Qu'est-ce qu'une carte Visa Vanilla : tout ce que vous devez savoir

Have you ever heard of a Vanilla Visa Card? If you’re looking for a simple and convenient way to manage your spending, this could be the answer you’ve been searching for.

Whether you want to shop online, make purchases in-store, or even gift someone special, a Vanilla Visa Card offers flexibility and ease. You’ll discover what a Vanilla Visa Card is, how it works, and why it might be the perfect choice for your financial needs.

You’ll learn about its benefits, potential drawbacks, and tips for using it wisely. By the end, you’ll be equipped with all the information you need to decide if this card is right for you. So, let’s dive in and unlock the potential of the Vanilla Visa Card!

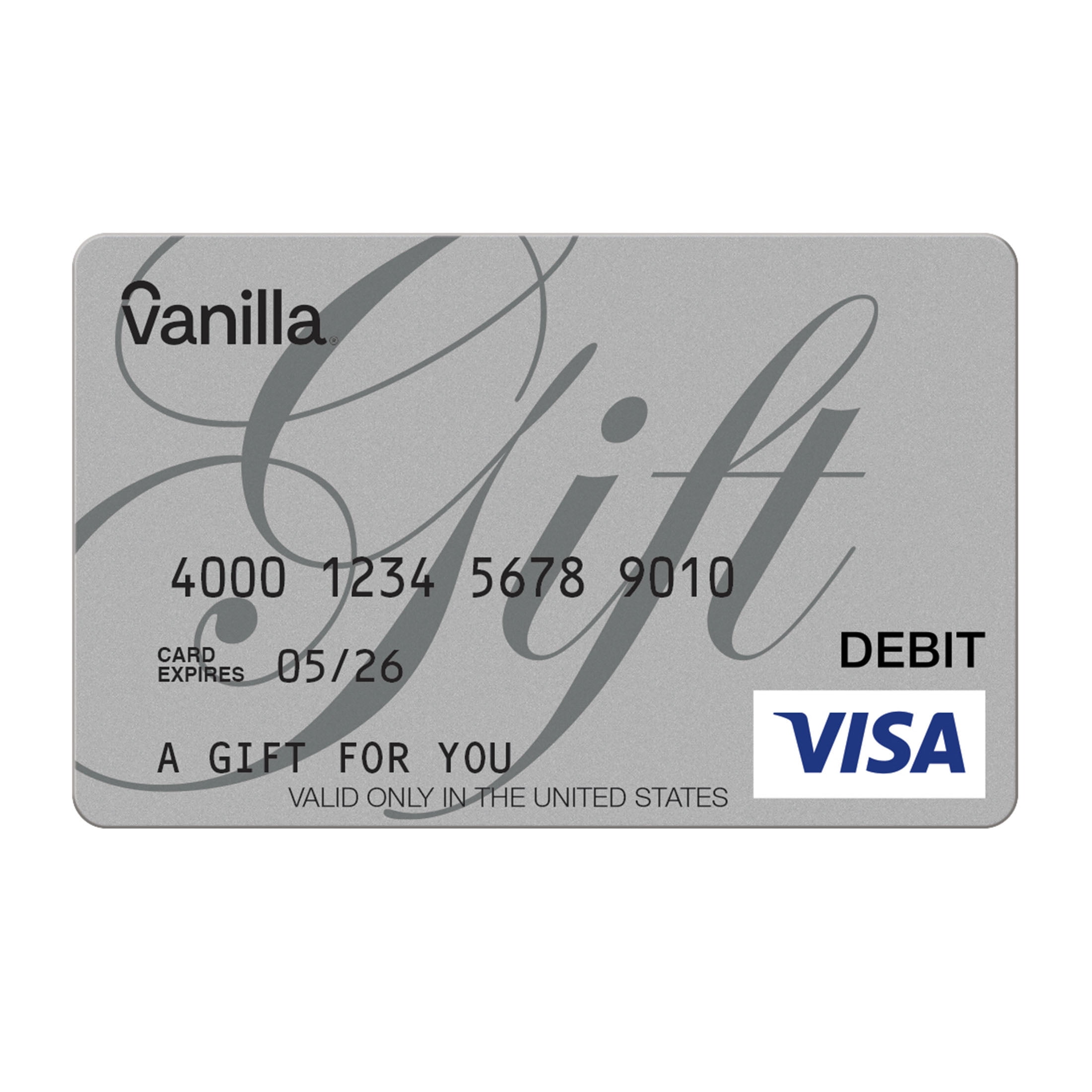

What Is A Vanilla Visa Card

If you’re looking for a convenient way to manage your spending without the hassle of traditional banking, a Vanilla Visa Card might be just what you need. This prepaid card can be used anywhere Visa is accepted, making it a versatile option for both online and in-store purchases. Let’s dive deeper into what a Vanilla Visa Card is and how it can benefit you.

