Comment annuler une carte bancaire Credit One

If you're considering canceling your Credit One Bank card, it's important to take a systematic approach. Start by evaluating your reasons for cancellation and reviewing your account status to guarantee all balances are settled. Once you've made that decision, you'll need to échanger des récompenses you've accrued before reaching out to service client. However, there's a specific process to follow that can make this change smoother, and it's vital to understand the implications of your choice. What steps should you take next to make sure everything goes as planned?

Évaluez vos raisons

Before you cancel your Credit One Bank card, take a moment to evaluate your reasons and guarantee it's the right decision for your financial situation. Consider whether high fees or interest rates are driving your decision. If you're aux prises avec des dettes, canceling may not be the best solution; it could impact your credit score negatively. Reflect on whether you've found a better card offering lower rates or rewards that suit your needs. Additionally, think about your spending habits and if having the card helps gérez vos finances de manière responsable. If the card's benefits outweigh the negatives, it might be worth keeping. Make sure you've weighed all options before making a final choice, ensuring it aligns with your objectifs financiers.

Vérifiez l'état de votre compte

Réviser votre statut du compte est essentiel pour comprendre tout soldes impayés, fees, or rewards before you decide to cancel your Credit One Bank card. Start by logging into your online account or checking your latest statement. Look for any pending transactions that might affect your balance. Make note of any frais annuels, late charges, or other penalties that could arise. Also, check if you have earned any points de récompense or cash back that you might want to redeem before closing the account. Understanding these details helps you avoid surprises and guarantees you make informed decisions about your finances. Taking this step not only protects your credit score but also provides peace of mind during the processus d'annulation.

Rembourser les soldes impayés

Pour garantir une processus d'annulation fluide, vous devriez rembourser tout soldes impayés on your Credit One Bank card. This step is vital because it assures you won't incur additional interest charges or affect your credit score negatively. Start by checking your current balance and making a payment that covers the total amount due. It's wise to verify that the payment processes successfully, so monitor your account to confirm the balance is zero before initiating the cancellation. Additionally, keep records of your payments for your financial safety. Once the balance is cleared, you'll be in a better position to proceed with canceling your card without any lingering obligations or concerns about unpaid debt.

Échanger des récompenses ou des avantages

Make certain to redeem any rewards or benefits you've earned on your Credit One Bank card before you cancel it, as they may be lost once the account is closed. To guarantee you don't miss out, follow these steps:

- Vérifiez votre solde de récompenses: Log into your account or use the mobile app to see how many points or cash back you have available.

- Review redemption options: Look for ways to use your rewards, whether it's gift cards, travel, or cash back. Choose the option that benefits you most.

- Échanger avant d'annuler: Complete the redemption process before you initiate your cancellation to avoid losing your hard-earned rewards.

Taking these steps will help you maximize the value of your Credit One Bank card before closing it.

Contactez le service client

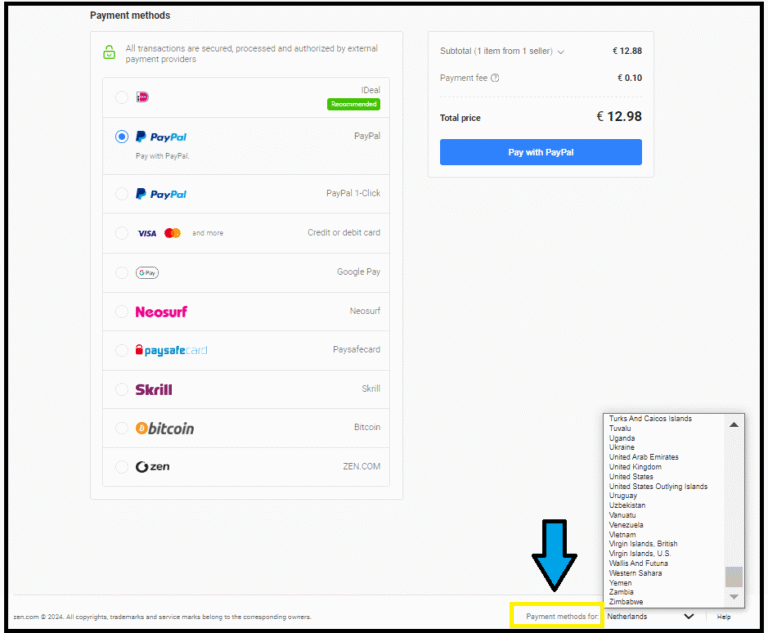

How can you effectively reach out to Service client de Credit One Bank pour initier le processus d'annulation? Tout d'abord, rassemblez vos informations sur le compte, including your card number and personal details, to expedite the call. You can contact them via their customer service number, which is usually found on the back of your card or on their official website. Make certain you're in a secure location when you call to protect your personal information. Be prepared to answer questions de sécurité for verification. If you prefer, you can also reach out through their online chat or secure messaging options. Always verify you're using the official Credit One Bank website to avoid scams. Keeping your data safe during this process is essential.

Soumettez votre demande d'annulation

Once you've contacted customer service, you'll need to submit your cancellation request clearly and directly. It's essential to provide specific details to guarantee the process goes smoothly. Here are three key points to include in your request:

- Your Account Information: Include your full name, account number, and any other identifying details to help them locate your account quickly.

- Motif de l'annulation: Briefly state why you're canceling. This can help the bank improve their services.

- Confirmation Request: Ask for written confirmation of your cancellation, so you have a record for your files.

Confirmer la fermeture du compte

It's important to confirm that your account has been successfully closed to avoid any future charges or complications. After submitting your demande d'annulation, reach out to Credit One Bank directly. Call their customer service number and ask for confirmation of your account closure. Make sure to note down the representative's name and any reference number they provide for your records.

You should also check your email for a confirmation message. If you don't receive one within a reasonable timeframe, suivi to verify everything is finalized. Finally, keep an eye on your statements for a month or two, even after closure, to ensure no frais inattendus appear. This proactive approach will help protect you from any potential issues down the line.

Surveillez votre rapport de crédit

Monitoring your credit report after canceling your Credit One Bank card is essential to verify that your credit history accurately reflects the closure and doesn't include any unauthorized charges. Regular checks can help you catch potential issues early, safeguarding your financial safety.

Here are three key things to look for:

- Statut du compte: Verify the Credit One account shows as 'closed' and reflects any outstanding balances or payments accurately.

- Frais non autorisés: Look for any unfamiliar transactions that could indicate identity theft or fraud.

- Modifications du score de crédit: Monitor any significant drops in your credit score, which could signal negative impacts from the account closure.