Combien de fois Santander reportera-t-il les paiements : explication !

Are you feeling overwhelmed by your financial commitments and wondering how many times Santander might defer your payments? You’re not alone.

Many people find themselves in a situation where they need a little extra breathing room. Understanding your options can make a huge difference in managing your finances effectively. We’ll uncover the ins and outs of Santander’s payment deferral policies, providing you with the information you need to make informed decisions.

Whether you’re looking to ease your current financial burden or simply planning for the future, this guide will arm you with the knowledge to take control. Let’s dive in and explore how Santander can help you stay on track without the added stress.

Santander Payment Deferral Options

Santander offers several payment deferral options to help customers. These options aim to ease financial stress. Customers can defer payments for a short period. This helps manage unexpected expenses. The bank allows deferring payments up to three times. Each deferral must be approved by Santander.

Deferral requests must be made in advance. It’s important to contact Santander early. Deferring payments can affect interest rates. Always check the terms carefully. Understanding the process is crucial. Santander provides guidance through customer service. Seeking help is encouraged.

Reasons For Payment Deferral

Many people face hard times. Job loss can make it tough to pay. Health issues might mean more bills. Some folks might have a big family. This means lots of needs. Unexpected costs can pop up anytime. A car break or a house fix. Sometimes, people have too many loans. Paying all at once can be hard. Natural disasters can ruin homes or work. Then, money gets tight. In such times, deferring payments helps.

Critères d'éligibilité

Santander may allow payment deferrals for some customers. To qualify, you must meet certain critères d'éligibilité. First, you should have a valid account with Santander. Your payment history should be generally good. This means paying on time in the past. You might need to show proof of financial difficulty. This could be a drop in income or unexpected expenses. Santander might ask for documents to prove your situation. Your loan should not be in default. You might need to have made a minimum number of payments. Each deferral request is reviewed individually. Santander will decide based on your circumstances. They may also consider the type of loan you have. Personal loans, car loans, and mortgages might have different criteria. It’s important to contact them directly. They will provide the most accurate information. Always check with your local branch or their customer service.

Processus de candidature

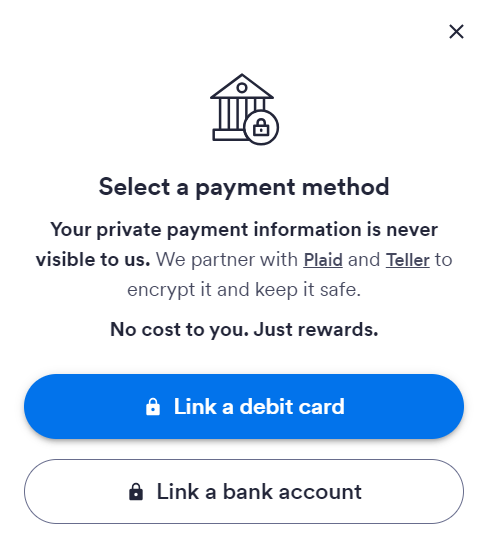

Applying for payment deferral at Santander is simple. Start by visiting their website or app. Find the section for payment deferrals. Fill out the form with your details. Make sure all information is correct. Submit the form online. Wait for a confirmation email from Santander.

You may need to provide extra documents. This helps them understand your situation. Keep these ready to avoid delays. Contact customer service if you need help. They can guide you through the process.

Once approved, you’ll get a new payment schedule. This helps you manage your finances better. Remember to check your email regularly. Santander will update you on your application status.

Impact On Credit Score

Deferring payments might affect your credit score. It may not always be direct. Santander usually reports to credit agencies. This could show your account as current. It’s important to check your credit report regularly. You should ensure no mistakes are there. Always ask Santander how deferring affects your credit.

Each lender may act differently. Some might not report deferrals. Others might add notes to your file. This helps explain why payments are late. It’s crucial to know this. Your credit score can impact future loans. It can also affect interest rates. Stay informed and proactive.

Frequency Of Deferrals Allowed

Santander offers payment deferrals for those who need help. You can defer payments up to three times a year. Each deferral gives you more time to pay. You must request a deferral before the payment due date. It’s important to know that interest still adds up during deferrals. This means you will pay more later. Always check with Santander for the exact rules. They might change depending on the loan type. Make sure to keep track of your payment plan. Understanding how deferrals work can save you trouble. If you have questions, contact Santander directly. They can help you with the process. Knowing your options is key for managing your finances. Stay informed and plan ahead.

Terms And Conditions

Santander offers payment deferral under specific conditions. Understanding these terms is vital for customers. Each deferral request is reviewed independently. Eligibility criteria include financial hardship proof. The number of deferrals allowed can vary. Communication with Santander is essential during this process. Customers must stay informed. Mises à jour régulières from Santander help in understanding options. Clear documentation is required to apply. Always read the fine print. The bank’s policies may change, so stay updated. Deferral does not mean payment cancellation. Terms and conditions ensure fairness for all.

Alternatives To Deferral

Sometimes, paying your loan might be hard. It’s important to know other options. Talk to Santander about a plan de paiement. This can make payments smaller et Plus facile. You can also look into refinancing your loan. This might lower your taux d'intérêt ou monthly payment.

Another option is loan consolidation. This means putting all your loans together. It makes it simpler to pay. Some people also use économies or ask for help from family. Remember, always check all détails before you choose. Make sure it helps you and your finances.

Managing Finances During Deferral

Managing finances can be tricky during deferral periods. Setting a budget is crucial. It helps track habitudes de dépenses. Consider dépenses essentielles first. Rent, groceries, and bills are vital. This keeps your living situation stable. Cut down on non-essential purchases. Save money for future needs.

Communication with lenders is important. Ask about taux d'intérêt during deferral. Understand how payments are affected. This avoids surprises later. Knowing these details helps with planning.

Utiliser outils financiers to assist. Apps can track expenses. They alert you about spending patterns. This makes budgeting easier. Stay informed about financial changes. Read updates from Santander. Keep an eye on their policies. Prepare for when payments resume.

Questions fréquemment posées

How Many Times Can Santander Defer Payments?

Santander typically allows payment deferrals on a case-by-case basis. The number of times they will defer payments depends on your situation. It’s best to contact Santander directly to discuss your options. Their customer service team can provide specific guidance tailored to your financial needs.

What Are Santander’s Payment Deferral Options?

Santander offers several payment deferral options to assist customers facing financial hardships. These options include short-term deferrals or extensions. They assess each situation individually. Contacting Santander’s customer service can provide detailed information about what options are available for your specific circumstances.

Can I Request A Payment Deferral Online?

Yes, you can request a payment deferral online through Santander’s website. They provide a convenient platform to submit your request and necessary documentation. This process allows you to manage your financial situation efficiently. Ensure you have your account information ready for a smooth experience.

Does Deferring Payments Affect My Credit Score?

Deferring payments with Santander may not directly affect your credit score if properly arranged. However, it’s crucial to ensure that the deferral agreement is documented. Always confirm that the deferral is noted on your account to avoid unintended credit impacts.

Regular communication with Santander is essential.

Conclusion

Navigating Santander’s payment deferral policies can feel challenging. Understanding your options is crucial. Santander offers flexible solutions to support customers. Always communicate with them to explore possibilities. Knowing your financial commitments helps in planning better. Stay informed about any changes in their policies.

This knowledge ensures you can make informed decisions. Remember, maintaining open communication with Santander can assist in managing payments effectively. Seek advice if unsure about the terms. Being proactive ensures you stay on top of your financial health. Your financial well-being is important.

Prioritize it with the right information.