Comment transférer de l'argent de Cash App vers un compte courant : guide simple

Imagine the convenience of moving your money instantly from a mobile app to your bank account without stepping outside or enduring long bank queues. If you’re using Cash App and wondering how to seamlessly transfer your money to your checking account, you’re in the right place.

This guide is crafted to make the process simple and stress-free for you. With just a few taps, you can have your funds where you need them most. Whether it’s for paying bills, shopping, or just having peace of mind, knowing how to transfer money efficiently can save you time and hassle.

By the end of this article, you’ll be equipped with all the knowledge you need to make these transfers effortlessly. So, let’s dive in and turn you into a money-moving pro!

Setting Up Your Cash App

Setting up your Cash App account is the first step to transferring money. This process is simple and quick. You’ll be ready to transfer money in no time. Let’s break down the steps to get started.

Créer un compte

Download the Cash App from the App Store or Google Play. Open the app and enter your phone number or email address. You’ll receive a confirmation code. Enter this code in the app to verify your identity. Choose a unique username, known as a $Cashtag. Your account is now created.

Lier votre compte bancaire

Open Cash App on your device. Tap on the profile icon in the top right corner. Select “Linked Banks” or “Add Bank.” Enter your bank information, including account and routing numbers. Cash App will verify your bank details. Once linked, your bank account is ready for transactions.

Easily move funds from Cash App to your checking account with a few taps. Open the app, select “Cash Out,” and choose the amount. Verify the details and confirm to complete the transfer.

Understanding The Home Screen

The home screen is your starting point. It’s designed to be user-friendly, with all your options laid out clearly. You’ll see your balance prominently displayed, offering a quick glimpse of your finances. This is where you can initiate most of your actions. Notice the buttons for sending and requesting money? These are your primary tools for transactions. Take a moment to explore the icons and see what each one does. Don’t worry if it feels overwhelming. Familiarity will grow with use. ###Accessing The Banking Tab

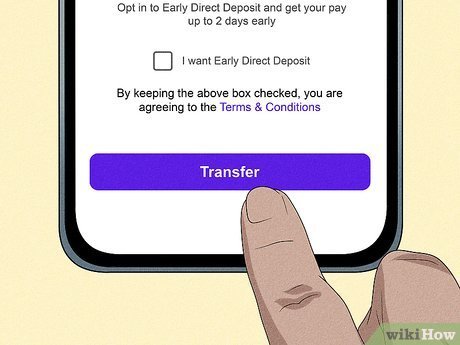

The Banking Tab is where the magic happens when transferring money to your checking account. Locate the small bank icon, usually found at the bottom of the home screen. Once you tap on it, you’re taken to a new screen. Here, you’ll see options for cashing out your balance. You can choose between an instant transfer or a standard one that takes a bit longer but doesn’t carry a fee. Think about your needs: Is speed crucial, or are you fine with waiting a couple of days? This choice can impact how you manage your funds. Navigating these features becomes second nature with a little practice. Have you ever wondered how technology can simplify your financial life? Cash App is a great place to start exploring those possibilities.Lancer un transfert

Transferring money from your Cash App to a checking account is straightforward. You can complete the process in just a few taps. This guide will help you initiate a transfer with ease. Follow the steps to ensure your money reaches your account safely.

Sélection de l'option de transfert

Open the Cash App on your smartphone. Look for the “Banking” tab at the bottom of the screen. Tap it to view your balance and transfer options. You will see an option to transfer money. Select the transfer option to proceed.

Choisir le montant à transférer

Decide how much money you want to transfer. Enter the amount in the designated field. Double-check to avoid mistakes. Confirm the amount is correct. Once verified, proceed to finalize the transfer.

Completing The Transfer

Transferring money from Cash App to your checking account is a simple process. Completing the transfer involves a few key steps. These ensure your funds safely reach your bank. Let’s explore how to complete this transfer smoothly.

Examen des détails du transfert

Double-check the amount you want to transfer. Ensure it matches your intention. Verify the receiving account details. This step prevents errors in the transfer process. Look for any fees associated with the transfer. Knowing these helps you plan accordingly.

Confirmation de la transaction

Once details are verified, proceed to confirm the transaction. Tap the confirmation button on your app. This action initiates the transfer process. Keep an eye on any prompts from the app. These guide you through the final steps. Wait for the confirmation message. This message indicates the transfer is successful.

