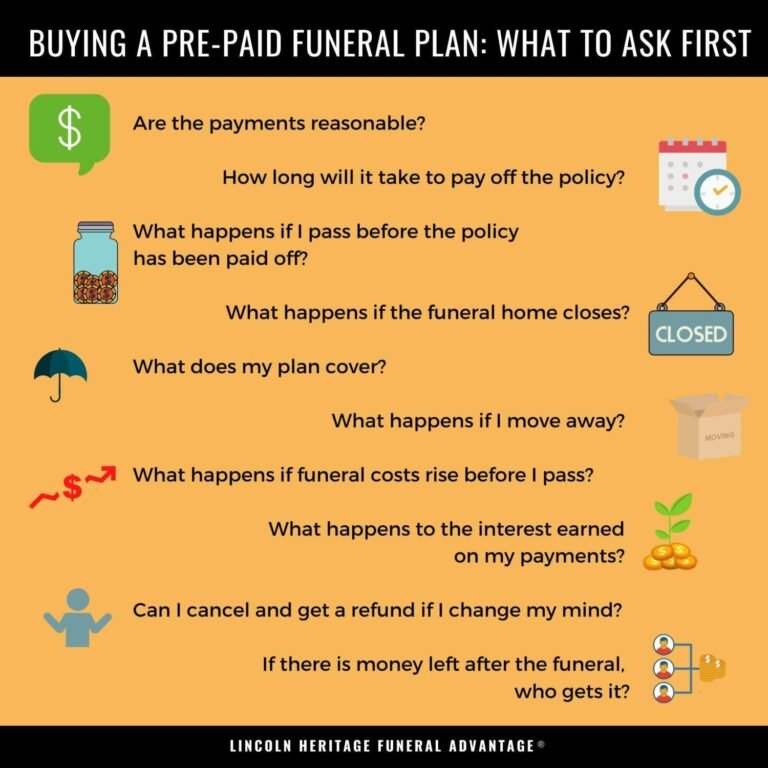

Qu'est-ce qu'un prêt hypothécaire à versements progressifs : un guide complet

Are you planning to buy a home but worried about the initial financial burden? Imagine stepping into your dream house today, knowing that your payments will start small and gradually increase as your income grows.

Sounds ideal, right? This is where a Graduated Payment Mortgage (GPM) comes into play. It’s designed to help you ease into homeownership without overwhelming your budget from the get-go. You’ll discover how a Graduated Payment Mortgage works, its benefits, and whether it’s the right choice for your financial situation.

Ready to unlock the door to your future home with manageable payments? Let’s dive in and find out how GPM could be your perfect match.

Graduated Payment Mortgage Basics

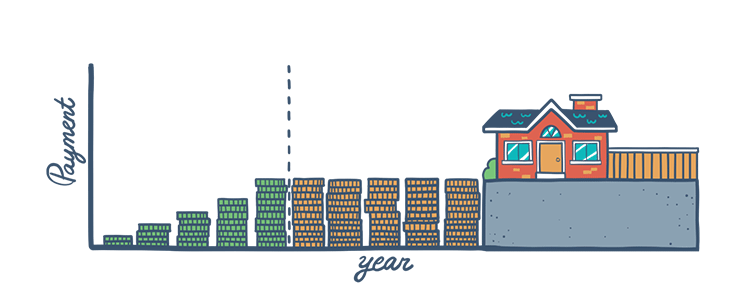

A Graduated Payment Mortgage is a type of home loan. It starts with lower payments. Payments increase gradually over time. This helps buyers who expect their income to rise. Early payments are easier for families. This mortgage plan is great for young professionals. They can afford a home now.

Taux d'intérêt might be fixed or adjustable. Payments increase on a set schedule. The goal is to make payments affordable. Families can plan their budget more easily. Understanding the terms is important. Buyers should read all the details. This mortgage can be useful for many people.

How Graduated Payment Mortgages Work

Graduated Payment Mortgages start with mensualités plus basses. These payments make it easier for borrowers at the start. The payments are not fixed. They are designed to increase over time. This helps when income is expected to grow.

Payments gradually become higher each year. The increase usually happens over the first five to ten years. This adjustment is planned. It helps align with borrowers’ increasing income.

Early payments may not cover all the interest. This can make the loan balance increase at first. This is called negative amortization. Eventually, payments get larger. They then start to reduce the loan balance.

Advantages Of Graduated Payment Mortgages

Graduated Payment Mortgages start with low monthly payments. This makes them easier to handle at first. Families with tight budgets find this helpful. They can buy a home without paying much upfront. This option suits those who expect future income growth.

As time passes, payments rise. But, many people’s incomes increase too. With more earnings, paying higher amounts becomes manageable. This plan is good for those who expect raises or better jobs. It prepares you for a brighter future.

First-time buyers often have limited savings. This mortgage type offers flexibility. Young buyers find this option attractive. It allows them to enter the housing market easily. Graduated payments make homeownership possible sooner.

Drawbacks To Consider

Graduated Payment Mortgages can lead to initial lower payments that might increase over time, causing financial strain. The risk of rising interest rates may affect the affordability of future payments. Homeowners may face challenges if their income doesn’t grow as expected to match the payment increases.

Rising Monthly Payments

Payments grow over time. Start small. End big. This can be hard for some. Budgeting gets tough. Planning is key. Over time, payments can feel heavy. Families must prepare well. Rising payments can surprise many. Always be ready.

Negative Amortization Risks

Negative amortization means debt grows. Pay less now. Owe more later. This is tricky. Some may not notice. Balances increase. This adds stress. Be aware of risks. Understand your loan fully. Always keep track.

