Comment transférer de l'argent de Netspend vers un compte bancaire ? Guide simple

Are you looking to move your money from a Netspend account to your bank account? You’re not alone.

Many people find themselves in a similar situation, eager to streamline their finances. The good news is that it’s entirely possible, and the process might be easier than you think. Imagine the convenience of having all your funds in one place, ready to use whenever you need.

In this blog post, you’ll discover the simple steps to make this transfer, saving you time and possibly even money. Ready to unlock the potential of your Netspend account? Let’s dive in and unravel the mystery behind transferring your money seamlessly.

Présentation de Netspend

Netspend offers a convenient way to manage your finances. It is a prepaid debit card service, providing flexibility without a traditional bank account. Users can make purchases, pay bills, and transfer money seamlessly. Netspend is popular among individuals seeking easy money management.

What Is Netspend?

Netspend is a leading provider of prepaid debit cards. It allows users to control spending and manage funds efficiently. Unlike credit cards, Netspend requires no credit check. This makes it accessible for many people. Users can load money onto their cards and use them like regular debit cards.

Features Of Netspend

Netspend offers numerous features that enhance user experience. Direct deposit is a key feature, providing easy access to funds. Users can receive paychecks or government benefits directly on their card. Mobile app access offers convenient account management. Alerts and notifications keep users informed about their balance and transactions.

Benefits Of Using Netspend

Netspend provides several advantages for users. It offers budgeting tools to help track spending. Users can set up alerts for low balance or unusual activity. Netspend also provides rewards programs, which can save money over time. Additionally, customer support is readily available for assistance.

Netspend Accessibility

Netspend is accessible to a wide audience. It does not require a traditional bank account. Users can manage their money without dealing with banking fees. Netspend is accepted at millions of locations worldwide. Its accessibility makes it a convenient choice for many.

Setting Up Direct Transfers

Setting up direct transfers from Netspend to a bank account is simple. It helps you manage your finances more effectively. By following a few steps, you can easily link your Netspend account to your bank.

Understanding Direct Transfers

Direct transfers allow you to move money without hassle. This service ensures your funds reach your bank securely. You can set it up with ease and peace of mind.

Requirements For Setting Up Transfers

To set up transfers, you need a few details. Your bank account number and routing number are essential. Ensure your information is accurate to avoid delays.

Steps To Initiate A Transfer

Log into your Netspend account first. Navigate to the transfer section. Enter your bank details accurately. Confirm the transfer to complete the process.

Vérification de votre compte bancaire

Verification ensures your account’s security. You may need to confirm small deposits. Check your bank statement for these amounts. Enter them on Netspend to verify your account.

Benefits Of Direct Transfers

Direct transfers save you time. They offer a convenient way to manage funds. You avoid physical trips to the bank, making life easier.

Sometimes, issues may arise during setup. Double-check your bank details for accuracy. Contact Netspend support if problems persist. They can guide you through any difficulties.

Linking Netspend To Your Bank

Transferring money from Netspend to a bank account is possible. Simply link your Netspend account to your bank. This process allows easy transfers, enhancing financial flexibility.

Linking your Netspend account to your bank can simplify your financial management. Imagine the ease of transferring money directly without juggling multiple apps or websites. But how do you make this connection seamless? Let’s dive into the essentials of linking Netspend to your bank account. ###Requirements For Linking

Before you start, ensure you have all the necessary details ready. You’ll need your Netspend account information, which includes your account number and routing number. Also, have your bank account details on hand. This includes your bank’s routing number and your account number. Check if your bank supports transfers from Netspend. Some banks may have restrictions or additional steps. Contacting your bank’s customer service can clarify any uncertainties. ###Steps To Connect Accounts

1. Log into your Netspend account. Navigate to the transfer section. This is where you’ll initiate the linking process. 2. Enter your bank details. Input your bank’s routing number and your account number. Double-check for accuracy; mistakes can delay the process. 3. Verify your account. Netspend may require you to verify your bank account. This often involves confirming small deposits made by Netspend to your bank account. 4. Complete the linking. Once verified, you can transfer funds. Follow the prompts to finalize the setup. Linking your accounts might seem daunting, but breaking it down into simple steps makes it manageable. Have you ever faced challenges in managing multiple accounts? Linking them might just be the key to better financial control.Using The Netspend Mobile App

