Transfer Money from Amex to Bank Account: A Quick Guide

Imagine having the power to move your money exactly where you want it, effortlessly and without hassle. If you’re an American Express cardholder, you’ve got a sleek financial tool right at your fingertips.

But do you know how to transfer money from your Amex to your bank account with ease? This guide is your key to unlocking that capability. You might be wondering if it’s complicated or if there’s a catch, and you’re not alone.

Many people feel uncertain about transferring funds between their credit cards and bank accounts. But fear not! We’ll break down each step clearly and simply, ensuring you’re fully equipped to handle your finances with confidence. Ready to discover how you can streamline your money transfers and take control of your financial flow? Keep reading to learn how simple it can be.

Understanding Amex Money Transfer

Amex Money Transfer allows easy movement of funds from your Amex card to your bank account. This service simplifies financial transactions, ensuring quick and secure transfers. Users appreciate the straightforward process, enhancing their overall banking experience.

Understanding how to transfer money from your American Express (Amex) account to a bank account can be a game-changer. It’s a useful skill, especially when you need quick access to funds for an unexpected expense or a timely investment opportunity. Whether you’re new to Amex or a seasoned cardholder, grasping this process ensures you’re in control of your finances and can make informed decisions with ease.How Does Amex Money Transfer Work?

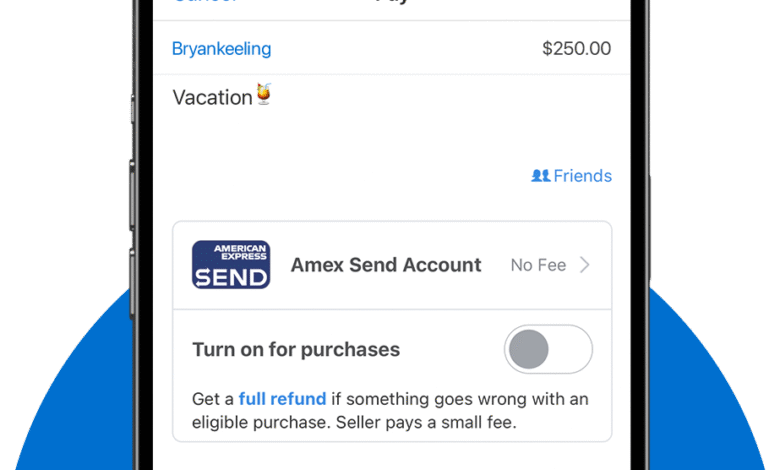

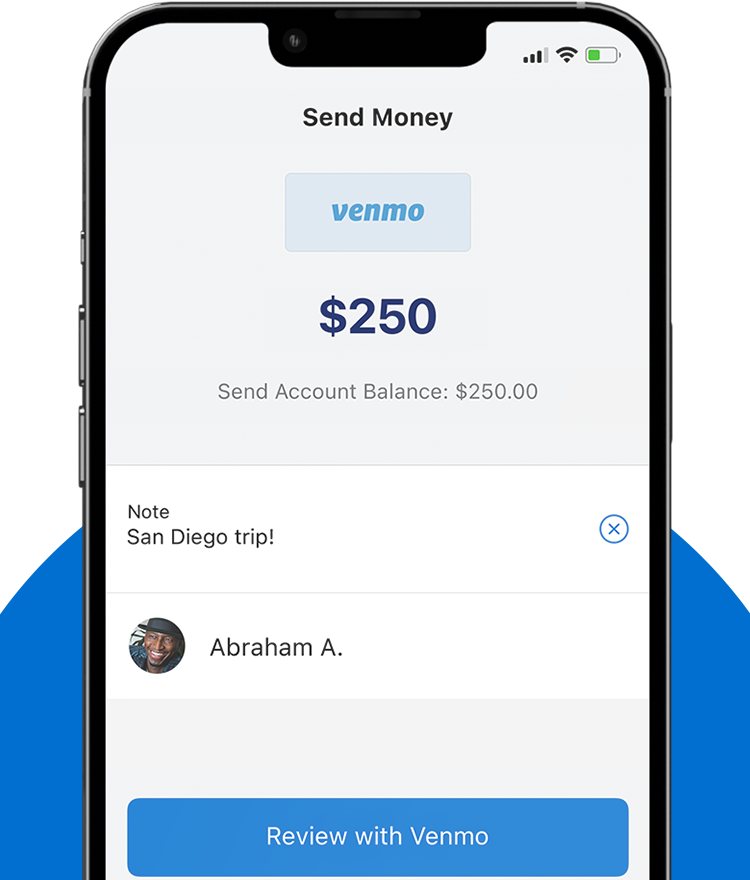

Amex offers a straightforward way to transfer money to your bank account. You can initiate a transfer through the Amex website or mobile app. Simply log in to your account, select the option to transfer funds, and enter the required details, such as your bank account number and the transfer amount. It’s as simple as ordering your favorite coffee online—just a few clicks and you’re done.What Are The Benefits Of Using Amex Money Transfer?

Using Amex for money transfers provides several advantages. One of the major perks is speed. Transfers are typically processed quickly, allowing you to access your money without delay. Additionally, Amex offers competitive transfer fees, often lower than those of traditional banks. This means you save money while managing your finances efficiently. Moreover, the security offered by Amex ensures your transactions are safe and secure, providing peace of mind.Considerations Before Making A Transfer

Before you hit that transfer button, there are a few things to consider. Check if your bank account is compatible with Amex transfers. Most accounts are, but it’s always good to verify. Be mindful of any limits on the transfer amount. These limits can vary based on your account type and transaction history. Also, review the fees associated with the transfer. While Amex often offers competitive rates, knowing the specifics ensures there are no surprises.Why Should You Use Amex Money Transfer?

