Les cabinets dentaires proposent-ils des plans de paiement : options de soins abordables

Are you putting off that much-needed dental visit because you’re worried about the cost? You’re not alone.

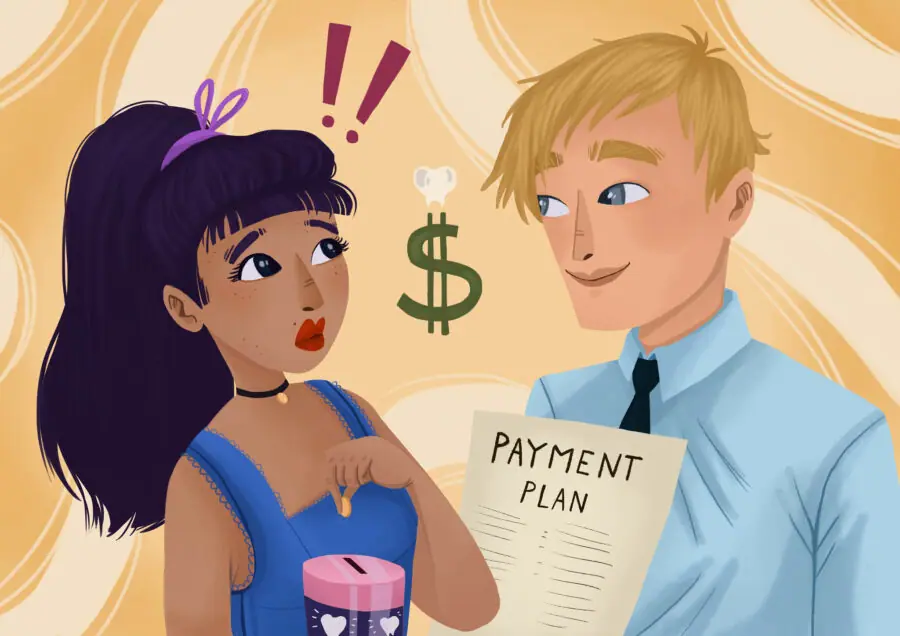

Many people wonder if dentist offices offer payment plans, and the good news is that many do. Imagine getting that brilliant smile you’ve always wanted without the stress of a big upfront payment. Picture the relief of addressing dental issues now and paying gradually, at a pace that suits your budget.

This article will explore how payment plans can make dental care more accessible for you. Ready to discover how you can manage your dental expenses more effectively? Let’s dive in.

Payment Plans In Dentistry

Types Of Dental Payment Plans

Dentist offices often offer in-house financing for dental care. Patients can pay over time. This plan helps manage high costs. Payments are usually monthly. Interest rates may be lower. Some offices might not charge interest at all. It’s a good way to get necessary treatment without full payment upfront.

Third-party financing involves outside lenders. Companies like CareCredit help with dental bills. They provide cartes de crédit or loans. Patients can pay back in installments. This option usually requires credit checks. Interest rates can vary. It’s important to read terms carefully. Some plans offer zero interest if paid quickly.

Installment plans allow payments in small amounts. Payments are made monthly or weekly. It helps spread out the expense. These plans are often flexible. Patients can choose what fits their budget. No credit checks are needed. It’s a simple way to manage dental costs.

Benefits Of Payment Plans

Payment plans help you manage dental costs. They break down big bills into smaller payments. This makes dental care more affordable for many families. You don’t have to pay everything at once. This is helpful for many people.

Delaying dental visits can cause more problems. Payment plans ensure you get care on time. You can see the dentist when needed. No waiting until you save enough money. This keeps your teeth and gums healthy.

Regular visits improve your oral health. Payment plans make it easier to go. You can keep up with cleanings and check-ups. This prevents cavities and gum disease. Healthy teeth make you feel good and look nice.