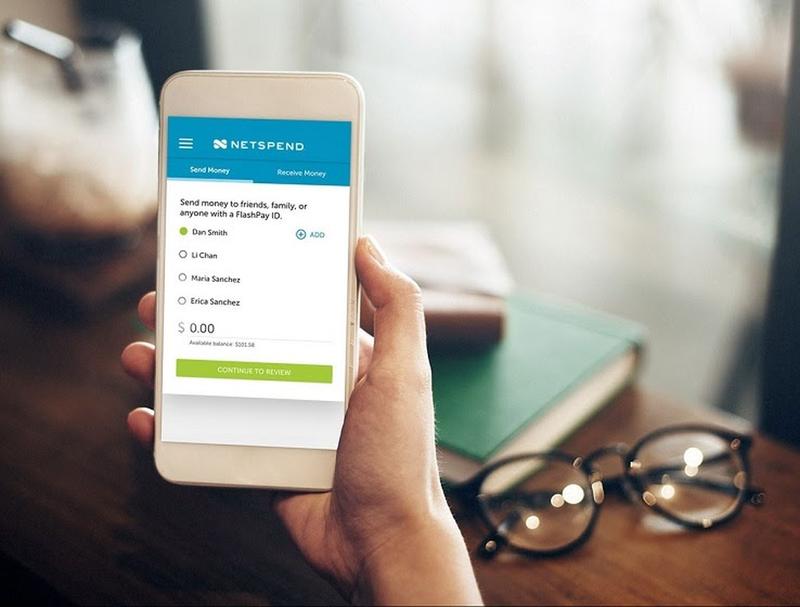

Transferring money from your Netspend account to a bank account can be done effortlessly using the Netspend mobile app. Imagine the convenience of handling your finances directly from your phone, without the hassle of visiting a bank or making phone calls. This app is designed to make your financial transactions smooth and stress-free, whether you’re at home or on the go.

Features Of The App

The Netspend mobile app is packed with useful features. You can quickly check your balance and transaction history, which helps you keep track of your spending. The app also provides real-time alerts for every transaction, ensuring you’re always in the loop.

With its intuitive interface, even those new to mobile banking find it easy to use. The app’s design puts everything at your fingertips, so you don’t have to hunt around for the information you need. Enhanced security features give you peace of mind when managing your money.

Lancer un transfert

Starting a money transfer is straightforward. Simply log into your Netspend app and navigate to the transfer section. From there, select the option to transfer money to a bank account, and follow the on-screen instructions.

Ensure you have your bank account details handy to avoid any hiccups. It’s as easy as entering your account number and routing number. Have you ever wondered how simple life could be if all transactions were this easy?

Once you’ve entered the required information, confirm the transfer. The app guides you through each step, making sure you don’t miss anything important. This process not only saves time but also makes managing your finances a breeze.

With the Netspend mobile app, transferring money becomes a task you can complete in minutes. Have you tried using the app yet for your money transfers? If not, you might be missing out on a tool that can simplify your financial life significantly.

Frais et limites de transfert

Transferring money from Netspend to a bank account involves fees and limits. Users can move funds, but charges may apply. Understanding these costs helps in managing your finances efficiently.

Comprendre les frais de transfert

When you transfer money from Netspend to a bank account, be prepared for potential fees. Netspend might charge a fee for each transfer, which can vary based on your account type and transfer method. It’s essential to check the specific fees associated with your account to avoid surprises. Consider how often you’ll need to transfer money. Frequent transfers could lead to accumulating fees, affecting your overall balance. If you’re not careful, these fees might take a bigger chunk out of your funds than you expect. Have you ever found an unexpected charge on your account? That’s a common issue when people overlook transfer fees. Always double-check the fee structure before making a transfer.Daily And Monthly Limits

Netspend has set daily and monthly limits on how much money you can transfer to a bank account. These limits ensure the security of your funds but can also be an obstacle if you need to transfer large amounts quickly. For instance, your daily limit might restrict how much you can transfer in a single day. If you need to move a substantial sum, you might have to plan multiple transfers over several days. Your monthly limit is another consideration. If you exceed this limit, you might have to wait until the next month to complete your transfers. This can be inconvenient if you’re trying to manage your finances efficiently. Have you ever been caught off guard by a limit? It can be frustrating, especially if you have urgent financial needs. Understanding these limits in advance allows you to plan your transfers accordingly. By being aware of the fees and limits, you can make more informed decisions about transferring money from your Netspend account to a bank account. This knowledge empowers you to manage your finances smartly and avoid unnecessary stress.

Dépannage des problèmes courants

Transferring money from Netspend to a bank account may encounter issues. Ensure your bank account is linked correctly. Verify if fees apply or transfer limits exist.

