How to Transfer Wisely Money to Bank Account: Smart Tips

Are you looking to transfer money to a bank account without losing a chunk of it in fees or getting stuck with delays? Transferring money might seem straightforward, but doing it wisely requires some insider knowledge.

Whether you’re sending funds to a loved one, paying a bill, or simply moving money between your accounts, knowing the right strategies can save you time, money, and a lot of stress. Imagine the peace of mind you’ll have when you know your money is moving efficiently and safely.

In this guide, you’ll discover practical tips and tricks that will empower you to make smart money transfers every time. Keep reading, because understanding how to transfer money wisely could transform your financial routine.

Choosing The Right Method

Transferring money to a bank account might seem straightforward, but choosing the right method can make a huge difference in terms of cost, speed, and convenience. Have you ever felt overwhelmed by the myriad of options available? You’re not alone. Knowing which method suits your needs can save you time and money. Let’s explore different options and see which one fits your circumstances best.

Bonifici bancari

Bank transfers are a reliable and secure way to move money. They are typically free if you’re transferring within the same bank. However, cross-border transfers might incur fees.

Imagine needing to send funds to family in another country. A bank transfer provides a trusted channel, but be prepared for possible delays and additional charges. Check with your bank to understand the specifics.

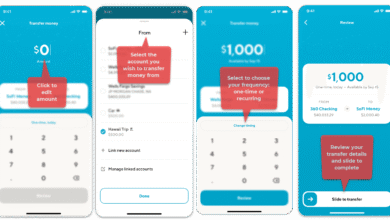

Portafogli digitali

Digital wallets offer a modern and fast alternative. They allow you to transfer money with just a few taps on your smartphone. Services like PayPal, Venmo, and Apple Pay are popular choices.

Have you ever paid a friend back for dinner using your phone? Digital wallets make it easy and often free for domestic transfers. Just ensure you and the recipient use the same service to avoid transfer fees.

Bonifici bancari

Wire transfers are ideal for large sums and international transactions. They provide a secure way to send money directly from one bank to another. However, they can be costly and take a few days to process.

Consider using a wire transfer for significant purchases or business transactions. While expensive, the security and reliability are worth the cost. Always compare fees from different banks to get the best deal.

Online Payment Services

Online payment services like TransferWise and Revolut offer competitive exchange rates and lower fees for international transfers. They are user-friendly and can often be managed through an app.

Have you ever been frustrated by hidden fees when sending money abroad? Online services are designed to be transparent and cost-effective. They might be your best option for sending money overseas without breaking the bank.

Each method has its pros and cons, and the best choice depends on your specific needs. What factors are most important to you when transferring money? Consider the cost, speed, and convenience to make an informed decision. Your wallet will thank you!

Evaluating Fees And Charges

Transferring money to a bank account involves understanding various fees and charges. These fees can significantly impact the amount received. Evaluating these costs ensures you make informed financial decisions. Knowing the types of fees can help avoid unnecessary expenses.

Hidden Costs

Some fees are not immediately visible. They might appear after the transaction. Always review the transaction details carefully. Look for any unexpected charges. These hidden costs can affect your budget. Understanding them prevents surprises.

Exchange Rates

Exchange rates play a crucial role in international transfers. They can alter the amount received. Always check the current rates before transferring. Compare different service providers for better rates. This step can save money and maximize your transfer.

Limiti di trasferimento

Many services impose limits on the amount you can transfer. These limits vary across different platforms. Know the maximum amount allowed for each transaction. It helps in planning large transfers effectively. Ensure your transfer does not exceed these limits.

Ensuring Security

Transferring money to a bank account needs extra caution. Security is vital. Online transactions are common. But they come with risks. Protecting your money is essential. Learn the best practices. Ensure your money is safe during transfers.

Secure Platforms

Choose a trusted platform for money transfers. Look for well-known services. They offer better security. Read user reviews. Check their security features. A secure platform protects your data. It keeps your money safe from threats.

Autenticazione a due fattori

Enable two-factor authentication (2FA) for your accounts. This adds an extra security layer. It requires a second form of verification. Often, it’s a code sent to your phone. This makes unauthorized access harder. Use 2FA for peace of mind.

Avoiding Scams

Scams are everywhere. Be cautious of suspicious emails or calls. Never share your bank details with strangers. Verify the identity of the person asking for information. Use official websites for transactions. Be smart and protect your money.

