Les entrepreneurs peuvent-ils facturer des intérêts sur les paiements tardifs ? Découvrez-le maintenant.

Late payments can be a real headache, especially when you’re a contractor trying to keep your business afloat. You might be wondering if you can charge interest on these overdue payments.

After all, your work deserves timely compensation. Understanding your rights can empower you to manage your cash flow better and maintain a healthy business. But before you decide to add interest to late payments, there are some crucial factors you need to consider.

Are you legally allowed to charge interest? How might this impact your client relationships? Keep reading to uncover the answers to these pressing questions and learn how to protect your business from the financial strain of late payments.

Legal Framework For Late Payment Charges

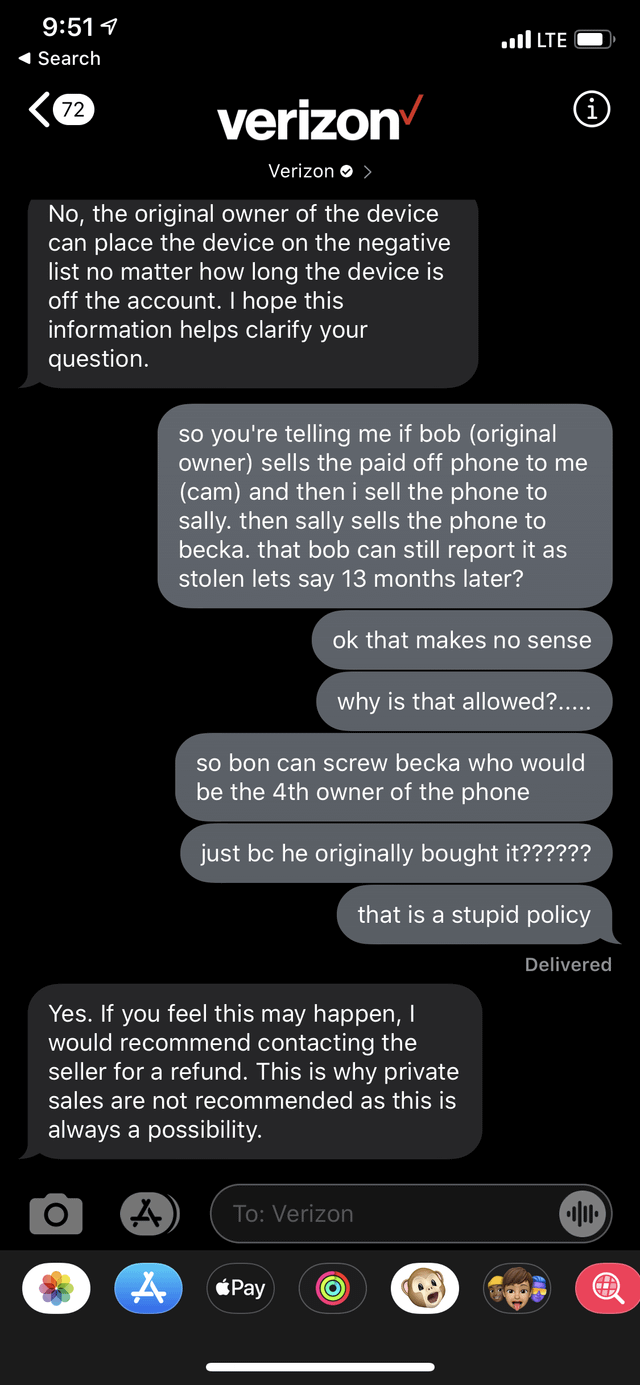

Contractors often face late payments. Charging interest can be a solution. But laws are important. Different places have different rules. Some allow charging interest. Others do not. Understanding local laws is crucial.

Most contracts mention late fees. Contract terms are key. They must be clear. Both parties should agree. If not, problems arise. Fair practice is important. It keeps trust.

Taux d'intérêt should be reasonable. High rates can cause trouble. Simple interest is common. It means easy calculations. Transparence builds good relationships. It helps avoid disputes.

Benefits Of Charging Interest

Charging interest on late payments helps contractors. It encourages clients to pay on time. Timely payments keep the business running smoothly. Contractors can plan better. They know when money will come in.

Interest can cover extra costs. Late payments can cause problems. Contractors might need to borrow money. Intérêt helps cover these costs. It is a fair way to manage cash flow.

Clients learn to respect contracts. They understand the importance of timely payments. Respect for contracts grows. This builds trust between clients and contractors. Trust is key for long-term relationships.