Transferring money from your Netspend account to a bank account should be simple. But sometimes, issues arise that can be frustrating. Whether it’s a failed transfer, unexpected fees, or a delay, these problems can disrupt your financial plans. Let’s address some common issues you might face and provide practical solutions to get your money where it needs to be.Failed Transfer Solutions

A failed transfer can be a puzzling experience. You might be left wondering why your money hasn’t moved as expected. Double-check your bank account details first. Incorrect information is often the culprit behind failed transfers. If the information is accurate, consider the transfer limits. Netspend might have restrictions on the amount you can transfer at one time. Breaking your transfer into smaller amounts could solve this issue. Another solution could be to check the network status. Sometimes, technical glitches can cause delays. Restart your device or try using another network connection to ensure everything works smoothly.Options de support client

When you face technical issues, don’t hesitate to reach out for help. Netspend’s customer support can be your lifeline. They offer various options to assist you. You can contact them via phone for immediate assistance. A customer service representative can guide you through troubleshooting steps. If you prefer written communication, email support is available. It’s a great way to explain your issue in detail and receive a comprehensive response. Netspend also provides live chat options. It’s fast and lets you resolve issues without making a phone call. Have you ever had to deal with a stubborn transfer problem? Your experience might offer insights to others. Share your tips or ask questions to find new solutions. Remember, you’re not alone in navigating these challenges.Alternatives aux transferts directs

Sending money from Netspend to a bank account involves several alternatives. Consider using linked accounts for seamless transfers. Explore third-party services for broader options and ease.

When you need to move money from your Netspend account to your bank account, you might find that direct transfers aren’t always possible. However, there are several alternatives that can help you accomplish this task. Whether you’re planning a vacation and need quick access to funds or simply looking for a reliable way to manage your money, these options can be effective. Let’s explore some of these alternatives.Utilisation de services tiers

Third-party services can be a lifesaver when transferring money from Netspend to a bank account. Services like PayPal or Venmo allow you to link your Netspend account and transfer funds seamlessly. You can then use these platforms to send money to your bank account. This method might involve small fees, but it’s often quicker than traditional bank transfers. Have you ever tried using PayPal to manage your money? It’s astonishing how fast transactions can be, sometimes making funds available in your bank within hours.Cash Withdrawals

If you’re someone who prefers tangible cash, withdrawing money directly from your Netspend card is a practical option. You can withdraw from ATMs and then deposit the cash into your bank account. ATMs are virtually everywhere, and this method allows you to handle your funds physically, offering a sense of control. It’s ideal for those who might need immediate cash or prefer handling money directly. Have you ever found yourself in a tight spot where you needed cash instantly? ATMs can be your best friend in such situations, ensuring that you never run out of funds when you need them most. When considering these alternatives, ask yourself what suits your lifestyle best. Is it the convenience of digital transfers, or the direct control cash gives you? Each option offers unique benefits, allowing you to choose what fits your needs.Questions fréquemment posées

Comment transférer de l'argent de Netspend vers ma banque ?

To transfer money from Netspend to a bank account, log into your Netspend account. Navigate to the transfer section and choose the option to transfer funds. Enter your bank account details accurately and specify the amount to transfer. Verify and confirm the transaction to complete the transfer.

Are There Fees For Netspend To Bank Transfers?

Yes, there may be fees associated with transferring money from Netspend to a bank account. The fee structure can vary based on your Netspend account type. It’s important to check the terms and conditions or contact Netspend customer service for detailed information on applicable fees.

How Long Do Netspend Transfers Take?

Netspend transfers to a bank account typically take 1 to 3 business days to process. The exact time may vary depending on your bank’s processing times. Ensure all details are correctly entered to avoid delays. Netspend provides notifications once the transfer is complete.

Can I Transfer Funds Using Netspend Mobile App?

Yes, you can transfer funds using the Netspend mobile app. Log into the app and navigate to the transfer section. Follow the prompts to input your bank details and the transfer amount. Confirm the transaction to initiate the transfer process conveniently from your mobile device.

Conclusion

Transferring money from Netspend to a bank account is possible. It’s a straightforward process. Follow the steps provided in your Netspend account. Ensure your bank details are accurate. This ensures a smooth transfer without issues. Regularly check your account for updates.

This keeps you informed of any changes. Always maintain a record of your transactions. It helps in tracking your finances efficiently. If issues arise, contact Netspend support for help. They are there to assist with any concerns. Keep your financial information secure and private.

Manage your money wisely and stay informed.