Les retards de paiement des loyers affectent-ils la cote de crédit ? Découvrez la vérité.

Imagine this: it’s the end of the month, and your rent is due. But life happens, and you find yourself a bit short on cash.

You might wonder, “What’s the big deal if I pay my rent a little late? ” If you’ve ever asked yourself this question, you’re not alone. Many people are unsure about how late rent payments might affect their credit score.

We’re diving into the world of credit scores and rent payments to unravel the truth. You’ll discover whether a late rent payment could potentially haunt your credit report. Why is this important? Because your credit score is more than just a number. It can influence your ability to secure loans, qualify for a mortgage, or even land that dream job. Stick with us as we explore the ins and outs of this vital topic. By the end, you’ll have a clear understanding and practical tips to protect your financial future. Curious about the real impact of late rent payments on your credit score? Let’s find out together.

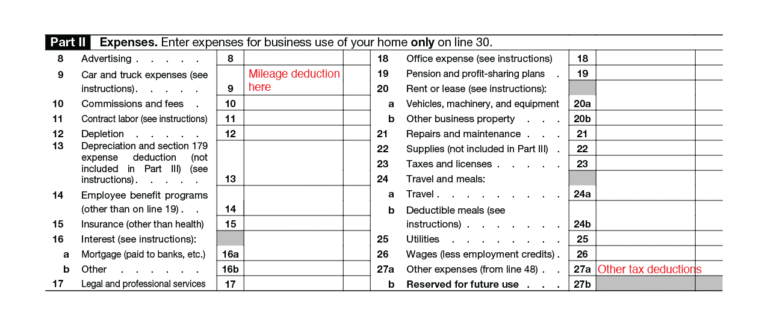

Impact Of Rent Payments On Credit Score

Rent payments usually don’t show on credit reports. Late rent payments might affect your cote de crédit. Some landlords report late payments to bureaux de crédit. This can lower your score. Paying rent on time is important. It helps keep your score safe.

Rent reporting services can help. They add your payments to credit reports. This can boost your score. But late payments still hurt. Always pay rent on time. Your credit score will thank you.

Landlord Reporting Practices

Landlords may report late rent to credit bureaus. Not all do this. But late rent can show on your credit report. It is like paying bills late. It can lower your credit score. Some landlords use direct reporting. This means they report rent payments directly. Your score can drop if you pay late. Not every landlord reports. Check if yours does. Always ask your landlord about their reporting practices.

Some landlords use third-party services. These services report rent payments. They help track rent payment history. Third-party services report both late and on-time payments. This can affect your credit score. Paying rent on time is important. It helps keep a good credit score. These services can help you see your rent payment record. They report to credit bureaus like Experian. Always ask if your landlord uses these services.

Types Of Rental Agreements

Traditional lease agreements are popular among renters. They usually last for 12 months. Renters sign a contracter with the landlord. This contract includes rules. Breaking the lease can lead to problems. Late rent payments might cause frais. A poor payment history can affect future rentals. Renters must suivre the agreement rules. This will keep the rental in good standing. Keeping up with payments is important.

Month-to-month rentals offer flexibility. They do not have a long-term commitment. Renters can move with short notice. This rental type might cost more. Landlords can increase rent anytime. Late payments here can also cause issues. Renters must pay on time. This keeps a good rental history. A good record helps in future rentals. Always communicate with the landlord if there’s a problem.

Role Of Rent Payment Platforms

De nombreuses personnes utilisent online payment systems to pay rent. These systems make paying rent easy. They help track payments too. If you pay on time, it shows in records. Late payments also get recorded. Landlords often use these records to judge tenants.

Automatic rent services take money from your account each month. They ensure rent is paid on time. This helps avoid late fees and bad credit marks. Many people find these services useful. They don’t worry about forgetting rent. It’s a safe way to manage monthly payments.