Setting Up Clear Payment Terms

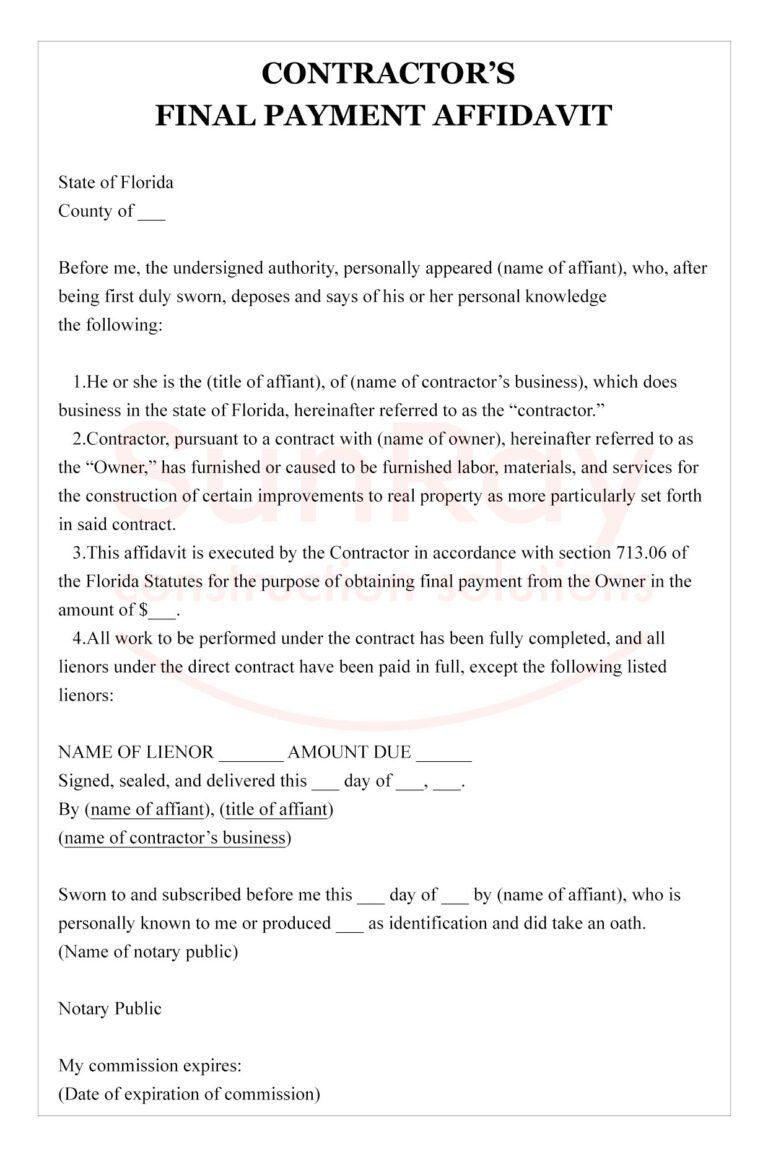

Contractors can add interest clauses in their contracts. This helps in managing late payments. It is important to set clear conditions de paiement. These terms must be easy to understand. Stating the interest rate is crucial. Explain how interest is calculated. Use simple math examples. This keeps things clear for clients. Both parties should agree on these terms. Sign the contract after agreement. This avoids confusion later.

Communication is key in contracts. Explain the payment terms clearly. Use simple words to describe them. Ensure that clients understand each term. Ask if they have questions. Address any concerns they might have. This builds trust between you and your client. It also reduces payment delays. Clear communication avoids future problems. Keep records of all discussions. It helps if disputes arise.

Calculating Interest Rates

Fixed interest rates stay the same each month. This means payments are predictable. Variable interest rates can change. They depend on market conditions. Sometimes they go up. Other times they go down. Choosing the right type is important. It can affect how much you pay. Contractors often prefer fixed rates. They are easier to manage. Variable rates might be risky. But they can offer lower costs sometimes. Think carefully before deciding.

Interest calculators help figure out costs. They are easy to use. Input the amount owed. Then add the interest rate. The calculator does the math. It shows how much extra is due. These tools save time. They prevent mistakes. Using them ensures correct billing. Many are available online. Some are free. Others might cost money. Choose one that is user-friendly. This helps understand interest better.

Managing Client Relationships

Contractors face issues with late payments often. Payment disputes can strain relationships. It’s important to stay calm. Speak politely with clients. Explain the issue clearly. Use simple words. Clear communication helps. Listen to their side too. Both sides should understand each other. Find a solution together. Offer flexible payment plans if needed. This builds trust. Clients will appreciate it.

