Puis-je transférer de l'argent d'une carte Vanilla Visa vers un compte bancaire ?

Have you ever wondered if you can transfer money from a Vanilla Visa gift card to your bank account? You’re not alone.

Many people receive these cards as gifts or rewards, and while they’re great for shopping, you might prefer the cash in your bank. Imagine the freedom of using that money to pay bills, save, or spend as you wish. This article will guide you through the possibilities, helping you unlock the full potential of your Vanilla Visa card.

Stay with us, and discover how to make the most of your gift card.

Qu'est-ce qu'une carte-cadeau Visa Vanilla ?

A Vanilla Visa Gift Card is a prepaid card. You can use it like a debit card. It is accepted almost everywhere. No need for a bank account. Just load money onto the card. Then, spend the amount loaded. It works for online shopping too. Perfect for gifting.

These cards offer flexibility. Buy them at retail stores. Choose a card with a set value. They are easy to use. A great way to control spending.

Features Of Vanilla Visa

Vanilla Visa cards are prepaid. You decide the spending limit. No overdraft fees. No interest charges. They are secure. Use them without sharing bank details. They are convenient. Accepted at many places. Simple activation process. Check balance anytime online.

Vanilla Visa cards offer freedom. Spend without limits. No monthly fees. They provide peace of mind. A budget-friendly option. Great for students and travelers. Enjoy spending with ease.

Types Of Vanilla Visa Cards

Vanilla Visa offers various card types. Standard gift cards are popular. They come with set denominations. Reloadable cards are versatile. Add funds whenever needed. Perfect for regular spending. Special occasion cards are unique. Ideal for birthdays and holidays.

Each card type has its benefits. Choose based on needs. Standard cards are great gifts. Reloadable cards are handy. Special cards add a personal touch. Explore options before buying.

Uses For Vanilla Visa Cards

Transferring money from Vanilla Visa cards to a bank account is not directly possible. These prepaid cards are mainly for purchases. They offer a convenient way to pay without cash or checks.

Vanilla Visa cards have become a popular financial tool for many, offering convenience and flexibility. Whether you receive one as a gift or purchase it for personal use, these prepaid cards can be incredibly useful. But how do you maximize their potential? Let’s explore some practical uses for Vanilla Visa cards that might surprise you and enhance your financial experience.Shopping And Purchases

Vanilla Visa cards are perfect for everyday shopping and purchases. You can use them at most retail stores, just like a regular credit or debit card. This makes them an ideal solution for budgeting your shopping trips. Imagine walking into your favorite store with a set limit on your spending. A Vanilla Visa card helps you stick to your budget, preventing any impulse buying. Plus, you won’t have to worry about carrying cash, which is an added convenience.Online Transactions

In today’s digital world, online transactions are a part of daily life, and Vanilla Visa cards are a secure option for this. They provide an extra layer of security when shopping online, as they are not linked directly to your bank account. I once used a Vanilla Visa card for an online purchase from a new retailer. The transaction was smooth, and I felt secure knowing that my personal banking information wasn’t exposed. Have you ever hesitated to shop online due to security concerns? A Vanilla Visa card could be the perfect solution. These cards can also be a great way to manage subscriptions or one-time online purchases. You can easily track your spending and ensure you don’t exceed your monthly budget. With a Vanilla Visa card, you can explore online shopping without the usual worries.Direct Transfer To Bank Account

Transferring money from a Vanilla Visa card to a bank account isn’t directly possible. Instead, consider using a PayPal account as an intermediary. This method allows you to transfer the card’s balance to PayPal, then move it to your bank account.

Is It Possible?

Yes, it’s possible to transfer money from a Vanilla Visa card to a bank account. However, the process is not as straightforward as transferring from one bank account to another. You’ll often need to use third-party services or apps that facilitate this transfer. These services typically allow you to add your Vanilla Visa card to your account and then move the funds to your bank. Have you ever tried to move funds from a prepaid card and found yourself frustrated? Understanding the process can help ease that frustration. It’s worth investigating which services or apps are the most reliable and user-friendly for this task.Limitations And Restrictions

While transferring funds is possible, there are limitations and restrictions to be aware of. Some services may charge a fee for each transaction, which can add up if you’re transferring small amounts frequently. Always check for any fees before proceeding. Additionally, not all banks support transfers from prepaid cards through third-party apps. Double-check with your bank to ensure they accept such transfers. This can save you time and potential disappointment. Another point to consider is the transfer limits. Some services have daily or monthly caps on how much you can transfer. If you’re planning to move a significant amount, make sure these limits align with your needs. Have you ever been caught off guard by hidden fees or restrictions? Being informed about these limitations can prevent surprises and help you manage your money more effectively.

