Come trasferire denaro dal conto di trading alla banca facilmente

Imagine this: you’ve just made some successful trades and your trading account is looking healthier than ever. Now, it’s time to reap the benefits and transfer those earnings to your bank account.

But how do you go about it? This is a question many investors face, and finding the right answer can be crucial for managing your finances efficiently. You’ll discover a step-by-step guide to transferring money from your trading account to your bank account seamlessly.

We’ll simplify the process so you can focus on what truly matters—growing your wealth. Stick around to unlock the secrets to hassle-free money transfers and ensure your hard-earned cash lands safely where you want it.

Understanding Trading Accounts

Understanding trading accounts is crucial for anyone involved in trading. These accounts act as a bridge between you and the stock market. They hold your securities and facilitate buying and selling. Knowing how they work can make trading smoother and more efficient.

Types Of Trading Accounts

There are different types of trading accounts. Each serves specific needs. A cash account is the most basic type. You pay in full for each purchase. This is simple and low-risk. Then, there are margin accounts. These allow you to borrow money to buy more stocks. It increases potential returns but also risks. Options accounts let you trade options contracts. These are more complex and require experience.

Key Features And Benefits

Trading accounts offer various features. They provide easy access to stock markets. You can trade stocks, bonds, and other securities. They offer real-time tracking of your investments. This helps you make informed decisions. Trading accounts also come with analytical tools. These tools help in analyzing market trends. They offer insights into stock performance. Many accounts have low fees, making trading affordable. You can also benefit from customer support. This is helpful for resolving issues quickly.

Collegamento del tuo conto bancario

Easily transfer money by linking your bank account with your trading account. Access funds quickly and securely. Follow simple steps to ensure smooth transactions and manage your finances efficiently.

Selecting A Compatible Bank

Start by choosing a bank that is compatible with your trading platform. Most platforms offer a list of preferred banks to streamline the linking process. Check if your bank is on this list to avoid any compatibility issues. Consider the bank’s online services. A bank with a robust online banking platform can make transactions smoother and faster. It’s also beneficial if your bank offers low or no fees for electronic transfers. Make sure your bank account is active and in good standing. Any restrictions or issues with your account could delay the linking process. ###Processo di verifica

Verification ensures that the bank account you wish to link is indeed yours. This step is vital to prevent unauthorized access to your funds. You may need to provide proof of identity and account ownership. The trading platform might request small deposits or withdrawals to verify your account. These transactions confirm the connection and are typically reversed once verification is complete. Keep an eye on your bank statements for these transactions. Promptly confirm them with your trading platform to expedite the process. Are you prepared to ensure that your financial data remains secure during this process? Linking your bank account is more than just connecting numbers; it’s about securing and managing your financial resources effectively. By selecting a compatible bank and completing the verification process, you can enhance your trading experience.Avvio di un trasferimento

Transferring money from a trading account to a bank account is a straightforward process. It requires a few essential steps. Knowing how to initiate a transfer is crucial for seamless transactions. This process ensures your funds reach your bank safely and efficiently. Let’s explore the steps involved in initiating a transfer.

Steps To Transfer Funds

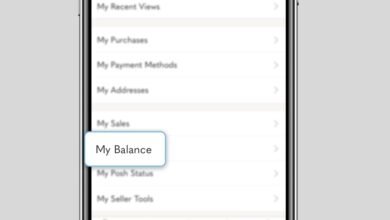

First, log into your trading account. Locate the ‘Transfer Funds’ option. This is usually found in the account settings or dashboard. Select the account you wish to transfer money from. Enter the amount you want to transfer. Ensure the details are correct before proceeding. Confirm the transfer request.

Next, verify your identity. This step is for security purposes. Some platforms may require a two-factor authentication. Follow the prompts on your screen. Once verified, your transfer request will be processed.

Finally, check your bank account. Confirm the arrival of your funds. Transfers can take a few hours or days. Keep your transaction ID handy for reference.