Keep a polite tone always. Even when frustrated. Professionalism is key. Use formal language in emails. Avoid slang and casual talk. Dress appropriately when meeting clients. Show respect and courtesy. Timeliness matters. Be on time for meetings. Respond to emails quickly. Clients notice these things. It builds confidence and respect.

Considérations juridiques

State laws matter for contractor payments. Some states have rules for interest on late payments. Contractors must know these rules. Federal laws also play a role. They set guidelines for fair business practices. Ignoring these laws can lead to trouble. Penalties or fines might occur.

Contracts are crucial. They outline terms for payment and interest. Both parties agree to these terms. A clear contract avoids confusion. It defines interest rates for retards de paiement. Contractors should ensure contracts are signed. Written agreements protect both sides. They offer clarity and security.

Alternatives To Charging Interest

Contractors can offer plans de paiement to clients. This can help both parties. Clients may pay in small amounts. This makes payments easier for them. Contractors receive regular payments. It reduces the risk of not getting paid. Payment plans can be flexible. They can fit different budgets. This option can build trust. Clients appreciate options that suit their needs. It shows understanding and care. Contractors and clients can agree on a schedule. It keeps things clear and organized. Regular payments mean less worry for contractors. It helps manage cash flow better.

Offre réductions for early payments can be effective. Clients save money by paying early. This encourages them to pay on time. Contractors benefit from quick payments. It improves cash flow. Discounts can be a small percentage. Even a little savings can motivate clients. Early payments mean less stress for contractors. They get funds sooner. Discounts can create a win-win situation. Clients feel rewarded. Contractors have fewer late payments to worry about. This method is simple and clear.

Études de cas

Contractors can charge interest on late payments, ensuring timely compensation for their work. This practice is often outlined in contracts to prevent payment delays. Understanding this option helps contractors maintain cash flow and financial stability.

Successful Implementation

Some contractors apply interest on late payments. They find it effective. It helps them get paid on time. Clients are more careful. They avoid late payments. This method can improve cash flow. It also brings stabilité financière. Contractors feel secure. They plan better for their work.

Lessons Learned From Mistakes

Not all contractors succeed. Some face unhappy clients. Clients complain about extra charges. This damages the relationship. It’s important to communicate clearly. Explain the terms upfront. This avoids confusion. Some contractors forget this step. They learn from these mistakes. Clear terms help both parties. It builds trust.

Expert Insights

Industry professionals say contractors can charge interest on late payments. This practice is legal in many places. It’s important to know local laws. Some regions have specific rules about interest rates.

Contractors should discuss payment terms early. Clear agreements avoid confusion later. Experts suggest adding interest terms in contracts. This helps both parties understand expectations.

Advice From Industry Professionals

Professionals recommend setting fair interest rates. High rates can upset clients. Reasonable rates encourage timely payments. They keep business relationships healthy.

Effective communication reduces late payments. Contractors should send payment reminders. Regular updates help clients remember due dates. This practice can minimize late fees.

Common Pitfalls To Avoid

Avoid charging excessive interest. It might break trust with clients. Understand legal limits on interest rates. Violating these can lead to legal trouble.

Don’t forget to document payment terms. Written agreements prevent misunderstandings. Make sure both parties sign the contract. This ensures everyone knows the rules.

Questions fréquemment posées

Can Contractors Legally Charge Interest On Late Payments?

Yes, contractors can legally charge interest on late payments. However, this must be clearly stated in the contract. Ensure both parties agree on the interest rate and terms. It’s important to comply with state laws and regulations regarding interest rates.

What Is A Typical Interest Rate For Late Payments?

The typical interest rate for late payments varies. It often ranges from 1% to 1. 5% per month. Contractors should specify the rate in the contract. Always check local laws to ensure compliance with legal limits.

How Can Contractors Enforce Late Payment Charges?

Contractors can enforce late payment charges by including clear terms in their contracts. They should communicate these terms to clients beforehand. Consistently following up on overdue payments is crucial. Legal advice may be necessary for persistent non-payment issues.

Are There Laws Regulating Late Payment Interest?

Yes, there are laws regulating late payment interest. These laws vary by state and jurisdiction. Contractors must adhere to maximum allowable interest rates. Violating these laws can result in penalties or legal issues.

Conclusion

Charging interest on late payments helps contractors manage cash flow. It encourages timely payments. Clear communication about terms is crucial. Clients should understand the agreement. Transparency builds trust between parties. Contractors must comply with local laws. This avoids legal issues.

Regularly review and update contract terms. Stay informed about industry standards. Reliable payment systems benefit both contractors and clients. They ensure smooth project progression. Contractors can protect their financial interests. Clients receive quality service without payment delays. Balancing these aspects leads to successful projects.

Everyone wins with fair practices.