What Is A Vanilla Visa Card?

A Vanilla Visa Card is a prepaid debit card that allows you to load a specific amount of money onto it. Unlike credit cards, you can only spend what you have loaded, which makes it easier to control your budget. It’s a popular choice for those who want to avoid overspending or for those who may not qualify for a traditional credit card.

Comment ça marche ?

Using a Vanilla Visa Card is straightforward. Simply purchase the card at a retailer or online, load it with funds, and you’re ready to go. You can use it just like a regular credit or debit card, but keep in mind that once you spend the loaded amount, you’ll need to reload the card if you want to use it again.

Où pouvez-vous l'utiliser ?

You can use your Vanilla Visa Card at millions of locations worldwide that accept Visa. This includes online shopping, restaurants, and retail stores. It’s a great way to make purchases without linking your bank account or credit card information directly.

What Are The Benefits?

- Contrôle budgétaire : Since you can only spend what you load, it helps you stick to your budget.

- Gift Giving: It makes an excellent gift for birthdays or holidays, giving recipients the freedom to choose what they want.

- No Credit Check: You don’t need a credit history to obtain one, making it accessible to more people.

Are There Any Fees?

While Vanilla Visa Cards are convenient, be aware of potential fees. There may be an activation fee when you purchase the card, and some locations charge a fee to reload it. Always check the terms and conditions before you buy to avoid surprises.

Have you ever tried using a prepaid card? What was your experience like? Understanding the ins and outs of a Vanilla Visa Card can empower you to manage your finances better while giving you flexibility in your spending.

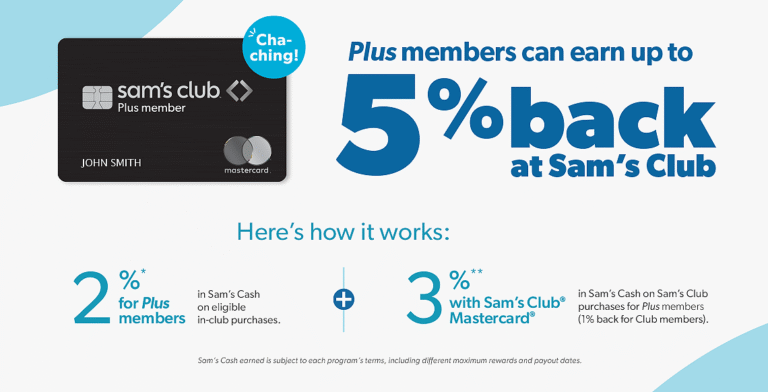

Credit: www.walmart.com

Comment ça marche

The Vanilla Visa Card is simple to use. Understanding how it works helps you manage your money better. Here’s a breakdown of the process.

Activation Process

First, you need to activate your Vanilla Visa Card. This can be done online or by phone. Find the activation number on the card package. Follow the prompts to complete the activation.

Make sure to have your card handy. You will need the card number and security code. After activation, the card is ready for use.

Utiliser la carte pour les achats

Using the Vanilla Visa Card is easy. Just swipe it like a regular debit or credit card. Enter your PIN when prompted, if required.

The card works wherever Visa is accepted. You can use it for online shopping or in stores. Keep track of your spending to avoid going over your balance.

Vérification de votre solde

Knowing your balance is important. You can check it online or through the mobile app. Call the customer service number on the back of your card for help.

Regularly checking your balance helps you manage your funds. This way, you won’t be surprised at checkout.

Types Of Vanilla Visa Cards

A Vanilla Visa Card is a prepaid card that allows you to make purchases wherever Visa is accepted. There are different types, including gift cards and reloadable cards. Each type serves unique purposes, making them flexible for various spending needs.

Cartes prépayées

Prepaid Vanilla Visa Cards are ideal for everyday purchases. You load a specific amount onto the card before using it. This way, you can only spend what you’ve loaded, helping you manage your budget effectively. These cards are widely accepted, just like a traditional credit or debit card. You can use them for online shopping, in stores, or even at ATMs. Imagine having a financial tool that keeps you on track while enjoying your favorite activities.Cartes-cadeaux

Gift Cards are perfect for special occasions. They allow you to give the gift of choice to friends and family. Instead of worrying about what someone might like, you can simply load a card with a specific amount. Whether it’s a birthday, holiday, or just a thoughtful gesture, these cards add convenience. Recipients can use them wherever Visa is accepted. This flexibility makes them a popular choice for gift-giving.Reloadable Options

