Pouvez-vous transférer de l'argent entre des comptes 529 ?

You've set up a 529 account to save for your child's education, but now you're wondering if you can transfer those funds to another account. Maybe your child's educational plans have changed, or you've found a plan with better investment options. Whatever the reason, you can transfer money between 529 accounts, but there are some rules to follow. You'll want to make certain the transfer doesn't trigger any penalties or taxes. But before you make the move, you should understand the specifics of the processus de transfert and how it may impact your overall savings strategy.

Understanding 529 Account Transfers

La plupart 529 plans allow you to transférer de l'argent between different accounts, but there are rules and restrictions you need to understand to avoid penalties and other unwanted consequences. You'll want to review your plan's specific requirements before making a transfer. Typically, you can transfer funds between accounts with the same beneficiary or to a different beneficiary who is a family member of the original beneficiary. You can also transfer funds to a different 529 plan, but this may be subject to state tax implications. It's important to evaluate the potential tax consequences and any impact on financial aid before making a transfer. You should also confirm whether the new plan has any enrollment or transfer fees.

Raisons de transférer des fonds 529

You may want to transfer 529 funds to take advantage of frais moins élevés, better investment options, or more favorable state avantages fiscaux offered by a different plan. Another reason is a change in your stratégie d'investissement or risk tolerance. Perhaps you initially chose a conservative investment portfolio, but now you're willing to take on more risk in pursuit of higher returns. You might also transfer funds if the beneficiary's educational plans change, such as switching from a four-year college to a vocational school. Additionally, you may want to transfer funds to consolidate multiple accounts or to change the account owner or beneficiary. By transferring funds, you can adapt your 529 plan to your changing needs while maintaining tax benefits.

How to Transfer 529 Accounts

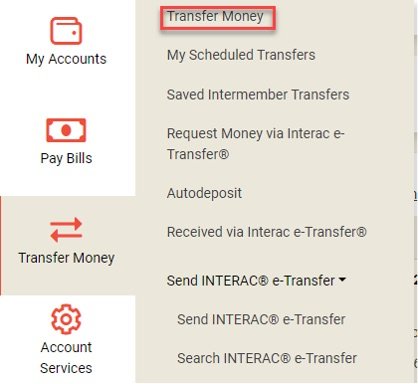

Transferring 529 accounts involves understanding the specific rules and procedures of both the original and destination plans to guarantee a smooth and tax-free transfer of funds. You'll need to review the plans' details, including investment options, fees, and any potential penalties for withdrawals or transfers. Start by contacting the administrators of both plans to confirm their transfer procedures. You may need to complete a formulaire de transfert or request a transfer online. Be sure to specify the informations du destinataire and the amount to be transferred. The processus de transfert typically takes a few weeks, but it's important to confirm this timeline with the plan administrators to verify that the funds are transferred correctly and without any issues.

Potential Tax Implications Involved

The key to steering transfers between 529 accounts without incurring tax liabilities hinges on meeting specific requirements. You won't incur tax penalties or liabilities if you transfer funds from one 529 account to another for the même bénéficiaire. However, if you transfer funds to a different beneficiary, the transaction is considered a non-qualified distribution for tax purposes. In this case, the earnings on the investment will be subject to income tax and a 10% penalty. Additionally, some states may recapture state tax benefits if you transfer funds out of a 529 account for a non-qualified purpose. To avoid tax implications, guarantee you understand the transfer rules and requirements before making a transfer between 529 accounts. Consult a conseiller financier if needed.

Impact sur l'admissibilité à l'aide financière

Changing the beneficiary of a 529 account or transferring funds to a different account can impact a student's eligibility for financial aid, as these assets are generally reported on the Free Application for Federal Student Aid (FAFSA). You should consider the potential effects on financial aid when making changes to a 529 account.

| Account Change | Impact on FAFSA | Financial Aid Effect |

|---|---|---|

| Change in beneficiary | New beneficiary's info required | May affect Expected Family Contribution (EFC) |

| Transfer to new account | New account owner's info required | May affect EFC |

| Transfer to different 529 plan | No change in FAFSA reporting | No effect on EFC |

| Rolling over to new account | No change in FAFSA reporting | No effect on EFC |

| Closing a 529 account | No longer reported on FAFSA | May increase financial aid eligibility |

Common Transfer Mistakes Avoided

Several common mistakes can be avoided when you're transfert de fonds from one 529 account to another, starting with verifying that the new account is established before initiating a transfer. You should also confirm that the recipient is eligible to receive the funds, as some 529 plans have restrictions. Additionally, review the investment options in the new account to make sure they align with your financial goals. It's also important to understand the potential implications fiscales of transferring funds between 529 accounts. You may be subject to state tax penalties or taxes on earnings if you're not careful. By doing your due diligence, you can avoid costly mistakes and guarantee a smooth transfer process. Always consult with a conseiller financier if you're unsure.