Quelles banques acceptent les paiements de taxe foncière : les meilleures options dévoilées

Imagine it’s that time of year again when property tax bills start making their way to your mailbox. The thought of dealing with yet another payment can be daunting, but what if there was a simple way to handle it?

You might be wondering which banks will accept your property tax payments, saving you time and hassle. This blog post is here to clear up the confusion and guide you to the best options available. By the time you finish reading, you’ll know exactly where to go and how to make your property tax payments without a hitch.

Dive in to discover the banks that can streamline this process for you, ensuring peace of mind and more time for things you truly enjoy.

Top Banks For Property Tax Payments

Many banks help with property tax payments. This makes life easy. Chase Bank is popular. It has branches everywhere. People trust Chase Bank. Bank of America also offers this service. It has many customers. It is reliable. Wells Fargo is another choice. It is known for good service. These banks make payments simple. They offer help to customers. Many people use them.

Find more banks near you. Ask about their services. Some banks have online options. This saves time. People enjoy online banking. Explore your options today. Make payments easy and quick.

National Banks Offering Services

Bank of America helps pay property taxes easily. They have online services. Payments can be made from home. This saves time and effort. Bank of America is safe and trusted by many. Their customer service is also very helpful. They guide you if needed. Making payments is simple with them.

Wells Fargo offers easy property tax payments. You can do it online. Their website is easy to use. No need to visit the bank. They keep your details safe. Many people trust Wells Fargo for payments. They also have friendly customer service. They can answer questions quickly.

Chase Bank lets you pay property taxes online. It’s quick and simple. You can trust them with your money. Chase Bank is known for their security. They make payments stress-free. Their support is always ready to help. You can call them anytime.

Regional Banks To Consider

PNC Bank is a popular choice for tax payments. They have many branches. You can pay property taxes easily. Online services make it even simpler. Check their website for details.

SunTrust offers convenient tax payment options. Local branches are available for your needs. Their staff is friendly and helpful. Online banking is also an option. Visit their site to learn more.

Fifth Third Bank makes tax payments easy. They provide simple solutions for property taxes. Many branches are open to assist you. Their online platform is user-friendly. Find more information online.

Credit Unions Accepting Tax Payments

Navy Federal Credit Union helps members pay property taxes with ease. They provide services that make tax payment simple. Members can use their account to pay taxes directly. This saves time and effort. Navy Federal is known for its helpful customer service. They guide members through the payment process. Many find this service useful. It reduces stress during tax season. Navy Federal offers secure online payment options. This makes the process safe and convenient. Members feel confident paying taxes with Navy Federal.

Alliant Credit Union supports property tax payments for its members. Their system is user-friendly and straightforward. Members can pay taxes using online services. Alliant provides clear instructions for payment. This helps members understand the process easily. Alliant Credit Union values security in transactions. Members trust their secure system for tax payments. This builds confidence in the credit union. Alliant is committed to making tax payments hassle-free. Many members appreciate their reliable services.

Online Banks And Digital Solutions

Ally Bank is a popular choice for online banking. They offer easy ways to pay bills. This includes property tax payments. Their platform is user-friendly and secure. You can set up paiements automatiques. This helps you never miss a payment. Ally Bank has a helpful service client team. They are available to answer questions.

Chime is another digital bank. It is known for its simple interface. You can easily manage your property tax payments. Use the app to keep track of payments. Chime sends alertes for upcoming payments. You can also make paiements uniques. Chime ensures your payments are safe and fast.

Factors To Evaluate

Choose a bank with accès facile near your home or work. Online banking makes paying taxes simpler. Some banks offer mobile apps. They help you pay bills on the go. Check if the bank has many branches. More branches mean easier service.

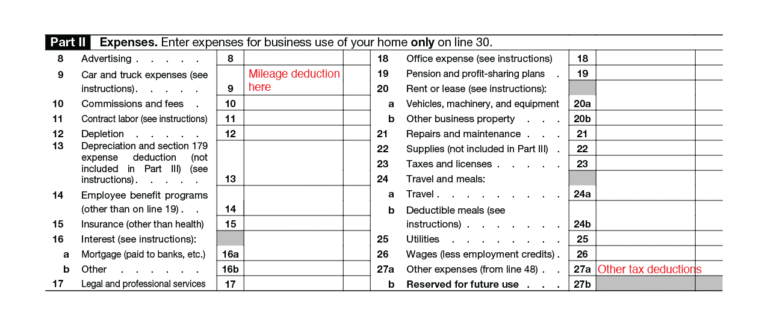

Understand the fees before choosing a bank. Some banks charge for property tax payments. Others offer free services. Look for hidden costs. Compare banks to find the best deal. Choose wisely to save money.

