Can I Transfer Money from Netspend to My Bank Account Easily?

Are you trying to figure out how to transfer money from your Netspend account to your bank account? You’re not alone.

Many people want to know how to make their money work seamlessly between different platforms. Whether you’re managing your finances or simply looking to streamline your money transfers, this question is crucial. Imagine the peace of mind you’ll feel knowing exactly how to move your money securely and efficiently.

By the end of this article, you’ll have a clear understanding of the process, empowering you to make informed decisions with your finances. Stick around, and let’s unlock the secrets to hassle-free money transfers together!

Netspend Overview

When you think about managing your finances, convenience is key. Netspend is a financial service that offers prepaid debit cards, providing you with an easy way to handle your money without needing a traditional bank account. But what exactly makes Netspend stand out, and how can it fit into your financial lifestyle?

Understanding Netspend Services

Netspend provides prepaid debit cards that are both user-friendly and accessible. With no credit check required, it’s an option for those who might struggle with traditional banking. You can load money onto your card, use it for purchases, and even withdraw cash at ATMs.

Netspend also offers online account management tools. You can monitor your spending and receive alerts. This makes it easy to stay on top of your finances without the hassle of paper statements.

Features And Benefits Of Netspend

One significant benefit of Netspend is its Direct Deposit feature. You can have your paycheck or government benefits deposited directly onto your card. This means faster access to your money and avoiding the need to cash checks.

Netspend also comes with a range of cardholder benefits. These include purchase protection and a rewards program. You can earn cash back on eligible purchases, which is a nice perk for regular users.

How Netspend Compares To Traditional Banking

Netspend can be a lifesaver for those without access to traditional banking. It provides a straightforward alternative with fewer fees. However, it lacks some features of traditional banks, like interest on savings.

For many, the flexibility of not having a checking account is appealing. However, it’s important to weigh the pros and cons based on your financial needs. Would you prefer the simplicity of a prepaid card, or do you value the features of a full-service bank?

Is Netspend Right For You?

Choosing a financial service is personal and should align with your lifestyle. If you need a simple solution without the constraints of a bank, Netspend could be a great choice. It offers autonomy and control over your money.

However, consider how often you’ll need to transfer funds to a bank account. While Netspend is convenient for spending, transferring money to a bank account involves extra steps. Are you comfortable with this process, or do you need more direct access to bank services?

By understanding how Netspend works, you can make informed decisions. Whether you’re using it as a primary financial tool or a supplementary one, knowing its features will help you maximize its benefits. Always consider what works best for your unique financial situation.

Transferring Money To Bank

Transferring money from Netspend to a bank account is possible. Simply link your bank account to your Netspend account. Follow the steps provided by Netspend to complete the transfer easily.

Transferring money from your Netspend account to your bank might seem like a simple task, but it opens up a world of convenience. Picture having instant access to your funds, whether you’re planning a holiday or just paying bills. The process is straightforward, yet a few tips can make it seamless. Let’s dive into how you can effectively transfer money from your Netspend account to your bank. ###Understanding The Basics

The first step is knowing what you need. Start by ensuring that your Netspend account is linked to your bank account. This linkage is crucial for smooth transfers. Have your bank’s routing number and your account number handy. Is your bank account already linked to Netspend? If not, this is your starting point. ###Setting Up Your Transfer

Once you have the necessary information, log into your Netspend account. Look for the money transfer option, usually located in the account dashboard. Enter your bank account details carefully. Double-check to avoid errors—mistakes can delay your transfer. ###Timing And Fees

Wondering how long it takes for the money to show up in your bank account? Usually, transfers can take up to 2 business days. Timing can vary depending on your bank’s processing times. Are you concerned about fees? Netspend might charge a small fee for the transfer. Always check the fee structure before initiating the transfer. ###Security Tips

Security is paramount when transferring money. Ensure you’re using a secure network when accessing your accounts. Avoid public Wi-Fi. Have you ever thought about setting up account alerts? They can notify you of successful transfers and any suspicious activity. ###Problemi comuni e soluzioni

Sometimes transfers might not go as planned. Double-check your account numbers and routing numbers if the transfer fails. Have you ever faced delays? Your bank’s processing time could be the reason. Contact your bank for clarification if a transfer seems stuck. ###Is It Worth It?

Transferring money to your bank account can offer peace of mind. You have more control over your funds and can manage your finances effectively. Consider the benefits: easier bill payments, faster access to cash, and more flexibility in managing your money. Isn’t that worth exploring? You have the tools to make your money work for you. Why not take advantage of them?Methods For Transfer

Transferring money from your Netspend account to your bank is simple. Use the Netspend app or online account. Follow the steps to link your bank. Once linked, initiate the transfer. Transactions may take 1-3 business days. Always ensure correct bank details to avoid errors.