Using Amex for money transfers is not just about convenience. It’s about having control over your financial transactions. Imagine needing to send money to a friend urgently. With Amex, you can do it fast and securely, avoiding the hassle of traditional banking methods. Plus, it allows you to manage your funds effectively, ensuring you’re prepared for any financial challenge.Common Issues And How To Solve Them

Occasionally, you might face issues like a delay in processing or incorrect account details. If this happens, contact Amex customer service immediately. They are known for their responsive support and will help resolve your problem promptly. Always double-check the details before confirming a transfer. This simple step can save you from potential headaches. Are you ready to try Amex money transfers? If you have questions or experiences to share, feel free to comment below!Setting Up Your Amex Account

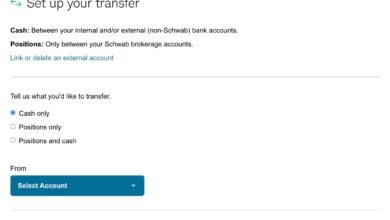

Setting up your Amex account for money transfers to your bank is straightforward. First, log into your Amex account. Then, link your bank details under the transfer section. Finally, initiate the transfer by entering the desired amount.

Creating An Online Account

Creating an online account with American Express is simple and quick. Start by visiting the Amex website and clicking on the “Create an Account” button. You’ll need to enter some basic details like your card number, personal information, and email address. Once you’ve filled in the details, hit “Submit,” and you’ll receive a confirmation email. Click the link in the email to verify your account. Now you can log in and explore the various features available to manage your card and finances.Collegamento del tuo conto bancario

Linking your bank account to your Amex account is essential for transferring money. Log in to your Amex online account and navigate to the “Payments” or “Transfers” section. Here, you can add your bank account by entering your bank details, including the account and routing numbers. Amex may perform a small test transaction to confirm your bank account. Keep an eye on your bank statement for a couple of small deposits. Once confirmed, your bank account will be linked, and you can transfer money seamlessly. Have you ever wondered how much time you could save by setting this up? With your Amex and bank account linked, transferring money is just a few clicks away. You’ll be able to manage your finances more efficiently, saving valuable time for other important tasks. Setting up your Amex account isn’t just about convenience; it’s about empowering you to take control of your financial transactions. Once you’re set up, you’ll wonder how you ever managed without it. Ready to make the most of your Amex account? Start today!Avvio del trasferimento

Start the process of transferring money from Amex to a bank account with ease. Log into your Amex account and select the transfer option. Follow the prompts to complete the transaction securely.

