Comment transférer de l'argent de Google Pay vers PayPal

You're among the 25% of mobile payment users who've chosen Google Pay as their go-to digital wallet. Now, you're looking to transférer des fonds from Google Pay to PayPal, but you're not sure where to start. You've linked your Google Pay account to a bank account or debit card – that's a great first step. To move forward, you'll need to initier un transfert from Google Pay to your bank account, and from there, you can add those funds to your PayPal account. But there's a significant step in between that you won't want to miss.

Understand Google Pay and PayPal

Pour initier une transfert d'argent from Google Pay to PayPal, you first need to understand the basic functionality of both services, starting with the fact that Google Pay is a portefeuille numérique that stores your payment methods, and PayPal is an online payment system that allows you to send and receive funds. You should recognize that both services offer traitement sécurisé des paiements, with features like encryption and authentification à deux facteurs to protect your transactions. Google Pay allows you to link credit or debit cards, while PayPal enables you to link bank accounts, credit cards, or debit cards. Understanding these basics guarantees a smooth transfer process. By familiarizing yourself with both services, you'll be able to navigate the transfer process with confidence and security.

Link Google Pay to Bank

Now that you understand the basics of Google Pay and PayPal, linking your Google Pay account to a bank account or debit card is the next step to facilitate transfers to PayPal. You'll need to add a payment method to Google Pay to allow transfers. Open the Google Pay app, tap the navigation menu, and select 'Modes de paiement.' Then, tap 'Ajouter un mode de paiement' and follow the prompts to link your bank account or debit card. Google Pay may request verification to guarantee your account's security. Once linked, you'll be able to transférer des fonds from Google Pay to other accounts, including PayPal. Make sure to review Google Pay's termes et conditions to understand any applicable fees or transfer limits.

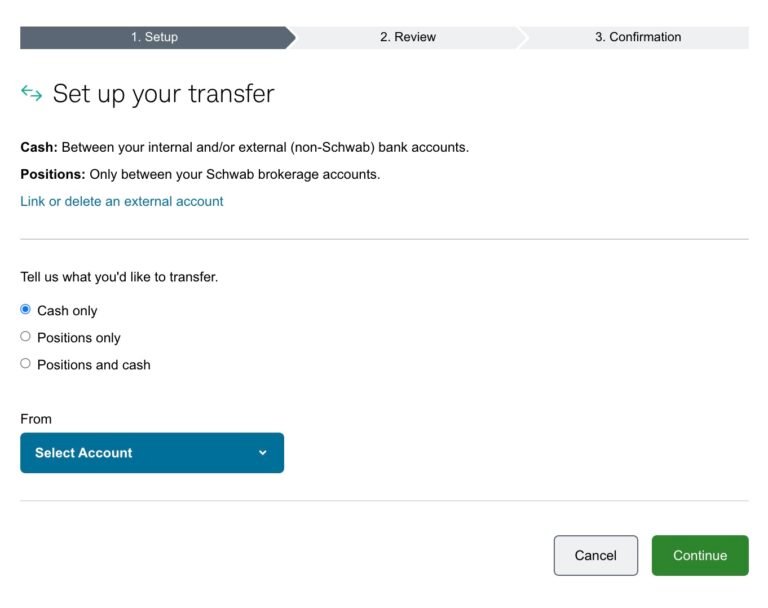

Add Bank to PayPal Account

Linking your bank account to PayPal is an essential step in facilitating transfers from Google Pay, so you'll need to add your bank account details to your PayPal account. To do this safely and efficiently, follow these steps:

- Connectez-vous à votre compte PayPal: Go to the PayPal website or mobile app and enter your login credentials.

- Navigate to the "Wallet" section: Click on the "Wallet" or "Link a bank" tab, depending on the device you're using.

- Select your bank: Choose your bank from the list of available institutions or enter your bank's name in the search bar.

- Enter your bank account details: Provide your bank account number and routing number to link your account to PayPal.

Verify PayPal Bank Account

Typiquement, verifying your bank account with PayPal involves confirming two small test deposits that PayPal sends to your bank account to guarantee the account is valid and belongs to you. You'll need to check your bank account's historique des transactions to find these deposits, which are usually under $1. Once you've located them, log in to your PayPal account and navigate to the 'Wallet' or 'Bank accounts' section. Click on the bank account you want to verify, then enter the exact amounts of the two test deposits. After submitting this information, PayPal will confirm your bank account is verified. This process can take a few days, but it's crucial to verify the security and integrity of your transactions.

Transfer Funds From Google Pay

With your PayPal bank account verified, you can proceed to transfer funds from Google Pay by first ensuring that your Google Pay account is properly linked to a debit card or bank account that can facilitate transfers. This step is essential to initiate a successful transfer. To link your account, follow these steps:

- Ouvrir Google Pay:Lancez l’application Google Pay sur votre appareil.

- Accéder aux paramètres du compte: Tap on the menu icon and navigate to the 'Account' or 'Settings' section.

- Ajouter un mode de paiement: Select 'Add payment method' and choose 'Debit card' or 'Bank account'.

- Enter Account Details: Enter your debit card or bank account details and confirm the linking process.

Once your account is linked, you can proceed with the transfer process.

Use PayPal to Receive Funds

To receive the transferred funds, you'll need to obtain your compte PayPal's numéros de routage et de compte. You can find these by logging into your PayPal account, clicking on 'Wallet,' then selecting 'Dépôt direct.' Next, select 'Get direct deposit info' and confirm your account information. You'll see your routing and account numbers. Make certain you keep these numbers secure to avoid any unauthorized access. With these numbers, you can receive the transferred funds directly into your PayPal account. By using this method, you'll be able to link your Google Pay and PayPal accounts securely and transférer des fonds seamlessly. Just make sure to review PayPal's termes et conditions for receiving direct deposits to understand any potential fees or requirements.

Check Transfer Status and Time

Once you've initiated the transfer from Google Pay to PayPal, you'll want to monitor the status of the transaction to guarantee it's processed successfully and within the expected timeframe. You can do this by:

- Checking your PayPal account: Log in to your PayPal account to see if the funds have been deposited.

- Verifying transfer details: Double-check the transfer amount, sender, and recipient details.

- Tracking transaction history: Review your Google Pay and PayPal transaction histories for updates.

- Contacting support: Reach out to Google Pay or PayPal support if there are issues with the transfer.

Manage Transfer Fees and Limits

Transfer fees and limits play a crucial role in the Google Pay to PayPal transaction process, affecting both the amount you can send and the charges incurred. You'll want to understand these fees and limits to avoid frais inattendus or transfer issues. Typically, Google Pay doesn't charge frais de transfert, but PayPal may charge a small fee for receiving funds. Additionally, there may be limits on the amount you can transfer per transaction or per day. You can check these limits in your Google Pay and PayPal accounts. To manage transfer fees and limits, review your account settings, update your limites de transfert if needed, and factor in any potential fees when sending funds. This guarantees a smooth and transaction sécurisée processus.