Les garages automobiles proposent-ils des plans de paiement ? Vos options de financement

Ever faced a hefty car repair bill that left you wondering how to manage the cost? You’re not alone.

Auto repairs can be unexpectedly expensive, and the financial burden can be overwhelming. But what if there was a way to ease that pressure? Imagine being able to spread out your payments, making it easier on your wallet without compromising on the quality of work your car receives.

We dive into whether auto shops offer payment plans and how that could be a game-changer for you. Discover the options available to make managing repair costs simpler and more manageable. By the end, you’ll feel empowered and informed, ready to tackle any car repair challenge with confidence. Keep reading to learn how you can keep your car running smoothly without breaking the bank.

Auto Shop Financing Basics

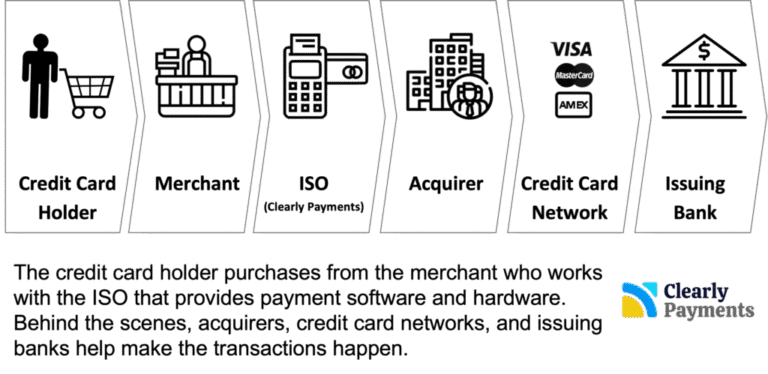

Many auto shops offer payment plans. This helps people pay over time. Financing options can ease the burden of large repair costs. Some shops partner with banks for loans. Others have in-house financing. In-house financing usually has a quick approval process. It’s often less strict than bank loans. Taux d'intérêt may vary depending on the shop. Be sure to ask about frais cachés. Always read the fine print. Clear terms are important. Some shops require a down payment. Others might need a credit check. Payment flexibility is a key benefit. It allows monthly payments. This helps manage budget better. Not all shops offer these plans. It’s important to call and ask first. Compare terms before choosing a plan. Affordable payment plans can make car care easier. It’s wise to plan before repairs start.

Types Of Payment Plans

Auto shops often offer interest-free financing. This means you pay no extra money. You only pay the price of the service. Many people like this plan. It’s simple and easy. You just need to make sure you pay on time.

Some shops provide deferred payment plans. You start paying later. Sometimes, you don’t pay for months. This plan helps if you have no money now. Be careful, there might be fees later.

Traditional installments are common. You pay a set amount each month. This amount includes interest. It’s divided into many payments. It’s good for long-term plans. Make sure you understand the total cost.

Credit-based Options

Many auto shops offer financement interne. This means they help you pay over time. You might not need a bank. It’s like a small loan from the shop. They may ask for a small down payment. Then, you pay the rest in paiements mensuels. This can make things easier for many people. It helps them manage big costs. Always check the taux d'intérêt first. It tells you how much extra you will pay.

Sometimes auto shops work with third-party companies. These companies give you a credit plan. You can use this to pay the shop. You get more time to pay. But remember, they might check your cote de crédit. A good score can mean meilleures offres. If your score is low, it might be harder. Always read the termes et conditions. It helps you understand what you agree to. This way, there are no surprises later.

No Credit Check Plans

Many auto shops offer layaway programs for their customers. These programs allow you to pay in small amounts. You can pick the schedule for your payments. This way, you can buy car parts or services without a credit check. You save money and then pay in full. It’s a good option if you don’t have all the money now.

Another choice is rent-to-own plans. Here, you pay a small fee to use the car part. After some time, you own the part. These plans are flexible and fit different budgets. They help if you want to avoid credit checks. You get what you need and pay over time.