Long-term Financial Planning

Long-term plans are crucial. A graduated mortgage needs planning. Rising payments affect future goals. Saving gets harder. Dream plans may change. Families must think ahead. Consider all factors. Seek advice when unsure. Planning helps avoid surprises.

Comparing With Traditional Mortgages

UN fixed-rate mortgage has the same payment every month. The interest rate never changes. This helps families plan their budget. These loans usually last for 15 or 30 years. Many people like them because they are simple. But the payments can be high at first.

Un adjustable-rate mortgage (ARM) starts with low payments. The rate can change later. It might go up or down. This type can be risky. Families might pay more over time. But the first payments are often less than fixed-rate loans.

With an interest-only mortgage, you only pay interest at first. This means the payments are small at the beginning. After a few years, you pay both interest and the loan. This can make the later payments much larger. It’s important to plan for these changes.

Eligibility And Requirements

UN bonne cote de crédit is important for a mortgage. Lenders like scores over 620. Higher scores mean better terms. Those with low scores may need to improve. Paying bills on time helps. Reducing debt can also increase scores.

Income proof is needed for a mortgage. Lenders check pay stubs and tax records. Stable income is preferred. Self-employed people may need extra documents. Consistent earnings make approval easier. Lenders want to see no big changes.

Not all properties qualify for this mortgage. Residential properties are preferred. Homes must be in good condition. Appraisals ensure fair value. Some properties need repairs first. Location matters too. Urban areas may have more options.

Tips For Borrowers

Assessing financial stability is important for mortgage decisions. Know your monthly income. Understand your monthly expenses too. List all debts you have. Compare income with expenses. Make sure you can pay the mortgage. Save money for emergencies. Do not forget about taxes and insurance. They add to monthly costs.

Future income projections help in planning. Will your income grow soon? Think about job promotions. Consider any bonuses. Plan for unexpected changes. If income drops, can you still pay? Think about new expenses in the future. Children or education can increase costs. Always plan for long-term.

Consulting with a mortgage advisor can be helpful. Advisors know mortgage details. They explain terms clearly. They offer advice on payments. Advisors help find better rates. They guide on loan types. Meeting an advisor can clear doubts. Choose someone experienced. Make sure you understand all advice given.

Exemples concrets

Graduated Payment Mortgage examples include teachers or nurses who expect salary increases over time. They benefit from initially lower payments. As their income grows, they can afford the gradually increasing payments. This helps them manage cash flow early in their careers while planning for future financial stability.

Case Study: Young Professional

A young professional named Alex bought a small apartment. Alex’s salary was low at first. But Alex expected a raise soon. A graduated payment mortgage helped Alex. The payments started small. They fit Alex’s budget. Over time, payments went up. But so did Alex’s salary. This way, Alex could buy a home early. No need to wait for a big salary.

Case Study: Growing Family

Meet the Smith family. They needed a bigger house. Their family was growing. A graduated payment mortgage was perfect. It started with small payments. This helped them save money. As their children grew, so did their income. Payments increased slowly. By then, the Smiths earned more. They could handle the bigger payments. This plan was easy for their budget.

Future Trends In Graduated Payment Mortgages

Graduated Payment Mortgages start with lower payments that gradually increase over time. This helps homebuyers manage initial costs. Future trends may focus on flexible terms and innovative payment structures, addressing affordability and economic changes.

Economic Influence

The economy affects mortgage trends. A strong economy boosts confidence. More people buy homes. Interest rates can rise. This makes loans expensive. When the economy slows, interest rates drop. Mortgages become cheaper. People can borrow more. Economic changes impact payments. Families plan better. They seek stable payments. They watch interest rates closely.

Market Adaptations

Markets change fast. Mortgages must adapt. New rules come in. Banks offer different options. Graduated payments help. They suit changing needs. Young buyers like them. Payments start low. They rise slowly. This helps budgeting. Families manage money well. They balance costs. They avoid high payments. Flexibility is key.

Questions fréquemment posées

What Is A Graduated Payment Mortgage?

A Graduated Payment Mortgage (GPM) is a home loan. Payments start low and increase over time. This helps borrowers with expected income growth. It’s beneficial for those anticipating higher future earnings. The initial low payments make homeownership more accessible. GPMs are popular among young professionals.

How Do Gpms Benefit Homebuyers?

GPMs offer lower initial monthly payments. This makes them attractive to homebuyers expecting income growth. They provide a path to homeownership without immediate financial strain. Buyers can plan for increasing payments. This aligns with their anticipated earnings. GPMs are ideal for those starting their careers.

Are Gpms Risky For Borrowers?

GPMs can be risky if income growth doesn’t occur. Borrowers need to plan for higher future payments. If income projections fall short, financial strain may result. It’s crucial to assess future earnings potential. Proper planning can mitigate risks. Consulting with financial advisors is advisable.

Who Should Consider A Graduated Payment Mortgage?

Young professionals with expected income growth should consider GPMs. They’re also suitable for those entering stable career paths. If you anticipate higher future earnings, GPMs can be beneficial. Evaluate your financial situation and career prospects. This mortgage type requires careful financial planning.

Conclusion

Graduated Payment Mortgages offer a flexible start for homebuyers. Payments begin low and gradually increase over time. This can help manage early financial constraints. It’s ideal for those expecting income growth. But, plan ahead to meet future payments. Understand the terms fully before deciding.

This mortgage type suits specific financial situations. Always consult a financial advisor. They can guide you based on your needs. Explore all options to make an informed choice. Home buying should be a step towards financial security.