Comment obtenir des paiements mensuels sur Afterpay : guide simplifié

Imagine having the power to shop for your favorite items and spread the cost over time without any stress. This is where Afterpay comes in, offering you the convenience of splitting your payments into manageable chunks.

But did you know there’s a way to make these payments even easier with monthly installments? Yes, you can enjoy your purchases now and pay later with greater flexibility. In this guide, we’ll unveil the secrets to setting up monthly payments on Afterpay, ensuring you stay in control of your finances while indulging in the shopping experience you love.

Stay with us to discover how you can make this payment plan work for you, saving you both time and financial worry.

Qu'est-ce qu'Afterpay ?

Afterpay is a popular way to buy now and pay later. It lets you split your purchase into four paiements faciles. You pay the first part right away. The next payments are due every two weeks. You can buy what you want without waiting.

Many stores accept Afterpay for online and in-store shopping. You just need to create an account. It’s simple and quick. Afterpay does not charge interest. It can help you manage your budget better. But, remember to pay on time. If you miss payments, you may face late fees.

Setting Up An Afterpay Account

Visit the Afterpay website. Click on the S'inscrire button. Fill out the form. Provide your email address. Create a mot de passe fort. Enter your personal details. Make sure all information is correct. Verify your email after signing up. Check your inbox for a verification link. Click the link to confirm your account. Once verified, log in to your new account. You can start shopping immediately.

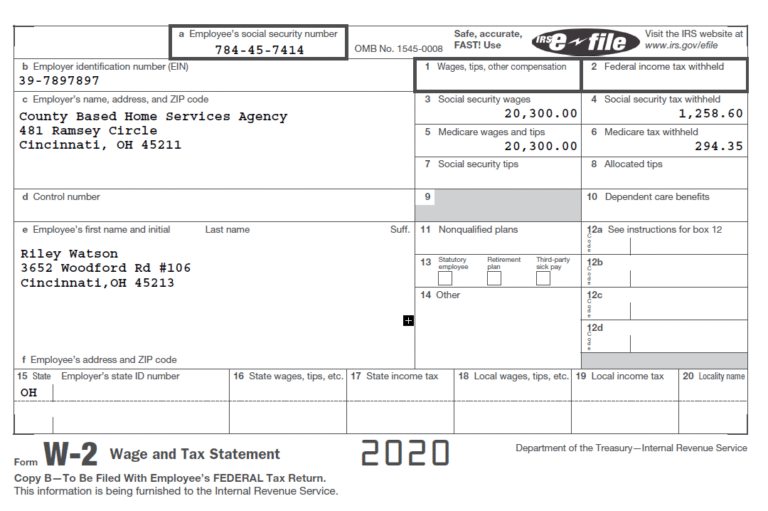

Must be 18 years or older. Have a valid email address. Need a carte de débit ou de crédit. Must be a resident of the country where Afterpay operates. Ensure a good payment history. No overdue payments. Check if your card allows Afterpay transactions. Some banks may restrict usage. Make sure to meet all these requirements. Otherwise, account setup might fail.

How Afterpay Works

Afterpay lets you buy now and pay later. You can split your payment into four parts. Pay the first part right away. The rest come every two weeks. This makes buying easier. No need to worry about paying all at once. It helps plan your spending better.

Afterpay is interest-free. You pay no extra money if on time. Late payments may have a small fee. Keep track of due dates. That way, you avoid any fees. It’s easy to stay on track with reminders. This makes Afterpay a smart choice.