Timing Your Transfers

Transferring money wisely involves choosing the right time for transactions to minimize fees. Consider exchange rate fluctuations and bank processing times to optimize your transfer. Planning ahead ensures your money reaches its destination efficiently.

Transferring money to a bank account can be a straightforward process, but did you know that timing can impact the efficiency and cost of your transfers? Understanding when to send money can help you avoid unnecessary fees and ensure your funds arrive when you need them. Timing can be influenced by several factors, such as market fluctuations, banking hours, and public holidays. Let’s explore how these can affect your transfers and how you can make wise decisions.Fluttuazioni del mercato

The value of your money can change depending on market conditions. If you are transferring funds internationally, exchange rates can vary throughout the day. Timing your transfer during favorable market conditions can save you money. Consider monitoring exchange rates and setting alerts for optimal rates. This way, you can act quickly when rates are beneficial, potentially saving on currency conversion costs. Ask yourself: Is now the right time to send money, or should you wait for the market to shift?Banking Hours

Banks have specific hours when they process transactions. Sending money during banking hours can expedite the transfer process. Check your bank’s cut-off times for transactions. Sending money early in the day might mean it gets processed within the same day, reducing delays. Have you ever wondered why your transfer took longer than expected? It might be due to sending money after banking hours.Public Holidays

Public holidays can disrupt regular banking operations. Transfers initiated during holidays might experience delays. Plan ahead by checking your local calendar for upcoming holidays. If a holiday is approaching, consider transferring money in advance to avoid interruptions. Reflect on a time when a holiday delayed your transaction. How did it impact your financial plans? Choosing the right time to transfer money requires awareness of these factors. By strategically timing your transfers, you can optimize your financial transactions and ensure your funds are available when needed.Tracking And Confirmation

Transferring money wisely involves careful tracking and confirmation. Ensure your bank details are accurate before initiating transactions. Always verify transfer receipts to avoid errors and ensure funds reach the intended account.

Transferring money to a bank account can sometimes feel like sending your hard-earned cash into a void, leaving you wondering if it arrived safely. That’s where the importance of tracking and confirmation comes in. Ensuring that your money reaches its destination securely and quickly can save you from potential headaches and financial mishaps. Through effective tracking and timely confirmations, you gain peace of mind and control over your funds.Receiving Notifications

Receiving notifications about your money transfer is crucial. Many banks and financial platforms offer SMS or email alerts to confirm the status of your transaction. Have you ever felt the relief of getting that instant notification that your funds have safely landed in the recipient’s account? If not, it’s time to enable this feature. Real-time updates allow you to act promptly if something seems amiss. Most apps and services have easy-to-follow steps to set up these alerts. Make sure your contact information is up to date to avoid missing out on these crucial updates.Monitoring Transactions

Keeping an eye on your transactions gives you control and transparency. Regularly check your bank statements or use mobile banking apps to monitor the movement of your money. This practice helps you catch any unauthorized transactions early. Consider setting up a routine to review your accounts. Maybe every Sunday morning with a cup of coffee? You might even find unexpected charges or fees you weren’t aware of. By spotting these early, you can address them before they become bigger issues.Resolving Issues

What if you notice an issue with your transfer? Immediate action is key. Contact your bank or service provider as soon as you spot a problem. They usually have dedicated teams to assist with transaction disputes or errors. Prepare by having transaction details handy, such as the amount, date, and recipient information. Sometimes, your proactive approach can resolve issues faster than expected. Have you ever had a situation where a quick call or email sorted out a financial hiccup? Share your experience to help others navigate similar issues. Tracking and confirmation are not just technical steps; they are your tools for ensuring your money’s safety. How do you ensure your transfers are tracked and confirmed?

Utilizing Financial Tools

Transferring money to a bank account can seem daunting. But using the right financial tools simplifies the process. Financial tools help track spending, set alerts, and manage budgets. They provide insights into your financial habits. This ensures you transfer money wisely and stay on top of your finances.

Budgeting Apps

Budgeting apps organize your finances effectively. They allow you to set spending limits. This helps prevent overspending and ensures you save enough for transfers. Many apps categorize expenses automatically. This makes it easy to see where your money goes.

Some popular apps include Mint and YNAB. They offer user-friendly interfaces and helpful features. You can track your spending in real-time. This provides a clear picture of your financial situation.