Dépannage des problèmes courants

Easily move funds from Cash App to your checking account by linking your bank and verifying details. Ensure app updates are current to avoid errors. Double-check account numbers for a smooth transaction process.

Transferring money from Cash App to your checking account should be a seamless process. However, sometimes things don’t go as planned. Understanding how to troubleshoot common issues can save you time and frustration. Let’s dive into some practical solutions to get your money moving again.Résoudre les retards de transfert

Transfer delays can be annoying, but they often have simple explanations. Double-check that your bank details are correct. An incorrect account number or routing number is a common culprit. Sometimes, Cash App might be experiencing high traffic. This can slow down transfers. If this happens, try transferring your funds outside of peak hours. If everything seems fine but the delay persists, check your app for updates. Outdated versions might have bugs that impact transfers.Handling Failed Transactions

A failed transaction can be unsettling. First, ensure there are no connectivity issues. A weak internet connection can disrupt the process. Verify that you have sufficient funds in your Cash App balance. Insufficient funds can cause transactions to fail. Sometimes, security measures can trigger a transaction to fail. This can happen if unusual activity is detected. In this case, reaching out to Cash App support for assistance is your best bet. Have you ever experienced a failed transaction? Share your story in the comments. How did you resolve it? By understanding these common issues, you can avoid unnecessary stress. With a few checks and balances, you’ll have your money where it needs to be in no time.

Ensuring Security And Privacy

Transferring money from your Cash App to your checking account is a seamless process. However, ensuring security and privacy during this transfer is crucial. You wouldn’t want your hard-earned money falling into the wrong hands. Just imagine the peace of mind you get knowing your transactions are safe. Let’s dive into ways you can protect your account and recognize any fraudulent activities.

Protéger votre compte

Security begins with having a strong password. Choose a combination of letters, numbers, and special characters that aren’t easily guessed. Avoid using personal information like birthdays or names.

Enable two-factor authentication for an added layer of security. This requires you to verify your identity through a code sent to your phone or email. It acts as a second lock to your account.

Regularly update your app to the latest version. Updates often include security patches that protect against new threats. An outdated app might leave your account vulnerable.

Reconnaître les activités frauduleuses

Be vigilant about unexpected notifications. If you receive alerts about transactions you didn’t make, investigate immediately. It might be a sign of unauthorized access.

Watch out for phishing attempts. Fraudsters may try to trick you into revealing personal information through fake emails or messages. Always verify the source before clicking on any links.

Review your transaction history regularly. Spotting unfamiliar transactions early can prevent potential losses. Have you ever noticed a charge that seemed off? It’s always better to be safe than sorry.

Your awareness is your best defense against fraud. How do you ensure your transactions remain secure? Share your experiences and insights in the comments below. Let’s create a community that protects one another!

Questions fréquemment posées

How Do I Link My Bank Account To Cash App?

To link your bank account to Cash App, open the app, tap on the bank icon, then ‘Add Bank’. Enter your bank details. Follow the prompts to complete the connection. This allows you to transfer money to and from your checking account easily.

Can I Transfer Money Instantly To My Bank?

Yes, you can transfer money instantly. Cash App offers an instant transfer option. However, there’s a fee for this service. The standard transfer is free but takes 1-3 business days. Choose the option that suits your needs and proceed accordingly.

Y a-t-il des frais pour transférer de l’argent ?

Transferring money from Cash App to your bank account is free with standard deposits. However, instant transfers charge a 1. 5% fee. You can choose between free standard deposits or pay for instant transfers. Carefully consider your urgency and cost preferences before making a choice.

How Long Does A Standard Transfer Take?

A standard transfer from Cash App to your bank takes 1-3 business days. The timing depends on your bank’s processing times. If you need funds sooner, consider using the instant transfer option, which incurs a fee but provides quicker access.

Conclusion

Transferring money from Cash App to your checking account is simple. Follow the steps carefully. Double-check all details before you confirm. This ensures your money reaches the right place. Regular transfers help manage finances better. Keeping track of funds is important for budgeting.

It also helps avoid any unexpected fees. Remember to update your app regularly. This helps you enjoy new features and fixes. Stay informed and make secure transactions. Your financial safety matters. With practice, transferring money becomes easy. Stay confident in managing your money.

You can do it!