Alternative Methods For Transferring Funds

Transferring funds from a Vanilla Visa card to a bank account directly isn’t possible. Yet, there are alternative methods to achieve this transfer. These methods provide flexibility and simplicity, helping you manage your funds efficiently.

Using Paypal

PayPal is a popular choice for transferring funds. You can link your Vanilla Visa card to your PayPal account. Once linked, funds can be transferred from the card to PayPal. Afterward, move the money from PayPal to your bank account. This process is straightforward and widely used by many.

Services tiers

Several third-party services can facilitate fund transfers. These services act as intermediaries, allowing you to transfer money from your Vanilla Visa card to your bank. Ensure the service is reputable and secure. Many users have found these services helpful. They offer convenient and quick transfers. Always check for fees or charges before proceeding.

Steps To Transfer Money Via Paypal

Transferring money from a Vanilla Visa to a bank account involves using PayPal as an intermediary. First, link your Vanilla Visa to PayPal. Then, transfer funds from PayPal to your bank account. This method ensures your Vanilla Visa funds reach your bank efficiently and securely.

Linking Vanilla Visa To Paypal

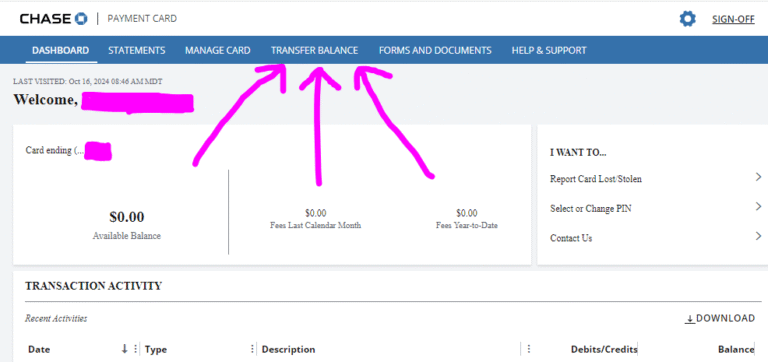

To get started, you need to add your Vanilla Visa card to your PayPal account. Begin by logging into your PayPal account. If you don’t have one, setting it up is quick and simple. Once logged in, navigate to the “Wallet” section. Here, you’ll find the option to “Link a card.” Select this option and enter your Vanilla Visa card details. Be sure to input the card number, expiration date, and security code. After entering the details, save the information. PayPal may charge a small refundable fee to verify your card. This fee will appear on your card statement as a code. Enter the code in your PayPal account to confirm the card. ###Transferring Funds To Bank

With your Vanilla Visa linked to PayPal, transferring the funds to your bank account is the next step. In your PayPal account, head to the “Transfer Money” option. This is typically found in the “Wallet” or “Activity” section. Choose the option to transfer money from the Vanilla Visa card to your PayPal balance. This step converts your gift card balance into PayPal funds. Once the balance is in your PayPal account, select “Transfer to your bank.” Choose the bank account where you want the funds deposited. If you haven’t linked your bank account yet, you’ll need to do so by providing your bank details. Double-check the amount and the bank details to avoid any errors. Click “Transfer” to complete the process. It may take a few business days for the funds to appear in your bank account. Keep an eye on your bank account balance to confirm the transfer. By following these steps, you can smoothly transfer money from a Vanilla Visa gift card to your bank account using PayPal. It’s a practical solution for turning gift card balances into usable cash. Have you tried this method before, or do you have any tips to share? Let’s discuss your experiences in the comments!

Utilisation de services tiers

Transferring money from a Vanilla Visa card to a bank account requires using third-party services. These services help bridge the gap between prepaid cards and bank accounts. Users must ensure the service is secure and reliable.

Transferring money from a Vanilla Visa gift card to your bank account might seem a bit challenging at first. However, using third-party services can make the process straightforward and efficient. These services act as a bridge, allowing you to transfer the balance from your card to your bank account with ease. But which service should you choose? And what costs are involved? Let’s dive into some practical insights.Popular Services

When looking to transfer funds from your Vanilla Visa to your bank account, several third-party services can help. PayPal is a popular choice, as it allows you to link your Vanilla Visa and then transfer funds to your bank account. Another option is Venmo, which works similarly and is known for its user-friendly interface. Square’s Cash App also provides a straightforward way to move your funds, often with minimal hassle. Each of these services comes with its own set of instructions and requirements, so it’s essential to choose the one that suits your needs best.Frais et charges