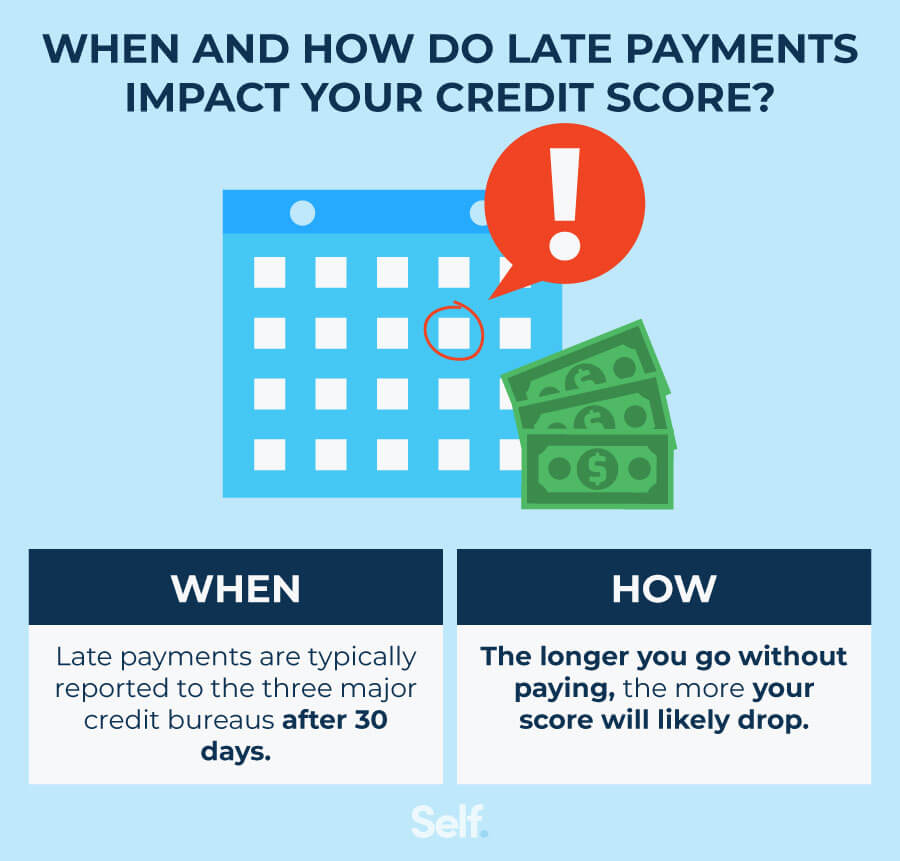

Late Payments And Credit Reports

Rent payments can impact your credit score. Late payments are often recorded. Lenders may report them after 30 days. This can affect your credit report. A late payment stays on record for seven years. It’s important to pay rent on time.

Late rent payments can hurt your credit score. This makes getting loans hard. Credit scores show how well you pay bills. A low score can mean higher interest rates. Keeping a good score is important. Always try to pay rent before it’s late.

Protecting Your Credit Score

Talking to landlords helps in many ways. Expliquer why rent is late. Ask for more time if needed. Arrange a payment plan. Being honest is key. Landlords may give options. Help is available if you ask. Problems happen. Communication can solve them. Éviter surprises for landlords.

Ensemble reminders for rent due dates. Utiliser calendars or apps. Budget money each month. Know how much rent costs. Sauvegarder a little each week. Plan ahead. Have a backup plan. Talk to family for advice. Make payments automatic. Transfert money to landlords on time. Stay organized. Being prepared is important.

Alternatives To Traditional Credit Reporting

Late rent payments can sometimes affect your credit score. Newer credit systems consider rent payment history. It’s crucial to pay rent on time to maintain a healthy credit profile.

Rent Payment History Services

Rent payment history services help renters. These services report rent payments to credit bureaus. They boost credit scores without using credit cards. On-time rent payments are key. They show responsibility and financial discipline. Some landlords offer these services. Others need renters to sign up themselves. It is a simple process. Positive rent reports can build a good credit profile. They help renters in the long run. Consistent payments matter. They reflect a stable financial habit. Rent payment reporting is a smart choice. It offers a new way to improve credit.

Building Credit Through Alternative Means

Alternative credit-building methods are growing. Cartes de crédit sécurisées are one option. They require a deposit. This deposit acts like a safety net. It helps people with no credit history. Credit builder loans are another option. They work like a savings plan. You pay monthly. Payments build your credit score. These loans teach good habits. They prepare you for future financial needs. Choosing wisely is important. Always check terms before signing up. Alternative ways to build credit are helpful. They provide a path for those starting out.

Questions fréquemment posées

Do Late Rent Payments Show On Credit Reports?

Late rent payments typically don’t appear on credit reports. However, if your landlord reports to a collection agency, it could impact your credit. It’s best to pay rent on time to avoid potential credit issues.

Can Landlords Report Late Payments To Credit Bureaus?

Yes, landlords can report late payments to credit bureaus if they use specific reporting services. This can negatively impact your credit score. Always communicate with your landlord if you’re experiencing financial difficulties.

How Long Do Late Rent Payments Affect Credit Score?

If reported, late rent payments can affect your credit score for up to seven years. However, their impact diminishes over time, especially if you maintain good credit habits afterward.

Do Rent Payment Services Affect Credit Score?

Some rent payment services report timely payments to credit bureaus, which can positively affect your score. Conversely, missed payments reported by these services can negatively impact your credit score.

Conclusion

Late rent payments can impact your credit score. Paying rent on time is crucial. Late payments might lead to negative marks on your credit report. These marks can lower your credit score. A lower score can make it hard to get loans or credit cards.

Always keep track of rent deadlines. Set reminders if needed. Being proactive helps maintain a healthy credit score. Good credit opens more opportunities. Remember, consistency is key. Prioritize timely payments for financial stability. Stay informed and protect your credit health.

Responsible habits lead to better financial outcomes.