分割払いの仕組み:簡単なガイド

Ever found yourself at a restaurant, staring at the bill, and wondering how to fairly divide the cost with friends? Or maybe you’ve been in a group project where sorting out who owes what becomes a headache?

That’s where split payments come in handy. Understanding how split payments work can save you time, stress, and maybe even a little money. Imagine having a method that simplifies dividing expenses, whether it’s a dinner bill, rent, or a shared gift.

You deserve an easy and straightforward solution to manage shared expenses, and this is exactly what split payment offers. So, how does it work, and how can it make your life easier? Let’s dive in and explore the mechanics behind split payments, so you can take control of your finances with confidence and ease.

What Is Split Payment?

Split payment means dividing a bill. Each person pays part of it. It helps friends share costs. For example, at a restaurant, the bill splits among diners. Everyone pays their share. This method avoids confusion. It keeps things fair and clear.

Online shopping uses split payment too. You can use multiple cards. Or mix gift cards with credit cards. This helps if one card has low balance. It makes buying easy and stress-free. Many apps offer split payment features. They simplify sharing costs with friends.

Businesses use split payment for invoices. It allows customers to pay in parts. This option helps with large bills. It provides flexibility and convenience. Split payment is a common practice. It makes handling money simpler for everyone.

Benefits Of Split Payment

Split payment helps share costs with others. This method makes it easier to divide bills. Friends can pay their part of a dinner bill. It’s simple and fair. Everyone pays exactly what they owe. No more arguing over money. Businesses use split payment too. It helps manage budgets better. Splitting payments is fast and secure. It’s perfect for online shopping. No need for cash or checks. Makes life less stressful.

Split payments are useful for subscriptions. Services like Netflix or Spotify offer this option. You can share costs with family or roommates. This saves money every month. Splitting payment is flexible. You can use it for many things. It works with apps and websites. Easy for everyone to use.

Types Of Split Payment

Equal split is very simple. Everyone pays the same amount. If a meal costs $60, and there are three friends, each pays $20. This method is fair when everyone consumes equally. It works best in group settings. No one feels left out. Everyone shares the cost evenly.

あ percentage split divides costs based on a share. One person might pay 30%, while another pays 70%. This is useful for different budgets. It works in business deals too. Each person pays based on their share. Fair and clear for all parties.

その custom split allows for any division. Each person decides how much to pay. Maybe someone had a smaller meal. Or someone wants to cover more. This method is flexible. It adjusts to personal needs. Everyone agrees on the amounts beforehand.