Some banks offer more than tax payments. They provide conseils financiers. Others have loan options. Some banks help with investment plans. These services can benefit you. Choose a bank that meets all your needs.

How To Make Payments

Visit your bank to pay property taxes. Bring your tax bill. Talk to the teller or cashier. Hand over cash or a check. They will process your payment. Get a receipt before leaving. This proves you paid. Some banks have special desks for tax payments. Look for signs or ask staff. Make sure all info matches your tax bill.

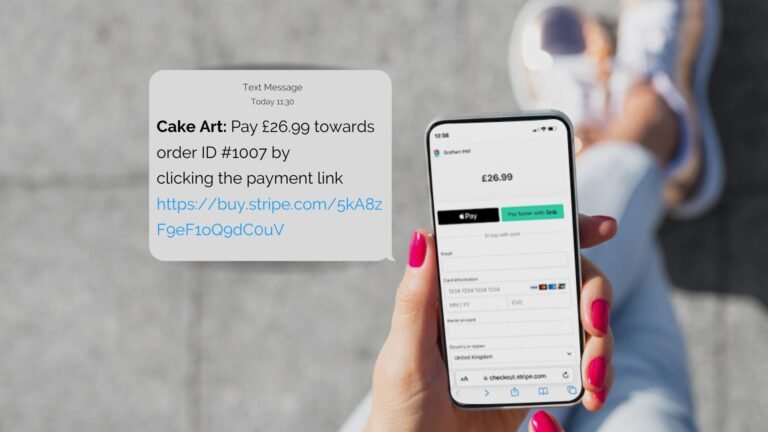

Log in to your bank’s website. Find the bill payment section. Enter your property tax details. Use your account to pay. Check your info twice before clicking submit. Online payments are quick and safe. Banks send you a confirmation email. Always save this email. This is proof of payment. Some banks offer auto-pay options. Set it up to avoid missing deadlines.

Download your bank’s app. Open the app and log in. Go to the payments tab. Enter your tax info. Use your phone to pay directly. Check all details carefully. Mobile apps send notifications. These alert you when payments are due. Apps can be set to auto-pay. Ensure your app is updated. This keeps your info secure.

Tips For Choosing A Bank

Find banks that accept property tax payments. Look at their fees. Compare different banks. Check their online services too. Some banks offer easy online payment options. Others might need you to visit the branch. Make a list of banks that fit your needs.

Read what other people say about the bank. Check avis clients online. Happy customers mean the bank is reliable. Look for reviews about property tax payments. If many people like the service, it’s a good sign. Avoid banks with too many bad reviews.

See if the bank is open when you need it. Some banks have more branches and ATMs. Others might be open on weekends. Check if they have 24/7 online support. This helps if you have questions anytime. Make sure the bank is easy to reach.

Questions fréquemment posées

Which Banks Accept Property Tax Payments?

Many major banks, like Chase and Bank of America, accept property tax payments. They offer this service through online banking or at their branches. Always check with your local bank to confirm their specific procedures. Some banks may charge a fee for this service, so inquire beforehand.

Can I Pay Property Taxes Online Through Banks?

Yes, most banks offer online property tax payment services. This feature is available through their online banking platforms. You can schedule payments or set up automatic deductions. Ensure your bank supports this service and review any associated fees. Online payments are convenient and help avoid late penalties.

Do All Banks Offer Property Tax Payment Services?

Not all banks provide property tax payment services. It largely depends on the bank’s policies and location. Major banks typically offer this service, while smaller institutions might not. Always verify with your bank if they can process property tax payments.

It’s crucial to explore all available options.

Are There Fees For Bank Property Tax Payments?

Some banks charge fees for processing property tax payments. These fees can vary based on the bank and payment method. It’s important to check with your bank for specific details. Some banks might waive fees for certain accounts or under specific conditions.

Always compare options to avoid unnecessary costs.

Conclusion

Exploring banks for property tax payments simplifies your financial tasks. Many banks offer convenient options for these payments. Visit your local branch or their website for details. It’s smart to understand your bank’s payment process. This ensures you avoid late fees and penalties.

Keep records of all transactions for future reference. This helps in managing your finances effectively. Always verify payment methods accepted by your bank. This ensures a smooth process every time. Remember, proper planning can save time and money. Stay informed and proactive in handling your property taxes.

Your financial health depends on it.