Online Transfer Option

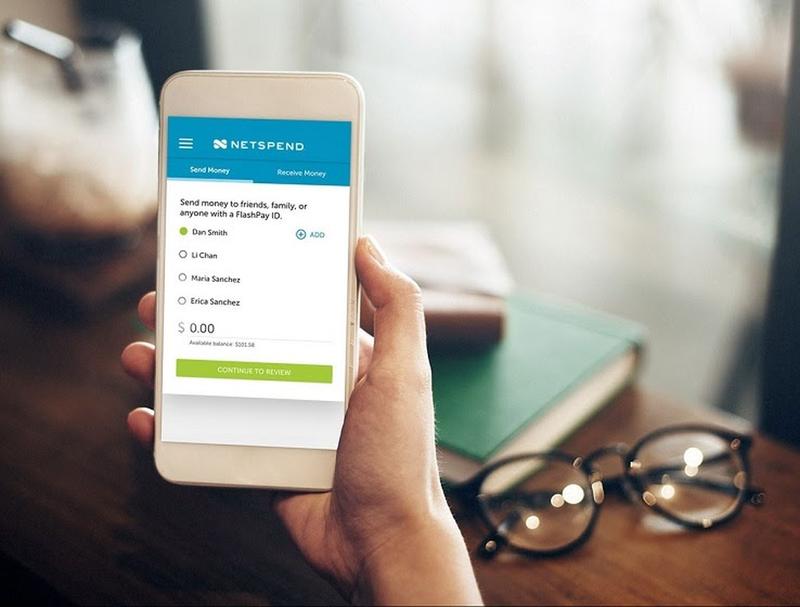

Online transfers are a popular choice for many users. They offer the convenience of managing your funds from the comfort of your home. You can initiate a transfer by logging into your Netspend account on their website. Once logged in, navigate to the transfer section. Here, you’ll find an option to transfer funds directly to your bank account. Ensure you have your bank’s routing and account numbers handy. Have you ever found yourself needing to transfer money quickly, only to realize you don’t have the right information at hand? Always keep your banking details updated.Mobile App Process

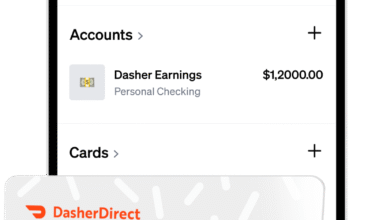

Do you prefer handling your finances on the go? The Netspend mobile app is an excellent tool for this. With just a few taps, you can transfer funds to your bank account directly from your phone. Download the Netspend app if you haven’t already. Once installed, log in and look for the transfer feature. It’s usually straightforward, but if you encounter any issues, the app often provides helpful prompts. Make sure your app is updated to avoid any glitches during the transaction.Direct Deposit Option

Direct deposits can be a lifesaver if you often receive regular payments. They allow money to be transferred automatically from your Netspend account to your bank account on a set schedule. This method is ideal for those who receive regular payments like salaries or benefits. To set this up, you’ll need to provide your bank’s details to Netspend. Consider how much easier your life could be when you don’t have to manually transfer funds every month. It’s a set-it-and-forget-it method that ensures you never miss a payment date. Each method offers its unique benefits. Whether you value convenience, speed, or automation, there’s a solution tailored for you. Are you ready to streamline your financial processes with these transfer methods?

Setting Up Transfers

Setting up transfers from your Netspend account to a bank account is simple. It involves linking your bank account and verifying your details. This guide will help you understand the process. Follow these steps to ensure a smooth transfer.

Collegamento del conto bancario

First, access your Netspend account online. Locate the option to add a bank account. Enter your bank account details carefully. Provide your bank’s routing number and your account number. Double-check the information to avoid errors. This step is crucial for successful transfers.

Processo di verifica

Verification ensures your account is secure. Netspend may send small deposits to your bank account. Check your bank statement for these deposits. Log back into your Netspend account to verify the amounts. Enter the deposit amounts accurately to complete verification. This process confirms your ownership of the bank account.

Commissioni e spese

Transferring money from Netspend to a bank account involves fees and charges. Understanding these costs is crucial for managing finances effectively. This section will explore the standard fees and any hidden charges associated with this process.

Standard Fees

Netspend typically charges a transfer fee. This fee can vary based on the transfer method. Some users may face a flat fee. Others might pay a percentage of the transfer amount. Always check the current fee structure. This ensures no surprises during the transfer.

Costi nascosti

Hidden charges can sometimes occur during transfers. These might include foreign transaction fees. Or processing fees not clearly mentioned. Reviewing the terms and conditions helps. This ensures awareness of all potential charges. Staying informed avoids unexpected costs. Always keep an eye on your account statements.

Misure di sicurezza

Transferring money from Netspend to a bank account involves secure steps to protect your funds. Ensure your account details are correct to avoid errors. Always use trusted networks and keep your login information confidential for safe transactions.

