Stripeから銀行口座に送金する方法:簡単ガイド

Are you wondering how to smoothly transfer your hard-earned money from Stripe to your bank account? You’re not alone.

Many individuals and businesses use Stripe for its seamless payment processing, but when it comes time to access your funds, the process can feel a bit daunting. Imagine the relief and confidence you’ll feel knowing exactly how to make that transfer with ease and efficiency.

We’ll unravel the steps and provide you with clear guidance, ensuring your funds move without a hitch. Stick around, because unlocking the full potential of Stripe can make a significant difference in your financial management. Ready to take control of your transactions? Let’s get started.

Setting Up Your Stripe Account

Transfer money from Stripe to your bank easily. Connect your bank account. Follow simple steps for quick transfers. Regularly check your balance and transaction history to stay updated. Enjoy seamless transactions with Stripe.

Setting up your Stripe account is a crucial step in seamlessly transferring money to your bank account. Imagine Stripe as a bridge connecting your online business to your financial world. It’s designed to make transactions effortless. But before you can start moving funds, you need to lay a solid foundation. This means creating your account, verifying who you are, and linking it to your bank. Let’s walk through each step, ensuring your Stripe setup is smooth and secure. ###Creating An Account

Starting your Stripe journey is simple. Visit Stripe’s website and click on the “Sign Up” button. Fill in your details—name, email, and a strong password. This is your gateway to managing transactions efficiently. Remember, accuracy here saves headaches later. Once you’ve submitted your information, check your email for a confirmation link. Click it to activate your account. ###本人確認

Stripe values security. To protect both you and your customers, verifying your identity is essential. You’ll need to provide some personal information and documentation. This might include a government-issued ID and your Social Security number. This step ensures your account is legitimate and trustworthy. Have you ever wondered why verification is so critical? It’s all about maintaining trust in the digital payment ecosystem. ###銀行口座のリンク

After verification, it’s time to connect your bank account. Navigate to the “Payments” section and select “Bank Accounts”. Enter your bank details—account number and routing number. This is where Stripe will deposit your earnings. Stripe may send a small test deposit to ensure the connection is secure. Confirm the amount to complete the process. Linking your bank account opens the door to seamless transactions. Imagine the ease of having your business earnings just a transfer away. Setting up your Stripe account doesn’t have to be daunting. With each step, you’re building a robust framework for your business finances. Have you encountered any hurdles in setting up online financial systems before? How did you overcome them?Understanding Stripe Dashboard

Whether you’re new to Stripe or have been using it for a while, understanding the Stripe dashboard is crucial for managing your financial transactions seamlessly. The dashboard is your gateway to overseeing your payments, balances, and payouts. It’s designed with simplicity in mind, yet offers a robust set of features to help you transfer money to your bank account efficiently.

Imagine opening your Stripe account and being greeted by a clean, intuitive interface. It’s like walking into a well-organized workspace where everything you need is at your fingertips. The homepage presents an overview of your account activities, giving you quick insights into your earnings and recent transactions. You can easily access various sections through the sidebar, making navigation straightforward.

Take a moment to explore the different tabs available. The “Home” tab gives you a snapshot of your recent transactions and balances. The “Payments” tab is where you dive deeper into individual payments, with details like amount, date, and status. As you become familiar with these sections, transferring money from Stripe to your bank account becomes second nature.

Locating The Payouts Section

Transferring money from Stripe to your bank starts with finding the right section in your dashboard. Head over to the “Balance” tab in the sidebar. This is where you’ll find the “Payouts” section, a dedicated area for managing your money transfers. Here, you can view upcoming and completed payouts, along with their respective dates and amounts.

Clicking on the “Payouts” section reveals detailed information about each transfer. You can see which payouts are scheduled, giving you peace of mind knowing when your money will arrive in your bank account. It’s empowering to have this level of control and transparency over your finances.

Have you ever wondered how simplifying this process can free up your time for what truly matters? With Stripe’s easy-to-use dashboard, you don’t have to spend hours figuring out transactions. Instead, you can focus on growing your business or enjoying that cup of coffee, knowing your finances are well-handled.

Understanding the Stripe dashboard is more than just learning where to click; it’s about gaining confidence in managing your business’s money flow. By mastering the navigation and payouts section, you’re better equipped to handle financial matters swiftly and accurately. So, the next time you log into Stripe, take a moment to appreciate the ease and efficiency it brings to your financial management.

Initiating A Transfer

Initiating a transfer from Stripe to your bank is simple. Stripe offers a seamless process. Follow clear steps to ensure a smooth transaction.