How Split Payment Works

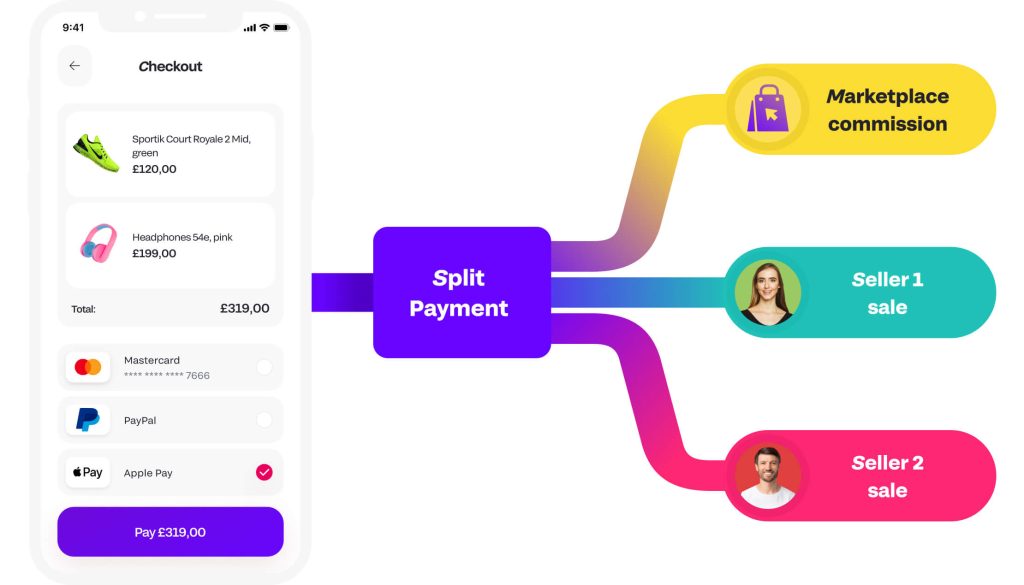

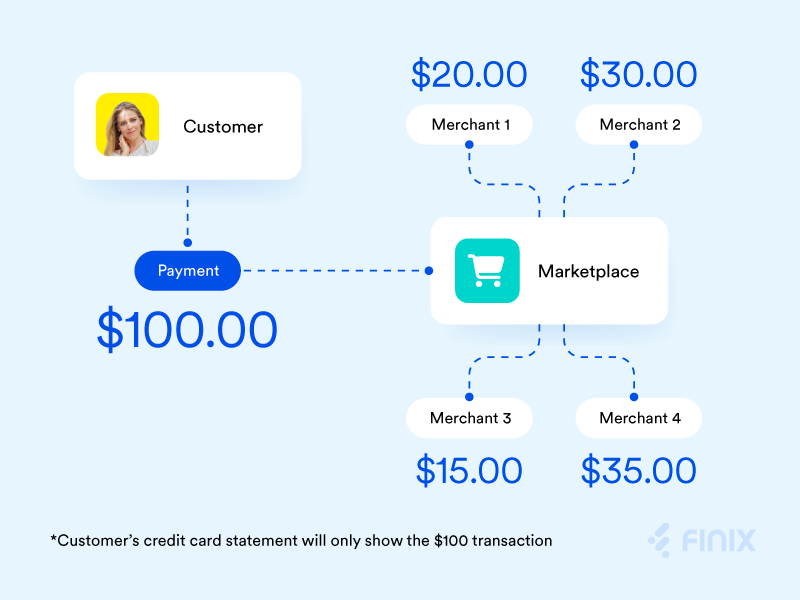

Split payment begins by setting up a payment system. This system divides payments between different parties. Businesses choose their partners. They connect their payment gateways. Each partner needs an account. These accounts help in tracking payments. Proper setup is crucial for accuracy. This ensures that each party gets the right amount.

Transactions are processed through the payment system. The system calculates how much each party gets. It uses preset rules. These rules decide the split. Customers make payments. The system splits the money. Everyone gets their share. This happens automatically. No manual work is needed.

Settlement is the final step. Each party receives their funds. This happens after the transaction. 和解 checks if the split was right. It confirms the amounts. Businesses check their accounts. Errors are corrected if found. This keeps the system fair. Everyone trusts the process.

Split Payment In Different Sectors

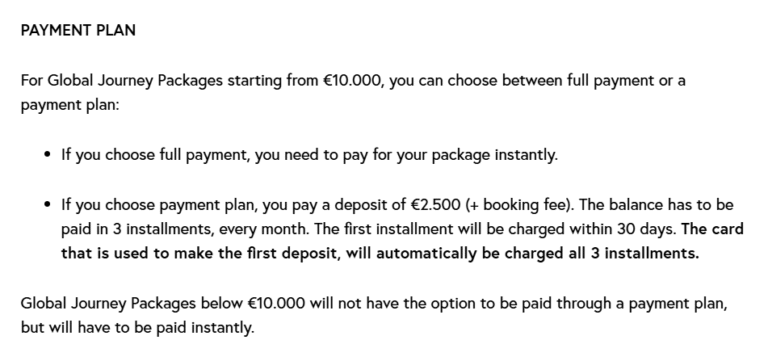

Split payment allows buyers to divide a transaction into multiple payments, suiting diverse sectors like retail and healthcare. This method offers flexibility by enabling partial payments from different sources or accounts. Businesses benefit from improved cash flow, while consumers enjoy manageable payment options.

E-commerce

E-commerce sites often use split payment. Buyers can pay with two or more methods. For example, part by card and part by gift card. This makes shopping flexible and easy. It also helps customers use all their payment options. Sellers get their money from different sources, ensuring a smooth transaction. This feature attracts more customers as they can manage their budget better.

