Les cartes de crédit Elan Financial Services sont-elles faciles à obtenir ?

Is it true that getting approved for Elan Financial Services credit cards is easier than with other issuers? While many applicants report success, the answer isn't as straightforward as it might seem. Factors like your cote de crédit, income, and overall financial profile play significant roles in the processus d'approbation. If you're curious about how these elements interact and what you might expect regarding interest rates and terms, there's more to explore about what could impact your application.

Overview of Elan Financial Services

Elan Financial Services is a prominent provider of credit card solutions that caters to a diverse range of financial needs for both consumers and businesses. They offer a robust platform designed to deliver security and reliability, which is essential for those seeking peace of mind in their financial transactions. Their commitment to service client et innovative technology guarantees that you can manage your credit effectively and safely. Elan emphasizes compliance with industry regulations, providing you with protections against fraud and unauthorized transactions. Moreover, their interface conviviale and responsive support team make it easier for you to navigate your financial choices. Overall, Elan Financial Services stands out as a trustworthy option for those prioritizing safety in their credit card experience.

Types of Credit Cards Offered

When exploring options de crédit, you'll find that a variety of credit cards are available through Elan Financial Services, each tailored to meet specific needs and preferences. They offer options like cash back cards, which reward you for everyday purchases, and travel rewards cards, designed for those who often journey. Additionally, there are cartes de crédit sécurisées, ideal for individuals looking to build or rebuild their credit history. Some cards come with taux d'intérêt bas, while others may feature introductory offers or bonuses. Each card typically includes varying fees, interest rates, and rewards structures, allowing you to choose one that aligns with your financial goals and spending habits. By evaluating these options, you can make a safer, more informed decision.

Understanding Credit Score Requirements

Comprendre le credit score requirements for Elan Financial Services credit cards is essential, as these scores can greatly impact your chances of approval and the terms you might receive. Generally, a bonne cote de crédit—typically 680 or higher—is preferred for better approval odds and favorable interest rates. Lower scores might still get you approved, but you could face taux d'intérêt plus élevés and less favorable terms. It's important to regularly check your credit score and verify it reflects your financial behavior accurately. Addressing any errors or outstanding debts prior to applying can improve your standing. By being aware of the score requirements, you can take proactive steps to enhance your solvabilité, making the application process smoother and more secure.

Importance of Income Verification

Income verification is a essential step in the credit card approval process, as it helps lenders assess your ability to repay the debt and manage your financial obligations effectively. When you apply for a credit card, lenders often require preuve de revenu to guarantee you have a stable financial foundation. This process mitigates the risk of lending, as it indicates your capacity to handle monthly payments. By verifying your income, lenders can tailor credit limits and terms that align with your financial situation, promoting responsible borrowing. Additionally, accurate income representation can enhance your chances of approval, leading to more favorable credit opportunities. Ultimately, income verification plays a significant role in safeguarding both your financial health and the lender's investment.

Other Approval Criteria

While income verification is a key factor, lenders also consider several other criteria that can influence your credit card approval. Understanding these factors can help you gauge your chances of getting approved for an Elan Financial Services credit card.

- Cote de crédit: Your credit score reflects your creditworthiness and is essential in the decision-making process.

- Ratio dette/revenu: Lenders assess your debt relative to your income to determine your ability to repay.

Tips for Improving Approval Chances

Improving your chances of getting approved for an Elan Financial Services credit card involves taking proactive steps to enhance your credit profile. Start by checking your rapport de solvabilité for errors and disputing any inaccuracies you find. Aim for a cote de crédit of 650 or higher, as this can greatly boost your approval odds. Additionally, maintain a low taux d'utilisation du crédit, ideally below 30%. If you have any dettes impayées, consider paying them down to improve your overall financial health. Finally, make sure you have a revenu stable and a consistent employment history, as these factors demonstrate your ability to manage credit responsibly. By following these tips, you'll position yourself favorably for approval.

Common Reasons for Denial

Several factors can lead to the denial of your Elan Financial Services credit card application, with credit history and score being among the most significant. A low credit score or a history of missed payments can raise red flags for lenders. Additionally, other common reasons include:

- Insufficient income or employment history

- Recent applications for multiple credit accounts

Understanding these factors can help you strategize your application. If you find yourself denied, it's essential to review your credit report for inaccuracies or areas that need improvement. Taking proactive steps can enhance your chances of approval in the future, ensuring you're better prepared to secure the credit you need.

Comparing Elan Cards to Competitors

After addressing potential reasons for credit card application denial, it's important to evaluate how Elan Financial Services credit cards stack up against those offered by competitors with respect to rewards, fees, and approval criteria. Elan cards often feature competitive rewards programs, particularly for cash back and travel benefits, which can be appealing if you prioritize these features. However, some competitors might offer lower annual fees or more flexible approval criteria, making them easier to obtain for individuals with varied credit histories. Additionally, reviewing terms and conditions is vital; frais cachés can impact your overall experience. Ultimately, weighing these factors against your financial goals will help you determine whether an Elan card aligns with your needs better than its competitors.

Expériences et avis clients

Many customers frequently share their experiences with Elan Financial Services credit cards, highlighting both positive aspects and areas for improvement. Most reviews indicate that the application process is straightforward, which can enhance your confidence in seeking approval. However, some users express concerns regarding customer service responsiveness.

- Positive experiences often center around competitive interest rates.

- Many appreciate the user-friendly online account management tools.

Next Steps After Approval

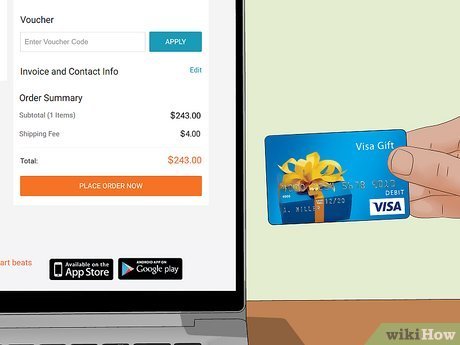

Once you've successfully navigated the processus d'approbation for your Elan Financial Services credit card, it's important to understand the next steps to maximize your benefits and guarantee responsible usage. First, familiarize yourself with the card's termes et conditions, including interest rates and fees. Set up online account management to easily track your spending and payments. Create a budget that includes your card usage to avoid overspending. Make paiements ponctuels to maintain a good credit score and avoid late fees. Consider enrolling in rewards programs or other benefits offered. Finally, monitor your account regularly for any transactions non autorisées, ensuring a secure and safe experience with your new credit card. Taking these steps will help you use your card wisely and effectively.