Les paiements d'impôt composites sont-ils déductibles ? Maximisez vos économies.

Are you navigating the complex world of taxes and wondering if composite tax payments are deductible? You’re not alone.

Many individuals, just like you, are seeking clarity on this topic to maximize their financial efficiency. Understanding the nuances of tax deductions can lead to significant savings, putting more money back in your pocket. Imagine the relief of confidently filing your taxes, knowing you’ve claimed every possible deduction.

We’ll unravel the mystery of composite tax payments and their deductibility, providing you with the insights needed to make informed financial decisions. Stay with us as we delve into this crucial topic, ensuring you leave with a clear understanding and peace of mind.

Composite Tax Payments Explained

Composite tax payments combine different taxes into one payment. This can make it easier to manage. Businesses often use composite tax payments. They pay taxes like sales and income together. Individuals might also use composite tax payments. It depends on their tax situations. Gouvernements offer this to simplify tax processes. It helps reduce paperwork and save time. Paying taxes this way can be more efficient. But, it’s important to understand how they work. Knowing your tax obligations is vital. Always check if composite taxes apply to you. This helps avoid mistakes. Understanding composite tax payments is helpful. It can make tax season less stressful.

Deductibility Criteria

Understanding the rules for tax deductions is important. Some tax payments can be deducted. But not all. To deduct, payments must meet certain critères. Payments should be related to dépenses professionnelles. They must not be personal. Only expenses needed for business can be deducted.

Keeping des registres précis is important. Records help show the purpose of the payment. If records are not clear, deductions might not be allowed. Always consult a tax expert if unsure. They can guide on what is deductible.

Benefits Of Deducting Composite Taxes

Deducting composite taxes can be helpful for many people. It can make tax bills smaller. This means you pay less money. It also helps in keeping more cash for other needs. Many find it useful during tough times. It can ease financial stress.

Taxes can be complex. Deducting them simplifies the process. It reduces the amount you owe. This is good for families and businesses. Saving money can lead to better planning. More funds can be used for growth. It makes financial management easier.

Understanding deductions is key. It helps in budgeting. It ensures you use resources wisely. Many appreciate the relief it brings. It promotes better financial health. Knowing about this can help in smart decisions. It is a beneficial strategy.

Idées fausses courantes

Many people think composite tax payments are always deductible. This is not true. Some taxes are deductible but not all. It’s important to know which are. Personal taxes often confuse people. They mix them with business taxes. But they are different. Business taxes can be deductible. Personal taxes often are not. Always check with a tax expert. They can tell you what is deductible. This helps avoid mistakes. Mistakes can be costly.

Strategies For Maximizing Tax Savings

Paying taxes can be tricky. It is important to know how to save money on taxes. One way is through composite tax payments. They might be deductible. This means you can subtract them from your total tax. That can lower the amount you owe.

Some people use tax credits. These are special rules. They let you pay less tax. Others use tax deductions. Deductions lower your income. This means you pay less tax too. Both ways help you keep more money.

Always keep good records. These are important for tax time. Receipts and documents help show what you paid. They can be proof if you need it. Talk to a tax expert if you have questions. They can give good advice.

Consulting Tax Professionals

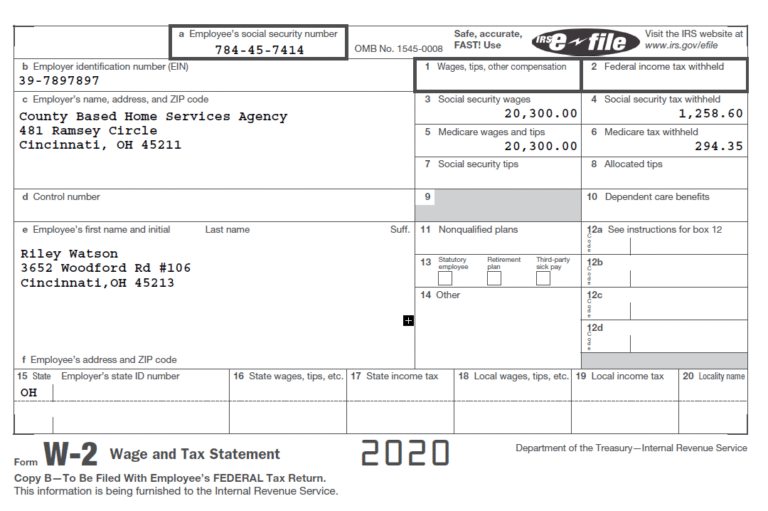

Tax professionals help you with tricky tax rules. They know the laws well. They advise on composite tax payments. This can save money. Experts help with deductions too. They guide you on what is deductible. They answer tax questions. They explain tax forms clearly. They make sure everything is correct.

Professionals help with planning. They suggest ways to lower taxes. They assist with document preparation. They ensure proper filing of tax forms. They keep you updated on tax changes. This helps avoid mistakes. Mistakes can lead to pénalités. They work to maximize remboursements. This is helpful to everyone.

Case Studies And Examples

Many people ask if composite tax payments are deductible. Let’s explore some examples. One family paid composite taxes on their rental property. They wanted to know if they could deduct these payments. The answer was yes. This helped them save money.

Another case involved a small business owner. She paid composite taxes for her store. She was happy to learn she could deduct these payments. This reduced her overall tax bill.

In one city, composite tax payments are common. Many residents benefit from deducting them. It is important to know local rules. Rules can vary. Always check with a tax expert.

These examples show composite tax payments can be deductible. Knowing this can help save money. It is essential to understand the process.

Future Trends In Tax Deductions

Tax deductions are changing over time. New laws affect what people can deduct. It’s important to know these changes. Technology plays a big role. More people use apps to track expenses. This makes it easier to find deductible items. Governments might offer new deductions soon. They want to help people save money.

Environmental actions might become deductible. People are encouraged to be green. Solar panels and electric cars could save money on taxes. Éducation expenses might also change. More online courses are available now. This could mean new tax breaks for students.

Questions fréquemment posées

What Are Composite Tax Payments?

Composite tax payments are a simplified tax method for businesses. They streamline tax compliance by combining multiple tax obligations into one payment. This approach can save time and reduce administrative burdens for eligible businesses. However, eligibility and rules vary by jurisdiction, so consult a tax professional for guidance.

Are Composite Tax Payments Deductible?

Yes, composite tax payments can be deductible for businesses. They are often treated as ordinary business expenses. However, the deductibility may vary based on the specific tax regulations of your jurisdiction. It’s essential to consult with a tax advisor to ensure compliance with local tax laws.

How Do Composite Tax Payments Work?

Composite tax payments work by consolidating various tax liabilities into a single payment. This simplifies the tax process for businesses by reducing paperwork. Businesses pay a predetermined amount based on their income or other criteria. It’s crucial to understand the specific rules in your area, as they can differ.

Who Qualifies For Composite Tax Payments?

Eligibility for composite tax payments depends on local tax laws. Typically, small to medium-sized businesses qualify. They must meet specific criteria, such as income thresholds or industry type. Consult your local tax authority or a tax professional to determine if your business qualifies.

Conclusion

Understanding composite tax payments and deductions is crucial. Knowing what’s deductible helps you save money. Always consult a tax professional for advice. They can guide you through complex tax rules. Stay informed to make smart financial decisions. Remember, every deduction counts.

Keep records organized and up-to-date. This ensures accuracy in your tax return. Being proactive with taxes can reduce stress. Educate yourself on tax laws regularly. It benefits your financial health. Stay compliant and avoid penalties. Knowledge is power in managing your taxes.

Make informed choices to optimize your returns.