Quel est le code de signature sur une carte de crédit

Vous pourriez penser que le code de signature Sur votre carte de crédit se trouve la clé d'un coffre-fort souterrain rempli de trésors, mais son rôle est bien plus pratique. Cet ensemble de chiffres apparemment insignifiants joue un rôle essentiel dans sécuriser vos transactionsComprendre son objectif et son fonctionnement pourrait vous éviter fraude potentielleAlors, à quoi sert exactement ce code et pourquoi devriez-vous vous y intéresser ? Explorons les subtilités de ce petit mais puissant protecteur de votre sécurité financière.

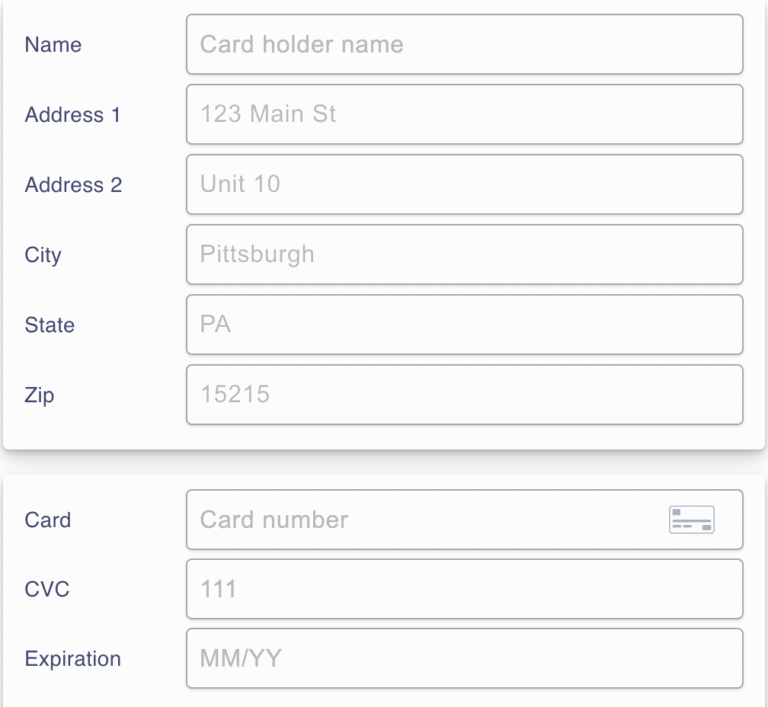

Définition du code de signature

UN code de signature, souvent trouvé au dos de votre carte de crédit, est un identifiant alphanumérique unique qui vérifie votre identité lors des transactions. Ce code est généralement composé de trois ou quatre chiffres et fait partie d'un mesure de sécurité Pour éviter toute utilisation non autorisée. Lors d'un achat, il vous sera généralement demandé de saisir ce code, ainsi que votre numéro de carte et sa date d'expiration, offrant ainsi une protection supplémentaire. Il est essentiel de préserver la confidentialité de ce code, car sa divulgation peut entraîner des pertes. activités frauduleusesIl est important de comprendre la signification du code de signature pour maintenir votre sécurité financière et protégez vos informations personnelles dans le contexte actuel des transactions numériques. Assurez-vous toujours que les informations de votre carte sont protégées.

Objectif du code de signature

Le code de signature sert de critique mesure de sécurité, garantissant que seul le titulaire légitime de la carte peut autoriser les transactions et vous protège contre les fraudes potentielles. Lorsque vous utilisez votre carte de crédit, ce code sert d'outil de vérification pour confirmer votre identité. Il permet aux commerçants de confirmer que vous êtes bien le propriétaire légitime, minimisant ainsi les risques de fraude. utilisation non autorisée. De plus, en cas de litiges ou frais frauduleux, disposer d'un code de signature peut être essentiel pour résoudre les problèmes, car il constitue un point de référence pour les deux parties. En exigeant cette couche d'authentification supplémentaire, les sociétés de cartes de crédit souhaitent renforcer votre sécurité globale, vous permettant ainsi de faire vos achats en toute confiance, sachant qu'une protection est en place contre le vol d'identité et les pertes financières.

Comment fonctionnent les codes de signature

Les codes de signature fonctionnent comme un identifiant unique lié à votre carte de crédit, garantissant que vous seul pouvez autoriser les transactions en comparant votre signature manuscrite à celle enregistrée. Lorsque vous signez pour un achat, le commerçant compare cette signature à ses archives. Si elles concordent, votre transaction est approuvée.