Reloadable Vanilla Visa Cards take convenience a step further. You can add funds multiple times, making them a practical choice for frequent use. This option is great if you want to use a card for regular expenses without the hassle of applying for a new one. You can manage your spending easily by adding funds as needed. Plus, you can track your expenses through online tools provided by the card issuer. This feature helps you stay organized and in control of your finances. Now that you know about the different types of Vanilla Visa Cards, which one fits your lifestyle best? Would you prefer the simplicity of a prepaid card, the thoughtfulness of a gift card, or the versatility of a reloadable option? Your choice could make a significant difference in how you manage your spending.Where To Buy

Finding a Vanilla Visa Card is easy. Many options exist for purchasing one. You can buy them online, in physical stores, or through third-party platforms.

Détaillants en ligne

Many online retailers sell Vanilla Visa Cards. Websites like Amazon and Walmart offer them. These sites usually have various amounts available. You can choose the value that fits your needs. Purchasing online is simple. Just add the card to your cart and check out.

Physical Stores

Physical stores also sell Vanilla Visa Cards. Look for them in grocery stores and pharmacies. Big chains often have a gift card section. You can find cards of different amounts. Visit the store, select your card, and pay at the register.

Third-party Platforms

Third-party platforms provide another option. Websites like eBay may have Vanilla Visa Cards. Always check the seller’s rating. Ensure you buy from a trusted source. This way, you can avoid scams.

Fees And Limits

Understanding the fees and limits of a Vanilla Visa Card is essential. Knowing these details helps you manage your card better. Let’s explore the key aspects like activation fees, transaction fees, and spending limits.

Activation Fees

When you buy a Vanilla Visa Card, there is often an activation fee. This fee can vary based on the card’s value. Typically, it ranges from $3 to $6. Be sure to check this fee before purchasing.

Frais de transaction

Transaction fees may apply when you use your Vanilla Visa Card. These fees can occur during purchases or cash withdrawals. Some merchants might charge a fee for using prepaid cards. Always read the terms to avoid surprises.

Limites de dépenses

The Vanilla Visa Card has spending limits. These limits depend on the card’s value. Usually, the maximum limit is $500. Spending limits help you manage your budget effectively.

Crédit : www.reddit.com

Advantages Of Vanilla Visa Cards

Vanilla Visa Cards offer several benefits. They are simple to use and widely accepted. These cards provide a great option for many people. Let’s explore the main advantages.

Ease Of Use

Using a Vanilla Visa Card is straightforward. You can load money onto the card easily. Just visit a store or use online services. Once loaded, you can use it like a regular credit card. This makes shopping convenient.

No need to worry about complicated processes. You don’t have to remember passwords or PINs. Just swipe and go. This simplicity is a big plus for many users.

Large acceptation

Vanilla Visa Cards are accepted almost everywhere. You can use them in stores and online. Major retailers and websites accept these cards. This makes them versatile for everyday purchases.

You won’t face issues finding a place to use your card. Whether buying groceries or clothes, Vanilla Visa Cards work well. This wide acceptance is a significant advantage.

No Credit Checks

Getting a Vanilla Visa Card does not require a credit check. This is great for people without a credit history. You can load funds without worrying about your credit score.

This feature makes it easier for everyone to have a payment option. You can enjoy shopping without the stress of credit approval. It opens doors for those who need financial freedom.

Inconvénients potentiels

The Vanilla Visa Card offers many benefits. Still, it has some drawbacks. Understanding these can help you make an informed choice.

Lack Of Reload Options

The Vanilla Visa Card cannot be reloaded. Once the balance is gone, you cannot add more money. This limits its use for ongoing expenses. Users may need to buy a new card each time. This can be inconvenient and costly.

Limited Security Features

Security is important when using a prepaid card. The Vanilla Visa Card has basic security features. It lacks advanced protections found in bank accounts. If lost or stolen, getting funds back can be hard. This may leave users vulnerable to fraud.

Expiration And Maintenance Fees

The Vanilla Visa Card comes with expiration dates. If not used, funds may expire. Some cards also have maintenance fees. These can reduce the balance over time. Users should check the terms to avoid surprises.

Common Uses

The Vanilla Visa Card offers flexibility and convenience. Many people use it for different purposes. Here are some common ways to use this card.

Achats en ligne

Online shopping is a popular use for the Vanilla Visa Card. It is easy to enter card details on websites. This card works at many online retailers. Users can buy clothes, electronics, and more. The card provides a safe way to shop online. There are no worries about overspending. The set amount on the card keeps spending in check.