Automated Alerts

Automated alerts keep you informed about your account activity. They notify you of balance changes and upcoming bills. These alerts help you avoid overdraft fees and missed payments. Setting alerts for low balances is useful. It prevents unwanted surprises.

Many banks offer alert services. You can customize them to suit your needs. This ensures you stay updated on your financial status.

Monitoraggio delle spese

Expense tracking highlights your spending habits. It helps identify unnecessary purchases. This allows you to cut back and save more money. Tracking expenses regularly shows patterns and trends. You can adjust your budget accordingly.

Many tools offer expense tracking features. They display spending data in easy-to-read charts. This simplifies the analysis of your financial behavior.

Understanding Transfer Policies

Transferring money wisely to a bank account involves understanding fees and exchange rates. Choose a reliable service for secure transactions. Keep transaction details handy for easy tracking.

Transferring money to a bank account is a common financial activity, but navigating the maze of transfer policies can be daunting. Understanding these policies is crucial to ensure your funds are transferred swiftly and securely. Whether it’s a local or international transfer, knowing the rules can save you time and unnecessary fees. Let’s dive into the essentials of transfer policies. ###Politiche bancarie

Every bank has its own set of rules for transferring money. These can include limits on how much you can transfer at once or within a day. Some banks may require you to authorize large transfers in person or via a secure app. For example, if your bank has a daily limit of $5,000 for online transfers, planning ahead can prevent delays. It’s also important to know about fees that might be attached to different types of transfers. Some banks charge for instant transfers while others might offer free transfers if you’re willing to wait a few days. Have you checked your bank’s transfer limits and fees recently? Keeping up with this information can help you make wise decisions. ###International Transfers

Sending money abroad involves additional considerations. Exchange rates can fluctuate, affecting how much your recipient actually receives. Some banks offer better rates than others, so it pays to shop around. Fees for international transfers can also add up quickly. A transfer fee of $30 might not seem like much, but it can be significant if you’re sending money frequently. Consider using services like Wise or PayPal for international transfers. They often offer competitive rates and lower fees compared to traditional banks. ###Conformità normativa

Compliance with regulations is non-negotiable. Banks and financial services must adhere to laws that prevent money laundering and fraud. This means you might need to provide identification or additional documentation for certain transfers. Have you ever been surprised by a request for extra paperwork during a transfer? Understanding these requirements upfront can make the process smoother. If you’re transferring a large sum, be prepared for scrutiny. Knowing the regulations can help you avoid unexpected delays and ensure your transfers are secure. Transferring money doesn’t have to be stressful. By understanding bank policies, considering international transfer options, and complying with regulations, you can make wiser choices. Are you ready to transfer your funds wisely and efficiently?Domande frequenti

How To Transfer Money To A Bank Account Wisely?

To transfer money wisely, compare fees and exchange rates. Choose reliable platforms like PayPal, Wise, or banks. Avoid peak times for better rates. Always double-check recipient details to prevent errors. Security is paramount; use encrypted connections and two-factor authentication for safe transactions.

What Are The Safest Money Transfer Methods?

Safest methods include bank transfers, PayPal, and Wise. These platforms use encryption and secure protocols. Always verify recipient details before transferring. Using two-factor authentication adds an extra security layer. Choose well-reviewed services to ensure reliability.

Can I Transfer Money Internationally Securely?

Yes, you can transfer money internationally securely using platforms like Wise or PayPal. These services offer secure transactions with encryption. Ensure you input correct recipient details to avoid errors. Comparing fees and exchange rates can help you save money while transferring internationally.

Are There Hidden Fees In Money Transfers?

Hidden fees can exist in some money transfers. Always check for transfer fees, conversion rates, and service charges. Platforms like Wise and PayPal often show fees upfront. Reading terms and conditions helps identify potential hidden costs. Compare different services to find the most transparent option.

Conclusione

Transferring money wisely ensures your funds reach their destination safely. Always double-check account details to avoid mistakes. Use secure methods to protect your information. Consider transaction fees to save money. Online banking can simplify the process. Set alerts for successful transfers.

Stay informed about exchange rates if sending abroad. Keeping records helps track your transactions. Trust reputable services for international transfers. Following these tips makes your money transfer experience smooth. Stay vigilant, and your funds will be secure.