ACH Credit Deluxeとは? 簡単に説明

Have you ever glanced at your bank statement and noticed a transaction labeled “ACH Credit DeluxeDeluxe Payments”? You’re not alone.

These terms can sound complex and confusing, leaving you wondering what they mean and how they impact your finances. Understanding these transactions is crucial because they play a significant role in how money moves in the digital age. By decoding the mystery behind ACH Credit DeluxeDeluxe Payments, you can gain more control over your financial life and make informed decisions.

Stick with us as we unravel this financial enigma, empowering you with the knowledge you need to navigate your bank statements with confidence.

Ach Credit Deluxe Overview

ACH Credit Deluxe is a 支払方法. It lets money go from one bank to another. This is done electronically. People use it for paying bills そして sending money. Businesses also use it for 給与計算. The process is 安全 そして 安全な. It saves time because it is 速い. No need for チェック または 現金. Just use the bank account. It is also cost-effective. Banks may charge small fees. But it is usually less than other methods. Many people trust it. They like its simplicity. It works for many types of transactions. Easy to set up. Easy to use.

Basics Of Ach Payments

ACH payments are a way to move money. They stand for Automated Clearing House. This network helps send money between banks. It is used in the USA. People use ACH to pay bills or get paychecks. It is a safe and easy method. Businesses like it because it costs less. It is also faster than writing checks. Most people use ACH for online payments. It is very common in today’s world.

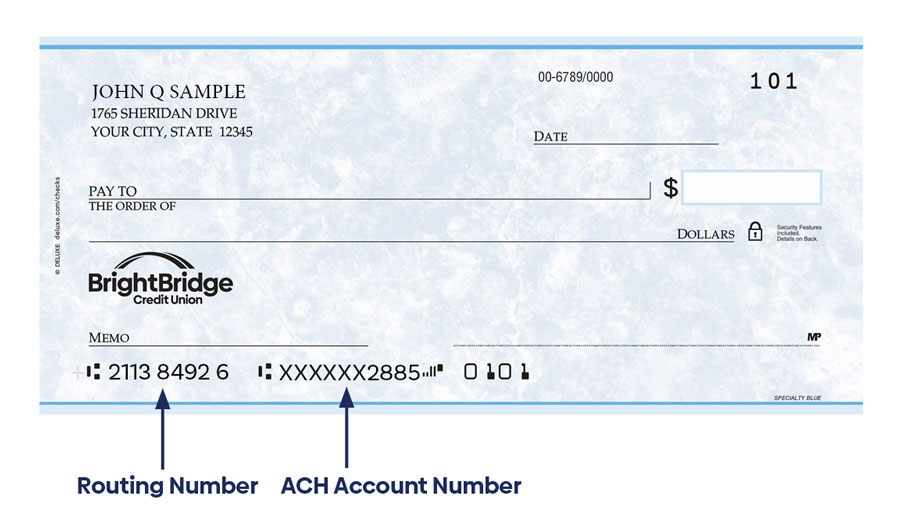

ACH transactions start with a request. Someone asks their bank to send money. The bank checks if there is enough money. If yes, the bank sends the request to the ACH network. The network clears the payment. Then, the money reaches the other bank. This process can take a few days. Banks do these steps in batches. This means they process many payments at once. It helps make the system efficient.

Features Of Deluxe Payments

Deluxe Payments offer many benefits. They are fast and easy. You can trust them. They are very secure. They keep your money safe. You can use them anytime. They work day and night. It is simple to set up. You can do it quickly. They have good support. Help is just a call away.

Businesses can save time. No need to handle checks. Payments are automatic. It helps with cash flow. Businesses get money faster. Tracking is easy. You can see all transactions. It reduces errors. Mistakes are less likely. It saves money. Less paperwork means lower costs.

Process Of Ach Credit Deluxe

ACH Credit Deluxe starts with the initiation of a payment. The sender gives the authorization to transfer money. This involves filling out a form with the bank. The bank needs to confirm the sender’s identity. Once confirmed, the process moves forward.

After initiation, the bank processes the transaction. Funds move from the sender’s account to the receiver’s account. The bank checks for any errors. If errors occur, the transaction stops. Successful transactions continue smoothly. This ensures safe and 効率的 payments.

セキュリティ対策

Ensuring Secure Transactions is very important for ACH Credit Deluxe payments. Every transaction uses strong encryption. This keeps your data safe. Special codes are used to protect information. These codes are hard to break. Only trusted systems can read these codes. This ensures that your money goes to the right place. Secure systems check all transactions. They look for anything unusual. If they find something, they stop the transaction. This keeps your money safe.