Initiating the transfer of money from your American Express (Amex) account to a bank account can seem daunting at first. However, with a little guidance, it can be a straightforward process. Whether you’re paying off your credit card, transferring funds for savings, or just need cash in your bank account, knowing how to efficiently initiate this transfer is crucial. Have you ever found yourself needing to transfer money from your Amex account to your bank account? You’re not alone. Many people face this need and aren’t sure where to start. Let’s break it down step-by-step.Begin by logging into your Amex account through their official website or mobile app. Make sure your internet connection is secure to protect your financial data. Once logged in, locate the section dedicated to money transfers or account management. You might find yourself surprised at how user-friendly the Amex portal is. It’s designed with you in mind, making navigation intuitive. Have you noticed how modern platforms prioritize simplicity?

Inserimento dei dettagli del trasferimento

After navigating to the transfer section, you’ll need to enter the necessary details. This includes your bank account number and routing number. Double-check these details to avoid any errors that could delay the transfer. Consider this: an error in one digit can lead to a completely different bank account. It’s happened to many, and it’s a headache you want to avoid. Wouldn’t you rather spend a minute verifying than days rectifying?Confirming The Transaction

Once you’ve entered the details, the next step is confirming the transaction. Review all the information you’ve inputted. It’s your chance to catch any mistakes before they become a problem. Click the confirm button with confidence. Have you ever experienced that relief after verifying everything is correct? It’s a small moment of triumph, knowing your money is on its way safely. Transferring money from Amex to your bank account is a skill that you can master with practice. Each successful transfer boosts your confidence for the next time. Are you ready to take control of your finances today?

Commissioni e spese

Transferring money from Amex to a bank account may incur fees. These charges depend on the transaction amount and destination. Always check the specific fees for your transfer before proceeding.

Informazioni sulle commissioni di trasferimento

When you initiate a transfer from your Amex to your bank account, you might encounter transfer fees. These fees vary depending on several factors, including the amount you’re transferring and the type of account. Some transfers might be free, especially if you’re shifting funds within the same country. But international transfers often come with higher charges. Always check the specific terms related to your card or account, as they can differ widely. Have you ever been surprised by a fee you didn’t expect? It’s a common issue many face, so don’t hesitate to contact customer service for clarity. This step can save you money and frustration.Currency Exchange Considerations

If you’re transferring money to an account in another currency, currency exchange rates will play a significant role. These rates fluctuate daily, impacting how much you ultimately receive in your bank account. Amex might charge a currency conversion fee, adding to the overall cost of your transaction. Keep an eye on exchange rates; even a slight change can affect large transfers significantly. It’s worth asking yourself: Is now the right time to transfer? Timing can be a strategic tool in minimizing costs, especially if you’re dealing with sizable amounts. With these insights, you can navigate the transfer process more effectively. Always weigh the fees against the benefits and keep your financial goals in focus.Tempi di trasferimento

Understanding the time it takes to transfer money from an Amex account to a bank account is crucial. Transfers don’t happen instantly. Knowing the timeframe helps in planning expenses and payments. Whether for personal or business purposes, being aware of transfer durations is essential.

Estimated Processing Times

The transfer from Amex to a bank usually takes 1 to 5 days. The exact time can vary by bank. Some banks may process transfers faster than others. Weekends and holidays can extend processing times. Always factor in these potential delays.

Fattori che influenzano la velocità di trasferimento

Several factors can influence transfer speed. Bank policies play a significant role. Each bank may have different processing times. Additionally, the type of Amex account affects speed. Personal accounts might differ from business ones. Time of day also matters. Transfers made late may process the next day.

Misure di sicurezza

When you’re transferring money from your American Express account to your bank, ensuring the security of your transactions is paramount. You want peace of mind knowing your hard-earned money is safe. The good news is that several security measures are in place to protect your data and detect fraudulent activity.

Protecting Your Information

Your financial information is sensitive, and protecting it is crucial. American Express uses advanced encryption technologies to keep your data secure during transfers. This means that your personal details are scrambled and only accessible to authorized systems.