Choosing The Right Transfer Method

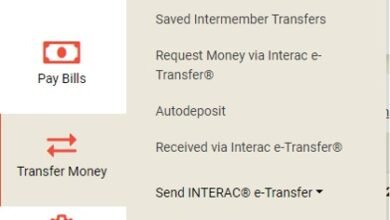

Different platforms offer various transfer methods. Direct bank transfers are common. They are reliable and secure. Some platforms also offer PayPal or wire transfers. Choose a method that suits your needs. Consider the speed and fees of each option.

Direct bank transfers are often free. They may take longer than other methods. PayPal might charge a fee but offers faster transfers. Wire transfers are quick but can be expensive. Assess the pros and cons of each method.

Always ensure your bank details are accurate. Incorrect details can delay your transfer. Double-check everything before confirming. This ensures a smooth and successful transaction.

Informazioni sulle commissioni di trasferimento

Transferring money from your trading account to your bank involves understanding fees and processes. Start by checking your trading platform’s withdrawal options and fees. Ensure your bank details are correct to avoid delays or additional charges.

Common Fee Structures

Transfer fees often differ based on the method you choose and the financial institution involved. Some platforms charge a flat fee per transaction, making it easier to predict costs. Others might impose a percentage fee based on the amount you are transferring, which can be more expensive for larger sums. Certain brokers offer free transfers if you’re moving funds between accounts within the same institution. However, moving money to a different bank might incur higher costs. Always check the fee schedule of your broker to avoid surprises.Modi per ridurre al minimo le commissioni

Consider timing your transfers strategically. If your broker offers a monthly free transfer, plan accordingly to take advantage of it. Instead of making multiple small transfers, consolidate them into fewer, larger ones to reduce fees. You might also find that using specific transfer methods can lower costs. Some platforms charge less for electronic transfers compared to wire transfers. Check if your broker has partnerships with banks that offer reduced fees for transfers. Have you explored loyalty programs with your broker? Many brokers reward frequent users with reduced fees or even waive them entirely after a certain number of trades. This could be a smart way to keep more money in your pocket. Understanding transfer fees is not just about saving money; it’s about optimizing your financial strategy. What steps will you take to maximize your earnings from your trading endeavors?Misure di sicurezza

Transferring money from your trading account to your bank account requires care. Security is a top priority to protect your funds. Understanding and implementing essential security measures ensures safe transactions.

Garantire transazioni sicure

Use a strong password for your trading account. Include numbers, symbols, and both uppercase and lowercase letters. Change your password regularly. Enable two-factor authentication for added security. This adds an extra step to verify your identity.

Check the website’s URL. It should start with “https://” indicating a secure connection. Avoid using public Wi-Fi when accessing your account. Public networks can be less secure and expose your information.

Recognizing Red Flags

Watch for unusual activities in your account. These may include unexpected login attempts or unauthorized transactions. Report any suspicious activities immediately to your financial institution.

Be cautious with emails or messages asking for your account details. Financial institutions will never ask for sensitive information via email. Verify the source before responding to any communication.

Keep your antivirus software updated. This protects your devices from malicious attacks. Stay informed about the latest security threats and scams.

Risoluzione dei problemi comuni

Transferring money from a trading account to a bank account can face common issues. Check account details carefully. Ensure sufficient funds are available. Contact support if errors occur.