不正行為防止 is another key part. Systems are in place to spot bad actions. These systems watch for strange activities. They alert the team if they find any. This helps to stop fraud before it happens. Every step is watched carefully. This keeps your money and data secure. Teams work hard to protect your details. They use the best tools available. Your safety is always their top goal.

Comparing Ach Credit And Debit

ACH Credit Deluxe Payments allows businesses to transfer money directly between bank accounts efficiently. ACH Debit pulls funds from an account for transactions. Understanding these helps streamline financial operations.

Differences Explained

ACH Credit sends money to another account. ACH Debit takes money from an account. These methods are opposite. ACH Credit is good for paying bills. ACH Debit is used for subscriptions.

Use Cases For Each

- ACH Credit: Used for direct deposit, business payments, and bill payments.

- ACH Debit: Ideal for regular payments like gym memberships and utility bills.

Common Use Cases

企業 use ACH credit payments for many reasons. These payments are fast and safe. They help in paying salaries to employees. Vendors receive payments through ACH credits too. This method reduces paperwork. It saves time and money. Companies find it easier to manage cash flow. Automated processes make it simple. Reports are clear and easy to understand.

Consumers use ACH credit payments for オンラインショッピング. Bills are paid through ACH credits. This includes water and electricity bills. Rent payments can be made too. It’s secure and quick. Many people prefer this over cash. It reduces the need to visit banks. Transactions are easy to track. It’s a reliable option for everyday payments.

潜在的な課題

技術的な問題 can slow down payments. Systems may crash or freeze. This causes delays in processing payments. Software bugs might corrupt data. Important information can be lost. Network problems stop transactions. Payments can’t go through. Outdated systems struggle with new updates. They fail to work smoothly. Technical support may not be quick. This leaves users waiting for help. Security breaches are a risk. Data must stay safe.

Regulatory concerns are important for payments. Rules change often. Companies must stay updated. Non-compliance can lead to fines. This costs businesses money. Laws differ by region. Payments must follow local rules. Data privacy is a big issue. Personal information must be protected. Licenses are needed to operate legally. Without them, businesses face shutdowns. Regulatory bodies watch over payment systems. They ensure everything is legal.

Future Of Ach Credit Deluxe

Many people now use ACH Credit Deluxe for sending money. It is fast and safe. More banks are adding it to their systems. This makes it easy for everyone. Businesses like it too. They can pay workers quickly. People enjoy the 低料金. This saves them money. More shops accept it now. This means you can use it almost anywhere.

New tools make ACH Credit Deluxe better. These tools make it faster. They also make it more secure. You can now send money with a phone app. This is easy and quick. Many companies work on improving it. They want to make sure it is the best choice. People like these changes. It helps them manage their money well.

よくある質問

What Is Ach Credit Deluxe Payments?

ACH Credit Deluxe Payments are electronic transfers through the Automated Clearing House network. They allow businesses to send money directly to bank accounts. This method is efficient, secure, and cost-effective for transactions. It’s commonly used for payroll, vendor payments, and other business-related transfers.

How Do Ach Payments Work?

ACH payments work by transferring funds electronically between banks. The sender authorizes the transaction, and the bank processes it. Funds move between accounts through the Automated Clearing House network. This process is secure and typically completes in 1-2 business days.

Are Ach Credit Deluxe Payments Safe?

Yes, ACH Credit Deluxe Payments are safe. They use secure networks and encryption to protect transactions. Banks and financial institutions follow strict regulations. This ensures the safety and security of fund transfers. Always monitor your accounts for any unauthorized transactions.

How Long Do Ach Payments Take To Process?

ACH payments typically take 1-2 business days to process. The exact time depends on the banks involved. Transactions might be faster with same-day ACH options. However, regular processing times are generally within this timeframe. Planning ahead is recommended for timely transactions.

結論

Ach Credit Deluxe offers a simple way to handle payments. It provides a reliable, efficient process for both businesses and customers. Transactions are fast and secure, making it a preferred choice. Users appreciate its ease and convenience. This payment method can help improve financial management.

Businesses can streamline their processes with it. Customers enjoy hassle-free transactions. Understanding its benefits can enhance your payment experience. Consider using Ach Credit Deluxe for smoother financial operations. This method supports your needs efficiently and safely. Embrace this tool for a better financial journey.