How To Choose A Payment Plan

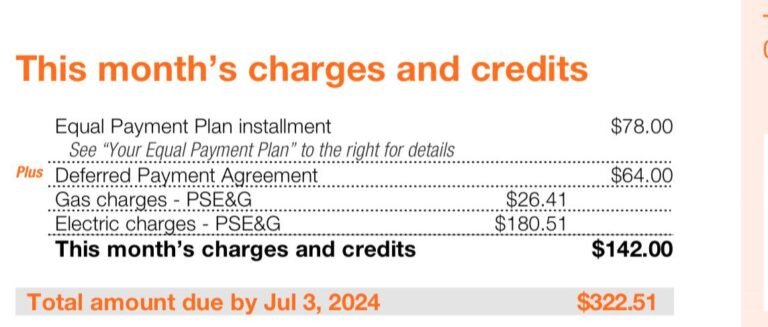

Comprendre votre budget is key. Count your monthly income. List all your expenses. Dental costs should fit this budget. Consider any économies you have. Emergency funds are also important. You may need them later. Being clear about your needs helps. It makes choosing a plan easier.

Look at different plans de paiement. Some have low monthly payments. Others offer réductions if paid early. Read details about each plan. Compare their avantages et limites. Choose what suits your financial situation. Pick the plan that helps you best.

Termes are rules. Conditions are requirements. Read them carefully. Know what you are agreeing to. Understand all fees involved. Look for any hidden charges. Contact the office if you have questions. It’s crucial to know before signing up.

Questions To Ask Your Dentist

Understanding coverage and limitations is important. Ask what treatments are covered. Know what is not covered too. This helps plan your budget better.

Ask about taux d'intérêt on payment plans. Some plans have interest. Others might not. Knowing the rate helps avoid surprises. It helps in comparing options.

Find out about the duration of payment plans. Some plans last a few months. Others might extend for years. Choose a duration that fits your budget. Longer plans might have smaller payments.

Alternatives To Payment Plans

Many dentist offices provide payment plans, but alternatives like dental credit cards and health savings accounts exist. These options can help manage costs without a long-term commitment. Patients can also explore dental discount plans or insurance to cover treatments.

Dental Insurance

Dental insurance helps pay for dentist visits. It covers basic procedures like cleanings. Some plans also cover major treatments like root canals. Monthly payments are required. It reduces costs for expensive work. Always check what your insurance covers.

Discount Dental Plans

These plans are not insurance. They offer réductions on dentist services. You pay a small fee each year. Get reduced rates for many procedures. Find a dentist who accepts the plan. Save money on regular visits. Perfect for those without insurance.

Health Savings Accounts

Health Savings Accounts, or HSAs, are special bank accounts. You save money for health costs. Use it for dental expenses. Contributions are tax-free. Pay for treatments directly. A smart way to manage dental costs. Ideal for those with high-deductible insurance plans.

Tips For Managing Dental Expenses

Dental care is important for health. Focus on essential treatments first. Talk to your dentist about what you need. Ask about payment plans for costly treatments. Staying informed helps in making smart choices.

Use preventive services to avoid big costs later. Regular check-ups and cleanings keep teeth healthy. These services are often covered by insurance. They help catch problems early.

Community resources can help with dental costs. Local clinics may offer reduced fees. Some places provide free dental days. Research nearby options. Many people find help this way.

Questions fréquemment posées

Do Dentists Offer Payment Plans?

Yes, many dental offices offer payment plans to help manage costs. These plans can be flexible, allowing patients to pay over time. Options often include monthly payments, interest-free periods, or third-party financing. It’s best to discuss available plans directly with your dentist’s office.

Are Dental Payment Plans Interest-free?

Some dental payment plans offer interest-free options, but not all. Interest-free plans usually require timely payments. It’s important to ask your dental office about any interest rates or fees. Understanding the terms can help you choose the best option for your budget.

What Types Of Payment Plans Do Dentists Provide?

Dentists typically offer several types of payment plans. These can include in-house financing, third-party financing, or dental credit cards. Each plan has different terms and conditions. It’s essential to discuss your options with the dental office staff to find a plan that suits your needs.

How Do I Qualify For A Dental Payment Plan?

Qualifying for a dental payment plan often requires a credit check or proof of income. Some plans may have more lenient requirements. Discuss your financial situation with the dental office to see what plans you might qualify for. They can guide you through the application process.

Conclusion

Dentist offices often offer payment plans for various treatments. These plans help patients manage costs better. Flexible options ensure that dental care remains accessible. Discuss options with your dentist during your visit. Understanding the terms can ease financial stress. Planning ahead can make dental visits more affordable.

Research and compare options to find the best fit. Always ask questions if you’re unsure. Proper planning leads to better oral health. A healthy smile is worth the investment. Consider payment plans to maintain your dental care routine.