Hospitality

In hotels and restaurants, split payments are common. Guests can pay part cash and part card. This helps them manage expenses better. Large groups can also split bills. Each person pays their share easily. Hotels often allow this for room charges too. It makes guests feel more at ease. Managing payments becomes simpler for staff.

Freelancing Platforms

Freelancers often work with split payments. Platforms pay them in parts. First, they get money after starting a project. Then, more payment comes after completing milestones. This ensures freelancers get paid for their work. Clients feel secure too. They pay after seeing progress. It builds trust between clients and freelancers.

Challenges Of Split Payment

Managing split payments involves complex coordination. Balancing multiple transactions can lead to errors. Distributing funds across different accounts often presents challenges in timely reconciliation.

Technical Limitations

Split payment systems often face complex technical challenges. Systems need to handle multiple transactions at once. This requires advanced coding and software. Many platforms struggle to integrate with old systems. Poor integration leads to errors and delays. Security risks also arise. Multiple transactions mean more chances for fraud. Developers must create strong defenses. They need to protect user data at every step.

Regulatory Concerns

Regulations vary across regions and countries. Payment systems must follow different laws. This can be hard for global businesses. Each country has its own rules for transactions. Companies need legal experts to help navigate these rules. Failure to comply can result in fines. Privacy laws also play a role. Systems must ensure data is safe. Users expect their information to be protected.

User Experience Issues

User-friendly design is crucial for split payment success. Systems can be hard to use. Users may find steps confusing. Poor design leads to frustration. It can cause users to abandon transactions. Clear instructions are needed. Users want smooth and easy experiences. They prefer simple processes without many steps. Companies must focus on improving interfaces.

Future Of Split Payment

Technology makes split payment easier and faster. Smartphones help people split bills. Apps are used to share costs with friends. ブロックチェーン makes transactions secure. Artificial intelligence suggests best ways to split. People use voice commands for payments. Wearables allow quick transactions. More ways to pay are coming soon.

More people use split payment now. オンラインショッピング sites offer split payment options. Restaurants allow bill splitting. Ride-sharing apps help passengers share costs. Subscription services let users pay together. Businesses want to offer split payments. 利便性 そして 容易に drive these trends. Everyone wants simple payment methods.

よくある質問

What Is Split Payment In Finance?

Split payment divides a transaction into multiple payments. It’s a method allowing buyers to use multiple payment sources. This can include credit cards, debit cards, or digital wallets. It’s commonly used in e-commerce and retail. Businesses benefit by offering flexible payment options, attracting more customers.

How Does Split Payment Benefit Businesses?

Split payment increases sales by offering flexibility. It allows customers to use multiple payment methods. This convenience can lead to higher conversion rates. Businesses can also reduce cart abandonment. Offering split payment can enhance customer satisfaction and loyalty. It helps businesses cater to diverse customer preferences.

Can Split Payment Be Used For Online Purchases?

Yes, split payment is widely used for online purchases. Many e-commerce platforms offer this feature. It allows buyers to pay with multiple cards or accounts. This flexibility can enhance the shopping experience. Online retailers benefit from increased sales and reduced cart abandonment.

It is a convenient option for customers.

Is Split Payment Secure For Transactions?

Yes, split payment is secure when using reputable platforms. Payment gateways use encryption to protect data. Security features safeguard customer information during transactions. It’s essential to use trusted services for safe payments. Businesses should ensure compliance with security standards. This helps maintain customer trust and data safety.

結論

Understanding split payment is crucial for modern transactions. It simplifies shared expenses. Businesses and individuals benefit from its ease. No more math headaches. Split payment tools handle it all. They offer transparency and speed. Perfect for group activities or outings.

Online platforms often support this method. Secure and straightforward. Embrace split payments for hassle-free financial management. They make budgeting easier. Enjoy peace of mind knowing costs are shared fairly. Ideal for today’s fast-paced world. Explore options and see how they fit your needs.

Happy sharing!