Pros And Cons Of Payment Plans

Payment plans help you pay for car repairs. You don’t need all the money at once. This means you can fix your car sooner. No more waiting for a big payday. Plans can fit your budget. Choose the one that works best for you. Sometimes, these plans have low or no interest. This saves you money. Spreading out payments makes managing money easier.

Payment plans can have downsides. You might pay more in the end. Interest can add up. Missing a payment can lead to fees. It can hurt your cote de crédit. Always check the terms carefully. Some plans can have hidden costs. Be sure to read everything. Know what you’re agreeing to before you sign.

Factors To Consider

Exploring auto shops’ payment plans? Consider their interest rates and terms. Check if they require a credit check. Understand the payment schedule to avoid surprises.

Interest Rates And Fees

Interest rates can make payments bigger. High rates mean more money paid. Fees are also important. Hidden fees increase costs. Always ask about fees before signing. Some shops offer low rates, but have high fees. Compare different shops. Check total cost of the payment plan.

Conditions d'éligibilité

Shops have rules for payment plans. Good credit is often needed. Some shops want proof of income. Others ask for references. Age limits can apply. Some plans need a acompte. Know what you need before applying. Prepare documents to show you qualify. Talk to the shop if unsure.

How To Choose The Right Plan

Auto shops often offer payment plans to help manage repair costs. Consider interest rates and payment schedules to find the best plan. Evaluate your budget to ensure timely payments.

Évaluer votre situation financière

Knowing your finances helps you pick a good plan. Check your income et dépenses mensuelles. This shows how much you can pay. Don’t forget about other bills. You need to know what you spend each month. This helps find a payment plan you can afford. Économiser de l'argent is important too. Set aside some for emergencies.

Comparing Different Options

Auto shops offer different payment plans. Look at interest rates. Lower rates mean less extra cost. Check repayment terms. Shorter terms may have higher payments. Longer terms might cost more over time. Ask about discounts. Some shops give price cuts for early payments. Read all terms carefully. Understand what you agree to. Choose what fits your budget.

Questions To Ask Your Auto Shop

Comprendre le termes et conditions of payment plans is important. Some shops may charge extra fees. Ask about the interest rate. It might add to your total cost. Make sure you know the plan duration. Shorter plans might have higher payments. Longer plans might cost more in the end. Always read the fine print. It might have hidden details.

Be aware of coûts cachés in the payment plan. Some shops might include fees. Others might charge for late payments. Asking questions can prevent surprises. Know if there are setup fees. Sometimes, they add to your bill. Also, check for early payment penalties. Paying off early should not cost extra. Always confirm what is included in the plan. This helps you budget better.

Questions fréquemment posées

Do Auto Shops Offer Financing Options?

Yes, many auto shops offer financing options for customers. These plans allow you to pay over time. It helps in managing unexpected repair costs. Terms can vary, so it’s important to understand the interest rates and payment schedules. Always ask about the details before committing.

How Do Car Repair Payment Plans Work?

Car repair payment plans work by dividing repair costs into manageable payments. They often involve a credit check. Once approved, you’ll make monthly payments until the balance is cleared. Some shops partner with financing companies. Always read the terms and conditions carefully to avoid surprises.

Are Payment Plans Available For All Repairs?

Not all auto shops offer payment plans for every repair. Availability often depends on the shop’s policies and the repair cost. Smaller repairs might not qualify for financing. It’s best to ask the shop directly. They can provide specific information based on your needs.

Do Payment Plans Affect Credit Scores?

Yes, payment plans can affect your credit score. Timely payments can improve your score, while missed payments may harm it. Some plans may involve a credit check. It’s essential to understand the terms and ensure affordability before committing. Always monitor your credit report for any changes.

Conclusion

Exploring auto shop payment plans offers flexibility and peace of mind. Many shops provide options to fit different budgets. This helps make car repairs more manageable. Always ask about terms and conditions. Compare plans before deciding. This ensures you choose what’s best for you.

A good plan can ease financial stress. It allows you to maintain your vehicle without worry. Keep your car in top condition without breaking the bank. Payment plans might just be the solution you need. Stay informed and make smart choices for your vehicle’s care.