Voici une description du fonctionnement de ce processus :

| Étape | Description |

|---|---|

| 1. Capture de signature | Vous signez le reçu. |

| 2. Vérification | Le marchand compare les signatures. |

| 3. Approbation | S'ils correspondent, la transaction se poursuit. |

| 4. Tenue de registres | Le commerçant conserve la signature pour référence ultérieure. |

| 5. Contrôle de sécurité | Des audits réguliers garantissent l’exactitude de la signature. |

Ce processus minutieux renforce la sécurité de vos transactions.

Importance pour la prévention de la fraude

L’utilisation de codes de signature joue un rôle essentiel dans prévention de la fraude en veillant à ce que seuls utilisateurs autorisés peut effectuer des transactions. Lorsque vous signez pour un achat, votre signature agit comme un méthode de vérification, confirmant votre identité. Cela sert de moyen de dissuasion contre utilisation non autorisée Les commerçants comparent la signature du reçu à celle de votre carte. En cas de divergence, ils peuvent refuser la transaction, protégeant ainsi vos actifs financiers. De plus, les codes de signature offrent un niveau de responsabilité ; en cas de divergence, ils peuvent faciliter les enquêtes. Bien qu'ils ne soient pas infaillibles, ces codes constituent un élément essentiel d'une stratégie de sécurité plus globale, contribuant à minimiser les risques. fraude à la carte de crédit et protégez vos informations financières.

Aspects juridiques et réglementations

Cadres juridiques entourant transactions par carte de crédit dictent souvent l'utilisation de codes de signature comme moyen de validation de l'identité et protéger les consommateurs contre la fraude. Dans de nombreuses juridictions, la réglementation impose aux commerçants de vérifier les signatures afin de confirmer que le titulaire de la carte est bien celui qui effectue la transaction. Cette exigence vise à réduire le risque de fraude. utilisation non autorisée et renforcer la confiance des consommateurs dans les paiements électroniques. De plus, Loi sur la facturation équitable du crédit La loi offre aux consommateurs le droit de contester les frais frauduleux, soulignant l'importance de la vérification des signatures. Cependant, il est important de reconnaître que si les signatures offrent un niveau de sécurité, elles ne sont pas infaillibles. Face à l'évolution des lois, il est essentiel de se tenir informé de ces réglementations pour garantir votre sécurité. sécurité financière et comprendre vos droits en tant que consommateur.

Conseils pour la sécurité du code de signature

Un moyen efficace de améliorer la sécurité de votre code de signature consiste à surveiller régulièrement vos relevés de compte pour détecter tout transactions non autoriséesSi vous remarquez quelque chose de suspect, signalez-le immédiatement à votre banque. Pensez également à utiliser un stylo sécurisé Lorsque vous signez votre carte, il est plus difficile de la falsifier. Conservez toujours votre carte de crédit en lieu sûr et soyez prudent lorsque vous communiquez vos informations de carte. achats en ligneVérifiez que le site web est sécurisé, comme indiqué par « https:// » dans l'URL. Enfin, pensez à configurer alertes de transaction sur votre compte pour recevoir des notifications en temps réel. En adoptant ces mesures proactives, vous pouvez réduire considérablement le risque de fraude lié à votre code de signature.

Alternatives aux codes de signature

En ce qui concerne les préoccupations concernant sécurité du code de signature continuent de croître, de nombreux titulaires de cartes explorent des alternatives qui offrent une protection renforcée contre la fraude et transactions non autorisées. Une option populaire est l'utilisation de authentification biométrique, comme la reconnaissance d'empreintes digitales ou faciale, qui ajoute une couche de sécurité difficile à contourner pour les fraudeurs. Une autre alternative est tokenisation, où les informations de votre carte sont remplacées par un identifiant unique pour les transactions en ligne, minimisant ainsi les risques de failles de sécurité. De plus, l'utilisation cartes de crédit virtuelles Pour les achats en ligne, on peut limiter les risques en fournissant un numéro de carte temporaire. Enfin, certaines banques proposent authentification à deux facteurs, nécessitant une confirmation par SMS ou par e-mail, ainsi que les informations de votre carte. Ces méthodes peuvent grandement renforcer votre sécurité dans la gestion de vos finances.