Transferring money from your trading account to your bank account should be a straightforward process. However, sometimes things don’t go as planned, and you might encounter unexpected issues that can disrupt your financial flow. Understanding these common problems and knowing how to troubleshoot them can save you time and frustration. Let’s explore some typical challenges you might face and how to tackle them effectively.Trasferimenti ritardati

Delayed transfers can be frustrating, especially when you rely on timely access to your funds. Many factors can contribute to this delay. Sometimes it’s due to the processing time required by banks or trading platforms, which can take several business days. Double-check the platform’s processing timeline for withdrawals to set realistic expectations. If you’ve experienced a delayed transfer, contact customer support to ensure there are no hidden issues. Keep an eye on your email or platform notifications. Sometimes, additional verification steps are needed, which can slow things down. Always ensure your account details are correct to avoid unnecessary delays. Have you ever wondered why some transfers are quicker than others? It might be worth considering using instant transfer options that some platforms offer, though they may incur extra fees.Transazioni non riuscite

Failed transactions can be particularly worrying, especially if they involve large sums of money. There could be several reasons why a transaction fails. Common issues include incorrect bank details, insufficient funds, or technical glitches on the platform. Ensure your bank details are accurate and up-to-date. A simple typo could prevent a successful transfer. Check your account balance to ensure you have enough funds to cover the transaction, including any fees. Technical issues might be out of your control, but you can still take proactive steps. Try using different browsers or devices if you encounter repeated failures. You might be surprised how often this resolves the issue. If all else fails, reach out to customer support for assistance. They’re usually equipped to handle these situations and can offer solutions or alternatives. How do you handle failed transactions when they occur? Sharing your experiences can provide insight for others facing similar challenges. Being proactive and informed can make a world of difference in managing your financial transfers smoothly.Tips For A Smooth Transfer

Transferring money from a trading account to a bank account can be simple. Begin by logging into your trading platform. Follow the steps to transfer funds, ensuring your bank details are correct. Always check the transfer fees and processing time.

This ensures a hassle-free transaction.

Migliori pratiche

To start, always double-check the details. Ensure the bank account information linked to your trading account is accurate. A typo here could mean delays or even lost funds. Use secure connections. Always initiate transfers from a secure and trusted device. This reduces the risk of unauthorized access to your accounts. Consider the timing of your transfer. Some banks process transactions faster on weekdays. If you need the funds quickly, avoid initiating transfers on weekends or holidays.Evitare le insidie più comuni

One common mistake is not being aware of transfer fees. Some trading platforms charge for withdrawals, so it’s wise to review fee structures in advance. Don’t forget to keep records. Save confirmations and transaction IDs. This helps resolve any discrepancies that might occur. Be mindful of currency conversions. If your trading account and bank account operate in different currencies, there might be additional fees or exchange rate considerations. By focusing on these actionable tips, you can streamline the transfer process. What’s your biggest concern when transferring funds? Addressing these issues in advance can make your experience stress-free.Domande frequenti

How Do I Transfer Money To My Bank Account?

To transfer money, log into your trading account. Find the “Withdraw” or “Transfer Funds” option. Enter your bank details and the amount. Confirm the transaction. The process may take a few business days. Always check for any fees associated with the transfer.

Ci sono commissioni per il trasferimento di denaro?

Yes, transferring money may incur fees. These fees vary by trading platform and bank. It’s important to check your trading account’s fee structure. Some platforms offer free transfers under certain conditions. Always read the terms and conditions before initiating a transfer.

How Long Does The Transfer Process Take?

The transfer process usually takes 2-5 business days. The exact time depends on your trading platform and bank. Transfers initiated on weekends or holidays may take longer. Always check with your trading platform for specific timelines. Keep track of your transaction status through your account dashboard.

Posso trasferire denaro a livello internazionale?

Yes, many trading platforms allow international transfers. However, international transfers may have higher fees and longer processing times. Ensure your bank account can receive international transactions. Check for any currency conversion fees. Always verify the details with your trading platform and bank before proceeding.

Conclusione

Transferring money from a trading account to a bank account is straightforward. Follow the steps shared above to ensure a smooth transfer. Always check the fees and limits. This helps avoid unexpected surprises. Keep your account information secure. Protect your funds from unauthorized access.

Regularly review your statements. Stay informed about your transactions. Remember, each platform might have different rules. Always verify details before proceeding. With careful attention, you can manage your finances effectively. Stay organized to achieve your financial goals. Make each transaction with confidence and clarity.