Think of encryption as a digital padlock that only you and your bank can unlock. It’s important to ensure your own devices are secure too. Regularly updating your passwords and using two-factor authentication can add an extra layer of protection.

Have you ever paused before clicking a suspicious link? That’s a good instinct. Avoiding phishing scams can significantly reduce the risk of exposing your financial information. Always ensure you’re on the official American Express website before initiating any transfers.

Identifying Fraudulent Activity

American Express is vigilant about monitoring transactions for any unusual activity. They use sophisticated algorithms to identify potential fraud. If something seems amiss, you’ll be alerted promptly so you can take action.

Have you ever received a notification about a transaction you didn’t make? Your card issuer is watching out for you. It’s vital to report any discrepancies immediately to prevent unauthorized access to your funds.

Consider this: a sudden surge in small transactions can indicate fraud. Regularly reviewing your statements can help you spot such anomalies early. Being proactive about monitoring your account is one of the best ways to guard against fraudulent activity.

Security is not just a concern—it’s a responsibility shared by you and your financial institution. Are you doing everything you can to protect yourself? Implement these security practices to ensure your money stays where it belongs.

Risoluzione dei problemi comuni

Transferring money from your Amex to your bank account should be simple. Yet, sometimes unexpected issues arise. Understanding these common problems can make the process smoother.

Trasferimenti non riusciti

Sometimes, transfers don’t go through. This can be due to incorrect account details. Double-check your bank account number. Ensure you have entered the right routing number. Another reason could be insufficient funds in your Amex account. Confirm your balance before initiating a transfer.

Delays And Discrepancies

Money might take longer to reflect in your bank account. Check if there are any pending transactions. These can cause delays. Also, verify your account statements. Look for any discrepancies in the transferred amount. Contact Amex support for clarification if needed.

Contacting Amex Support

Contacting Amex Support is crucial for resolving issues with transferring money. Whether you’re facing technical problems or need guidance, Amex offers support. Getting in touch can ensure a smooth transaction process.

Available Support Channels

Amex provides several channels for customer support. You can call their customer service line. It’s often the fastest way to get help. They also offer support through email. This option is ideal for less urgent queries. Amex’s official website has a live chat feature. It’s convenient for quick questions. Don’t forget about their social media accounts. They often respond to inquiries there too. Choose the method that suits your needs best.

When To Reach Out

Reach out when you encounter issues transferring money. If you see unexpected charges, contact support immediately. Technical problems with online transfers need prompt attention. If you’re unsure about transaction limits, ask for clarification. It’s important to contact them during working hours. This ensures a quicker response. Always have your account information ready. It speeds up the support process.

Domande frequenti

How To Transfer Money From Amex To A Bank Account?

To transfer money from Amex to a bank account, log in to your American Express account online. Navigate to the transfer section, select your bank account, enter the amount, and confirm the transaction. Ensure your bank details are accurate to avoid errors during the transfer process.

Can You Link Amex Directly To A Bank?

Yes, you can link your Amex card directly to a bank account. This allows seamless transfers and payments. You’ll need to provide your bank account information during the setup process. Once linked, you can easily manage funds between your Amex and bank account.

What Are The Fees For Transferring From Amex?

Transferring money from Amex to a bank account might incur fees. These fees depend on the type of Amex account and the transfer method. Check with American Express for specific fee details. Often, fees are lower for online transfers compared to other methods.

How Long Does Amex Transfer Take?

An Amex transfer to a bank account usually takes 1-3 business days. The exact time can vary based on your bank’s processing times. Ensure all transaction details are correct to avoid delays. Weekends and holidays might extend the transfer duration.

Conclusione

Transferring money from Amex to a bank account is straightforward. First, understand the process. Next, follow the steps provided by Amex. Ensure your bank details are correct. This avoids any delays or errors. Double-check your transaction details. This ensures a smooth transfer experience.

Always keep track of your finances. It helps in managing your funds better. Regularly review your bank statements. This keeps you informed. With these tips, transferring funds becomes stress-free and efficient. Stay informed and enjoy seamless transactions.