orchestration can be overwhelming. Systems need to handle many transactions quickly. Ensuring smooth operation requires advanced technology. Developers must design systems that are 安全な and efficient. Integrating various payment methods adds to the challenge. These systems must be flexible and able to adapt. Constant updates and maintenance are necessary. Without proper management, problems may arise.

規制コンプライアンス

Regulatory compliance is crucial for payment systems. Laws vary across countries. Companies must フォローする these laws carefully. Failure to comply can lead to penalties. Staying updated with changes is essential. Compliance ensures 信頼 and safety for users. Organizations must invest in legal expertise. This helps navigate complex regulations.

Vendor Selection

正しい選択 vendor is critical. Vendors provide essential services and tools. Their reliability affects system performance. It’s important to assess their track record. Vendors should offer support and regular updates. Cost, service quality, and reputation matter. Selecting a vendor impacts overall success. Careful evaluation helps in making informed choices.

Future Trends In Payment Orchestration

AI can make payments faster. It helps detect fraud quickly. Machine Learning improves payment 正確さ. It learns from past data. This ensures safer transactions. Smarter systems lead to better user experiences.

Blockchain provides a 安全な way to track payments. It keeps data safe and private. Transparency is a key feature. This builds 信頼 with users. Transactions are faster and more reliable.

Companies want to reach more countries. Payment orchestration helps with global payments. It supports many currencies. This makes it easier for businesses. They can serve customers from different regions.

Choosing A Payment Orchestration Platform

Flexibility is crucial. Platforms must support various payment methods. Security is vital. Look for encrypted transactions. Ensure easy integration with existing systems. Choose platforms with global reach. Reliable customer support is key.

| プロバイダー | 特徴 | Support |

|---|---|---|

| Provider A | Global reach, strong security | 24/7 support |

| Provider B | Flexible integration, various methods | Email support only |

| Provider C | Encrypted transactions, easy setup | 営業時間限定 |

Start with a small test. Make adjustments based on feedback. Train staff thoroughly. Ensure all systems are ready. Monitor results closely. Address issues quickly. Optimize processes over time.

よくある質問

What Is Payment Orchestration?

Payment orchestration is the strategic management of payment processes. It involves integrating multiple payment service providers into a single platform. This streamlines transactions and enhances efficiency. Businesses use payment orchestration to optimize their payment infrastructure. It helps in reducing costs and improving customer experience.

Why Is Payment Orchestration Important?

Payment orchestration is vital for simplifying complex payment processes. It offers businesses flexibility by integrating various payment methods. This improves transaction success rates and reduces failed payments. It also enhances security and compliance. Overall, payment orchestration supports business growth and customer satisfaction.

How Does Payment Orchestration Work?

Payment orchestration works by connecting multiple payment gateways. It routes transactions through the most efficient path. It uses intelligent routing and dynamic rules to optimize payments. This ensures higher success rates and reduced transaction costs. It also provides real-time analytics and reporting.

What Are The Benefits Of Payment Orchestration?

Payment orchestration offers several benefits, including streamlined payment processes and cost reduction. It enhances transaction success rates and customer satisfaction. Businesses gain flexibility by integrating multiple payment options. It also provides robust security and compliance features. Real-time insights and analytics help in better decision-making.

結論

Payment orchestration simplifies complex payment systems. It makes transactions smoother and more reliable. Businesses can manage multiple payment methods easily. This system reduces errors and saves time. It also enhances security, keeping customer data safe. Adaptability is key in today’s fast-paced market.

Payment orchestration offers that flexibility. Businesses improve efficiency and customer satisfaction with it. It’s essential for growth in e-commerce. Consider implementing payment orchestration for better results. It’s a smart choice for any business. Stay ahead by optimizing your payment processes.