When transferring money from your Netspend account to your bank account, security should be your top priority. It’s not just about convenience; it’s about ensuring your hard-earned money is safe. In this section, we’ll explore the security measures Netspend implements to protect your transactions.Encryption And Protection

Netspend uses advanced encryption technology to keep your data secure. This means your personal information is scrambled into a code during transactions, making it nearly impossible for hackers to access. Consider this: when you log in to your Netspend account, the site uses HTTPS, a protocol that ensures secure communication. It’s like having a digital lock on your account. But do you ever wonder how encryption impacts your daily transactions? It ensures that even if someone tries to intercept the data, they can’t make sense of it.Prevenzione delle frodi

Netspend has robust fraud prevention measures in place to safeguard your money. They monitor accounts for unusual activity and can alert you if something seems off. Think about a time when you received an alert about a suspicious transaction. This immediate notification can save you from potential loss. You can also add layers of protection by setting up alerts for every transaction. This keeps you informed and in control of your account. How often do you review these alerts? Regular checks can help you spot inconsistencies early, ensuring peace of mind. Remember, security isn’t just a feature—it’s an ongoing commitment to keeping your financial life safe. By understanding and utilizing these measures, you can confidently manage your funds.Common Issues

Transferring money from Netspend to a bank account can sometimes face hurdles. Users often encounter issues like declined transfers or incorrect details. Understanding these common problems can make transactions smoother.

Troubleshooting Tips

Check your bank account details before transferring. Mistakes in account numbers can cause failed transactions. Ensure your Netspend account has enough balance for the transfer. Insufficient funds can lead to declines. Update your app or browser to the latest version. This can fix any software-related issues. Clear cache and cookies if you face repeated errors. This step can resolve loading problems.

Assistenza clienti

Reach out to Netspend’s customer support for persistent issues. They offer help through phone and online chat. Have your account details ready for quicker assistance. Ask about any fees that might affect your transfer. Understanding these can prevent surprises. Follow up if issues aren’t resolved promptly. Persistence can help ensure your problem gets attention.

Benefits Of Transferring

Transferring money from Netspend to your bank account offers ease and flexibility. It ensures quick access to funds. This process helps in better financial management and keeps your money safe.

Transferring money from a Netspend account to your bank account can bring numerous benefits. Whether you’re looking for convenience or better financial management, understanding these perks can help you make informed decisions. Let’s dive into how this process can improve your financial life.Convenience Factors

Imagine being able to move your money with just a few clicks. Transferring funds from Netspend to your bank account offers unmatched convenience. You don’t need to visit a bank or an ATM, saving you valuable time. This ease of access means you can manage your funds anytime, anywhere. Whether you’re on vacation or simply at home, you have complete control over your finances. This level of convenience might even make you wonder why you haven’t started doing it sooner. Additionally, the digital nature of these transactions means fewer chances of errors compared to handling physical cash. It’s a seamless process that ensures your money gets where it needs to be safely and efficiently.Financial Management

Transferring money to your bank account also plays a crucial role in effective financial management. Having your money in one place allows for better tracking and budgeting. You gain a comprehensive view of your finances, making it easier to plan for your future. Moreover, keeping a consolidated account helps in monitoring your spending habits. You can easily identify areas where you might be overspending and make necessary adjustments. This insight is invaluable for anyone aiming to improve their financial health. You can also set up automatic transfers to your savings account, fostering a habit of saving. This simple action can lead to significant savings over time, helping you reach your financial goals faster. Isn’t it empowering to take charge of your financial well-being with such simple steps?

Domande frequenti

How Do I Transfer Money From Netspend To My Bank?

Transferring money from Netspend to your bank is simple. Log into your Netspend account and select “Transfer Money. ” Choose your bank account, enter the amount, and confirm the transfer. Ensure your bank account is linked to avoid any issues.

C'è una commissione per il trasferimento di denaro?

Netspend may charge a fee for transferring money to your bank. Fees vary based on your account type and transfer method. Always check the fee structure on Netspend’s website or contact customer service for accurate information.

Quanto tempo richiede il trasferimento?

The transfer time from Netspend to your bank usually ranges from 1 to 3 business days. Factors like bank processing times can affect this duration. For quicker transfers, consider using instant transfer options if available.

Can I Transfer Money From Netspend Internationally?

Netspend primarily supports domestic transfers. For international transfers, you may need additional services or accounts. Verify if your bank and Netspend offer international transfer options. Always check the associated fees and regulations for international transactions.

Conclusione

Transferring money from Netspend to your bank account is straightforward. Start by linking your bank account on the Netspend app or website. Follow the prompts to transfer funds securely. It’s simple and helps manage your finances better. Remember to check any fees before proceeding.

Funds typically transfer within a few days. This method offers convenience and control over your money. Now, you can handle your finances with ease. Stay informed and make the best financial choices. Keep your money moving safely and efficiently. Always check your bank’s terms and conditions for any changes.