Steps To Make Monthly Payments

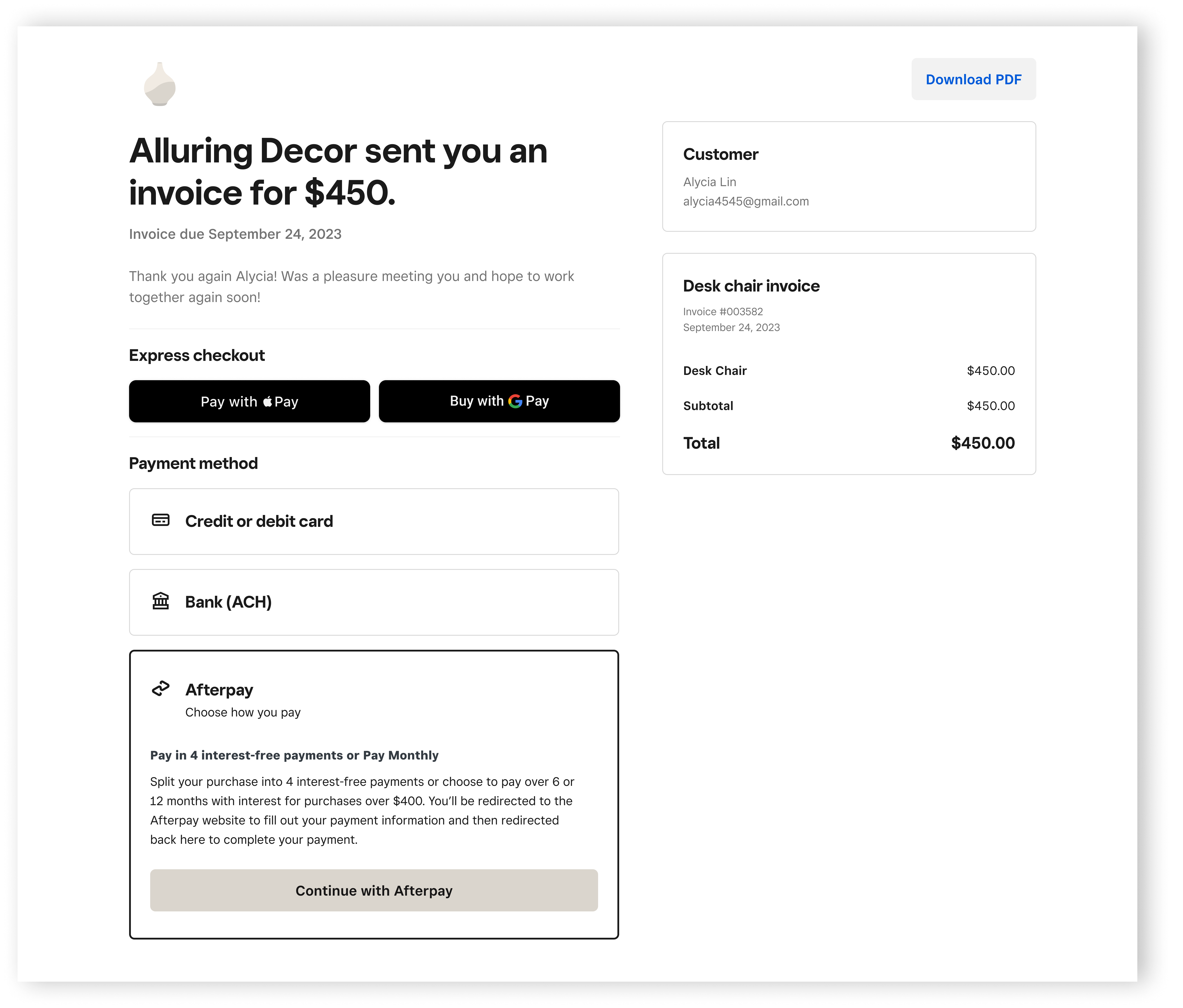

Après-paiement lets users pay in monthly parts. First, choose the monthly payment option at checkout. This spreads cost over months. Users get more time to pay. Payment plan is set up easily. It helps manage expenses better. Monthly payments are simple to track. This option suits many budgets. Paying monthly means less worry. Many find it useful.

Payment tools help track bills. Use Afterpay app for managing payments. It shows payment dates and amounts. Users can set rappels for due dates. This prevents late fees. Managing payments becomes easier. People stay organized. The app is user-friendly. Tools in the app help plan finances. It keeps users informed about their balance. Staying on track is important.

Benefits Of Using Afterpay

Afterpay allows you to buy now and pay later. This gives you more financial freedom. You can buy things without waiting for payday. This helps with budgeting. You pay a little bit each month. This makes big purchases easier to manage.

With Afterpay, there are no interest fees on your payments. This means you pay no extra money. Just the price of what you buy. It makes shopping more affordable. You can enjoy more things without paying more. This is good for your wallet.

Inconvénients potentiels

Late fees can be a big problem with Afterpay. If you miss a payment, Afterpay may charge a late fee. This fee can make your purchase more expensive. It is important to pay on time to avoid extra costs. Missing payments can also lead to more serious issues.

Impact on credit score is another concern. Afterpay does not affect your credit score directly. But if you fail to pay, it might lead to trouble later. Companies may report late payments. This can hurt your credit score. Keeping track of payments is vital to avoid these problems.

Tips For Effective Use

Using Afterpay smartly can help in managing money better. Plan purchases and know your spending limits. Make a list of things you need. Suivez vos dépenses weekly. Set aside money for Afterpay payments. This helps avoid surprises. Économisez un peu for emergencies. Knowing your budget keeps you safe.

Pay on time to avoid fees. Set reminders for payment dates. Use a calendar or app for alerts. Check your bank balance before buying. This ensures you have enough. Late payments can hurt your credit. Stay alert and manage your money wisely. It’s easy and keeps you stress-free.

Questions fréquemment posées

What Is Afterpay’s Monthly Payment Option?

Afterpay allows you to split your purchase into four equal payments. These payments are automatically deducted every two weeks. Currently, Afterpay does not offer a monthly payment option. Users must adhere to the bi-weekly payment schedule.

How Do I Set Up Afterpay Payments?

To use Afterpay, shop at a participating retailer and choose Afterpay at checkout. Create an account or log in to an existing one. Afterpay automatically splits your purchase into four equal payments. The first payment is due at the time of purchase.

Are There Fees For Late Payments On Afterpay?

Yes, Afterpay charges late fees if payments are missed. Fees vary by region but are capped at 25% of the purchase. It’s important to ensure sufficient funds in your account to avoid these fees.

Can I Use Afterpay In-store?

Yes, Afterpay is available for in-store purchases at select retailers. You need to set up a virtual card in the Afterpay app. Present the card at checkout to pay using Afterpay.

Conclusion

Getting monthly payments on Afterpay is simple and convenient. Just follow the steps outlined in this guide. Manage your budget effectively and enjoy flexible payments. Afterpay offers an easy way to buy now and pay later. Remember to make timely payments to avoid late fees.

This method helps in organizing your finances better. Whether shopping online or in-store, Afterpay provides a seamless experience. Try it today and enjoy your purchases without immediate full payment. Make smart financial choices and keep track of your spending. Stay informed and enjoy the benefits of Afterpay monthly payments.