Selecting The Right Options

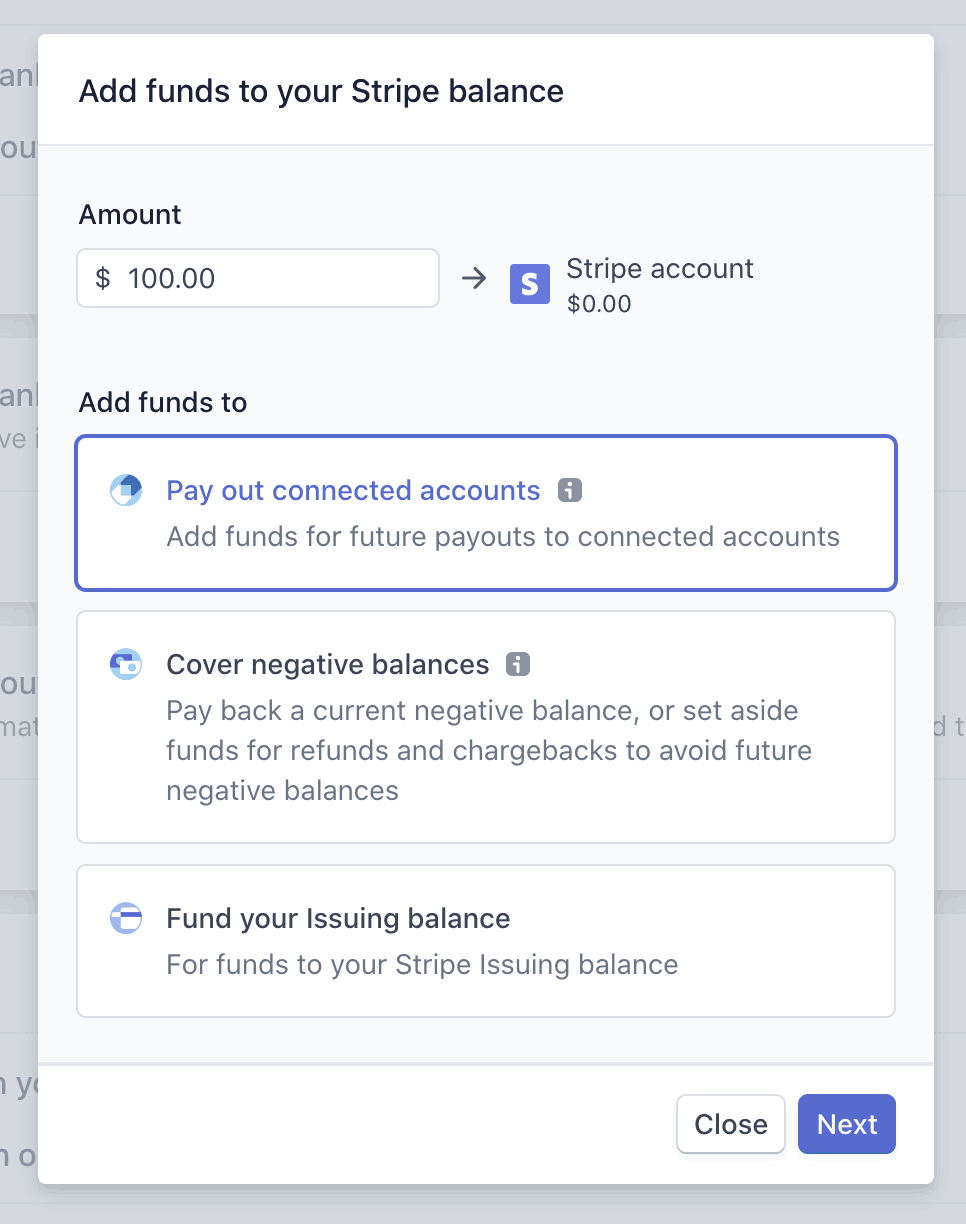

Log in to your Stripe account. Navigate to the dashboard. Look for the “Transfers” section. This section guides the transfer process. Choose “New Transfer” to begin. Ensure you select the correct bank account. Double-check to avoid errors.

送金詳細の入力

Input the amount to transfer. Ensure the amount is correct. Enter the transfer description. This helps in record-keeping. Choose the transfer type. Options may include instant or standard. Review all details carefully. Click “Submit” to initiate the transfer.

Managing Transfer Schedules

Managing transfer schedules in Stripe helps streamline your financial operations. Knowing when and how often to transfer funds can impact cash flow. This section will guide you through choosing between automatic and manual transfers. It will also explain how to set up transfer frequencies for efficient money management.