Achats en magasin

In-store purchases are another common use. Many stores accept the Vanilla Visa Card. Shoppers can find it in grocery stores, gas stations, and more. The card allows for quick and easy payments. Simply swipe or tap the card at checkout. It works just like a debit or credit card. Users enjoy the freedom of cashless transactions.

Gifting Purposes

The Vanilla Visa Card makes a great gift. It is perfect for birthdays or holidays. Recipients appreciate the choice it offers. They can use it at their favorite stores. This card is easy to wrap and give. It eliminates guesswork in buying gifts. Friends and family can spend it as they wish.

Conseils pour maximiser les avantages

Using a Vanilla Visa Card can be simple. You can get the most out of it with some smart tips. These tips help you manage your money better. Let’s explore how to maximize your benefits.

Suivi de vos dépenses

Keep an eye on your spending. Track every purchase you make. Use a budget app or a simple notebook. This helps you see where your money goes.

Set a monthly limit for your expenses. Stick to this limit to avoid overspending. Knowing your balance helps you make better choices.

Avoiding Hidden Fees

Be aware of fees that can sneak up on you. Check the terms before using your card. Some cards have activation fees or monthly charges.

Always read the fine print. This helps you avoid surprises. Pay attention to transaction fees, especially for international purchases.

Using With Other Payment Methods

Combine your Vanilla Visa Card with other payment methods. Use it for online shopping and pay with cash for local stores. This can help you manage your budget better.

Consider linking it to an app that offers rewards. This can give you extra benefits for your spending. Using multiple methods can provide more flexibility.

Customer Support And Troubleshooting

A Vanilla Visa Card is a prepaid card. It allows you to shop online or in stores without a bank account. Customer support can help with card activation and troubleshooting any issues.

Customer support and troubleshooting are essential parts of using a Vanilla Visa Card. Whether you’re facing issues with transactions or need answers about your card, knowing how to reach out for help can make all the difference. Here’s how you can effectively navigate support options and resolve any card-related challenges you may encounter.Contacting Support

When you need assistance, the first step is knowing how to contact customer support. Vanilla Visa offers several ways for you to reach their team:- Phone Support: Call the customer service number found on the back of your card. It’s usually available 24/7.

- Online Chat: Visit the Vanilla Visa website for a live chat option. This can be quicker than waiting on hold.

- Email Support: If your issue isn’t urgent, you can send an email detailing your concern. Expect a response within a few business days.

Resolving Card Issues

Card issues can arise for various reasons. Perhaps your card isn’t working at a store or your balance seems incorrect. Start by checking your transaction history through the Vanilla Visa website or app. This can help you identify any discrepancies. If you notice something off, contacting support directly is crucial. They can provide real-time assistance and potentially resolve your issue during the call. Remember, patience is key. Sometimes, resolving a problem may take a little time, but staying calm can lead to a better experience.Handling Disputes

Disputes can happen, especially if you notice unauthorized charges. It’s important to act quickly. Begin by gathering evidence of the transaction. This includes dates, amounts, and any related correspondence. Contact customer support immediately to report the dispute. They will guide you through the process and may require you to fill out a dispute form. Maintaining records of all communications is essential. This way, you have a clear trail if you need to escalate the matter later. How do you feel when faced with a dispute? Understanding your rights and being proactive can help you navigate these situations with confidence.

Credit: blog.apexnetwork.co

Questions fréquemment posées

What Is A Vanilla Visa Card?

A Vanilla Visa Card is a prepaid card that can be used anywhere Visa is accepted. It is not linked to a bank account and can be loaded with a fixed amount of money. This card is ideal for budgeting or gifting purposes.

How Does A Vanilla Visa Card Work?

The Vanilla Visa Card works like a regular debit card. Users load money onto the card and can spend it until the balance reaches zero. Once the funds are depleted, the card cannot be reloaded. It’s simple and convenient for everyday purchases.

Where Can I Use My Vanilla Visa Card?

You can use your Vanilla Visa Card at any retailer that accepts Visa. This includes online stores, restaurants, and grocery shops. However, some merchants may place restrictions, such as for gas stations or hotels. Always check before using the card for specific transactions.

Can I Reload My Vanilla Visa Card?

No, Vanilla Visa Cards are not reloadable. Once the balance is spent, the card cannot be added to or reused. You can purchase a new card if you need additional funds. This feature helps users manage their spending effectively.

Conclusion

A Vanilla Visa Card is a simple way to manage money. It works like cash but is safer. You can use it online or in stores. It helps you stick to a budget. Loading money onto the card is easy and quick.

No need for a bank account. This card is great for gifts or personal use. Enjoy the freedom of spending without worries. Understanding how it works makes your shopping easier. Consider a Vanilla Visa Card for your next purchase.