Puis-je utiliser ma carte de crédit à Copenhague ?

When you're planning a trip to Copenhagen, you might wonder if you can rely on your carte de crédit for daily expenses. In general, credit cards are widely accepted in most places, but there are a few nuances you should be aware of. For instance, while Visa and MasterCard dominate, smaller vendors might still lean towards espèces. Plus, the possibility of extra fees could impact your budget. So, what should you know to navigate this smoothly? Understanding the local practices can make all the difference in your experience.

Credit Card Acceptance in Denmark

In Denmark, you'll find that acceptation des cartes de crédit est widespread, with most establishments, from restaurants to shops, ready to take your card for payments. This makes your travel experience smoother, allowing you to carry less espèces. However, it's important to be aware that some smaller vendors or rural areas may prefer cash, so having a small amount on hand is wise.

Additionally, Denmark uses chip-and-PIN technology, enhancing security during transactions. You'll also notice options de paiement sans contact, which are popular and convenient. Before traveling, verify your card is compatible with European systems to avoid issues. Overall, using credit cards in Denmark not only offers convenience but also helps you maintain a safe and secure method of managing your expenses.

Types de cartes de crédit utilisées

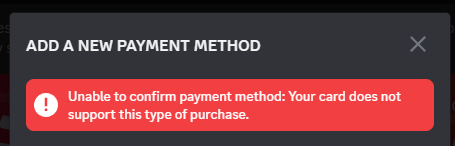

Exploring the various types of cartes de crédit used in Copenhagen can help you choose the best option for your travel needs. Visa and MasterCard are widely accepted, making them safe choices for everyday transactions. American Express, while less common, is still usable at many hotels and high-end restaurants. If you're considering a travel rewards card, be certain it has no frais de transaction à l'étranger; this can save you money while abroad. Additionally, chip-and-PIN cards are preferred for added security, especially when using self-service kiosks. Always inform your bank of your travel plans to avoid unexpected declines. Ultimately, choosing the right card can guarantee you have a smooth, secure experience while enjoying everything Copenhagen has to offer.

Frais et charges potentiels

Steering through potential fees and charges associated with credit card use in Copenhagen is essential for managing your travel budget effectively. One major concern is frais de transaction à l'étranger, which many sociétés de cartes de crédit impose on purchases made abroad. These fees can range from 1% to 3% of each transaction, adding up quickly. Additionally, some merchants may impose their own surcharges for credit card payments, especially for smaller transactions. It's also worth noting that dynamic currency conversion might be offered, allowing you to pay in your home currency; however, this often comes with taux de change défavorables. To minimize costs, consider using a credit card with no foreign transaction fees and always check your statements for any unexpected charges.

Conseils pour l'utilisation des cartes de crédit

En utilisant cartes de crédit in Copenhagen can be a convenient way to manage your expenses, but there are several tips to keep in mind for a smoother experience. First, always notify your bank about your projets de voyage to avoid your card being flagged for suspicious activity. Second, use ATMs associated with banks to minimize fees and guarantee security. When making purchases, opt for the monnaie locale to avoid dynamic currency conversion fees. Keep a méthode de paiement de secours, just in case your card isn't accepted. Finally, monitor your transactions regularly to catch any frais non autorisés early. By following these tips, you can enjoy your time in Copenhagen while keeping your finances secure and manageable.

Alternatives aux cartes de crédit

If you're looking for alternatives to credit cards while traveling in Copenhagen, consider options like debit cards, prepaid travel cards, and mobile payment apps. Each option offers unique benefits, guaranteeing your transactions are safe and convenient.

| Option | Avantages |

|---|---|

| Cartes de débit | Direct access to your bank account; low fees. |

| Cartes de voyage prépayées | Set spending limits; no overdraft risk. |

| Applications de paiement mobile | Quick transactions; often accepted widely. |

| Espèces | Widely accepted; useful for small purchases. |

Using these alternatives can help you manage your budget effectively while providing a sense of security. Always verify your chosen method aligns with your travel needs, keeping your financial safety in mind.