Before you proceed with any third-party service, it’s crucial to understand the fees involved. Most services charge a small percentage of the transaction as a fee. For example, PayPal may charge around 2.9% plus a small fixed fee per transaction. Venmo might have a different fee structure, often offering free transfers between friends but charging for instant transfers. It’s important to weigh these costs against the convenience offered. Are you willing to pay a bit more for immediate access to your funds, or would you prefer to wait for a free transfer option? Using these services can be a game-changer, but always keep an eye on the fees. It’s easy to overlook these small charges, but they can add up over time. Consider your financial habits—do you frequently need to move funds quickly, or is waiting a few days acceptable for you? By understanding the popular services and the associated fees, you’ll be better equipped to make an informed decision. Have you ever used a service that surprised you with unexpected fees, or perhaps one that offered a seamless experience? Your experiences could help others navigating the same path.Pros And Cons Of Transferring Money

Transferring money from a Vanilla Visa to a bank account has its advantages and disadvantages. Understanding these can help you make an informed decision. We will explore both sides, highlighting the benefits and drawbacks.

Avantages

Transferring funds to your bank account offers convenience. You can manage your finances more easily. It allows for better budgeting and tracking of expenses. Your money becomes accessible for online bill payments. This flexibility is a major advantage.

Transferring funds also enhances security. Bank accounts have robust protection measures. These measures reduce the risk of losing money. You can also earn interest on funds in a savings account. Over time, this can add up.

Drawbacks

There are also drawbacks to consider. Some services charge fees for transferring funds. These fees can add up over time. You may end up with less money than expected.

The process can be time-consuming. Transfers may not happen instantly. Delays are possible, affecting your plans. Some services have restrictions on transfer amounts. They might limit how much you can move at once.

Understanding both benefits and drawbacks helps in deciding. Make sure to weigh these factors carefully.

Security And Privacy Concerns

Transferring money from a Vanilla Visa card to a bank account raises security and privacy concerns. Users worry about data protection and potential fraud. Ensuring secure transactions is crucial for peace of mind.

Transferring money from a Vanilla Visa to a bank account might seem like a straightforward task, but have you thought about the security and privacy concerns involved? It’s essential to be aware of the risks to protect your financial information and ensure a smooth transaction. Let’s explore some key considerations to keep your details safe and avoid potential pitfalls.Protection des informations personnelles

When transferring money, safeguarding your personal details should be your top priority. Always verify that the platform or service you use is legitimate. Look for secure website indicators like “https://” and a padlock symbol in the URL bar. Avoid sharing sensitive information such as your card number and PIN over email or phone. If a service asks for more information than usual, question its authenticity. Have you ever shared your card details without thinking twice? It’s a common mistake that can lead to unauthorized access. Being cautious with your information is crucial to prevent identity theft.Avoiding Scams

The internet is full of schemes waiting to trap unsuspecting users. Be wary of offers that seem too good to be true, such as promises of guaranteed transfers or instant cash. Scammers often pose as customer service representatives. Always reach out to official channels to verify any suspicious requests. If you’re unsure, take a moment to research the company or service. Have you ever been tempted by a “limited-time offer” email? It’s essential to question such messages and verify their source to avoid falling victim to fraud. Always trust your instincts and stay informed. By understanding these security and privacy concerns, you can make informed decisions when transferring money from a Vanilla Visa to your bank account. Protecting your information and staying alert to scams can save you from future headaches and potential losses. Are you taking the necessary steps to keep your financial transactions secure?Questions fréquemment posées

How Do I Transfer Money From Vanilla Visa?

Transferring money from a Vanilla Visa to a bank account directly isn’t possible. However, you can use the card for purchases or transfer funds to platforms like PayPal, then withdraw to your bank. Always check the fees and restrictions involved before proceeding.

Can Vanilla Visa Be Linked To Paypal?

Yes, Vanilla Visa can be linked to PayPal. Add the card as a payment method in your PayPal account. This allows you to use the card for online transactions and potentially transfer funds to your bank. Verify your card’s compatibility and any associated fees.

Are There Fees For Vanilla Visa Transactions?

Vanilla Visa cards often have transaction fees. These fees can include activation charges, monthly maintenance fees, and transaction fees. Always read the terms and conditions to understand the costs involved. Some retailers may also impose additional fees for using prepaid cards.

Can I Check My Vanilla Visa Balance Online?

Yes, you can check your Vanilla Visa balance online. Visit the official Vanilla Visa website and enter your card details. This helps you track your spending and remaining balance. Alternatively, some issuers provide mobile apps for easy balance checks.

Conclusion

Transferring money from a Vanilla Visa to a bank account can be tricky. It’s not a direct process. You might need a workaround. Consider using a digital wallet. Connect it to your Vanilla Visa. Then transfer funds to your bank.

Always read the terms first. Fees might apply. Double-check all details. Safety should be a priority. This ensures your money stays secure. Take time to explore options. Choose what fits you best. With patience, you’ll find a suitable method.