Choosing Automatic Vs Manual

Automatic transfers simplify the process. Funds move to your bank without extra steps. This option suits businesses wanting regular cash flow. Manual transfers give more control. Choose manual if you prefer deciding when funds move. It’s ideal for those with irregular income patterns.

Setting Up Transfer Frequencies

Transfer frequencies determine how often money moves from Stripe to your bank. Weekly transfers offer stability and predictability. They are suitable for businesses with consistent income. Monthly transfers suit businesses with fluctuating income. Decide the frequency based on your cash flow needs.

転送ステータスの監視

Monitoring your transfer status ensures your funds move smoothly to your bank. Stripe offers tools to track these transactions effectively. This process helps you stay informed and address any issues promptly. Let’s dive into the details.

Checking Transfer History

Log into your Stripe dashboard. Navigate to the “Transfers” section. Here, you can view all past transactions. Each entry lists the date, amount, and status. Use filters to find specific transfers. This feature provides a clear picture of your financial activity. Keep an eye on this section regularly. It helps you spot irregularities early.

Resolving Transfer Issues

Encountering transfer issues can be stressful. Start by checking the transfer status. See if it’s pending or failed. Ensure your bank details are correct. Errors here can delay transactions. Contact Stripe support if problems persist. They offer guidance and solutions. Keep your account details updated. This prevents future issues and ensures smooth transfers.

Ensuring Security And Compliance

Transfer money from Stripe to a bank account securely and ensure compliance with regulations. Safeguard transactions by following detailed steps and verifying details before finalizing transfers. Keep your financial data protected while adhering to industry standards.

Understanding Security Measures

Stripe uses advanced encryption to protect user data. This encryption ensures that personal information stays confidential. Stripe also employs robust authentication processes. These processes verify the identity of users. Regular audits and monitoring keep the system secure. Stripe’s security team works diligently to prevent breaches. Understanding these measures helps users trust the platform.Staying Compliant With Regulations

Compliance with regulations is mandatory for financial transactions. Stripe adheres to international and local laws. This includes anti-money laundering (AML) policies. Users must provide accurate information to meet compliance standards. Stripe maintains transparency in its operations. This ensures that all transactions follow legal guidelines. Staying informed about these regulations is essential for users.Tips For Efficient Transfers

Transferring money from Stripe to a bank account can be simple. By following some tips, you can make transfers efficient and smooth. Mistakes in transfers can delay your payments. Understanding best practices is key. Here are some tips to help you.

Avoiding Common Mistakes

Double-check your bank account details before initiating the transfer. Errors can cause failed transactions or delays. Ensure you have met Stripe’s minimum transfer amounts. This prevents unnecessary hold-ups. Monitor your email for any alerts from Stripe. They inform you about issues that need attention. Set up notifications to stay updated on your transfer status.

Maximizing Transfer Efficiency

Schedule transfers on business days to avoid weekend delays. Weekends can slow processing times. Use Stripe’s instant payout feature for urgent transfers. This might cost extra but saves time. Keep a record of your transaction history. It helps in tracking past transfers and spotting patterns. Regularly review your Stripe dashboard settings. Ensure they align with your transfer needs.

よくある質問

How Do I Link Stripe To My Bank Account?

To link Stripe to your bank account, log into your Stripe dashboard. Navigate to the “Settings” section and select “Bank accounts. ” Enter your bank details accurately. Stripe might require verification. Once linked, you can transfer funds from Stripe to your bank account seamlessly.

What Are The Fees For Transferring Money From Stripe?

Stripe charges a small fee for each transaction. The exact amount depends on your location and currency. Generally, it ranges from 1% to 3%. Always check Stripe’s official website for the most current fees applicable to your account.

How Long Does A Stripe Transfer Take?

Stripe transfers usually take 2-7 business days to reach your bank account. The duration can vary based on your bank’s processing times. Stripe provides notifications for each step, ensuring you know when to expect the funds in your account.

Can I Transfer Money From Stripe To Any Bank?

Yes, you can transfer money from Stripe to any bank account that supports electronic transfers. Ensure your bank details are correct to avoid delays. Stripe supports a wide range of banks globally, making it convenient for international transactions.

結論

Transferring money from Stripe to your bank is simple. Follow the steps carefully. First, link your bank account to Stripe. Next, check your account settings. Ensure all details are correct. Then, initiate the transfer. Transfers usually take a few days.

Be patient. Monitor your bank for the deposit. Contact Stripe support if issues arise. They can assist you. Now, you’re ready to manage your earnings. Remember, practice makes perfect. Keep using Stripe confidently. Happy transferring!